Ripple does not power smart contracts on XRP Ledger, says CTO

- Ripple CTO David Schwartz responds to a user query on X and says the XRP Ledger does not have smart-contract functionality yet.

- Ripple plans to roll out smart contracts on its Ledger mainnet by 2025, per a press release.

- XRP erases 3% value on Wednesday, trades at $0.5260 at the time of writing.

Ripple (XRP) has plans to introduce smart contract functionality to its native blockchain, the XRP Ledger. However, as of September 11 the firm has not announced a date for its launch on the mainnet.

XRP trades at $0.5260, down 3% on Wednesday.

Daily digest market movers: Ripple does not have smart contracts on XRP Ledger

- Ripple Chief Technology Officer David Schwartz responded to a query from a crypto trader on X. When asked which smart contracts are rolled out on the XRP Ledger mainnet, Schwartz said none yet. The CTO said that “today XRP Ledger is a fixed-function ledger.”

There are none today. Today, XRPL is a fixed-function ledger.

— David "JoelKatz" Schwartz (@JoelKatz) September 9, 2024

- The payment remittance firm has previously shared plans to introduce smart contract functionality on the mainnet through utility functions like hooks. A press release by Ripple notes that 2025 is the likely timeline for the functionality’s launch.

- This would mark a key milestone as it would boost the Ledger’s functionality and likely drive demand for native token XRP.

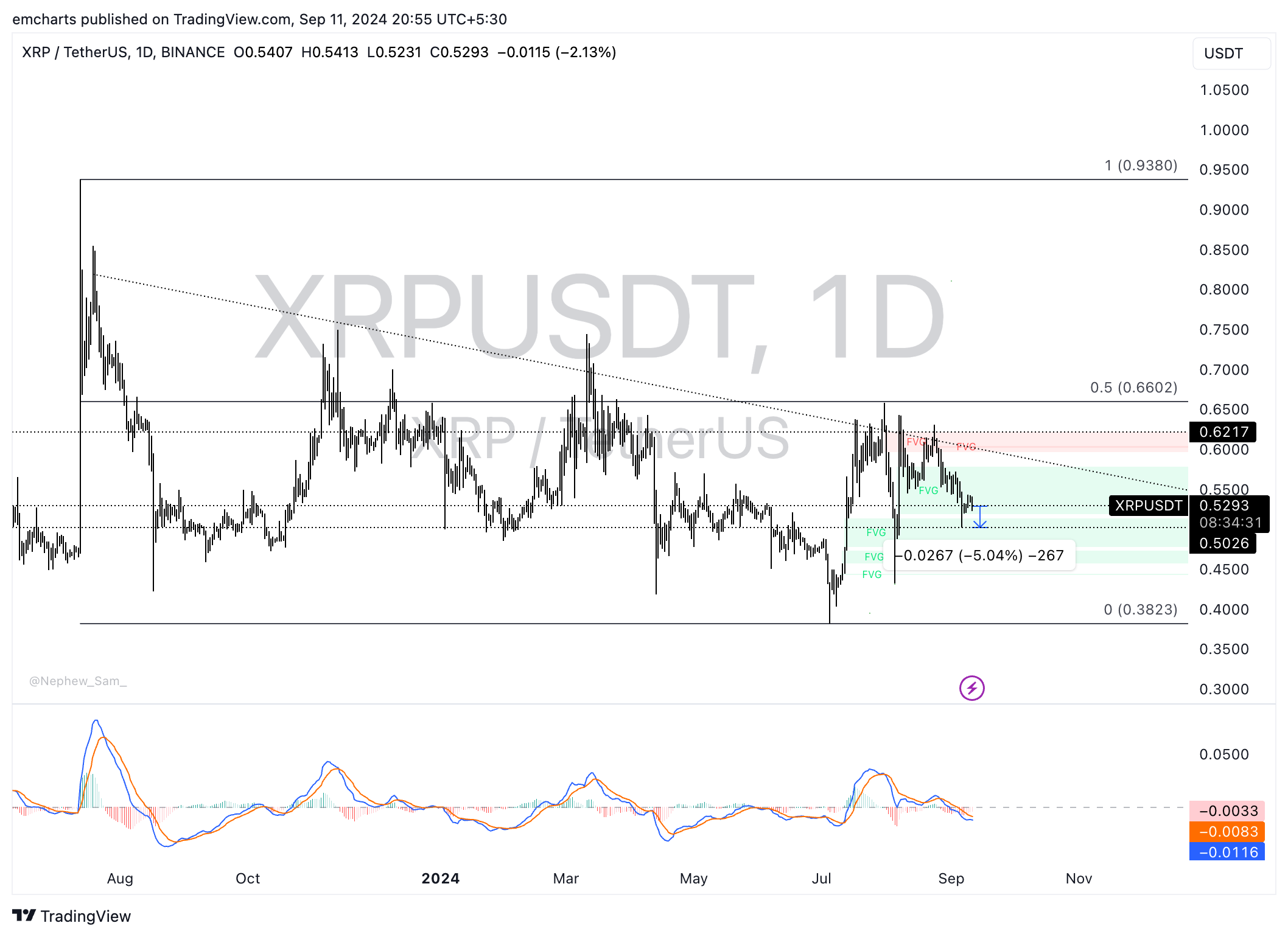

Technical analysis: XRP could extend loss by 5%

Ripple is in a downward trend that started following the July 12, 2023 top of $0.9380. The altcoin is in a state of decline and dipped to a low of $0.3832 on July 5, 2024. The altcoin’s price has since recovered somewhat, and XRP trades at $0.5293 at the time of writing.

XRP could suffer a decline of 5% and sweep liquidity at $0.5026, the September 6 low for the altcoin. This marks a key support level for the altcoin that has been respected for over 30 days since August 8.

The Moving Average Convergence Divergence (MACD) indicator shows red histogram bars under the neutral line. XRP price trend has underlying negative momentum, supporting the bearish thesis.

XRP/USDT daily chart

A daily candlestick close above the upper boundary of the Fair Value Gap (FVG) at $0.5785 could invalidate the bearish thesis. XRP could proceed to the psychologically important $0.6000 level once the FVG is filled.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.