Bitcoin Weekly Forecast: BTC reclaims $111,000 ahead of US CPI data release

- Bitcoin price pushes for $111,000 on Friday, after rebounding from the key support earlier this week.

- Market participants await US CPI data on Friday, which could spark fresh volatility in riskier assets such as BTC.

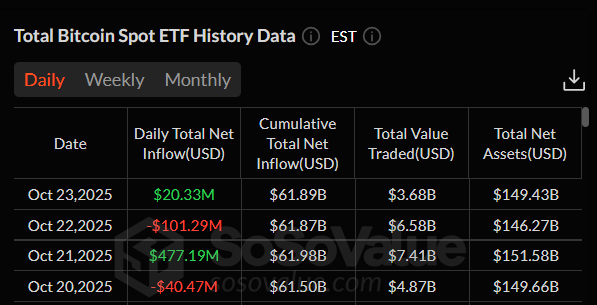

- US-listed spot ETFs remain indecisive, alternating inflows and outflows through the week.

Bitcoin (BTC) price reclaims $111,000 mark at the time of writing on Friday, after finding support around the key level earlier this week. Investors now focus on the US Consumer Price Index (CPI) data release due later on Friday, which could influence market sentiment and volatility. Meanwhile, institutional flows remain mixed so far this week, reflecting a cautious stance among investors.

Bitcoin could face volatility on US inflation data

The US Bureau of Labor Statistics will publish September’s CPI report to meet Social Security deadlines on Friday. However, the prolonged US government shutdown, now in its 24th day and the second-longest federal funding lapse in history, has halted other key economic data releases, including Nonfarm Payrolls (NFP). This growing uncertainty has added pressure to financial markets and clouded the Federal Reserve’s (Fed) monetary policy outlook.

As a result, the CPI data, which will finally be released this Friday after being delayed due to the shutdown, could act as a major catalyst, potentially sparking fresh volatility across risk assets such as Bitcoin.

Easing US-China trade tensions boosts sentiment

The easing of the ongoing US-China trade tensions has lifted investor sentiment this week, supported by news of high-level negotiations set to begin in Malaysia on Friday. China's Vice Premier He Lifeng will participate in the meetings, as well as US Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer.

Optimism further strengthened after the White House confirmed that US President Donald Trump and Chinese President Xi Jinping will meet next week during Trump’s Asia tour, raising hopes of progress before the looming tariff deadline. Renewed hopes of a potential agreement between the world’s two largest economies have boosted investors' confidence, supporting the recovery in risk assets such as Bitcoin.

Geopolitical conflicts keep a lid on Bitcoin

On the geopolitical front, Trump said on Tuesday he did not want a "wasted meeting" after a plan to have face-to-face talks with his Russian counterpart, Vladimir Putin, about the war in Ukraine was put on hold, BBC reported.

The report further highlighted that key differences between US and Russian proposals for peace became increasingly clear this week, seemingly dashing the chances of a summit.

Moreover, Washington announced late on Wednesday new sanctions on Russia's two largest Oil companies, Rosneft (ROSN.MM) and Lukoil (LKOH.MM), adding pressure on the Kremlin to end the war in Ukraine.

These mixed signs on the geopolitical front are making investors more cautious, keeping a lid on riskier assets like Bitcoin.

Indecisiveness among institutional investors

Institutional flows reflect a mixed sentiment so far this week, as Bitcoin spot ETFs saw alternating inflows and outflows — mild outflows of $40.47 million on Monday and $101.29 million on Wednesday contrast with the $477.19 million inflow on Tuesday and $20.33 million on Thursday, according to SoSoValue data. This highlights the indecisiveness among institutional investors, as fluctuating ETF flows suggest a cautious approach amid prevailing market uncertainty.

Total Bitcoin Spot ETF chart. Source: SoSoValue

Bealls Inc. becomes first US retailer to accept digital currencies

Bealls Inc., a privately held retail corporation operating across the United States, announced on Monday a partnership with digital payments platform Flexa to enable cryptocurrency payments across more than 660 stores nationwide. This integration makes Bealls the first national retailer to accept digital assets from over a dozen blockchains, including BTC, ETH, stablecoins and meme tokens.

This news is bullish for the overall crypto market in the long term as it signals growing mainstream adoption, validates the utility of cryptocurrencies in everyday transactions, and indicates wider acceptance. Moreover, it could encourage other large retailers to integrate crypto payments, thereby increasing demand and usage across multiple blockchain networks.

T. Rowe Price’s first crypto ETF targets multiple digital currencies

Traditional finance continues to edge deeper into the crypto ecosystem as T. Rowe Price (TROW.O), one of the largest asset managers in the US, took a major step on Wednesday as the firm filed for an S-1 registration with the US Securities and Exchange Commission (SEC) to launch an actively managed Exchange Traded Fund (ETF) tied to multiple digital currencies.

The move marks a major step in the firm’s expansion into digital assets, as the $1.8 trillion asset manager — having only entered the ETF space in 2020 — takes a decisive step toward direct participation in the crypto market.

However, the ongoing US government shutdown has stalled regulatory progress, delaying several altcoin ETF applications initially expected to launch in October, and potentially postponing a key catalyst for renewed crypto market optimism.

Trump pardons Binance founder Changpeng Zhao

US President Donald Trump has signed an official pardon for convicted crypto exchange Binance founder and former CEO Changpeng Zhao (CZ), the White House announced on Thursday. Zhao had pleaded guilty to money-laundering violations in 2023 and was sentenced to four months in prison in April 2024.

"Deeply grateful for today's pardon and to President Trump for upholding America's commitment to fairness, innovation, and justice," CZ wrote on his X post on that same day.

Following the announcement, cryptocurrency prices edged higher on Thursday as market sentiment improved on renewed optimism toward regulatory leniency and leadership stability in the crypto industry.

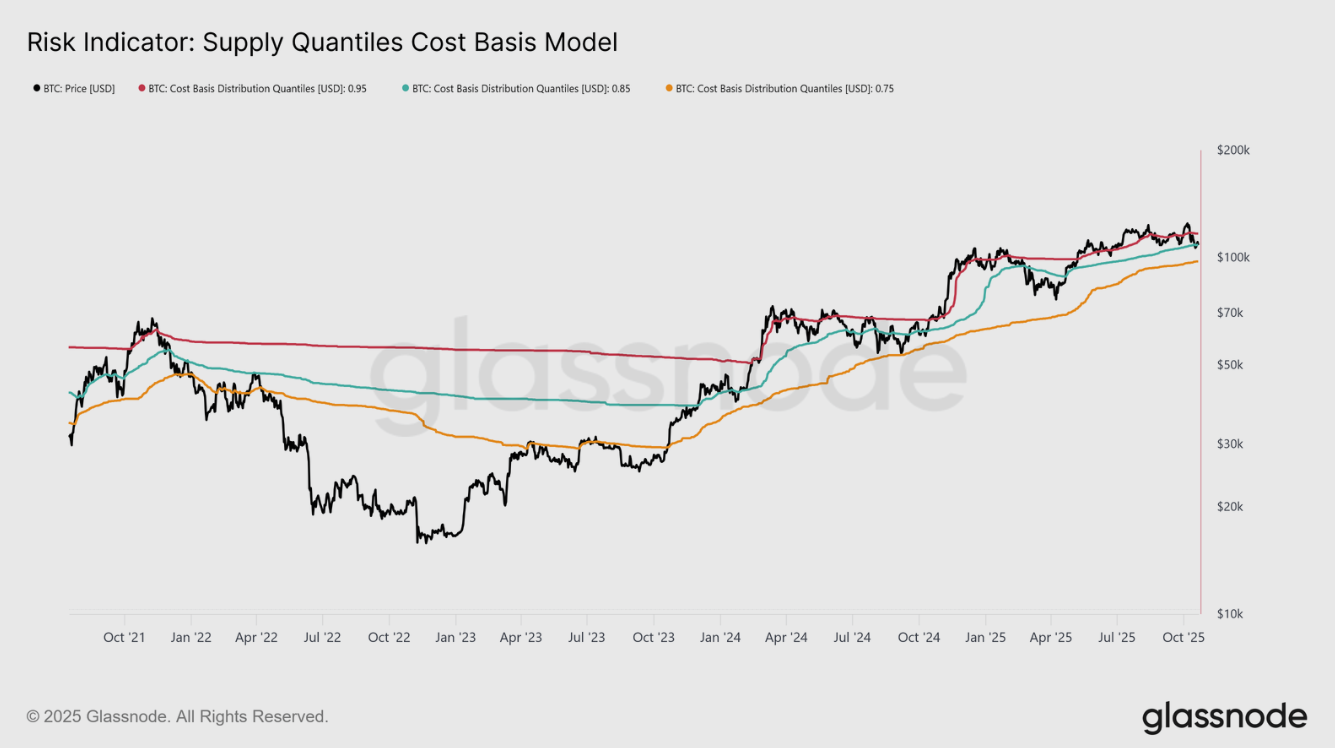

On-chain data show some signs of concern

Glassnode's weekly report, published on Wednesday, highlighted that BTC has corrected below the short-term holders’ cost basis at $113,100. Also below, the 0.85 quantile at $108,600 indicates growing demand exhaustion, as the market struggles to attract new inflows while long-term holders continue to sell.

This structural fatigue suggests that Bitcoin’s network may need an extended consolidation phase to restore market confidence. Moreover, if BTC corrects, it could revisit the 0.75 quantile level, currently around $97,500.

The report explains that the options market shows BTC has the same cautious structure. Despite record-high open interest, positioning leans defensive; put skew remains elevated, volatility sellers are under pressure, and short-term rallies are met with hedging rather than optimism.

“Together, these signals indicate a market in transition, one where exuberance has waned, structural risk-taking is subdued, and recovery will likely depend on restoring spot demand and mitigating volatility-driven flows,” said Glassnode analyst.

Bitcoin Price Forecast: BTC shows signs of fading bearish momentum

Bitcoin price faced rejection from the 50-day Exponential Moving Average (EMA) at $113,362 on Tuesday and declined by 2.68% the next day. However, BTC price retested the 61.8% Fibonacci retracement level (drawn from the April low of $74,508 to the record high of $126,199) at $106,453 and recovered 2.33% on Thursday. At the time of writing on Friday, BTC is trading above $111,000, nearing the previously broken ascending trendline.

If BTC breaks and closes above the trendline, it could extend the rally toward the 50-day EMA at $113,362. A successful move above this level could see more gains toward the 78.6% Fibonacci retracement level at $115,137.

The Relative Strength Index (RSI) indicator at 47 points upward on the daily chart, suggesting early signs of fading bearish momentum. For the recovery rally to be sustained, the RSI must move above the neutral level of 50. Moreover, the Moving Average Convergence Divergence (MACD) lines are converging to form a bullish crossover. If successful, this would further support a recovery ahead.

BTC/USDT daily chart

On the other hand, if BTC closes below $106,453, it could extend losses toward the October 10 low of $102,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.