NZD/USD consolidates below seven-month highs ahead of key employment data

• NZD/USD eased to 0.6008 on Monday, pulling back from seven-month highs near 0.6045 as the Kiwi consolidates strong January gains of around 5%.

• Tuesday brings Q4 labor market data; unemployment rate expected to edge down to 5.2% from 5.3%, which would be the first decline in four years.

• Markets pricing 80% chance of RBNZ rate hike by September after Q4 CPI surprised at 3.1% YoY, above the central bank's 1-3% target band.

The New Zealand Dollar (NZD) traded on a softer footing against the US Dollar (USD) on Monday, easing back from seven-month highs as the Kiwi consolidates after a stellar January rally. NZD/USD slipped to 0.6008, retreating from last week's peak near 0.6045 as profit-taking set in following a roughly 5% gain through January. The pair remains underpinned by shifting interest rate expectations following hotter-than-expected New Zealand inflation data.

Q4 employment data in focus for Tuesday

All eyes turn to Tuesday's release of New Zealand's fourth-quarter labor market statistics, due early Wednesday local time. Economists expect the unemployment rate to edge down to 5.2% from 5.3% in Q3, marking the first decline in four years and signaling that the jobs market may be stabilizing. Employment change is forecast to show positive growth after two consecutive quarterly declines, with some analysts expecting the strongest employment growth in around two years.

The labor data carries significant weight for the Reserve Bank of New Zealand (RBNZ) policy outlook. Signs of labor market stabilization would support the view that the economy is recovering from the RBNZ-induced slowdown, potentially limiting the scope for further rate cuts. However, sticky inflation remains the dominant factor; Q4 CPI surprised to the upside at 3.1% year-on-year, exceeding the RBNZ's 1-3% target band and shifting market expectations firmly toward rate hikes later this year.

RBNZ rate hike expectations build

RBNZ Governor Anna Breman notably refrained from pushing back against market expectations for a rate increase this year, a marked shift from her earlier tone when she had downplayed the likelihood of near-term hikes. Markets now price an 80% chance of a rate hike by September, with roughly a 50% probability of a move as early as July. The OCR currently sits at 2.25% following six cuts since August 2024, and the February 18 meeting is expected to see rates held steady.

USD supported by shutdown, Warsh nomination

The US Dollar Index (DXY) remained supported above 97.00 on Monday as the partial government shutdown extended into its third day. The Bureau of Labor Statistics (BLS) has confirmed that Friday's Nonfarm Payrolls release has been suspended until federal operations resume. Risk sentiment remained cautious as markets weighed the impact of the shutdown alongside President Trump's nomination of Kevin Warsh as the next Federal Reserve (Fed) Chairman.

NZ economic recovery signs emerge

Recent data showed New Zealand consumer confidence rose in January to its highest level since August 2021, while the trade surplus widened to NZ$52 million in December, above forecasts of NZ$30 million. These positive datapoints, combined with the potential for improving labor market conditions, add to the picture of a recovering New Zealand economy that may support the case for eventual policy tightening.

New Zealand Dollar price forecast

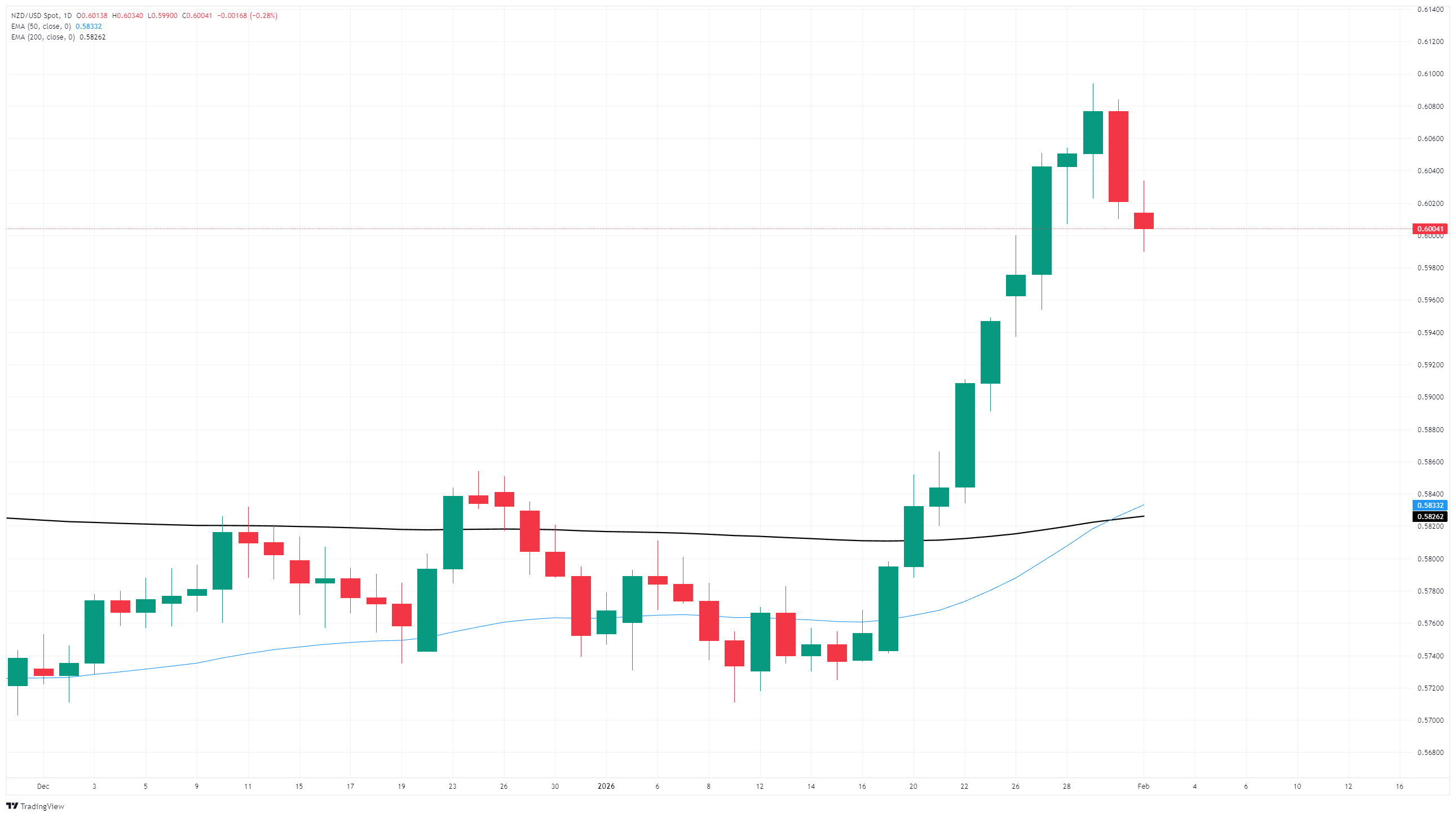

NZD/USD has pulled back from its recent test of seven-month highs near 0.6045, with the pair now consolidating around the 0.6000 psychological level. The retreat comes after a sharp January rally that saw the Kiwi climb nearly 5% against the Greenback, driven by the inflation surprise and shifting rate expectations. The 50-day Exponential Moving Average (EMA) is attempting to break above the 200-day EMA near 0.5850, setting up a potential golden cross that would confirm the bullish trend shift.

The 0.60 level has emerged as key near-term support, with a break below opening the door toward the 200-day EMA at 0.5850. On the upside, resistance is seen at the recent high of 0.6045, with a sustained break above this level potentially extending gains toward the 0.61 handle. The Relative Strength Index (RSI) has pulled back from overbought conditions near 76 and now sits in the mid-60s, suggesting some room for further upside without being overstretched.

Near-term direction will likely hinge on Tuesday's Q4 employment data. A better-than-expected labor market reading showing falling unemployment and positive job growth would reinforce the bullish case for the Kiwi and support bets on eventual RBNZ rate hikes. Conversely, weaker data could see profit-taking accelerate. Broader risk sentiment and the US government shutdown situation will also influence flows, with any resolution potentially dampening safe-haven USD demand and supporting risk-sensitive currencies like the NZD.

NZD/USD daily chart

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.