DePIN tokens' trading volume increases after US SEC's no-action letter to DoubleZero

- The US SEC issued a no-action letter for the DoubleZero project on Monday, stating that the 2Z token does not require registration under securities laws.

- The SEC highlights its limitations in regulating securities markets and not all economic activities.

- The DePIN segment trading volume has increased by 43% in the last 24 hours.

Decentralized Physical Infrastructure Network (DePIN) tokens have seen a 43% increase in trading volume over the last 24 hours, following the issuance of a no-action letter by the US Securities and Exchange Commission (SEC) on Monday to DoubleZero, a DePIN project.

US SEC issues a no-action letter to DoubleZero’s 2Z token

DoubleZero, a DePIN project focused on improving information transfer between blockchain nodes via fiber-optic networks, secured a no-action letter from the US SEC on Monday, as the Division of Corporation Finance advised against enforcement action.

The SEC support stems from the programmatic transfers on the DoubleZero network, which is not subject to Section 5 of the Securities Act, and the 2Z token is not an equity class security under Section 12(g) of the Exchange Act.

In an additional statement to the letter, the SEC clarifies that the DePIN projects distribute tokens based on the activity of a user or contributor in the network, rather than selling or distributing tokens to investors seeking investment returns with additional network development. This is a key feature that helps DePIN tokens bypass the Howey Test, popularized in the crypto community during Ripple's legal battle against the SEC.

Furthermore, the positive regulatory environment could boost potential corporate investments into DePIN projects.

Following the issuance of the no-action letter, DoubleZero announced that its 2Z token will be available on Binance Wallet on Thursday.

With the SEC’s greenlight to the project, the trading volume of DePIN tokens has surged by 43% in the last 24 hours, which could indicate an increase in traders’ interest. On the other hand, the market cap remains steady at $14.64 billion over the same period.

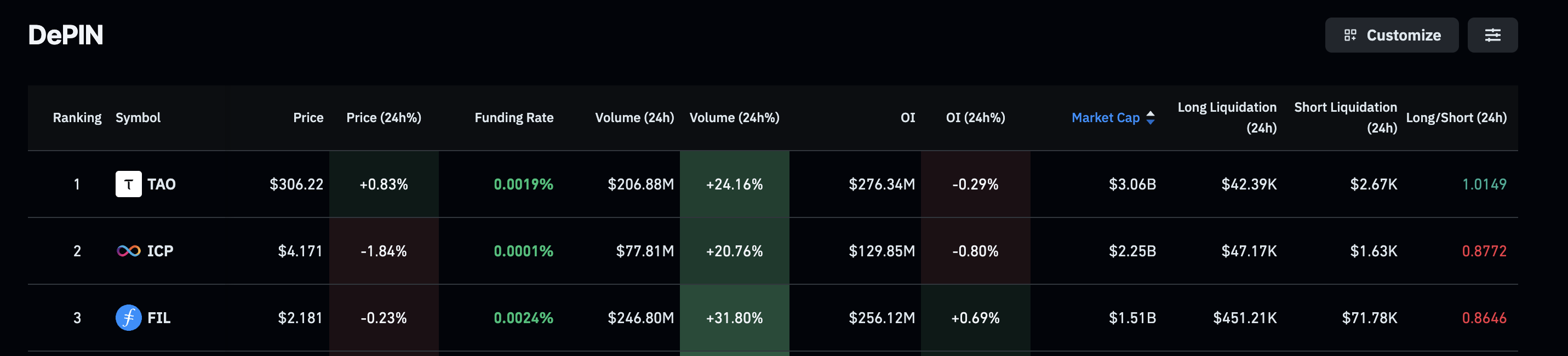

DePIN market data. Source: DePINscan.

Validating the volume surge, CoinGlass data reveal that the trading volumes of Bittensor (TAO), Internet Computer (ICP), and Filecoin (FIL) have surged by 24%, 20%, and 31% in the last 24 hours, respectively.

DePIN derivatives data. Source: CoinGlass