Ripple Price Forecast: XRP downslide persists while Ripple expands digital asset custody

- XRP slips further toward $2.18 support as crypto asset liquidation hit $1.33 billion in the last 24 hours.

- Ripple has acquired digital asset wallet and custody company Palisade to serve the needs of fintechs, crypto-native firms, and corporates.

- Palisade digital wallet solutions will be integrated into Ripple Payments, providing the core infrastructure for subscription payments.

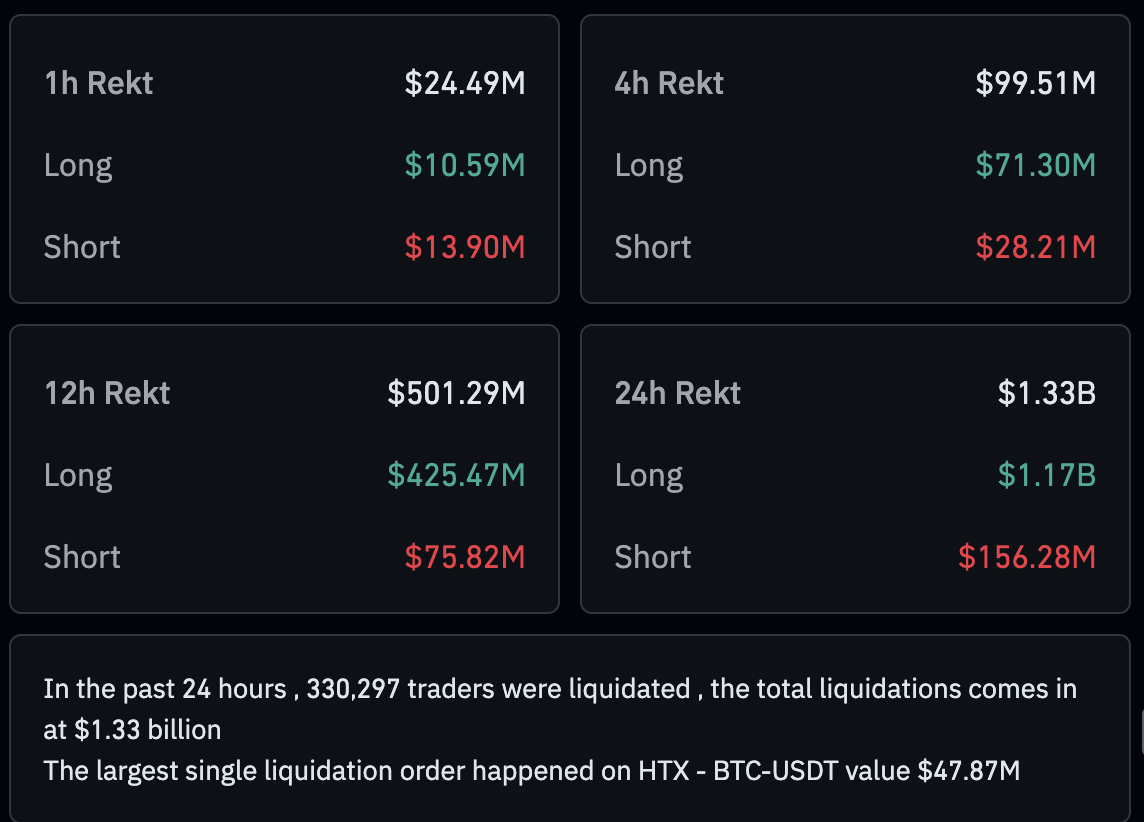

Ripple (XRP) slips to trade at around $2.26 at the time of writing on Tuesday, mirroring the persistent risk-off sentiment in the broader cryptocurrency market. XRP’s technical outlook remains weak, weighed down by pressure in the derivatives market as total crypto asset liquidations hit $1.33 billion over the past 24 hours.

Ripple acquires Palisade in digital asset custody expansion move

Ripple has completed the acquisition of Palisade, a digital asset and custody company. According to the announcement on Monday, the move aims to expand Ripple’s custody capabilities, particularly for fintechs, crypto-native firms, and corporates.

Ripple Custody was initially designed to serve the interests of banks and financial institutions seeking platforms that provide safe and secure storage for digital assets, stablecoins, and Real World Assets (RWAs).

Palisade’s integration allows Ripple Custody to broaden its offerings and use cases by bringing secure, fast, and scalable “wallet-as-a-service” technology, designed from the ground up to support high-speed value transfer.

“The combination of Ripple’s bank-grade vault and Palisade’s fast, lightweight wallet makes Ripple Custody the end-to-end provider for every institutional need, from long-term storage to real-time global payments and treasury management,” Monica Long, President of Ripple, said.

Ripple Payments will directly integrate Palisade’s technology to complement existing use cases. With this integration, Ripple will expand its services to offer subscription-based payments and value collection by facilitating high-speed transactions at scale.

Ripple has been aggressively expanding its product suite through strategic acquisitions, including the purchase of prime broker Hidden Road, now known as Ripple Prime, and GTreasury, a treasury management system provider. Ripple’s investment in the crypto ecosystem has topped $4 billion this year, according to the blog post.

Despite Ripple’s efforts to expand its investment in the crypto ecosystem, XRP continues to face selling pressure, falling by nearly 38% from its record high of $3.66 reached in mid-July.

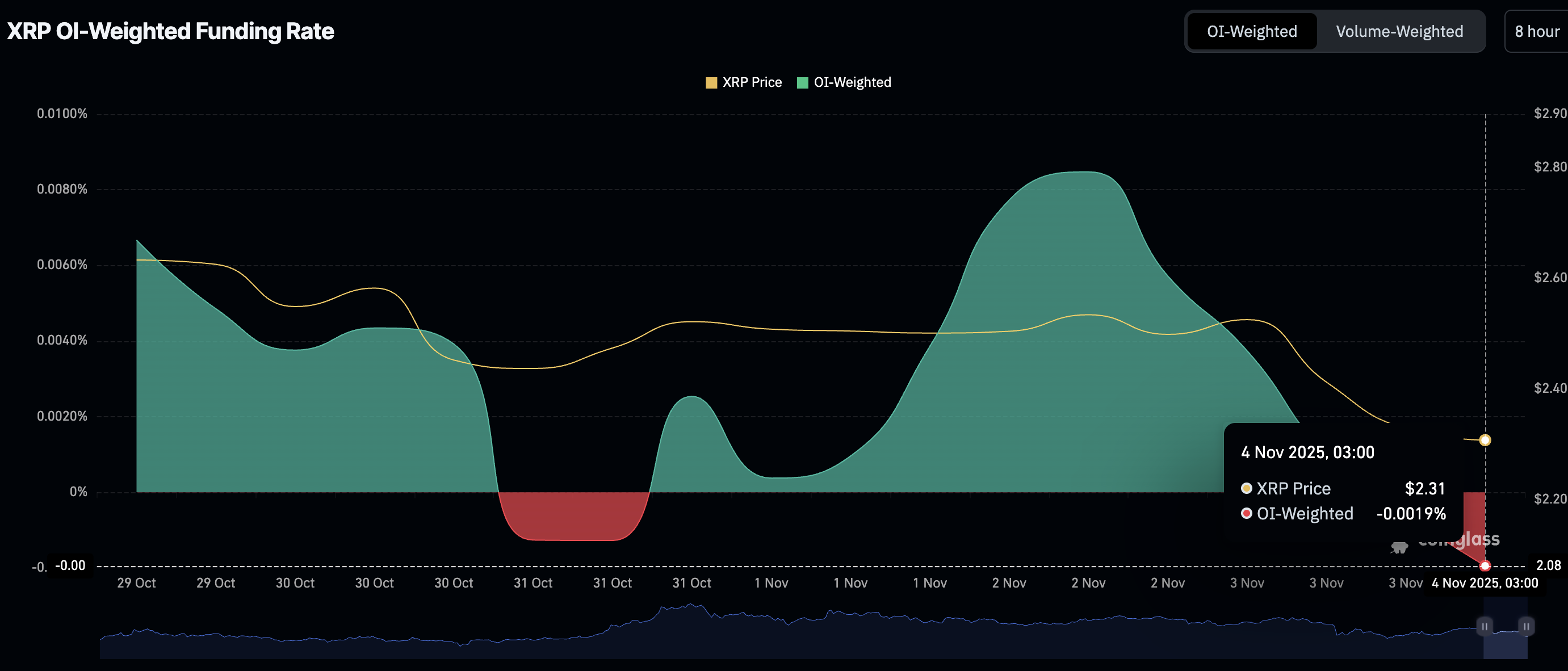

The sell-off in the broader cryptocurrency market has accelerated risk-off sentiment, as traders seek alternative investments. CoinGlass data shows the OI-weighted funding rate at -0.0019%, down from 0.0085% on Sunday. The sharp drop suggests traders are intentionally closing their long positions and piling into short positions, thereby depriving XRP of the tailwind needed to sustain its recovery.

XRP OI-Weighted Funding Rate | Source: CoinGlass

Crypto liquidations average $1.33 billion over the past 24 hours, reflecting the negative sentiment gripping investors. Of this, $1.17 billion is in long positions, with approximately $156 million of shorts wiped out. If traders don’t see a lifeline in the coming sessions, liquidation may continue wreaking havoc in the crypto market.

Crypto liquidation data | Source: CoinGlass

Technical outlook: Can XRP sustain recovery?

XRP is trading at around $2.26 at the time of writing on Tuesday. The token’s position below key moving averages, such as the 200-day Exponential Moving Average (EMA) at $2.59, the 50-day EMA at $2.62, and the 100-day EMA at $2.69, suggests a bearish technical structure.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart triggered a sell signal earlier in the day, calling upon investors to reduce their exposure. Recovery could be an uphill task if the red histogram bars below the mean line expand.

Furthermore, the Relative Strength Index (RSI) is at 36 and falling on the same daily chart, indicating that sellers have the upper hand.

XRP/USDT daily chart

Key areas of interest for traders are the next support at $2.18, last tested on October 18, and the area at $1.90, previously tested in June. If sentiment shifts positively, investors buy the dip, and a reversal could occur toward the 200-day EMA at $2.59 and the 100-day EMA at $2.69.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.