Fears of US involvement in the Israel-Iran conflict are weighing on sentiment and boosting the US Dollar's recovery.

Fed Powell maintained a hawkish stance and provided additional support to the US Dollar.

EUR/USD is under growing bearish pressure after breaching support at the 1.1500 level.

The EUR/USD pair is extending its reversal from last week's highs on Thursday, weighed by investors' aversion to risk, as fears of an escalation of the Israel-Iran war into a regional conflict have overshadowed the Federal Reserve's (Fed) monetary policy decision. The common currency broke below the 1.1500 level and is trading around 1.1450 at the time of writing.

US President Donald Trump stole the central bank's spotlight on Wednesday, leaving the world guessing whether the US may join Israel in its attack on Iran, and a report from Bloomberg, released somewhat later, suggested that US officials might be preparing to enter the war, probably on the weekend.

The US Dollar (USD) is drawing support from investors' risk-off reaction amid growing concerns that the conflict might escalate into a regional war, threatening the Oil supply and adding a new layer of uncertainty in the already strained global growth prospects.

The Federal Reserve left its benchmark interest rate unchanged at the 4.25%-4.50% range after its monetary policy meeting on Wednesday, and maintained the previous projections of 50 basis points (bps) cuts in the second half of the year.

Chairman Jerome Powell, however, curbed investors' enthusiasm, warning that inflation will increase in the coming months as the impact of tariffs starts to filter in. The US Dollar, which had eased after the decision, regained lost ground following Powell's hawkish rhetoric.

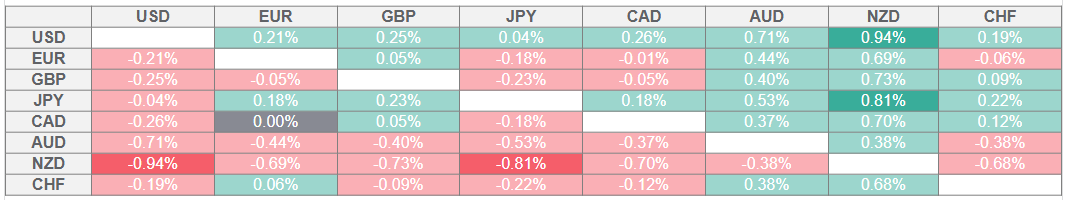

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The US Dollar appreciates on safe-haven demand

The risk-off mod prevails in FX markets as the Iran-Israel conflict enters its seventh day, with the US threatening to jump in and turn it into a full-blown war. Trump's comments on Wednesday, affirming that he "may or may not" strike Iran, put investors on edge and provided an additional boost to safe assets, such as the US Dollar.

Somewhat earlier, Iran's ambassador to the United Nations (UN) and the Supreme Leader, Ali Khamenei, rejected the US President's demands for unconditional surrender and had warned the US of "irreparable damage" if the US launches a direct attack on the Islamic Republic.

In this context, the Federal Reserve kept rates on hold and maintained its projections of two rate cuts before the end of the year. The bank, however, downgraded its GDP growth projections for 2025 to 1.4% from the 1.7% forecasted in March, while PCE inflation is now seen at 3% at the end of the year, up from previous estimations of 2.7%.

Later on, Chairman Powell maintained the hawkish tone of previous occasions, warning that US tariffs will ultimately be passed on to consumers in some form, before stating that the central bank is "well positioned to wait" before moving further on rates.

In the macroeconomic front, US weekly Initial Jobless Claims remained at relatively high levels on the week ending June 14, while construction activity data disappointed, adding to evidence that the economy is losing momentum in the second quarter of the year.

In the Euro Area, final CPI figures confirmed that monthly inflation remained flat in May, with the yearly CPI easing to 1.9% from 2.2% in April. Excluding food and energy, the core CPI was flat on the month, following a 1% rise in April, while the year-on-year rate eased to 2.3% from 2.7%. The impact of these figures on the Euro, however, was minimal.

The calendar is thin today with only some ECB speakers worth mentioning in the European session, while the US market is closed on bank holidays, which suggests that liquidity is likely to be lower during the American trading hours.

EUR/USD is under growing bearish pressure below 1.1500

EUR/USD broke below a small triangle pattern on Tuesday, and confirmed its immediate bearish trend on Wednesday, breaching the 1.1500 support Area. The pair is in a corrective phase, after the early-June rally, with technical indicators in the 4-hour charts well within bearish territory, suggesting that further decline is likely.

Price action is now testing support at the 1.1450-1.1470 area, where the pair's upside was halted on June 2, 8, and 10, and the base of the descending channel from June 12 highs meets the 38.2% Fibonacci retracement of the previously mentioned rally. Below here, the next support is at 1.1370, the June 6 and 10 lows, and the 61.8% Fibonacci retracement level.

On the upside, immediate resistance is at Tuesday's high of 1.1530 ahead of last week's highs at 1.1630, the highest since November 2021.

Are you looking to stay ahead of market trends? Join Mitrade’s WhatsApp channel now to unlock endless trading opportunities!

By following Mitrade on WhatsApp, you’ll gain:

Leading Edge: Real-time market updates to track price movements in forex, commodities, and indices.

Professional Insights: Expert analysis and trading strategies to boost your performance.

Global Perspective: Stay informed on central bank policies, geopolitical events, and macroeconomic trends.

Scan the QR code to join instantly and receive timely notifications, ensuring you never miss critical market insights.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.