Ripple Price Forecast: Why XRP could defy September's bearish sentiment

- XRP struggles to hold the 100-day EMA as negative market sentiment takes root.

- XRP's performance hinges on macroeconomic data, particularly the Fed's September interest rate decision.

- XRP has defied bearish sentiment, posting positive monthly returns in September for three consecutive years.

Ripple (XRP) exhibits weakness in its technical structure on Monday amid concerns in the broader cryptocurrency market that September is historically a bearish month.

The cross-border money remittance is trading above $2.76 at the time of writing as bulls search for a short-term support to prevent the decline from extending to $2.50.

Can XRP recover despite bearish sentiment?

XRP's performance in September would largely depend on the United States (US) macroeconomic data. Market participants will closely monitor key inflation indicators, including the unemployment rate on Friday, the Producer Price Index (PPI) on September 10, the Consumer Price Index (CPI) and Jobless Claims on September 11.

The Federal Reserve (Fed) will consider the above indicators, along with others, to assess the economy's status ahead of the central bank's interest rate decision on September 17.

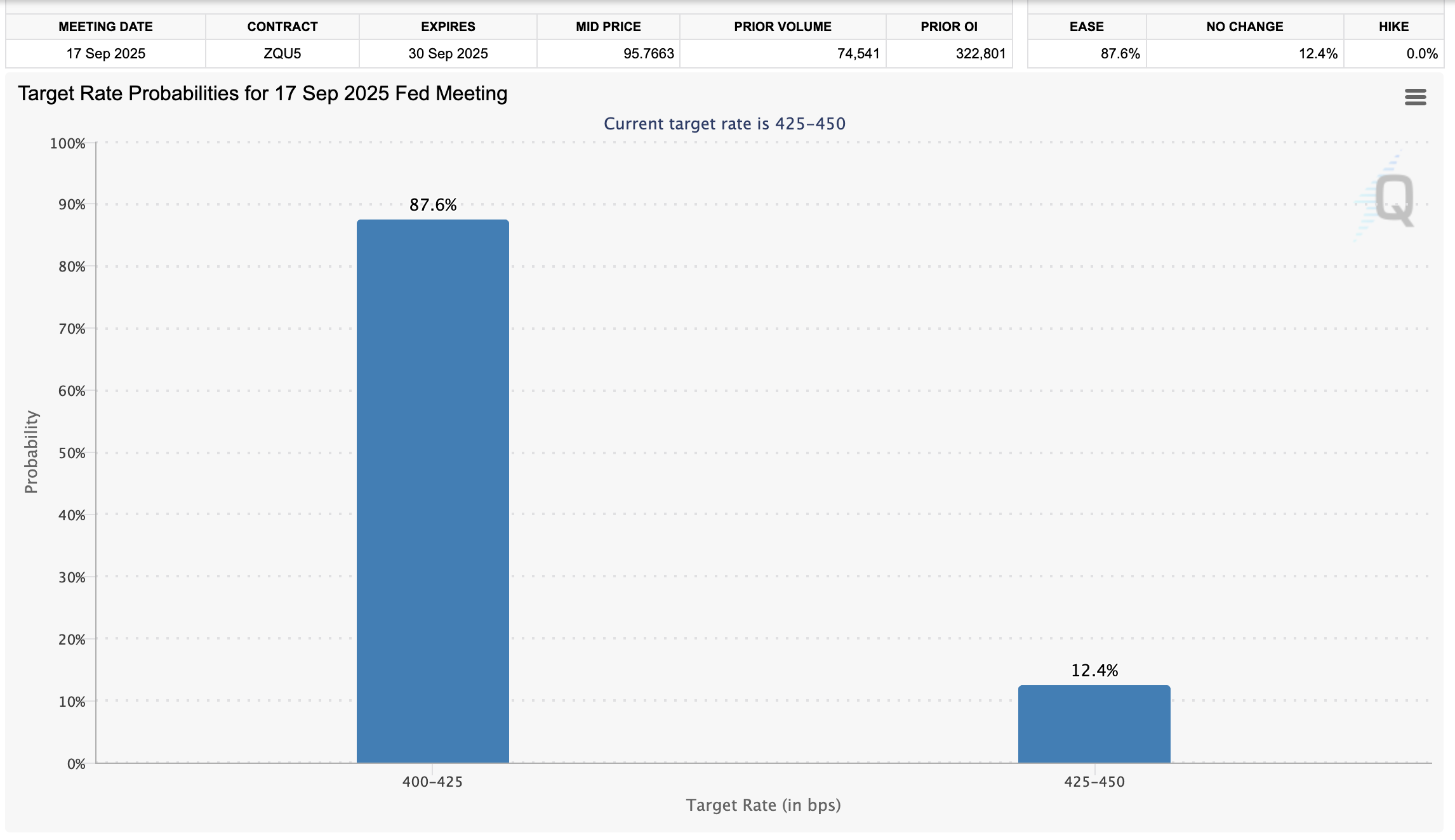

According to the CME Fedwatch tool, there is an 87.6% chance that the Federal Reserve will cut interest rates by 25 basis points (bps) to a range of 4% to 4.25%, a potential lifeline for risk asset classes, such as crypto and equities.

FedWatch Tool | Source: CME Group

Investors are looking forward to the first interest cut this year, which could boost interest in risk assets, including cryptocurrencies. Positive market sentiment could accelerate demand for XRP and intensify the tailwind ahead of a potential rebound above the $3.00 mark.

Still, risk-averse sentiment could prevail if the Fed does not cut the rates. Risk assets could suffer setbacks, affirming the current concerns about bearish sentiment in September.

On the positive side, data shows that XRP has posted positive market returns in the last three consecutive Septembers. In 2022, XRP closed September up 46.2%. In 2023, the token posted a minor profit of 0.42%, which increased to 7.98% in 2024, according to CryptoQuant.

There is a possibility that XRP will extend its profitable streak for the fourth consecutive year if sentiment improves in the coming days and weeks.

XRP monthly returns | Source: CryptoQuant

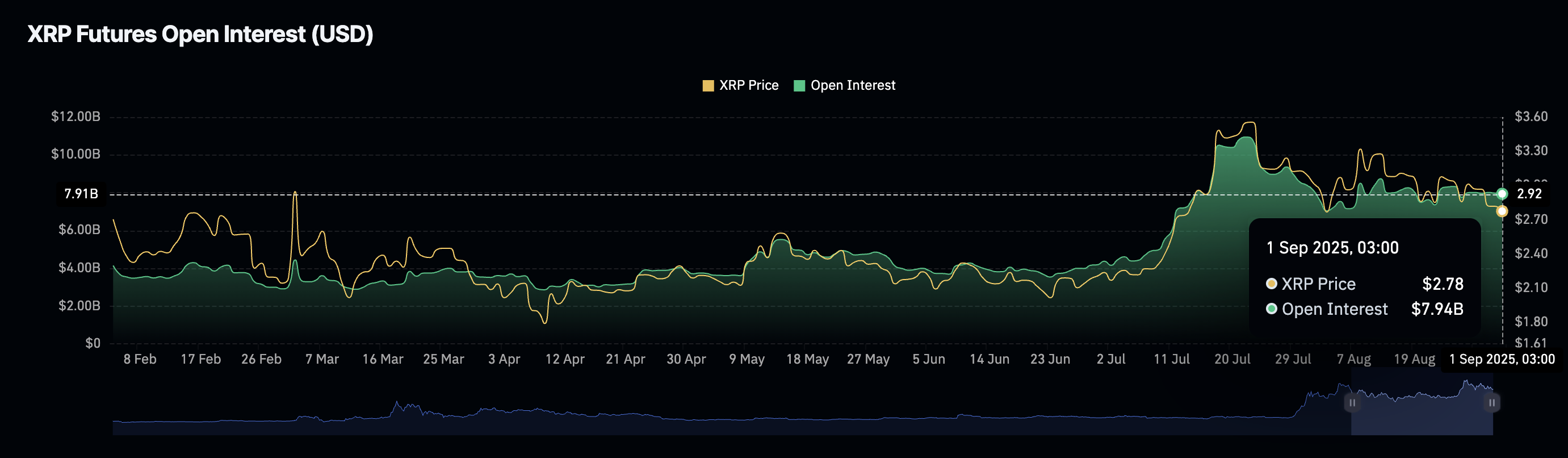

Retail interest in the international money remittance token remains relatively elevated near the $8 billion mark. Traders will be watching the Open Interest (OI), which represents the notional value of outstanding futures contracts, to gauge market sentiment and optimism.

Technical outlook: XRP edges lower

XRP price is struggling to hold the 100-day Exponential Moving Average (EMA) at $2.76 as bearish sentiment spreads in the broader cryptocurrency market. The path of least resistance is downward based on the prevailing technical picture.

A sell signal from the Moving Average Convergence Divergence (MACD) indicator has been maintained since July 25, reinforcing the bearish grip. Traders may continue de-risking with the blue MACD line remaining below the red signal line.

XRP/USDT daily chart

Buying pressure is also on a decline as reflected by the Relative Strength Index (RSI) dropping to 39 from its July peak of 88. Lower RSI readings would imply fading bullish momentum, as traders remain on the sidelines.

On the other hand, a daily close above the 100-day EMA, at $2.76, would go a long way to affirm a strengthening bullish grip. Key milestones include XRP's return above the $3.00 mark and a break above resistance at $3.35, tested in mid-August.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.