AI tokens fail to rally despite Nvidia reporting growth in quarterly earnings

- Nvidia announced Q2 revenue of $46.74 billion, up 56% in the past year.

- NVDA saw a 3% decline in after-hours trading despite the announcement.

- The Artificial Intelligence token sector failed to rally despite the chip-making giant's positive earnings.

The Artificial Intelligence token sector saw minimal price changes on Wednesday, despite Nvidia's (NVDA) Q2 report showing a 56% revenue growth to $46.74 billion over the past year.

AI crypto sector fails to react to Nvidia's Q2 earnings

Nvidia surpassed Wall Street's expectations on Wednesday with a higher-than-expected Q2 revenue of $46.74 billion, marking a 56% year-on-year growth. Adjusted earnings per share (EPS) rose to $1.05, up 54% in the past year.

Although Nvidia excluded China sales from its third-quarter forecast, CEO Jensen Huang stated on an earnings call that he views the China market as a $50 billion opportunity for the company this year.

Nvidia's Q2 results underscore the company's role in the global AI sector. On the earnings call, Huang shared that he anticipates a $3 to $4 trillion AI infrastructure scale within five years.

"Over the next five years, we're gonna scale into effectively a $3 to $4 trillion AI infrastructure opportunity," said Huang.

The company's stock took a different turn following the release of the report, dropping over 3% in after-hours trading.

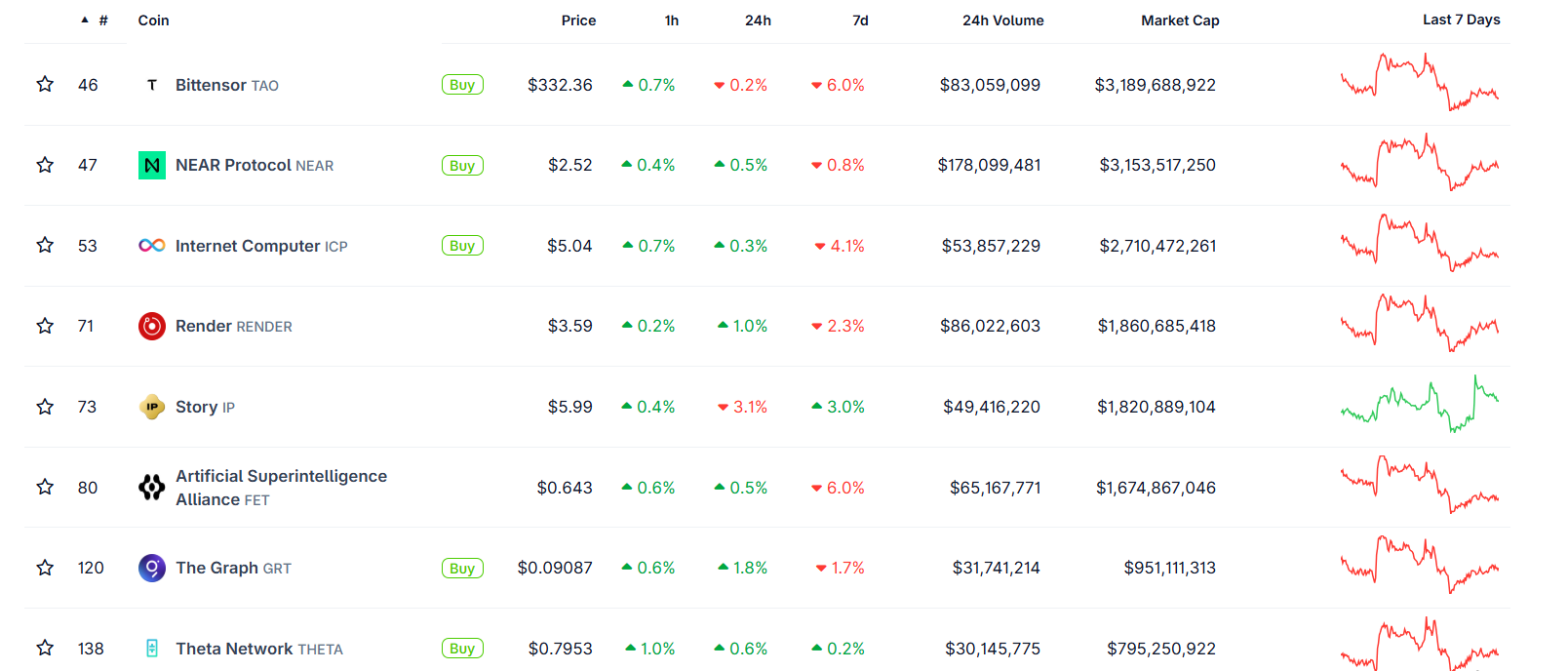

Alongside a decline in NVDA's shares, the Artificial Intelligence (AI) token sector saw price changes between -3% to +1%.

Nvidia's earnings reports are crucial to understanding the growth of the AI industry, and often influence investor sentiment across AI-related assets, including cryptocurrencies tied to AI developments.

Top AI tokens, including Bittensor (TAO), Near Protocol (NEAR), Internet Computer (ICP), RENDER and Artificial Superintelligence Alliance (FET), experienced minimal price changes over the past 24 hours.

Top AI tokens. Source: CoinGecko