Ethereum spikes over 6% following decision to split Pectra upgrade into two phases

- Ethereum developers have agreed to split Pectra upgrade into two phases.

- Phase one of the Pectra upgrade will go live in early 2025 and feature a proposal to improve the wallet experience.

- Ethereum could continue to rally if open interest stays on an uptrend and ETH overcomes the $2,595 resistance.

Ethereum is up 6% on Thursday following the recent decision by core developers of the Main chain to split the upcoming Pectra upgrade into two phases.

Ethereum core developers agree to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals (EIPs).

Pectra was set to be Ethereum's largest upgrade in recent times; however, core developers decided it would now feature a select number of proposals in two phases to make the upgrade less cumbersome.

Phase one will feature eight EIPs, including Ethereum co-founder Vitalik Buterin's EIP-7702, which introduces a novel method of account abstraction that will improve user experience in wallets.

The second phase will include an upgrade to how bytecode is processed and executed by the Ethereum Virtual Machine, the decentralized virtual computation engine that executes smart contracts on the Main chain. It will also include EIP-7594, which aims to implement a protocol to improve blob capacity.

Phase one of the Pectra upgrade will go live as previously scheduled in early 2025, while phase two will come much later.

According to core developers, the decision to split the upgrade allows key features to ship in the first phase while allowing room to implement the second properly.

Meanwhile, Ethereum ETFs recorded a net outflow of $9.8 million on Wednesday, following a $14.7 million exodus from Grayscale's ETHE and $4.9 million inflows in BlackRock's ETHA.

Ethereum could continue upward march if it overcomes $2,595 resistance

Ethereum is trading around $2,460 on Thursday, up over 6% on the day. ETH recorded over $31 million in liquidations within the past 24 hours, with long and short liquidations accounting for $5.68 million and $25.33 million, respectively.

Ethereum broke above the $2,395 price and descending trendline resistance as buyers stepped up momentum following the Federal Reserve's (Fed) 50-basis-point rate cut on Wednesday.

ETH/USDT 4-hour chart

The move could see ETH rally to the $2,595 rectangle's resistance. If it fails to see a correction around this level, then it could target the $2,817 key price level. After establishing a yearly high in March, the $2,817 price level served as a major support level for over four months following ETH consolidation. A reclaiming of this level could fuel the bullish momentum.

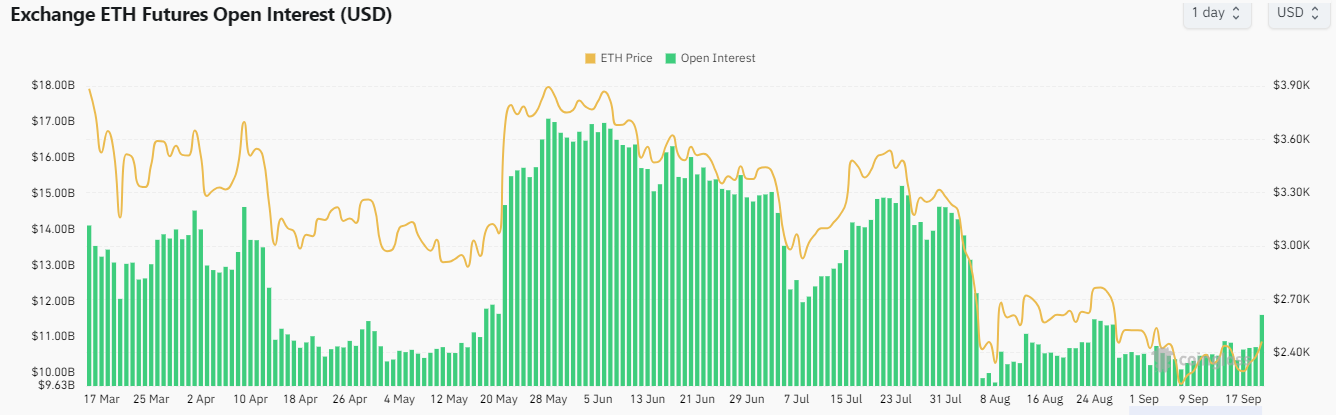

ETH's futures open interest (OI) also paints a bullish picture, rising more than 10% to cross $10.7 billion in the past 24 hours — its highest level since the market crash on August 5.

Open interest is the total number of unsettled long and short positions in a derivatives market. Rising OI often indicates increased traders' confidence, while vice versa for declining OI as traders are either closing positions or experiencing liquidations.

ETH's Open Interest

The growth in ETH's OI indicates traders are becoming increasingly confident of more potential upsides for ETH. A steady growth in this metric could see ETH sustain the uptrend.

The 4-hour Relative Strength Index (RSI) and Stochastic have entered their oversold region above 70 and 80, respectively, indicating a potential looming correction.

A daily candlestick below $2,395 will invalidate the thesis and see ETH consolidating again.

In the short term, positions worth $56.57 million risk liquidation if ETH declines to $2,412.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.