ADP Employment Report expected to highlight another month of modest hiring

- The US ADP Employment Change report is expected to show that job creation remains subdued.

- The ADP report is more important than usual as Nonfarm Payrolls data is delayed due to the partial US Government shutdown.

- Kevin Warsh’s appointment as the next Fed Chair and strong US economic data are boosting a US Dollar recovery.

The Automatic Data Processing (ADP) Research Institute will release its monthly report on private-sector job creation for January on Wednesday. The so-called ADP Employment Change report is expected to show that the United States (US) economy added 48K new jobs, following the 41K new payrolls witnessed in December.

These figures will be observed with particular interest this time, as the US Bureau of Labour Statistics (BLS) announced on Monday that the release of Friday’s key Nonfarm Payrolls (NFP) report will be delayed due to a partial US government shutdown. With the ADP report as the main reference for US employment this month, a significant deviation in the final figures might have a strong impact on the US Dollar (USD).

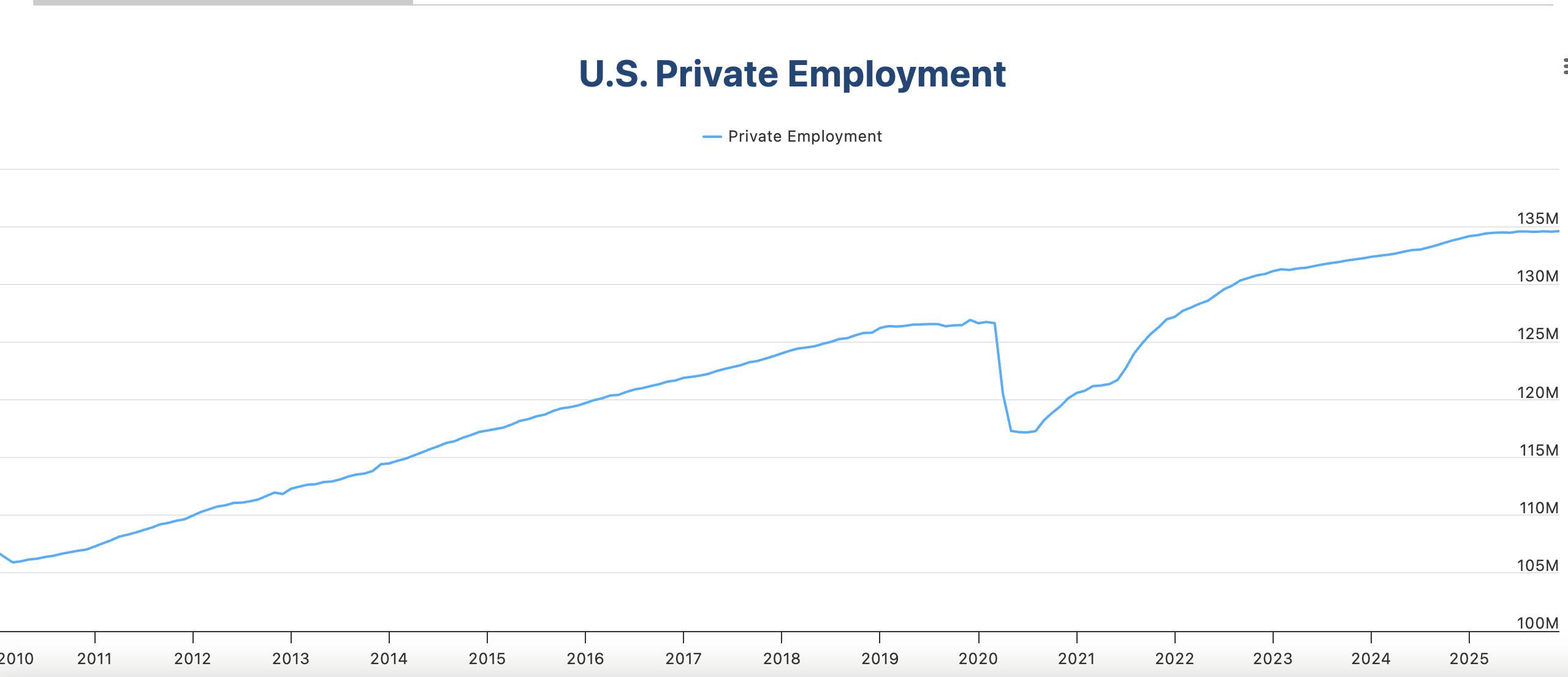

ADP Jobs Report will test the strength of the US economic recovery

January’s ADP Employment Change report comes in a context of improving optimism about the US economic outlook. A string of positive macroeconomic releases, namely the Q3 Gross Domestic Product (GDP) report and strong manufacturing activity, coupled with sticky inflation levels, have prompted traders to dial down bets of interest rate cuts by the Federal Reserve (Fed), at least until June.

This has boosted a recent US Dollar recovery, also triggered by investors’ relief after US President Trump confirmed that former Fed governor Kevin Warsh will replace Jerome Powell as Fed Chair at the end of his term.

The US economy showed a robust 4.4% anualized growth in the third quarter, according to the final GDP estimation released in January. Apart from that, factory activity expanded at its fastest pace in more than three years, according to January’s ISM Manufacturing PMI report, retail consumption bounced up strongly in November, and consumer sentiment data show a steady improvement over the last three months.

Bearing this in mind and considering that consumer inflation remains steady at levels well above the Fed’s 2% target for price stability, employment figures will be the last piece in the puzzle to assess the US central bank’s near-term monetary policy path.

January’s ADP report is expected to confirm that the labor market remains steady. Market consensus suggests that employment growth remains sluggish, but that employers are not firing either, or at least not to a large extent. This scenario cements the Fed’s stance of a cautious approach to rate cuts.

Atlanta Federal Reserve President Raphael Bostic stated at a panel speech on Monday that the central bank is close to the neutral rate and that monetary policy should remain “mildly restrictive” to get inflation back to the target. Unless the ADP shows a severe setback, this view would apply to the vast majority of the central bank’s monetary policy committee.

When will the ADP Report be released, and how could it affect the USD?

ADP will release the US Employment Change report on Wednesday at 13:15 GMT, and it is expected to show that the private sector added 48K new jobs in January.

The immediate US Dollar trend is positive. The US Dollar Index (DXY), which measures the value of the Greenback against six major currencies, appreciated 2% in the past week. Market’s relief following the appointment of former Fed Governor Kevin Warsh as the next Fed Chairman halted the US Dollar’s bleeding, while bright US economic data, a trade deal with India, and hopes that negotiations with Iran might de-escalate tensions in the Middle East, keep the Greenback supported.

Guillermo Alcala, FX Analyst at FXStreet, highlights resistance levels in the 98.00 area and 98.48 as the main hurdles for USD bulls: “The US Dollar Index is on a bullish correction amid a broader bearish trend, and bulls need to breach resistance at a previous support area around 98.00 to confirm a larger recovery and expose the January 23 high, at 98.48, ahead of the 100.00 round level.

On the downside, Alcalá sees the 97.05 level as key to maintain the immediate bullish recovery alive: “A bearish reaction below the 97.00 level would put the current recovery in question and increase pressure towards the January 28 close, at the 96.35 area.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Feb 04, 2026 13:15

Frequency: Monthly

Consensus: 48K

Previous: 41K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.