Ripple Price Forecast: XRP bullish momentum dampened as investors take profits

- XRP down leg extends below the 100-day EMA as bulls struggle to steady recovery, targeting $3.00.

- Investors who purchased XRP below $1 have increasingly realized profits, absorbing the token's bullish momentum.

- Selling pressure expands as retail demand fades, increasing the risk of a prolonged decline.

Ripple (XRP) is on the back foot on Friday, marking two days of consecutive declines as prices across the cryptocurrency market wobble. Its technical picture leans bearishly, reflecting the negative sentiment in the market.

Although Bitcoin hit a new all-time high of $126,199 on Monday, interest in altcoins remains generally subdued. Investors anticipate the US Federal Reserve (Fed) to cut interest rates by 25 basis points to the range of 3.75% to 4.00% later this month, an event that could help shape the bullish outlook.

Meanwhile, attention has shifted to technical levels as traders gauge whether XRP can defend its short-term $2.70 support and resume the uptrend, eyeing a break above the psychological resistance at $3.00.

Assessing the impact of profit-taking on XRP's bullish momentum

XRP price traded at around $0.60 in November before ending the year with a parabolic move above $2.00. The rally extended in the first quarter of the year as the crypto market responded positively to United States (US) President Donald Trump's promise to transform the crypto industry by championing clear regulations that support innovation while protecting customers.

XRP hit a high of $3.14 in mid-January, but sold off amid profit-taking and risk-off sentiment, culminating in the infamous tariff-triggered crash in April to $1.62. Interest in the cryptocurrency market steadied in the months that followed through to mid-July when XRP reached a new record high of $3.66.

Since its all-time high, XRP has maintained a general downtrend, reflecting risk-off sentiment and an overall lack of conviction in altcoins.

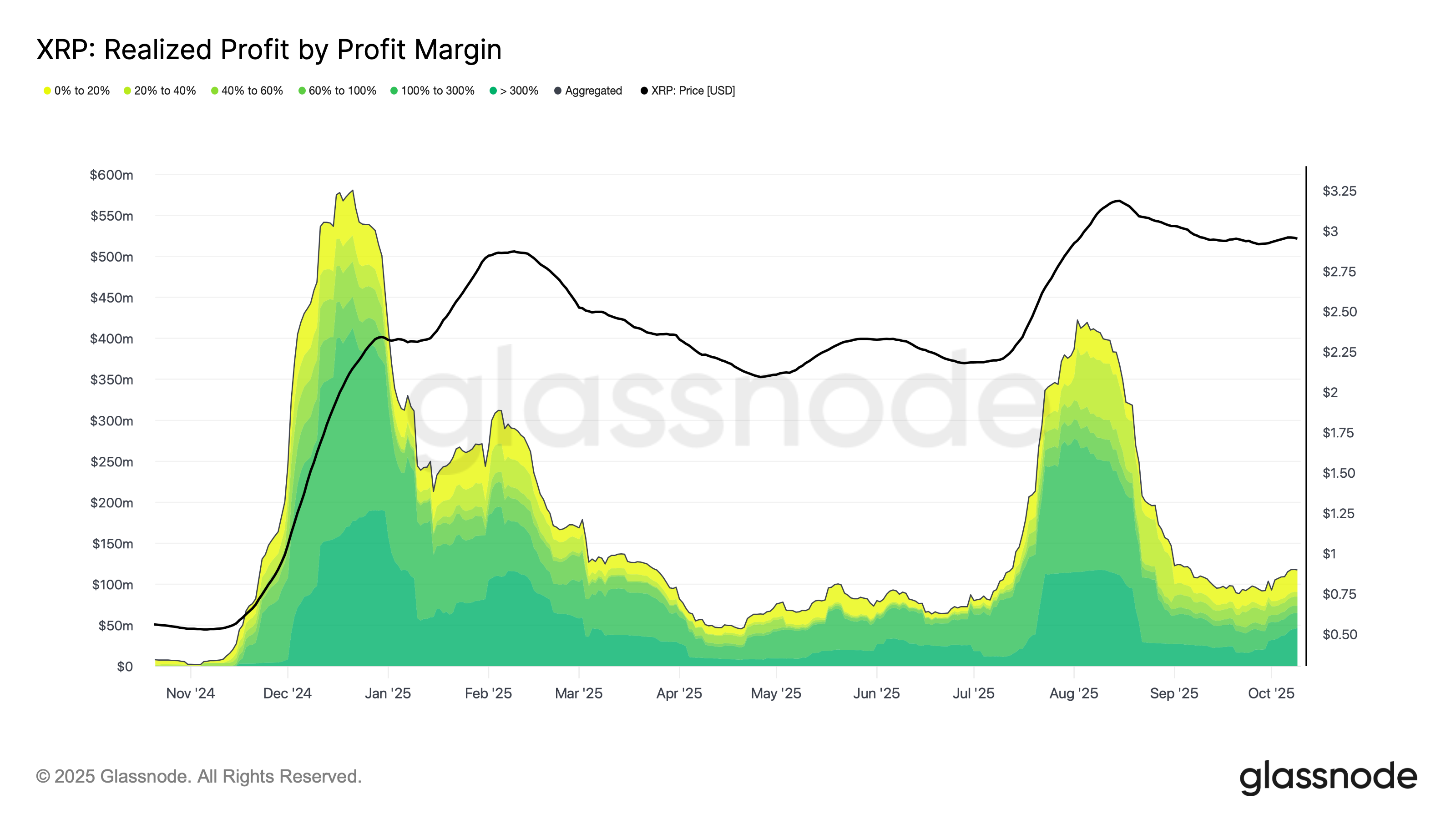

According to Glassnode data, profit-taking is one factor dampening XRP's bullish momentum. Investors who purchased the token below $1.00 have increasingly realized profits, contributing to selling pressure.

"Two major realization waves—Dec 2024 and July 2025—have so far exhausted much of the market's bullish momentum," Glassnode states.

XRP Realized Profit by Profit Margin | Source: Glassnode

Technical outlook: XRP bears tighten grip

XRP is trading at around $2.74 at the time of writing on Friday after attempts by the bulls to pare intraday losses failed, mirroring a massive bearish wave across the cryptocurrency market.

A sell signal from the Moving Average Convergence Divergence (MACD) indicator has been sustained since Thursday, suggesting that bears have the upper hand. If the blue MACD line remains below the red signal line, investors would be inclined to reduce risk exposure and XRP could extend the downtrend toward the short-term support at $2.70, tested in late September, and the 200-day EMA at $2.64.

XRP/USDT daily chart

On the flip side, a sustained move above the 100-day EMA resistance at $2.85 and the 50-day EMA at $2.91 may increase the probability of the XRP price breaking the downtrend and pushing for gains above $3.00.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.