Bitcoin vs Gold: XAU outperforms BTC in Q3

- Gold price soared to a new all-time high of $3,895 on Wednesday, returning a positive Q3 of over 16%.

- Bitcoin consolidated in Q3, recording modest gains of 5.63% after reaching its mid-August all-time high of $124,474.

- FXStreet interviews several experts to get their views on Bitcoin and Gold in the current market conditions.

Gold (XAU) outperformed Bitcoin (BTC) in the third quarter (Q3), rallying to a record high and closing Q3 with double-digit gains. Meanwhile, BTC delivered only modest returns after its mid-August peak, setting the stage for a closely watched Q4. To gain more insights into Gold and Bitcoin, FXStreet interviewed some experts in the crypto markets.

Performance of Bitcoin and Gold in Q3

Gold posted a stellar performance in the third quarter (Q3), hitting a new all-time high of $3,895 on Wednesday after months of steady accumulation. By late Q3, the yellow metal had risen 47% year-to-date, significantly outperforming the S&P 500, as US Dollar (USD) weakness, geopolitical risks, global uncertainty, and new US trade barriers fueled demand.

XAU/USD daily chart

Meanwhile, Bitcoin consolidated in Q3, recording modest gains of 5.63% after reaching its mid-August all-time high of $124,474, but it lagged behind equities and Gold as leverage liquidations and macroeconomic pressure weighed on performance.

BTC/USDT daily chart

What drives Gold prices to record highs?

The surge in the yellow metal price in Q3 has many reasons, as follows:

Central banks and emerging markets: Gold demand rises

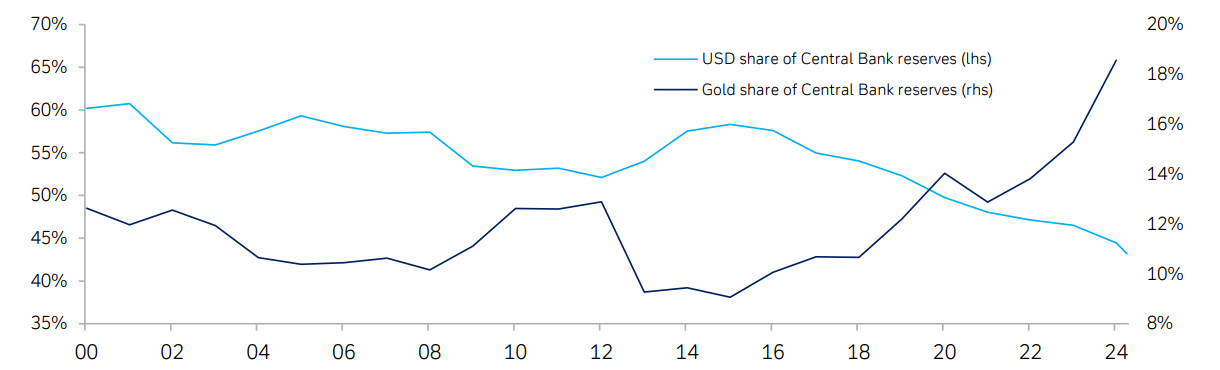

Central bank demand for Gold has continued to stay elevated despite reserves rising, with a 2025 World Gold Council survey of central bank managers showing the highest-ever proportions expecting both their own institution (43%) as well as global central banks collectively (95%) to increase their Gold reserves over the next 12 months. The USD’s share of central bank reserves are falling, while the Gold share is constantly rising as shown below.

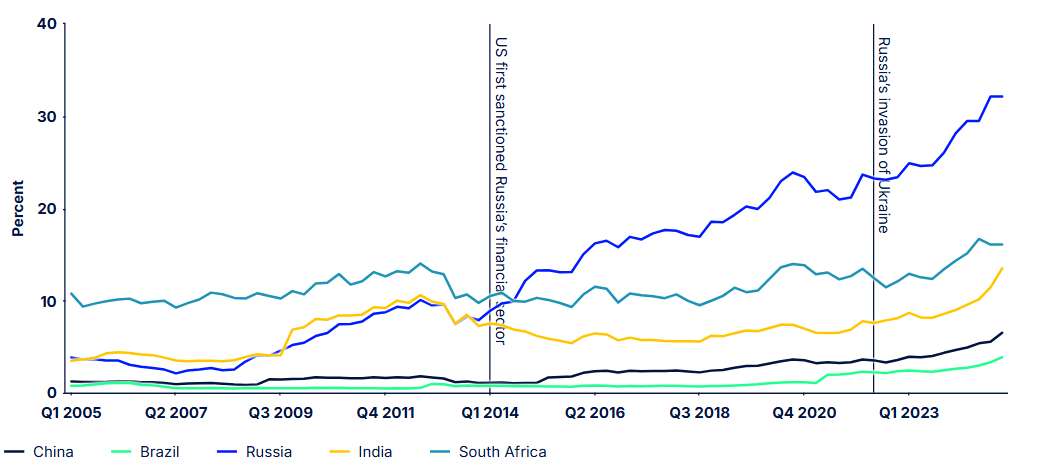

The chart below highlights that emerging market (EM) central banks, particularly China, have increasingly diversified their reserves into Gold. This trend, influenced by Russia’s experience with foreign reserves, has led many EM central banks to diversify their reserves with Gold due to rising geopolitical risks and US Treasury uncertainty.

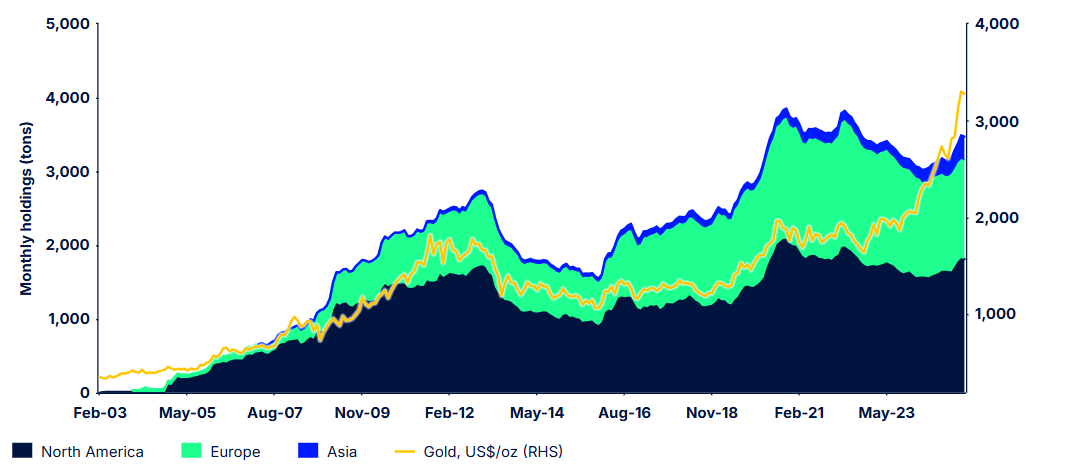

Apart from the central banks' demand, Gold ETFs have also soared, fueling XAU to record highs.

Geopolitical and trade uncertainty

Rising trade uncertainty and geopolitical conflicts have supported the price of the yellow metal, fueling risk-off sentiment in the market. US President Donald Trump’s 90-day tariff pause came to an end in mid-August, reigniting the trade tensions between the world's two biggest economies, the US and China.

Moreover, China has been gradually positioning the Yuan and Gold as alternatives to the US Dollar. Reports suggest Beijing encourages trade partners to convert surpluses into Gold stored in Shanghai. If even 80% of China’s trade surplus were converted, it could require 15–20% of annual global Gold output — creating a powerful tailwind for prices. The bigger the surplus, the stronger the demand, and the higher the support for Gold.

Additionally, the ongoing conflict in the Middle East between Israeli and Hamas, created a persistent undercurrent of global uncertainty throughout Q3. Adding to this, the Russia-Ukraine conflict also contributed to risk-off sentiment, with investors pouring billions into safe-haven assets, such as Gold. These ongoing uncertainties have caused the USD to weaken, reaching multi-month lows amid rising geopolitical and economic risks.

Fed interest rate cut

On the macroeconomic front, the Federal Reserve (Fed) adopted a “wait-and-see” approach to interest rate cuts throughout the year despite constant pressure from President Trump.

Fed Chair Jerome Powell at the Jackson Hole speech in late August, highlighted that the central bank will adopt a new policy framework of flexible inflation targeting and eliminate the 'makeup' strategy for inflation.

"Framework calls for a balanced approach when the central bank's goals are in tension," Powell added.

In mid-September, the FOMC reduced the fed funds rate by 25 basis points to a range of 4.00%–4.25%, marking the first rate cut since December 2024. The updated dot plot projected two additional 25 bps cuts by December 2025, bringing rates down to 3.50%–3.75%, with further easing to 3.25%–3.50% by the end of 2026.

This dovish stance departed from the Fed’s earlier wait-and-see stance, reflecting concerns that tariffs were pressuring goods prices without derailing the broader disinflation trend. Political undercurrents, including Trump’s calls for sharper cuts, added noise, but Powell reaffirmed the Fed’s independence, helping drive safe-haven assets like Gold to new highs.

Bitcoin: Consolidation and Macro Pressure

Bitcoin price hit a new all-time high of $124,447 in mid-August before retracing to July’s lows of $107,000. Unlike the Gold rally in Q3, the Bitcoin price has been consolidating between $107,000 and $120,000 and the reasons are explained below.

Massive long liquidations

During mid-September, the crypto market experienced the largest single-day liquidation of the year, with $1.65 billion in long positions wiped out, compared to just $145.83 million in shorts, highlighting excessive bullishness among traders.

Despite the liquidations, CryptoQuant’s BTC Estimated Leverage Ratio (ELR) stood at 0.26 on Thursday, close to its yearly peak of 0.291 recorded on September 11, yet still well below the record high of 0.358 in 2011, suggesting that traders remain moderately leveraged but not excessively overexposed.

-1759501550068-1759501550070.png)

Macro economic headwinds

Macroeconomic headwinds have kept Bitcoin trading in a consolidating range between $107,000 and $120,000. Trade tariff uncertainty fueled risk-off sentiment, while the Fed’s September rate cut turned into a sell-the-news event, dragging BTC back toward its July low of $107,000.

In addition, risk appetite weakened amid escalating global conflicts, including tensions between Iran and Hamas and the ongoing Russia-Ukraine war, prompting investors to shift toward safe-haven assets like Gold.

Institutional inflows

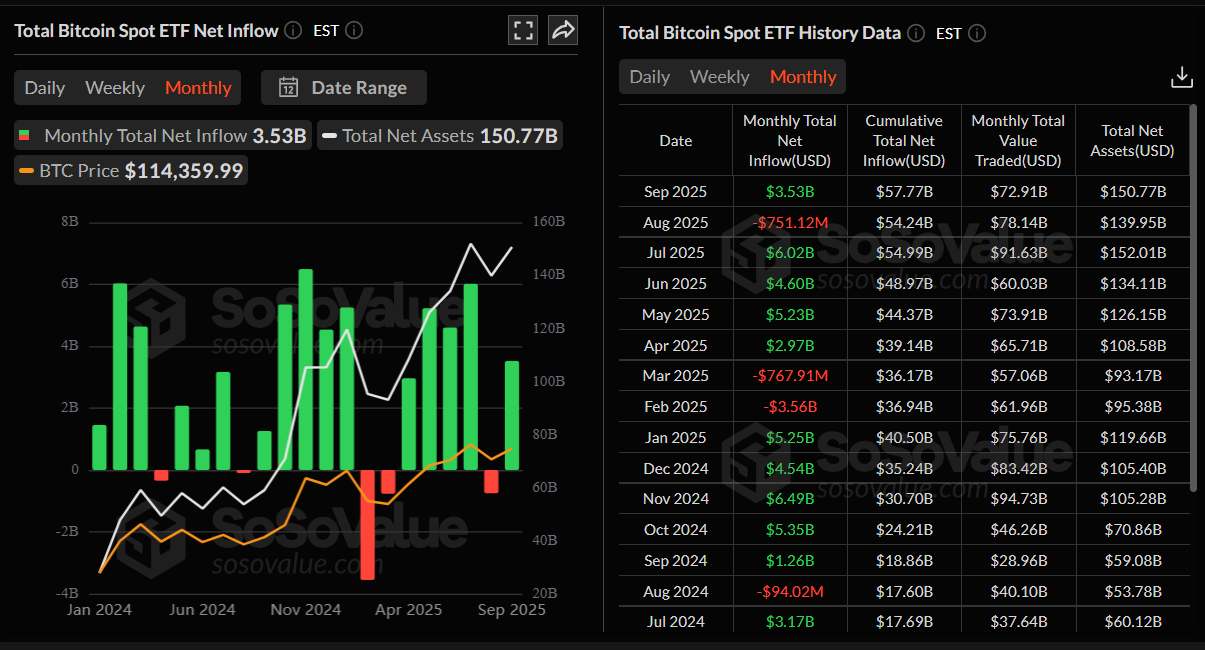

On the institutional side, Bitcoin spot ETFs recorded net inflows of $8.79 billion in Q3, a positive result, although lower than the $12.8 billion seen in Q2.

As seen in the monthly flows chart below, July saw $6.02 billion in inflows as Bitcoin rallied toward $120,000 and reached a new ATH of $124,447 in mid-August. However, flows turned negative in August, with $751.12 million in outflows dragging BTC down to a low of $107,000. In September, inflows rebounded to $3.53 billion, supporting a recovery and keeping BTC range-bound between $107,000 and $120,000 throughout Q3.

Bitcoin Total Bitcoin Spot ETF net inflow chart. Source: SoSoValue

Major drawdowns in Bitcoin treasury companies

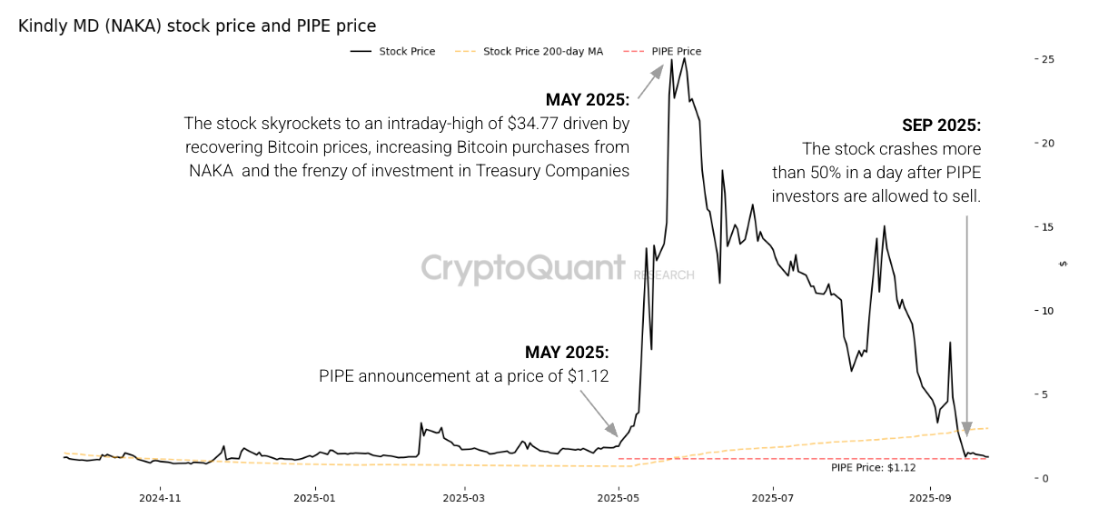

CryptoQuant highlighted that Bitcoin treasury companies that raised capital via Private Investment in Public Equity (PIPE) have experienced significant drawdowns, with share prices often reverting to their PIPE issuance levels.

As shown in the chart below, Kindly MD (NAKA), whose stock price skyrocketed from $1.88 at the end of April before the PIPE announcement, to an intraday high of $34.77, an 18.5x increase in less than a month. However, the stock has declined by 97% since then, reaching a low of $1.16, which is essentially the same as its $1.12 PIPE price.

The report also noted that other Bitcoin treasury companies, including Strive (ASST), Empery Digital (EMPD), and Sequans Communications (SQNS), appear to be following a similar path.

If this trend continues, fewer companies will have PIPE deals, which would affect the wider adoption of BTC and could weigh on broader BTC investor sentiment.

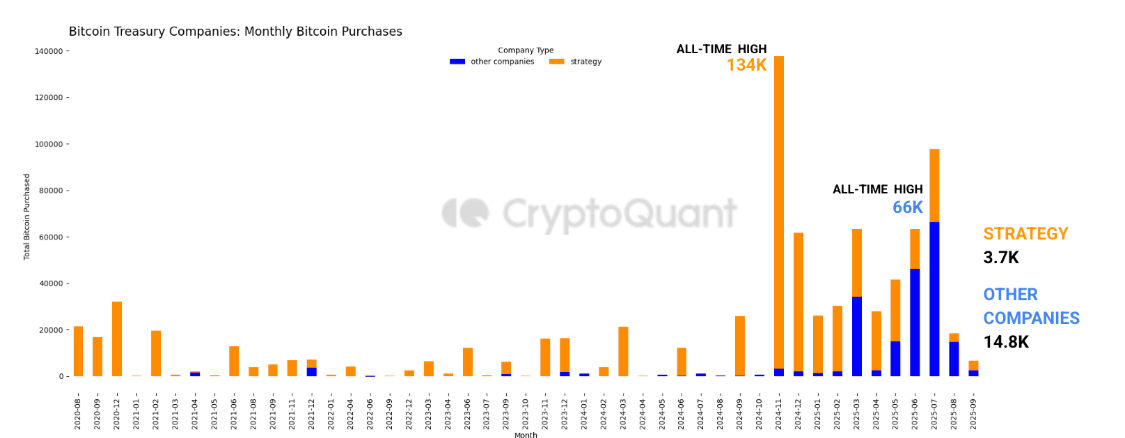

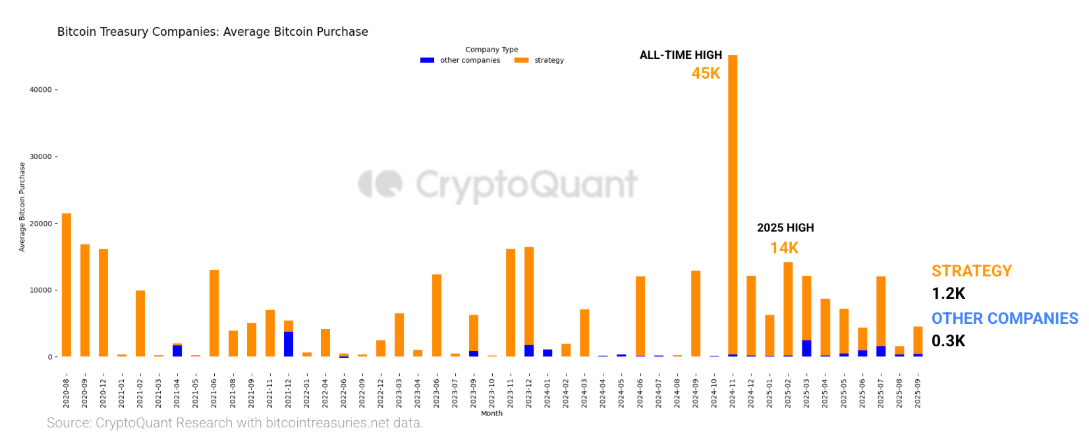

Corporate demand weakens

On the corporate side, the total amount of Bitcoin purchased by corporate companies declined significantly. In August, Strategy acquired 3,700 BTC, while other treasury companies purchased 14,800 BTC. This is significantly lower than the 134,000 Bitcoins purchased by Strategy in November 2024 and the 66,000 Bitcoin purchased by other companies in June 2025, their respective record-high purchases. August purchases also fell below the 2025 monthly averages, 26,000 BTC for Strategy and 24,000 BTC for other firms.

Moreover, treasury companies are purchasing less Bitcoin per transaction. In August, Strategy’s average purchase size fell to 1,200 BTC, the lowest in a year, compared with a 2025 peak of 14,000 BTC and an all-time high of 45,000 BTC in November 2024. Meanwhile, the other Bitcoin treasury companies purchased 343 Bitcoin on average per transaction, down 86% from their 2025 highs of 2,400 Bitcoin reached in March.

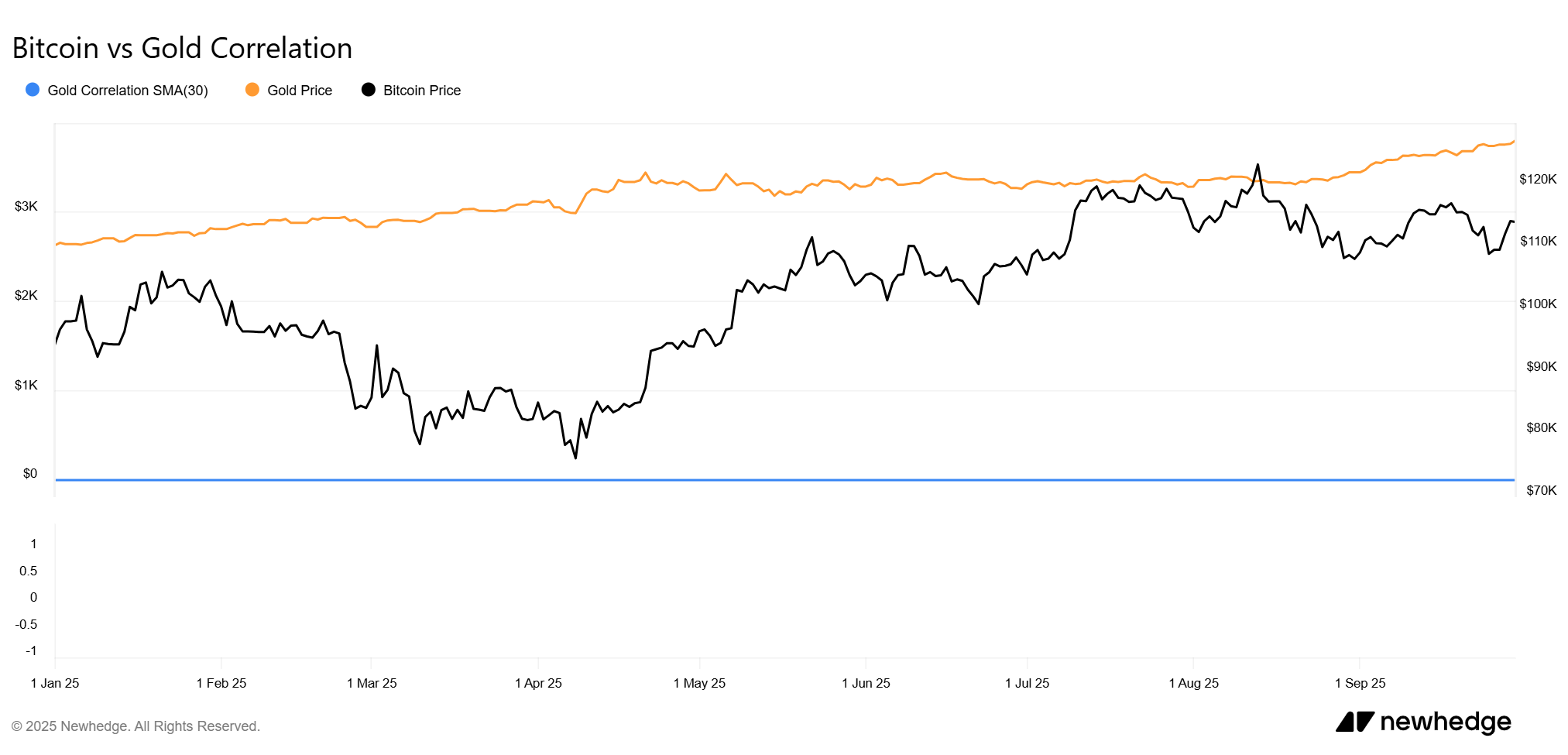

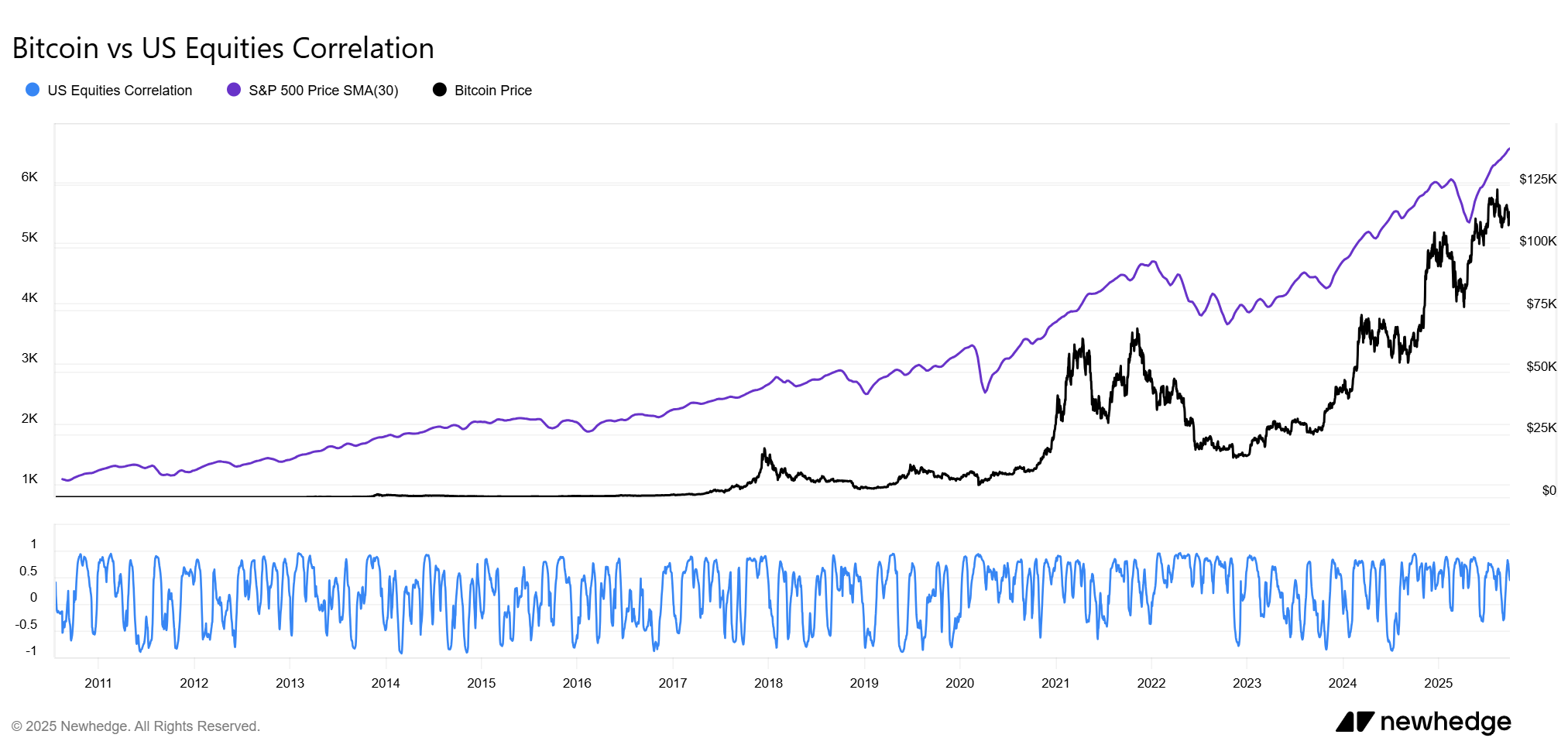

Correlation between Bitcoin and Gold

Bitcoin and Gold, often compared as alternative stores of value, exhibited a near-zero correlation in Q3 2025, making them complementary portfolio assets. In Q3, Gold surged as the USD weakened, while Bitcoin dipped amid equity volatility, highlighting divergent drivers.

However, Bitcoin’s correlation with the S&P 500 is positive, and its 30-day correlation often exceeds 70%. This suggests a close relationship between Bitcoin and traditional equity markets, particularly during periods of heightened market stress or macroeconomic uncertainty.

Moreover, the Deutsche Bank Research Institute report highlighted that Bitcoin has a low correlation with other asset classes, suggesting it can provide diversification benefits. A 2023 Fed study revealed that Bitcoin’s price is unrelated to all types of macroeconomic shifts except those related to inflation.

The analyst reported, “The case for Bitcoin as a reserve asset may be stronger for emerging markets, as studies show that Bitcoin can help holders circumvent capital controls in countries such as Argentina, Egypt and Nigeria. Bitcoin is increasingly seen as a workable alternative to relatively unstable local currencies.”

What's next in Q4?

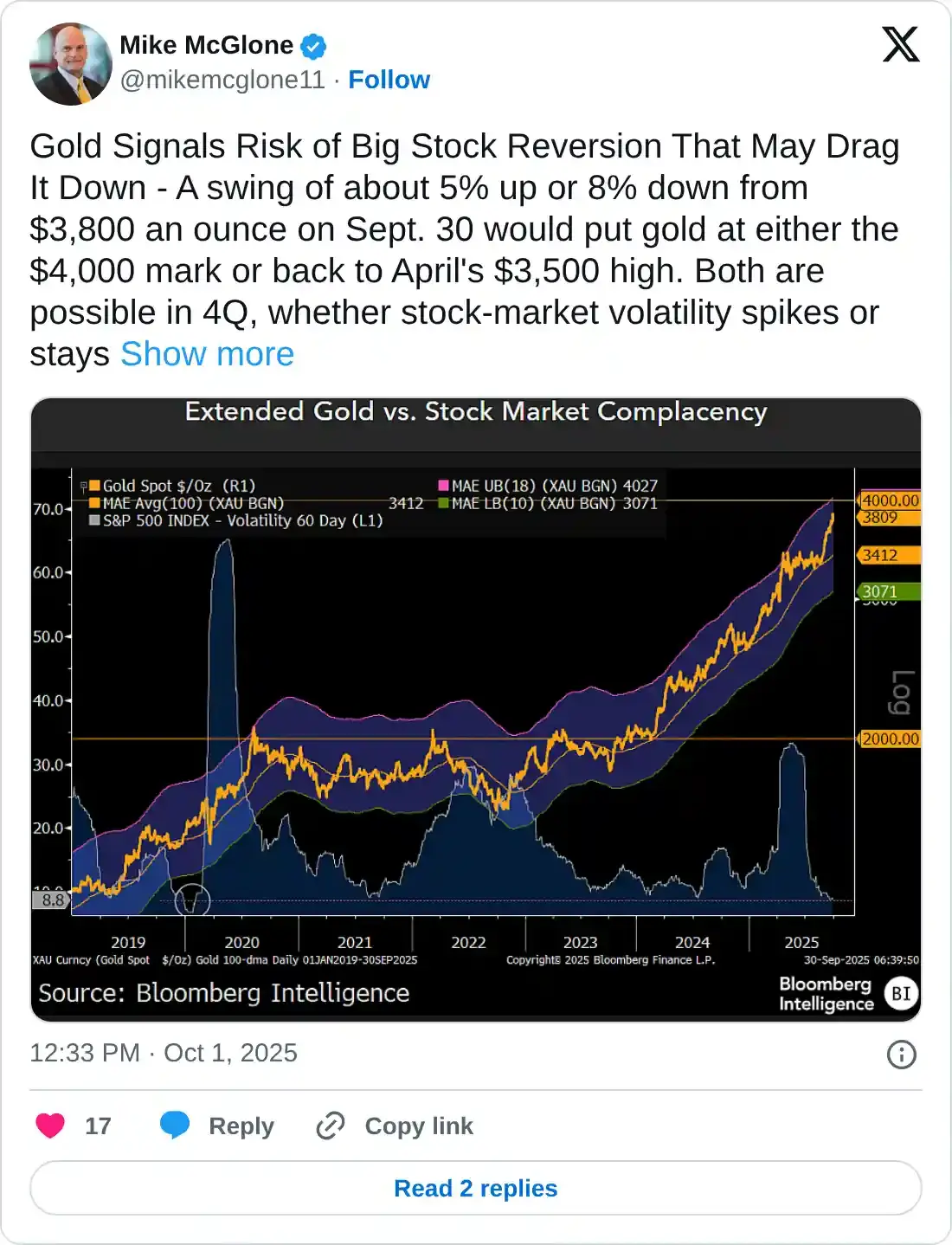

Gold could continue setting new record highs in Q4 if robust central bank demand and sustained ETF inflows persist. Rising geopolitical tensions and a weakening US Dollar are likely to provide further support. At the same time, expectations of two additional Fed rate cuts by year-end could trigger even more upside for the yellow metal.

However, Mike McGlone, Bloomberg Intelligence's Senior Commodity Strategist, posted on X some signs of concern for Gold in Q4.

McGlone stated that Gold signals risk of a significant stock reversion that may drag it down, with a swing of about 5% up or 8% down from $3,800 an ounce that would put Gold at either the $4,000 mark or back to April's $3,500 high. Both are possible in Q4, whether stock market volatility spikes or stays muted. In the former case, US treasuries could emerge as the top beneficiary, as in 2008.

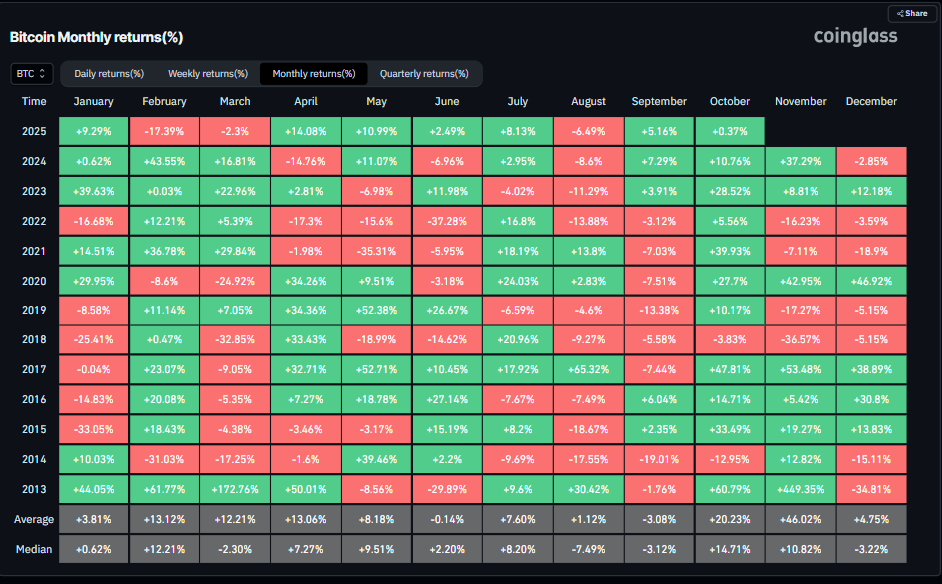

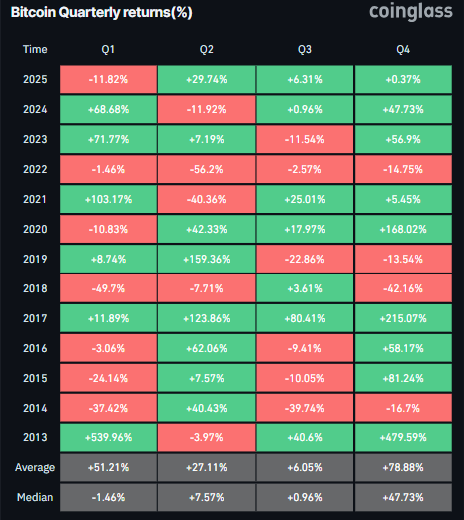

For Bitcoin, Historical data looks bullish as the monthly return for October has generally delivered a positive return for the cryptocurrency, averaging 20.23%, with the market terming it as the ‘Uptober’ rally. Adding to this optimism, the fourth quarter has been the best quarter for BTC in general, with an average of 78.88%, which could push BTC to new highs by the end of the year.

Apart from this, the dry powder necessary for a crypto rally is expanding, with total deposits of USDT into exchanges growing as large investors position themselves ahead of the Fed's next rate cut decision. The Net USDT deposits rose from $1.9 billion on September 11 to $2.33 billion on October 1.

Exchange Inflow (Total) - All Exchanges (1)-1759502112807-1759502112809.png)

Expert insights on Gold and Bitcoin

To gain further insight, FXStreet interviewed experts in the cryptocurrency markets. Their answers are stated below:

Carter Razink, co-founder of Spree.Finance

Q:1 How do you see the interplay between Bitcoin’s increasing correlation with equities and Gold’s inverse relationship with the USD shaping their roles as portfolio hedges in Q4, especially if stagflation risks from tariffs and inflation intensify?

In Q4 2025, global liquidity drives equities, Gold, and Bitcoin, but stagflation risks from tariffs (adding ~$2,400 to household costs) and 3%+ inflation complicate their hedging roles. Bitcoin, more correlated with equities (0.7–0.8), risks greater drops in equity corrections despite long-term upside from liquidity and fiat distrust. Gold, inversely tied to a weakening USD, I expect a continued rally of 10–20%+ in this increasingly stagflationary environment.

Q:2 Given gold’s and Bitcoin gains in 2025, driven by central bank buying and Bitcoin ETF inflows, how sustainable are these rallies into Q4, and what are the key risks that traders and investors should watch for?

Gold and Bitcoin rallies in 2025, driven by central bank buying, Bitcoin ETF inflows, and US debt issuance, should persist into Q4, with Gold eyeing $3,800+ and Bitcoin $145,000–$200,000 amid Fed rate cuts and liquidity. The primary risks in my mind are around USD strength (DXY >105) capping Gold, equity correlation (0.7–0.8) pulling Bitcoin down, and reduced debt issuance drying up liquidity. Increased stablecoin issuance creates demand for UST issuance, which will likely impact Bitcoin with more upside volatility than Gold.

Q:3 What are your price predictions for Gold and Bitcoin by year-end?

Assuming rate cuts and no significant equities downside, I can see Gold at $4.4k+ and Bitcoin at $200k+.

Marcin Kazmierczak, Co-founder of Redstone

Q1: Do you think Bitcoin’s ‘digital gold’ narrative still holds, or is Gold’s safe-haven dominance in uncertain times redefining their relative appeal?

Gold unquestionably remains the premier safe-haven asset: this is supported by both historical precedent and current data. When we analyze Bitcoin's actual behavior during uncertain times, it still moves as a high-risk asset. The statistical evidence is clear: Bitcoin has never functioned as a true safe-haven asset in the way Gold has for centuries.

For Bitcoin to genuinely become a safe-haven asset (transitioning from one of the most aggressive risk-on allocations institutions can hold to being considered defensive) would represent one of the greatest shifts in financial market history. This isn't just a change in price; it's a fundamental reordering of how major institutional managers perceive and classify an entire asset class.

I want to believe this transition will happen. The US government's validation of Bitcoin as "digital gold" due to its fixed supply and security is significant. But we must acknowledge the magnitude of this challenge: changing how institutional portfolio managers fundamentally categorize Bitcoin would be extraordinarily difficult. These are deeply embedded frameworks built over decades of risk management practice.

The reality is that Bitcoin currently serves as "digital gold" for tech-forward investors and a new generation building wealth in the digital age. Gold serves traditional institutions and central banks. Rather than one replacing the other, they're developing complementary roles. But Bitcoin evolving into a true safe-haven asset comparable to Gold? That would be one of the biggest miracles in financial history, and while the potential exists, we're not there yet, and getting there requires a seismic shift in institutional thinking.

Q2: What are your price predictions for Gold and Bitcoin by year’s end?

I'm generally bullish on both assets over the long term, but hesitant to provide concrete near-term targets. For Gold, the fundamental support from central bank buying and geopolitical uncertainty suggests continued strength, though quarterly volatility is inevitable.

For Bitcoin, I'm optimistic over a multi-year horizon, but what happens in the next quarter remains highly uncertain given macro crosscurrents. More importantly, I'm particularly bullish on the emerging infrastructure being built around crypto: stablecoins are seeing explosive adoption, Real World Assets are gaining institutional traction, and DeFi protocols are maturing into battle-tested infrastructure.

These sectors may offer more compelling opportunities than Bitcoin itself in the near term, as they're less correlated with broader equity market movements and driven more by fundamental adoption curves. Long-term, Bitcoin remains attractive, but the next quarter will largely depend on Fed policy and macroeconomic developments that are difficult to forecast with confidence.

Jake Kennis, Senior Research Analyst at Nansen:

Q:1 How do you see the interplay between Bitcoin’s increasing correlation with equities and Gold’s inverse relationship with the USD shaping their roles as portfolio hedges in Q4, especially if stagflation risks from tariffs and inflation intensify?

We see both BTC and Gold as potential hedges in Q4. The recent market environment has favored Gold over Bitcoin as a portfolio hedge, especially given its significant outperformance recently. Bitcoin's correlation to equities means it may amplify portfolio risk during stagflation, not mitigate it. Gold's decoupling from traditional USD inverse correlation and its strong price action over the last few months position it as the primary defensive asset at the largest scale. Bitcoin retains value as a long-term hedge against monetary system fragility but the short term correlation and run-up of Gold suggest varying short term trends for hedging risk.

Q2: Do you think Bitcoin’s ‘digital gold’ narrative still holds, or is Gold’s safe-haven dominance in uncertain times redefining their relative appeal?

The ‘digital gold’ narrative for Bitcoin still holds on longer time frames. In the short run, Gold has outperformed YTD in 2025 and demonstrated safe-haven qualities during uncertainty. With a $26.2T market cap, over 11x the size of BTC, Gold and Bitcoin remain in very different leagues by scale, leaving room for both assets to play unique roles.”

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.