Ethereum's bearish momentum weakens as Grayscale's ETHE outflows slowdown

- Ethereum's recent decline could alter predictions of ETFs sending ETH to an all-time high of around $5,000.

- ETH options worth $560 million expired on Friday amid market crash.

- Ethereum could reclaim key support level as technical indicators suggest bearish momentum is weakening.

Ethereum (ETH) is up 0.4% on Friday as ETH ETFs record another day of mild inflows. The recent market crash could also alter earlier predictions of the ETFs, boosting ETH to a new all-time around $5,000.

Daily digest market movers: Ethereum ETF Flows, Hashdex combined ETF, ETH options expiry

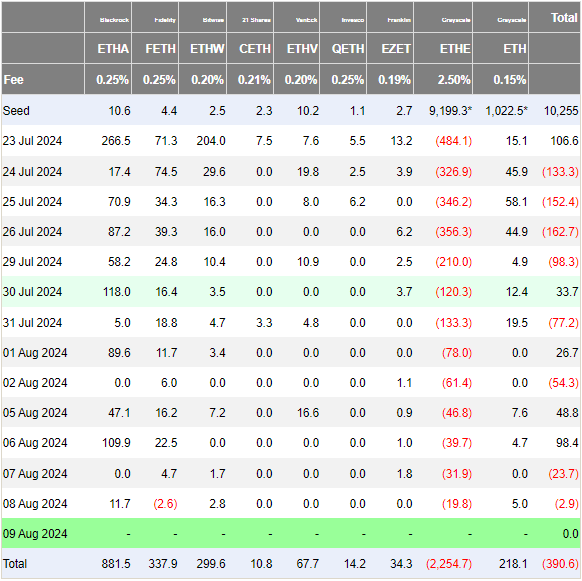

Ethereum ETFs saw mild net outflows of $2.9 million on Thursday following a 10% rally in ETH's price. BlackRock's ETHA recorded $11.7 million in inflows, while Grayscale's ETHE outflows reduced to $19.8 million.

Ethereum ETF Flows

With ETHE outflows trending toward zero, analysts expect ETH ETFs to begin recording consistent net inflows in the coming weeks.

Several analysts, including Bitwise CIO Matt Hougan, have earlier predicted that ETH ETFs could see net inflows of $15 billion in the first 18 months of launch. Most predictions suggested that such inflows could send ETH to set a new all-time high of around $5,000.

However, with the recent market crash that sent ETH to around $2,100, analysts' may need to update their predictions.

Also, on the ETH ETF front, the Securities & Exchange Commission (SEC) extended the time to decide on asset manager Hashdex's ETF that would own Bitcoin and Ethereum to September 30, according to the regulator's filing on Friday.

Meanwhile, ETH options with a notional value of $560 million, Put/Call Ratio (PCR) of 0.96 and Max pain of $2,950 expired today. The recent crash saw put (sell) options rising compared to calls (buy), as reflected in the hike in PCR from 0.55 to 0.96 in the past week, meaning most options traders turned bearish on ETH. A price reversal often follows when the PCR rises quickly.

ETH technical analysis: Ethereum could reclaim key support

Ethereum is trading around $2,600 on Friday, up 0.4% on the day. In the past 24 hours, ETH saw $41.03 million in liquidations, with long and short liquidations accounting for $18.2 million and $22.83 million, respectively.

ETH failed to overcome the $2,723 resistance level as prices quickly retraced on the daily chart after attempting a move above it.

ETH/USDT Daily chart

The Relative Strength Index (RSI) and Stochastic Oscillator have moved away from the overbought region in the past few days, meaning the bearish momentum is weakening.

If the bearish momentum continues to fade, ETH could retest the $2,723 resistance again.

A successful leg-up would see ETH aim for the $3,368 resistance, especially with a potential illiquid weekend and bulls returning to the market. This would also see ETH reclaiming the $2,800 key support that withstood bearish pressure for nearly six months before the recent market crash.

On the downside, ETH could follow a trendline to reach a swing low around the $2,000 psychological level in the coming weeks before rebounding. ETH has previously posted similar moves between August 2022 to November 2022 and July 2023 to October 2023.

In the short term, ETH could bounce around $2,548, where traders risk $24.4 million in liquidations.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.