Bitcoin Price Forecast: BTC drops below $108,000 amid tempered optimism

- Bitcoin price slips below $108,000 on Monday, following a 3.51% decline the previous week.

- US President Donald Trump’s latest comment offsets optimism fueled by the de-escalation of trade tensions between the US and China.

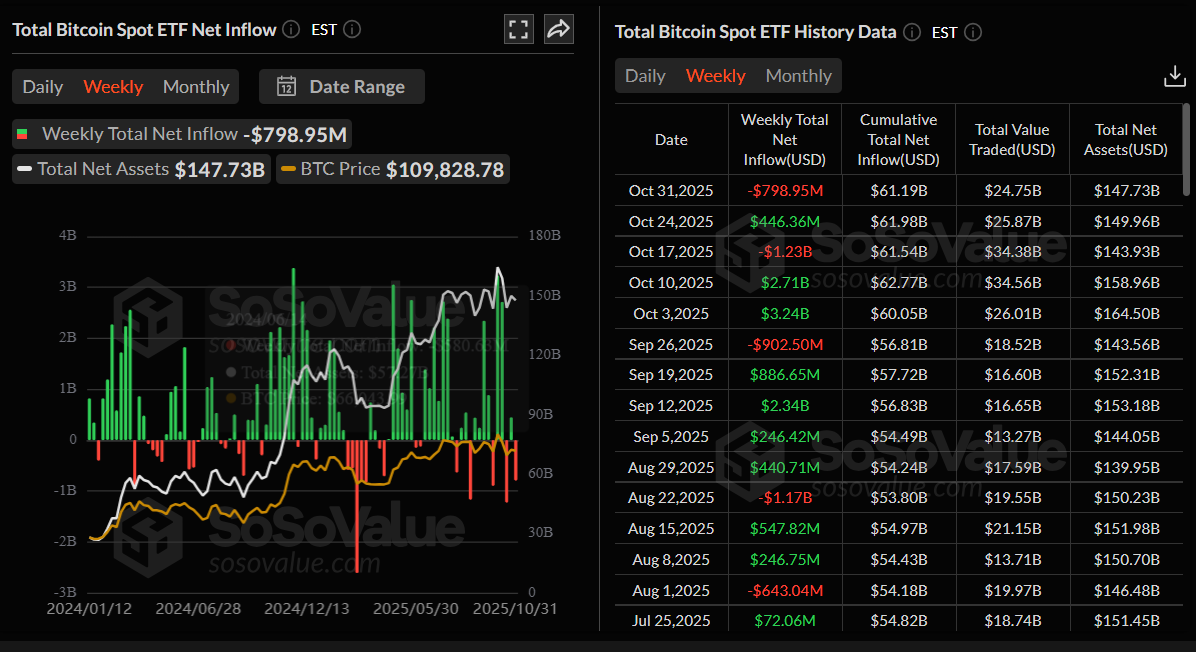

- US-listed spot Bitcoin ETFs recorded $798.95 million in weekly outflows, signaling fading institutional confidence.

Bitcoin (BTC) trades below $108,000 at the time of writing on Monday after correcting by over $3.5% in the previous week. The drop follows US President Donald Trump’s announcement that Nvidia’s advanced Blackwell AI chips would not be available to “other people,” a remark that tempered optimism from recent US-China trade de-escalation. Meanwhile, spot Bitcoin Exchange Traded Funds (ETFs) record nearly $800 million in weekly outflows, reflecting waning institutional confidence in the largest cryptocurrency by market capitalization.

Trump’s latest comments trigger slight risk-off sentiment

Bitcoin starts the week on a negative note, sliding below $108,000 during the early European trading session on Monday. This correction comes after US President Donald Trump said in an interview that aired on Sunday on CBS’s “60 Minutes” program and in comments to reporters aboard Air Force One that only US customers should have access to the top-end Blackwell chips offered by Nvidia.

This, to some extent, offsets the latest optimism fueled by the de-escalation of trade tensions between the US and China – the world’s two largest economies – and thus triggers a slight risk-off sentiment in the market, which doesn’t bode well for riskier assets such as Bitcoin.

In addition, the ongoing US government shutdown entered its 34th day on Monday amid a deadlock in Congress over the Republican-backed funding bill, heightening economic uncertainty and dampening sentiment.

Institutional demand shows signs of weakness

Bitcoin institutional demand shows early signs of weakness. SoSoValue data shows that spot Bitcoin ETFs recorded a total outflow of $789.95 million last week, breaking the positive inflow seen in the previous week. If these outflows continue and intensify, BTC could extend its ongoing price correction, as it suggests declining institutional confidence.

Total Bitcoin Spot ETF net inflow weekly chart. Source: SoSoValue

What’s next for BTC?

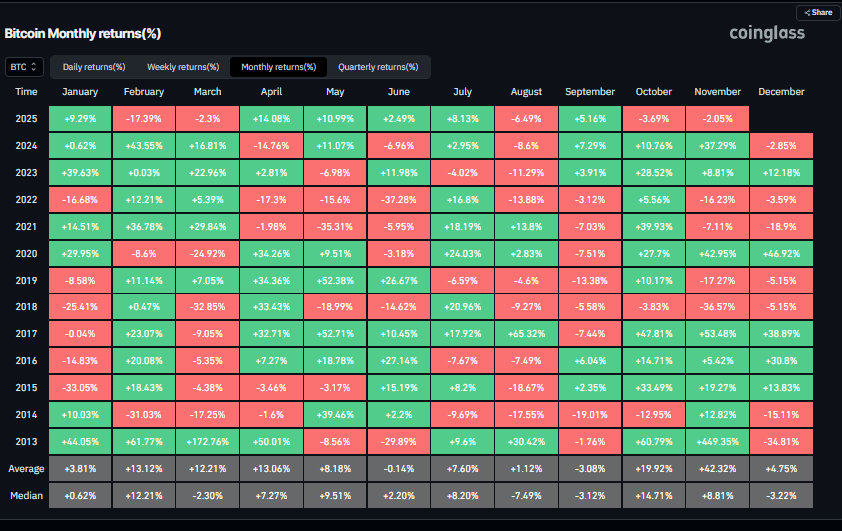

CoinGlass’s historical data shows that despite Bitcoin recording a 3.69% loss in October — disappointing traders who had anticipated an ‘Uptober’ rally — November has historically been the strongest month for BTC, delivering an average return of 42.32%.

Bitcoin monthly returns chart. Source: Coinglass

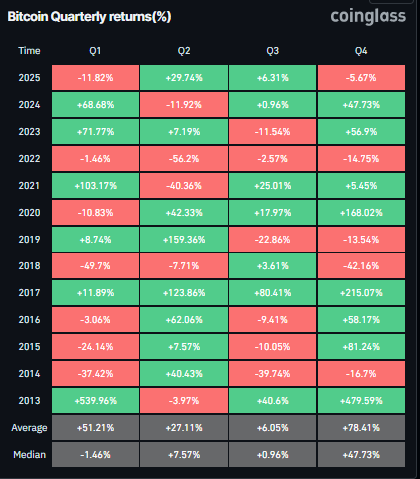

Adding to this optimism, the fourth quarter (Q4) has been the best quarter for BTC in general, with an average of 78.41%, which could push BTC to new highs by the end of the year.

Bitcoin Quartey returns chart. Source: Coinglass

Bitcoin Price Forecast: BTC bears are in control of the momentum

Bitcoin price faced rejection at the 78.6% Fibonacci retracement level (drawn from the April 7 low of $74,508 to the October 6 all-time high of $126,199) at $115,137 last week and declined by 3.51%. At the time of writing on Monday, BTC is trading down around $108,000.

If BTC continues its correction and closes below the 61.8% Fibonacci retracement level at $106,453, it could extend the decline toward the October 10 low of $102,000.

The Relative Strength Index (RSI) on the daily chart reads 41, below the neutral level of 50, indicating that bearish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) lines are also converging, with decreasing green histogram bars signaling fading bullish momentum.

BTC/USDT daily chart

However, if BTC finds support around the 61.8% Fibonacci retracement level at $106,453, it could extend the recovery toward the 50-day EMA at $112,502.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.