The cryptocurrency market has grown in leaps and bounds over the last few years. Still, Bitcoin remains the apex instrument, with nearly 50% of the market share. As a result, it continues to attract the most attention from people looking to explore diverse ways to take advantage and profit from the blossoming market.

The widely popular method is to hop an exchange, buy some Bitcoin and hold on to it in hopes that the value will rise in a few months or days. However, it’s no longer a highly profitable strategy for a number of reasons (more on this later). The second option is to find a reputable crypto CFD broker and trade Bitcoin CFD (contract for differences) instead.

Cryptocurrency contract trading can be highly profitable, perhaps even more than traditional Bitcoin trading, if you know what you have the right knowledge. We’ll cover all the details in this article.

What Is Cryptocurrency Contract Trading?

In cryptocurrency contract trading, the trader enters an agreement with a broker offering contracts for the cryptocurrency of their choice.

Contracts for difference (CFDs) are one of the most common types of cryptocurrency contract trading. In CFDs trading, you’ll enter into an agreement with the broker in relation to the movement of the underlying asset (Bitcoin, in this case).

You may also receive leverage that allows you to control more Bitcoin than your account balance would normally accommodate.

If you go “Long” on Bitcoin CFD, you’ll make a profit if Bitcoin’s market price continues in an upward trend. On the other hand, you’ll lose money if the market goes on a bearish run soon after you have entered the position. The size of your profit or loss will depend on factors like your contract size (lot size), profit target, and stop loss levels.

The major distinguishing factor to keep in mind when it comes to CFDs is that you don’t own the asset. So, as a Bitcoin CFDs trader, you don’t own any Bitcoin. You’ll only profit if you get your analysis on Bitcoin’s short, medium, or long-term movement right.

The “Long” or “Short” Trade for Bitcoin CFD

A“Long”contract =“Buy”order

You should go “Long” on Bitcoin CFD if you believe the asset will make a bull run in the near or long term.

Here’s an example based on a "Bitcoin 5x” margin contract :

When Bitcoin price appreciates by 10%, you can choose to close the position and take your profit, which will amount to 50% of the contract value; or continue to hold the position for higher profits.

Conversely when Bitcoin price depreciates by 10%, you can choose to close the trade manually at a loss or allow the automated stop loss function on most platforms to close the trade. If you close at the 10% mark, you’ll lose 50% of the contract amount. If you continue to hold the position, the losses will continue to accumulate.

In a scenario where Bitcoin price drops by 20%, you will lose 100% of your investment, (known as liquidation). Your principal will turn to zero but you won’t owe anyone.

The table below explains things a bit further:

A“Short”contract =“Sell”order

Conversely, you should go “Short” if you believe the asset will enter a bearish phase. Here’s how that will play out:

On most crypto CFD brokers, you have to select “Buy” to go long and “Sell” to go short. Unlike other forms of cryptocurrency contract trading like Futures, you don’t have to worry about time limits when you trade Bitcoin CFD. You can hold your trades for as little as five minutes or weeks.

Top 3 Crypto CFD Brokers

To trade Crypto CFDs, you’ll need to sign up with a reputable broker that offers the asset for trading. Here are the top three you can work with:

Mitrade

Mitrade is an ASIC-regulated, multi-award-winning broker with a rich history. Since its establishment, it has grown quickly into the preferred option for traders looking for a simplified trading experience. Mitrade offers Bitcoin CFD as well as CFDs on more than two dozen other cryptocurrencies.

Traders can enjoy flexible leverage, competitive spreads, zero commissions, and more. Most importantly, order execution is superfast and highly flexible. Traders can choose from micro to full lots when trading Bitcoin CFD on the proprietary Mitrade platform.

The intuitive interface and numerous functionalities make the platform the perfect choice for trades that want to avoid the “feature paralysis” that’s common when trying to trade on exchanges. It’s an excellent platform that strikes the perfect middle ground for all categories of traders.

You can open a demo account to test your Bitcoin trading skills in a few clicks.

IC Markets

IC Markets is one of the most popular brokers in the industry today. They offer CFDs on dozens of major cryptocurrencies, including Bitcoin. The broker offers a cutting-edge trading platform that most traders will love. It also offers deeper liquidity than many other brokers in this space.

Advanced traders will love the trading conditions on offer. However, the platforms available may not be the best for beginner or intermediate traders. IC Markets also do not have a proprietary web platform.

Plus500

If you’re looking for a broker you can trade Bitcoin CFD with, Plus500 should be high on your list. They have an intuitive platform that’s great for beginners. One of the biggest selling points of Plus500 is that they offer leverage of up to 300x when trading Bitcoin. However, it’s important to remember the downsides of such high leverage.

Also, the Plus500 platform may be limiting for intermediate or advanced traders that may want more analytical tools and other trade management functionalities. Overall, the company is one of the crypto CFD brokers to consider for your Bitcoin CFD trading journey.

How to Trade Bitcoin CFD on Mitrade?

Step 1: Click open account on Mitrade. Fill out the details and fund your account through any of the various deposit options.

Step 2: Select the cryptocurrency you want to trade (Bitcoin in this case).

Step 3: Open a Bitcoin “Long” or “Short” position.

If your technical or fundamental analysis points to Bitcoin trending upwards or downwards in the near term, you can open a Bitcoin “Long” or “Short” position on your Mitrade platform.

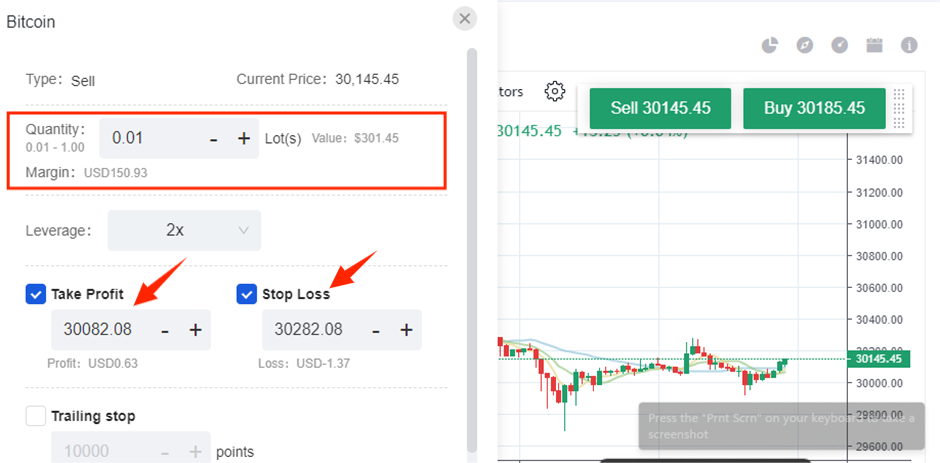

The trading interface is one of the most intuitive in the industry, so it shouldn’t take you too long to open your first Bitcoin CFD trade. Here’s the screen you can expect trading on the web platform.

Selecting “Sell” means you believe Bitcoin’s price will decline and you’d like to go short. Conversely, selecting “Buy” means you expect the price to continue appreciating.

Step 4: Adjust the order.

In this window, you’ll choose the size of your contract, the leverage, and your profit and stop-loss targets.

When you choose a profit target, Mitrade will automatically close out your position in profit when Bitcoin’s price reaches that price level. The stop loss level does the opposite by making sure you don’t lose too much if your analysis doesn’t pan out.

Mitrade offers 2X leverage for Bitcoin CFD trading, giving you the opportunity to potentially double your profits. However, you should also keep in mind that leverage can also amplify your losses.

If you run into any troubles using the platform, you can get in touch with the Mitrade team to resolve it instantly.

Direct market access | Deal on rising and falling market | 24-hour trading | Limit and stop-loss for every trade

Advantages of Trading Bitcoin CFD With Mitrade

Some of the main advantages of trading Bitcoin CFD with Mitrade include the following:

● No Expiry Date

When you trade Bitcoin CFD, you don’t have to worry about your contract expiring on a specified date, as is the case with Bitcoin futures trading. You can hold your position for as long as it takes for your prediction to play out.

● Flexibility With Trade Sizes

The minimum contract size for Bitcoin CFD is 0.01. Therefore, you can easily trade any size of Bitcoin you can afford. This is a huge advantage for beginners who are still trying to get their feet wet in terms of cryptocurrency trading. You can build confidence in your trading strategy, gradually increasing your position size as you gain more experience.

● Flexibility With Position Management

Mitrade offers a stable liquidity pool that allows traders to open and close positions as they deem fit. Whether you want to close your position in a minute or in 100 weeks, the choice is yours. This flexibility allows traders to take advantage of the micromovements in the cryptocurrency market.

● Leveraged Trading

Mitrade offers 2X leverage on Bitcoin CFD trading, allowing you to earn better profits with minor price movements. With 2:1 leverage, you can trade $2000 worth of Bitcoin with $1000 capital.

● Regulatory Protection

Since Mitrade is a regulated broker, you can enjoy protection against theft, fraud, and malpractice. The secure platform also eliminates the risk of losing your money to the cyberattacks prevalent in the cryptocurrency space.

Bitcoin CFD vs. Bitcoin

Here’s a quick comparison of Bitcoin CFD vs. Bitcoin under a few key metrics:

Ease of Trading

Depending on your experience level, it’s easier to trade Bitcoin CFD than spot Bitcoin. To trade Bitcoin CFD is as simple as funding your account and then going long or short, depending on your analysis.

To trade spot Bitcoin, you have to find a reputable exchange, enter your payment details, and wait for the exchange to process your order. In most cases, it’s also straightforward. However, for some exchanges, you’ll need to navigate the murky waters of peer-to-peer trading to find someone to sell you Bitcoin in exchange for cash.

Owning the Asset

When you trade Bitcoin CFD, you don’t own the asset. You’re only trading its movements.

With spot Bitcoin, you own actual Bitcoins. Even if you bought a fraction, it’s an asset you own. However, this presents a few unique challenges. First, you have to explore ways to safely store the asset, as exchanges are always at risk of getting hacked.

Secondly, the value of your asset can depreciate over time, and you can’t do anything about it other than take the loss. For example, owners of Bitcoin that bought it near all-time highs are currently nursing a more than 50% erosion in the value of the asset.

Taking Advantage of Micro Movements

The biggest advantage of Bitcoin CFD over spot Bitcoin is that you don’t have to perpetually hope for the price to keep appreciating. You can trade the asset when it’s in an uptrend by going long and trade it when it’s in a downtrend by going short.

You also don’t have to trade only huge moves either. Savvy Bitcoin CFD traders can make money when Bitcoin’s price goes up from $23,000 to $25,000 or from $20,000 down to $18,000. With spot Bitcoin, you’ll only make money if Bitcoin rises well beyond your purchase price AND you sell to the exchange or to someone else.

FAQ

How Can I Make Money Trading Bitcoin CFD?

You can make money trading Bitcoin CFD by taking the time to learn technical and fundamental analysis strategies. These strategies will allow you to predict micro price movements with some degree of accuracy.

Is Bitcoin CFD Trading Safe?

Bitcoin CFD trading is safe if you trade with a reputable crypto CFD broker.

How Much Is the Contract Fee?

Different brokers have different contract fees. However, contract trading typically has lower fees than spot trading. For example, Mirade CFDs contract fees are only the spreads and overnight swap fees, which are as low as 0.01%.

Final Words

At a time when the cryptocurrency market is stronger than ever, Bitcoin CFD trading gives traders another way of making money from the market. The days of locking away all your investable income on one asset are long gone. With the right education, you can make money from Bitcoin’s micro-movements without enduring all the downsides.

However, it all starts with signing up with a reputable broker like Mitrade.

Direct market access | Deal on rising and falling market | 24-hour trading | Limit and stop-loss for every trade

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.