Bitcoin Weekly Forecast: BTC bulls remain strong amid institutional demand, risk-on sentiment improves

- Bitcoin steadies around $95,500 on Friday after surging more than 5% so far this week.

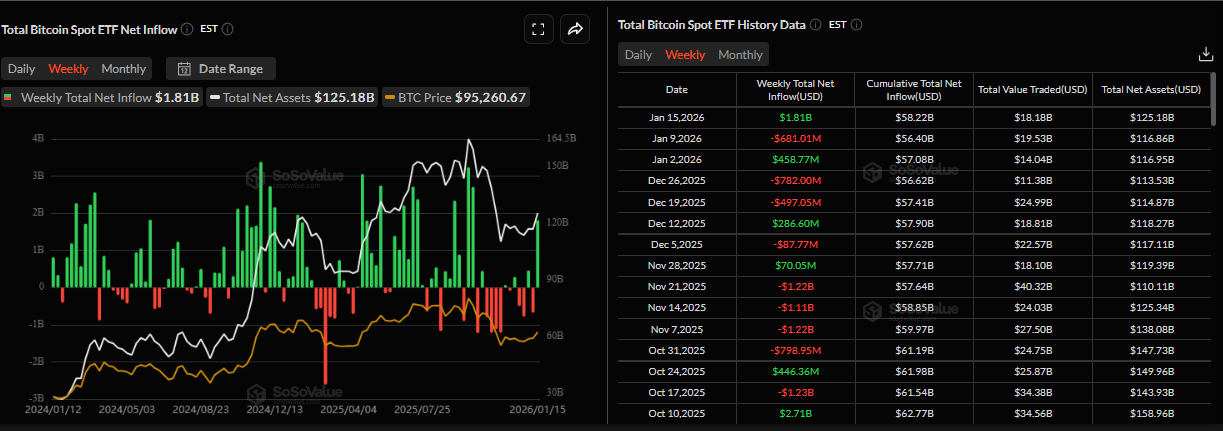

- Institutional demand for Bitcoin strengthened, with spot ETFs recording a net inflow of $1.81 billion until Thursday while Strategy added 13,627 BTC.

- Market sentiment improves due to softer-than-expected US core CPI and easing tensions between the US and Iran.

Bitcoin (BTC) price holds above $95,500 at the time of writing on Friday after rallying more than so far 5% this week. The rising institutional and corporate demand supports the bullish price action in BTC. In addition, market sentiment is improving amid supportive macroeconomic conditions and easing geopolitical tensions, further strengthening Crypto King.

Highest weekly inflow in 3 months

Bitcoin price rally this week was supported by growing institutional demand. The SoSoValue chart below shows that spot Bitcoin Exchange Traded Funds (ETFs) recorded a net inflow of $1.81 billion through Thursday, the highest weekly inflow since early October, when BTC reached a new all-time high of $126,199. If these inflows continue and intensify, BTC could rally toward the $100,000 psychological level.

The corporate demand for BTC also remained strong. Strategy Executive Chairman Michael Saylor announced on Monday that his company, Strategy Inc., purchased 13,627 BTC following a 1,287 BTC purchase last week, bringing the total reserve to 687,410. This highlights the firm’s continued aggressive accumulation strategy and long-term conviction in Bitcoin.

Macroeconomic data support risky assets

The US Bureau of Labor Statistics (BLS) released data on Tuesday showing that the US Consumer Price Index (CPI) rose 2.7% YoY in December. This figure followed 2.7% in November and matched the market consensus. However, the core CPI, which excludes Food and Energy prices, increased by 2.6% YoY in December, which was softer than the 2.7% expected. Meanwhile, the headline and core CPI rose by 0.3% and 0.2%, respectively, on a monthly basis.

The softer-than-expected US core CPI strengthened risk-on sentiment, with US equities hitting a new record high this week and risky assets such as BTC reaching nearly a two-month high at $97,924.

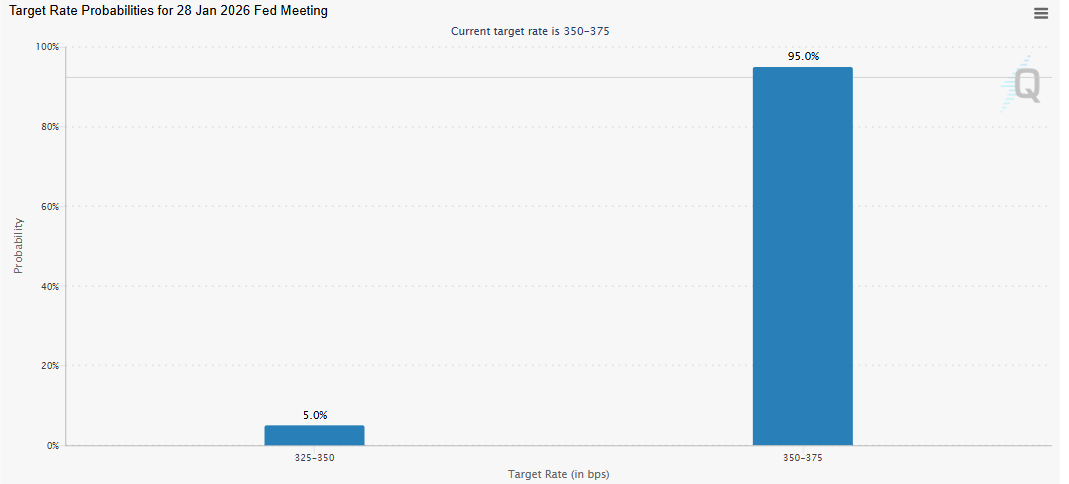

However, the BTC price pulled back slightly on Thursday following the US Initial Jobless Claims data. Initial Jobless Claims unexpectedly fell to 198K in the week ended January 10, below market expectations of 215K and down from the prior week’s revised 207K. The data confirmed that layoffs remain limited and that the labor market is holding up despite an extended period of high borrowing costs, increasing the likelihood that the Fed will keep interest rates on hold for the coming months.

The CME FedWatch tool, as shown below, indicates that market participants currently price in over a 95% chance that the US central bank will keep rates unchanged at its January 27–28 meeting.

Easing global tension boosts risk-on sentiment

US President Donald Trump said on Thursday that he had stepped back from threats of military action in Iran after receiving assurances that further killings would not occur and executions would be halted.

Investors' sentiment boosted following Israel and several Arab allies' urging Trump to refrain from attacking Iran, warning a US strike could trigger a wider regional conflict, according to Walter Bloomberg X post. Israeli Prime Minister Benjamin Netanyahu asked Trump to delay military action, while Qatar, Saudi Arabia, Oman, and Egypt have pressed for restraint and dialogue.

These easing geopolitical tensions between the US and Iran triggered a mild risk-on sentiment, supporting the price of BTC and riskier assets.

BTC could catch up to the S&P 500

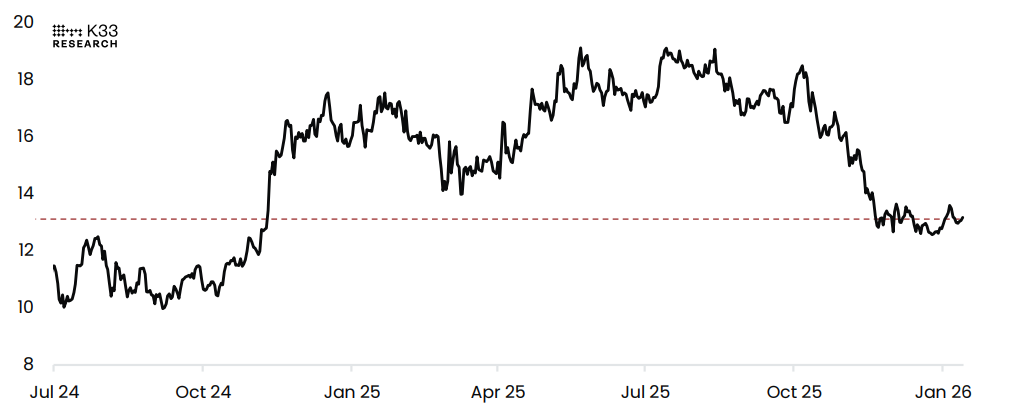

The K33 Research report on Tuesday highlighted several market-moving events on the horizon, primarily related to tariffs, Fed independence, and crypto regulation.

The analyst explained that Bitcoin’s price has remained largely stagnant even as the S&P 500 continues to rally, weighing on BTC’s relative performance versus Equities. With the BTC/SPX ratio locked in a three-month consolidation, as shown in the chart below, these upcoming events could act as catalysts for a sharp directional move.

US Senate delays the crypto market structure bill

On Wednesday, US Senate Banking Committee Chair Tim Scott announced that the Committee had postponed its markup of digital asset market-structure legislation amid ongoing bipartisan negotiations.

Scott said, “This bill reflects months of serious bipartisan negotiations and real input from innovators, investors, and law enforcement. The goal is to deliver clear rules of the road that protect consumers, strengthen our national security, and ensure the future of finance is built in the United States.”

The bill aims to clarify regulatory jurisdiction over crypto between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), and to establish a federal framework for overseeing digital-asset markets.

If passed, it would become the first comprehensive federal law to formally codify the crypto market structure, shifting oversight away from regulatory guidance and litigation and supporting wider adoption of cryptocurrencies.

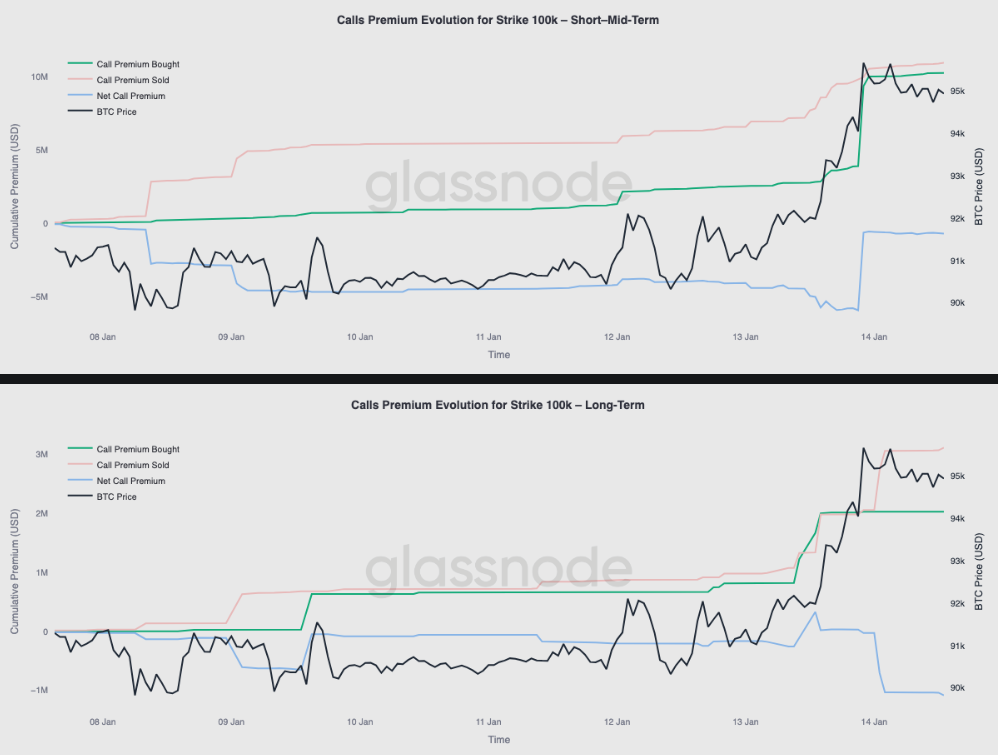

Options market suggests a bullish bias

The Glassnode chart below shows option flows around the $100K strike, indicating that traders increased call option buying while call selling activity stabilized. This pushes call premiums higher, showing strong demand for near-term upside exposure.

However, for longer maturities, it shows the opposite behavior. As spot rallied, richer call premiums further out the curve were used as opportunities to sell upside.

This split suggests the market is positioning for a potential retest of the 100K area, while simultaneously expressing hesitation about sustained acceptance above that level over longer horizons.

Is BTC bottoming here?

Bitcoin’s weekly chart shows the price has been holding above the 100-week Exponential Moving Average (EMA) since the end of November. As of this week, BTC rises 5%, nearing the 50-week EMA at $97,582, which is acting as immediate resistance.

If BTC breaks and closes above the 50-week EMA at $97,582 on a weekly basis, it could extend the rally toward the psychological $100,000 level.

The Relative Strength Index (RSI) on the weekly chart is 46, pointing upward toward the neutral level of 50, indicating fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above the neutral level.

On the daily chart, Bitcoin price rose more than 7%, reaching a nearly two-month high of $97,800 on Wednesday after finding support around the previously broken upper consolidation zone at $90,000 last week. As of Friday, it is trading at around $95,600.

If the 61.8% Fibonacci retracement level (from the April low of $74,508 to October’s all-time high of $126,199) at $94,253 holds as support, BTC could extend the surge toward the key psychological $100,000 level.

The RSI on the daily chart reads 64, above the neutral level of 50, indicating the bulls still have control of the momentum. Moreover, the Moving Average Convergence Divergence (MACD) shows a bullish crossover that remains intact, with rising green histogram bars above the neutral level, further supporting the positive outlook.

However, if the $94,253 level fails to hold, BTC could extend the decline toward the 50-day EMA at $92,216.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.