US 10-year yield rises after hot NFP’s hit Fed cut hopes

- US 10-year yield rebounds after 130K payroll gain beats forecasts; unemployment dips to 4.3%.

- Rate cut bets shift to July as markets trim near-term Federal Reserve easing expectations.

- Hawkish comments from Jeffrey Schmid reinforce restrictive stance despite softer inflation views.

US Treasury yields rise across the curve with the US 10-year Treasury note rising nearly one and a half basis points at 4.155% following the release of a strong jobs report in the US, which trimmed investors’ expectations of further easing by the Federal Reserve.

Treasury yields edge higher as robust jobs data and hawkish Fed rhetoric cool expectations of aggressive easing

The US 10-year Treasury yield bounced off from around 4.125% after the US Bureau of Labor Statistics (BLS) revealed that the economy added 130K people to the workforce, above economists’ estimates of 70K, as revealed by the latest Nonfarm Payrolls.

Digging inside the data, the Unemployment Rate fell from 4.4% to 4.3%, below Fed’s estimates of 4.5% for the full year.

Expectations that the Fed will cut in March, dissipated as money markets had priced in 27 basis points of easing towards July 2026. For the full year, investors seem confident that the US central bank will reduce rates twice, with the first reduction seen in July.

Hawkish comments by Kansas City Fed President Jeffrey Schmid, capped US yields fall. He said that “rate cuts might permit higher inflation to continue for a longer time,” and that policy needs to remain restrictive if inflation is near 3%.

The US Dollar Index (DXY), which measures the performance of the buck’s value versus six currencies, falls 0.14% down at 96.75, a tailwind for Gold prices.

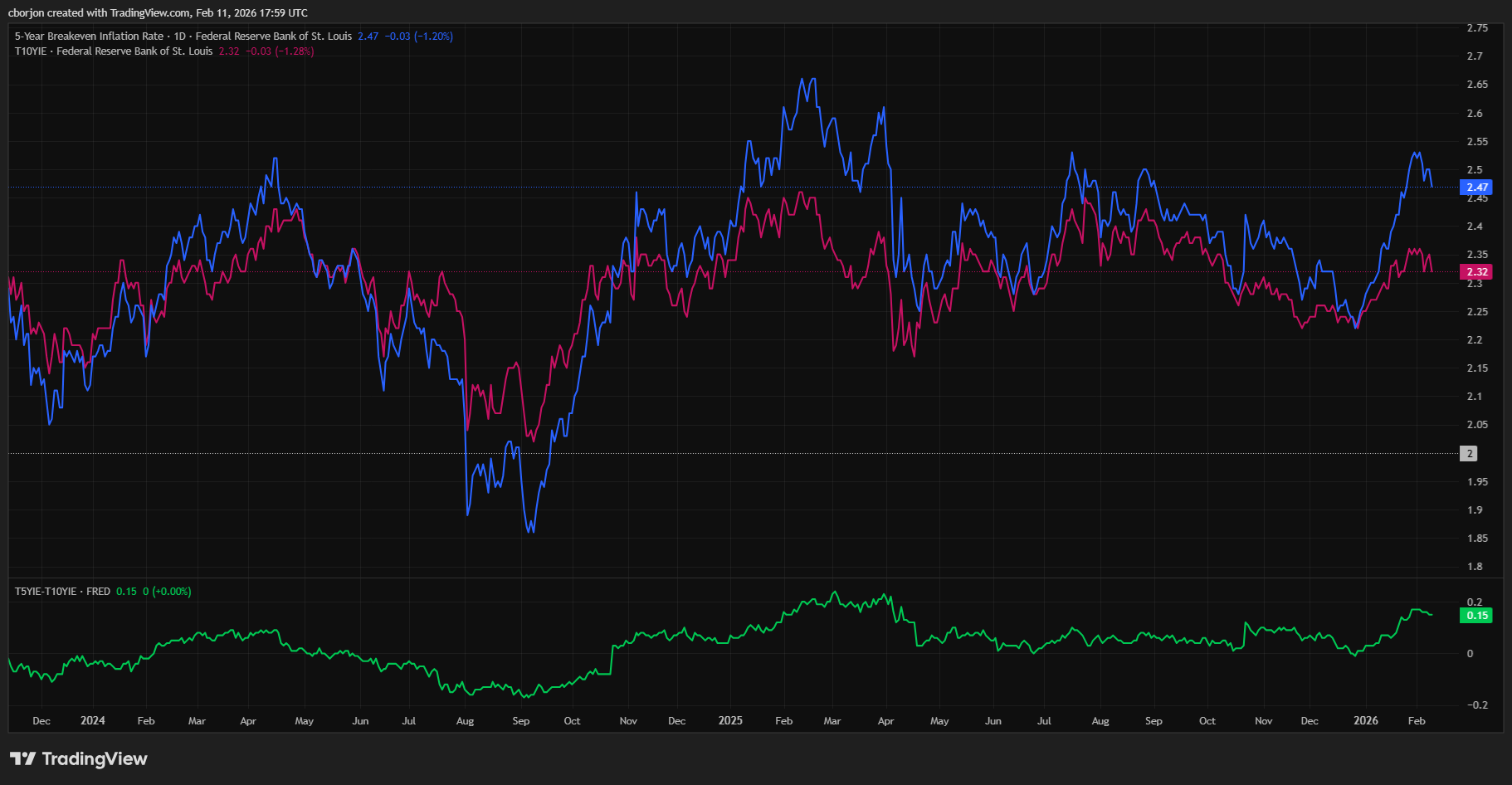

In the meantime, the financial markets inflation expectations in the US for five-years are at 2.47%, down from 2.5% a day ago according to the 5-year Breakeven Inflation Rate. For ten years, the 10-year Breakeven dipped from 2.35% to 2.32%, an indication that markets see inflation in the medium term, falling towards the Fed’s 2% goal.

Traders focus shifts to US Consumer Price Index data

Initial Jobless Claims and Fed speeches are scheduled for Thursday. On Friday, attention turns to January’s CPI report, with headline and core inflation expected to decline from 2.7% and 2.6% YoY to 2.5%, each respectively.

US 10-year Treasury note yield

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.