Prediction: IonQ Stock Will Be Worth This Much By Year-End 2026

Key Points

IonQ stock has rallied thanks to soaring revenue and an enthusiastic investor base.

The company has relied on stock issuances and acquisitions to fund its growth.

IonQ is drawing parallels to that of Cisco during the dot-com era.

- 10 stocks we like better than IonQ ›

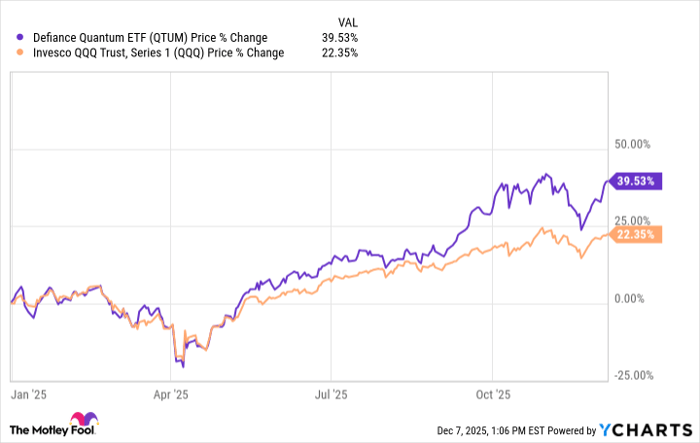

Quantum computing might just be the hottest ticket on the artificial intelligence (AI) train. Throughout 2025, shares of the Defiance Quantum ETF have gained nearly 40% -- almost double that of the Invesco QQQ Trust, which tracks the Nasdaq-100.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

QTUM data by YCharts

Among the most popular quantum computing pure-play stocks is IonQ (NYSE: IONQ), whose shares have soared by 39% over the last year. While IonQ has quite a bit of momentum behind it, I predict that shares will plummet next year.

Let's explore what fueled IonQ stock to begin with, and then assess why the stock could be headed for a sharp correction in 2026.

Image source: Getty Images.

Why IonQ stock soared in 2025

From a macro perspective, quantum computing stocks took off this year as growth investors looked to rotate capital into new AI-driven themes. For three years, unprecedented sums of capital have flowed toward semiconductors, data centers, cloud computing, and enterprise software.

Quantum computing is promising to revolutionize mission-critical industries across the board, with McKinsey & Company forecasting up to $2 trillion in additional economic value as a result of the technology.

When it comes to IonQ specifically, the company's trapped-ion architecture has unique integrations with the three largest cloud hyperscalers: Amazon Web Services (AWS), Microsoft Azure, and Alphabet's Google Cloud Platform (GCP).

Moreover, the company has consistently beat Wall Street revenue expectations in recent quarters -- lending to the idea that the company could be on the verge of a commercial breakthrough.

Against this backdrop, hopeful investors have flocked to IonQ in hopes that the company will become a leader in the quantum computing space and emerge as a titan of the AI boom.

Image source: Getty Images.

IonQ's charade might not last much longer

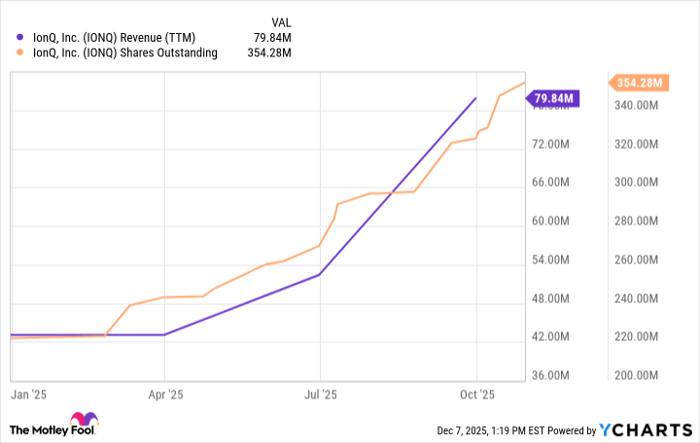

While IonQ's revenue growth is accelerating, so too is the company's outstanding share count.

IONQ Revenue (TTM) data by YCharts

At the moment, IonQ is hemorrhaging cash and has not outlined a thorough plan to reach profitability. In reality, IonQ has taken full advantage of its frothy valuation -- continuously issuing shares at its premium valuation in order to raise capital. Subsequently, the company has used this liquidity buffer to fund $2.5 billion of acquisitions.

By next year, I think more investors are going to figure out the strategy IonQ is employing. As a result, investors may grow tired of investing in the idea of a quantum breakthrough and begin demanding more concrete developments featuring real commercial products.

Prediction: IonQ stock will plummet in 2026

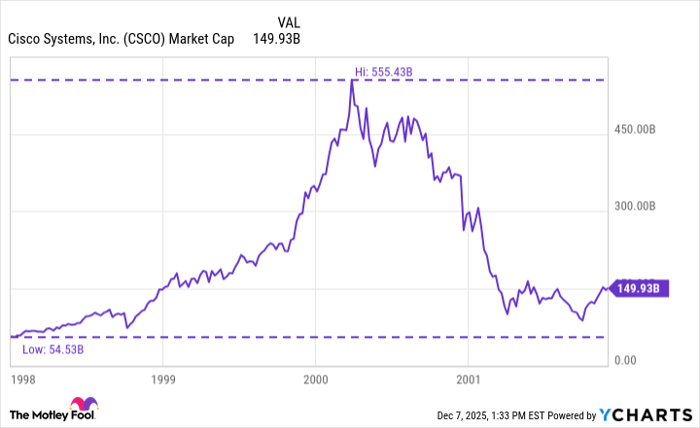

As of market close on Dec. 5, IonQ's market capitalization was $18.7 billion -- roughly the same combined size as competing platforms Rigetti Computing and D-Wave Quantum. In many ways, IonQ reminds me of Cisco in the late 1990s. At the peak of the dot-com bubble, Cisco was briefly the most valuable company in the world.

CSCO Market Cap data by YCharts

As the chart illustrates, Cisco's market value rose by nearly tenfold during its run-up throughout dot-com euphoria. However, when the bubble burst in early 2000, Cisco had a pretty epic fall -- losing roughly 73% of its value.

Since the dawn of the AI revolution, IonQ's market cap has risen by more than 2,000%. Given the company has little to show for its acquisition spending spree and with no profits on the horizon, I don't imagine IonQ sustains its rally for much longer.

While history doesn't repeat every moment the same way, it often rhymes. Should IonQ follow a similar trajectory to that of Cisco and lose about 70% of its value, the company would be worth about $5 billion next year.

To me, IonQ stock is too speculative to own and risks smart investors holding the bag in an otherwise profitable AI landscape.

Should you invest $1,000 in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,982!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,459!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Adam Spatacco has positions in Alphabet, Amazon, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Cisco Systems, IonQ, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.