The Euro ticks up from lows but maintains its broader bearish trend intact.

Hopes of progress on the Eurozone-US trade talks are providing some support to the Euro.

EUR/USD is moving within an expanding wedge, a potentially bearish formation.

The EUR/USD pair is trimming some of Monday's losses on Tuesday, although it maintains the bearish trend from last week's highs intact. Investors are keeping a cautious mood as US President Donald Trump announced new tariffs on a batch of countries, bringing global trade concerns back to the forefront.

The Euro (EUR) bounced up from nearly two-week lows at 1.1690 during Tuesday's Asian session, and is trading at 1.1740 at the time of writing, with upside attempts capped below a previous support area at 1.1750 so far.

The Eurozone was not among the recipients of Trump's tariff letters and will not receive one for the time being, as negotiations with the US are apparently showing progress and, according to market sources, a deal might be announced as soon as Wednesday.

This news has contributed to easing some pressure on the Euro, although upside attempts are likely to remain limited with concerns about global trade weighing on risk appetite. The economic calendar is light this Tuesday, and market concerns about a significant disruption of international trade are likely to support the safe-haven US Dollar to the detriment of riskier currencies, such as the Euro.

Euro PRICE Today

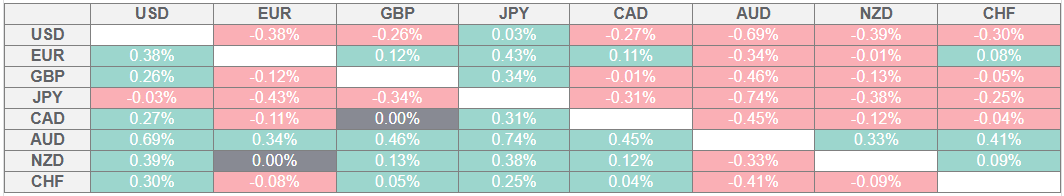

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The safe-haven US Dollar appreciates in risk-off markets

EUR/USD maintains a broader bearish tone with the US Dollar recovering from multi-year lows. Uncertainty about Trump's levies remains high and is likely to maintain the US Dollar bid, at least until Wednesday, when the minutes of the last Federal Reserve (Fed) meeting might provide some distraction from trade tariffs.

Data from Germany released on Tuesday revealed that the trade surplus increased by EUR 18.4 billion in May, from EUR 15.8 billion in April, against expectations of a slight decline to EUR 15.5 billion. The main reason for these figures, however, has been a larger-than-expected decrease in the number of imports, which points to a slower domestic demand.

On Monday, Eurozone Retail Sales contracted by 0.7% in May, the largest decline in almost two years, showing that US tariffs and the uncertain economic outlook in the Eurozone are starting to hurt consumer confidence.

The German Statistics Office also reported on Monday that Industrial Production grew 1.2% in May, against market expectations of a flat reading and following a 1.6% contraction in April. The impact on the Euro, however, was marginal.

The US economic calendar is light on Tuesday. The highlight of the week will be the FOMC Minutes, which will be released on Wednesday and might reflect the diverging views about monetary policy recently shown by some committee members, potentially throwing a spanner in the US Dollar's recovery.

EUR/USD is likely to remain capped below 1.1750 or 1.1780

EUR/USD is picking up from Monday's lows right below 1.1700 but maintains the corrective structure from last week's highs. Price action shows an expanding wedge pattern, a figure that tends to develop at major market tops.

Technical indicators remain in bearish territory, with the Relative Strength Index (RSI) still below 50 on the 4-hour chart, while a previous support, at the 1.1750 (near July 2 low), is now limiting upside attempts. Above here, the next hurdle is at the trendline resistance from last week's top, now at 1.1780.

On the downside, the pair has a significant support area at the confluence of the trendline support with the 38.2% Fibonacci retracement level of the June 24 - July 1 rally, at 1.1685. Below here, the pair might find support at 1.1630 - 1.1645, where previous highs meet the 50% Fibonacci retracement level of the mentioned late June rally.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.