How to Buy Bitcoin in Australia in Just 3 Minutes

Over the past decade, Bitcoin—the world’s biggest cryptocurrency—has surged in value by 10,000 times. Many investors have made a fortune riding this wave. Even now, with Australia’s crypto market growing steadily and regulations getting clearer, more Aussies are starting to take notice and buy Bitcoin. Since Donald Trump won the U.S. presidential election, the crypto market saw a major boost, hitting record highs. With growing investor interest and stronger government support, maybe you could also consider getting into the cryptocurrency market. In this article, we’ll show you how to buy Bitcoin in Australia in just 3 minutes!

Trading ways of bitcoin

Before trading, it is essential to understand the primary methods for trading Bitcoin and other cryptocurrencies. Cryptocurrency trading mainly involves two key approaches, along with additional ways to engage with Bitcoin:

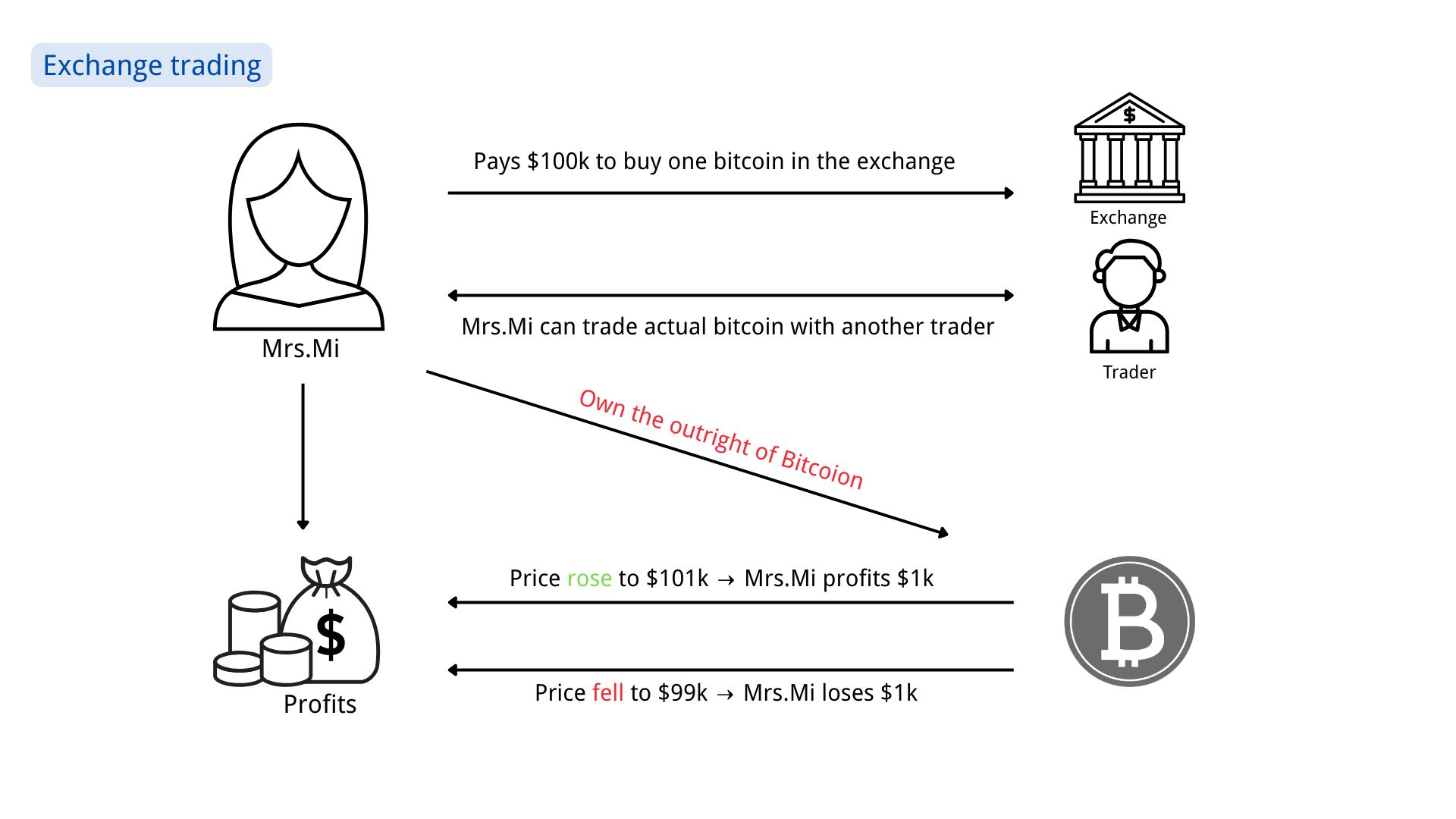

1. Cryptocurrency exchanges

Trading through a traditional cryptocurrency exchange is the most common way to buy Bitcoin. Investors can trade hundreds of cryptocurrencies there, primarily through spot trading—meaning they buy or sell the actual cryptocurrency and instantly transfer ownership on the platform. These exchanges come in two main types: centralized exchanges (CEX) and decentralized exchanges (DEX).

CEXs are run by companies that manage users’ funds and handle the trades, like CoinSpot or Coinbase. On the other hand, DEXs enable peer-to-peer trading directly on the blockchain without any middlemen, with examples including Uniswap and PancakeSwap.

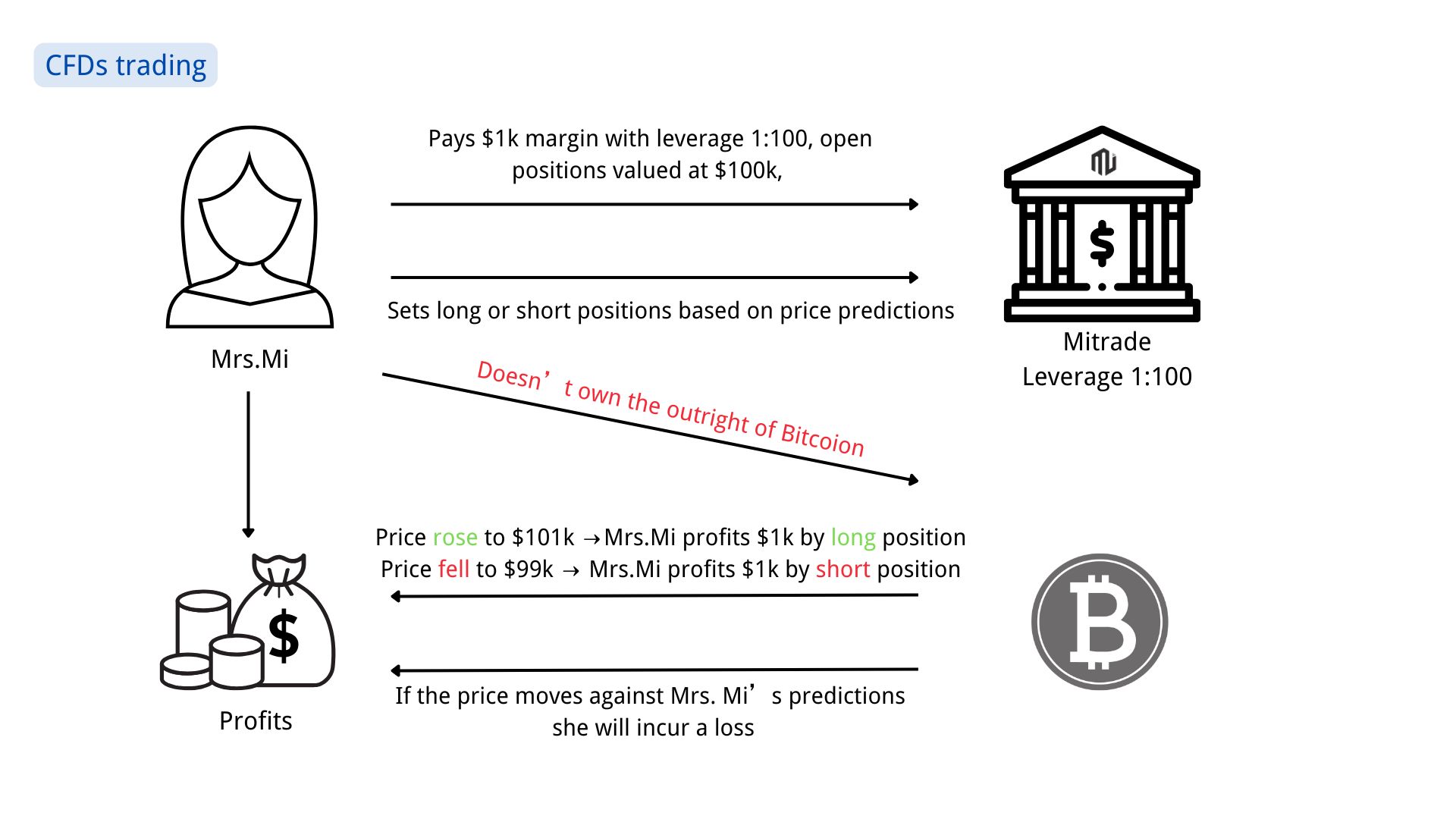

2. CFDs trading

Trading Bitcoin CFDs usually takes place on Over-The-Counter (OTC) platforms like Mitrade. With CFD trading, you don’t actually own the cryptocurrency. Instead, you’re simply speculating on Bitcoin’s price movements, speculating on whether the price will go up or down without holding the actual asset. CFD trading platforms typically offer leverage, enabling traders to open positions with a larger value while committing only a small amount of capital.

Here’s a simple example to explain the difference between exchange trading and CFD trading:

Let’s say Mrs.Mi wants to buy bitcoin, and the current market price of one Bitcoin is $100k.

*Leverage trading can boost your potential profits, but it also comes with the risk of amplifying your losses. If you’re new to trading, it’s advisable to start with low leverage.

*Leverage trading can boost your potential profits, but it also comes with the risk of amplifying your losses. If you’re new to trading, it’s advisable to start with low leverage.

3. Bitcoin wallets

Strictly speaking, Bitcoin wallets aren’t a way to buy Bitcoin—they’re for storing it. But nowadays, most wallets let you buy Bitcoin through third-party services built right in, like MoonPay, Ramp, or Paxos.

4. Peer-to-peer money transfer apps

Some cash transfer apps like PayPal and Venmo also let you buy Bitcoin right within the app. But keep in mind, if you’re buying small amounts, they usually charge higher fees.

5. Bitcoin ATMs

Bitcoin ATMs work pretty much like regular ATMs, but instead of just cash, you can buy or sell Bitcoin. You’ll often find them in the same places as normal ATMs. One thing to watch out for is the fees — Bitcoin ATM fees are usually a lot higher than what you’d pay on a traditional crypto exchange, so always double-check the fees before making a transaction.

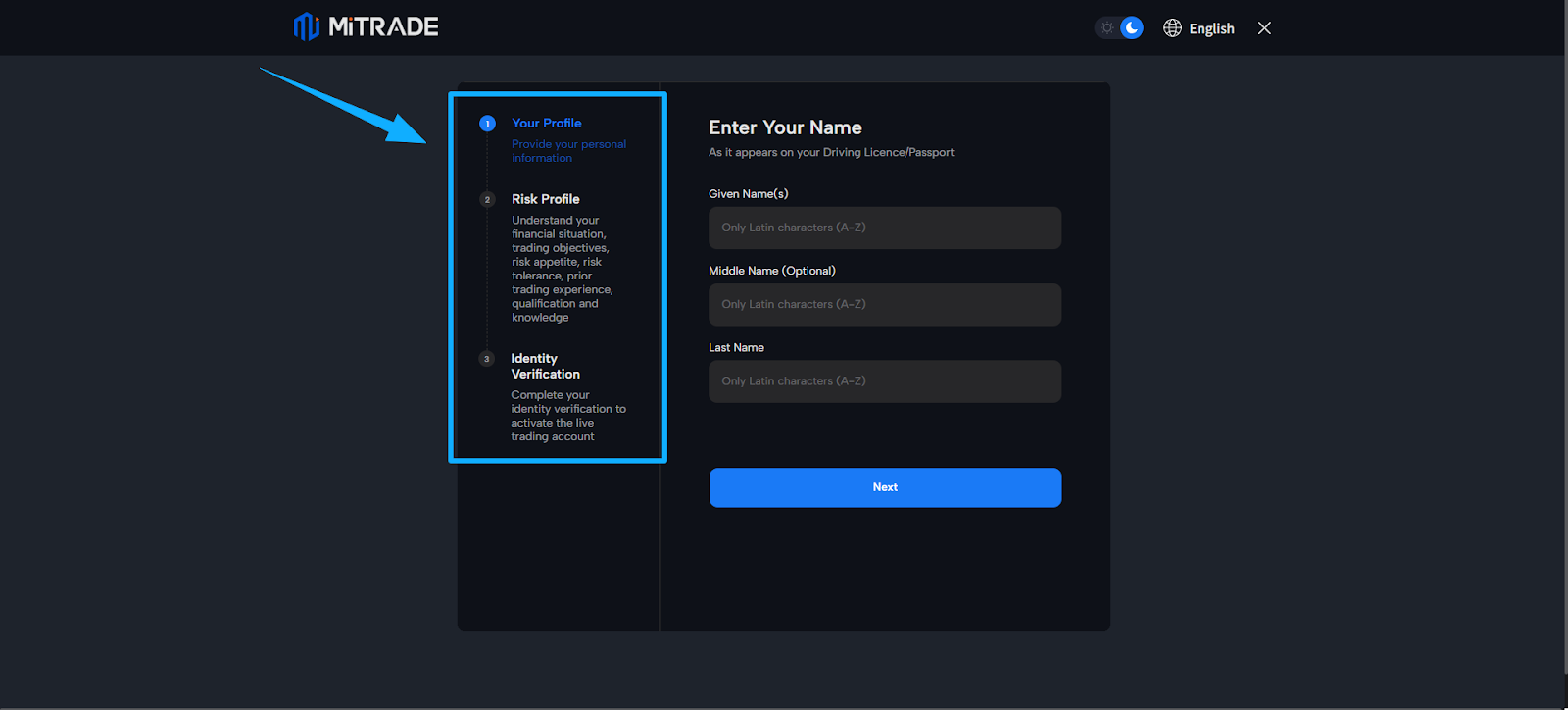

How to buy Bitcoin/Crypto step by step?

Step 1. Pick a reliable exchange that fits your trading style. For example, Mitrade is great for CFD trading, while CoinSpot and Coinbase are good for spot trading. In the examples below, we’ll use Mitrade to show you how it works.

Step 2. Open an account only takes 3 steps and about 3-5 minutes:

Fill out your profile

Complete the risk profile

Verify your identity

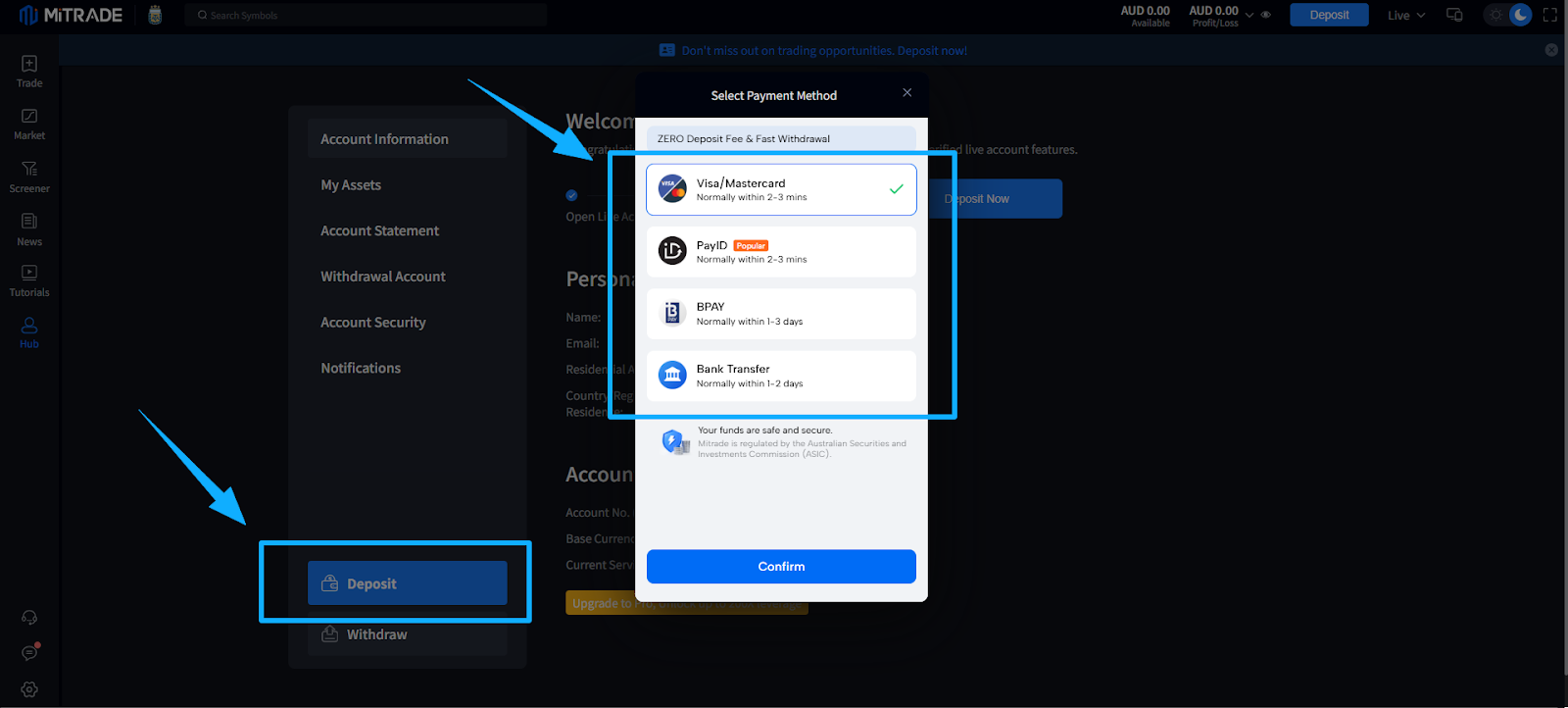

Step 3. Deposit funds

In Australia, you’ve got a few ways to deposit money—like PayID, direct deposit, credit card, and debit card. Just a heads up: direct deposits usually don’t have any fees, but credit and debit card payments often come with extra charges.

Step 4. Get trading

Place a market order or a pending order based on what suits you. Mitrade gives you various leverage options and order types, so you can open bigger positions with a smaller amount of funds and better manage your trading risks.

*Leverage trading can boost your potential profits, but it also comes with the risk of amplifying your losses. If you’re new to trading, it’s advisable to start with low leverage.

Step 5. Close your positions whenever you’re ready to stop trading.

Step 6. Withdraw your funds.

How to Choose a right exchange to buy Bitcoin/Crypto?

A good partner makes half the battle. When picking a reliable exchange, keep these in mind:

1) Safety

Check if the exchange has strong tech and fund protection in place, like anti-hacker measures, stable servers, and risk reserves. Without these, your assets could be at serious risk.

2) Compliance

Go for platforms that follow local laws. Licensed exchanges usually provide better security and customer protection.

3) Platform transparency

Make sure all product info, prices, and data are clear and upfront. Fees should be laid out so the whole process is honest and transparent.

4) Liquidity

Look for exchanges with good trading volume and liquidity, so you can buy and sell quickly. Otherwise, slippage might mess with your price and profits.

5) Fees

Double-check that fees (trading fee, withdrawal fee, etc.) are fair and transparent.

6) Customer Service

Pick a platform that responds quickly, offers multilingual support, and sorts problems efficiently to keep your trading easy and hassle-free.

Mitrade is a trusted, ASIC-regulated trading platform offering a user-friendly interface, low minimum trades, and competitive spreads. Award-winning for transparency and innovation, it provides fast order execution, 24/5 expert support, and access to global markets including shares, commodities, indices, and currencies—ideal for seamless, cost-effective trading.

Notices

Cryptocurrency is a wild ride, characterized by very high volatility with big highs and big lows.

Patience is crucial when navigating this market.

Always make decisions wisely and avoid acting on emotions.

Stick to the basics and maintain a disciplined approach.

Never invest more than you can afford to lose.

How does bitcoin work?

Bitcoin is a digital money system created by someone called Satoshi Nakamoto. It works without banks or governments. People can use Bitcoin like regular money or as an investment by buying it on crypto exchanges. Transactions happen directly between users and are recorded on a secure public ledger called the blockchain, which helps prevent cheating. Bitcoin earns money for investors when its value goes up.

How much is one bitcoin?

1 BTC = 114,301 USD (As of 14:30 UTC+8 on 11 September, 2025)

The latest price refer to https://www.mitrade.com/au/insights/markets/crypto/BTCUSD

How to mine bitcoin?

Mining bitcoin requires specialized mining equipment, such as ASIC miners. Miners compete to solve complex mathematical problems, and the first to solve the problem gets the right to add a new block to the blockchain and is rewarded with bitcoins. In addition, there is also pool mining, where multiple miners combine their computing power, and the rewards are distributed according to the proportion of computing power contributed by each miner.

What is the recommended transfer method for trading bitcoin?

The safest method is using trusted cryptocurrency exchanges or wallets with strong security features. Always use official platforms and enable two-factor authentication.

What’s the best crypto to buy right now?

The cryptocurrency market is highly volatile and risky, and there is no absolute "best" cryptocurrency. The choice of cryptocurrency depends on various factors such as personal risk tolerance and investment goals. Popular cryptocurrencies include Bitcoin and Ethereum, but it is important to conduct in - depth research and consider seeking professional financial advice before investing.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.