Gold slides as Warsh Fed pick, hot ISM data extends bullion unwind

- Gold drops over 4% amid rattled rate-cut bets following President Trump's nomination of Kevin Warsh as next Fed Chair.

- US manufacturing surges to 2022 highs after a strong Institute for Supply Management PMI, lifting yields and the US Dollar.

- Despite a 14% rout since Friday, bullion holds above key technical support as longer-term uptrend remains intact.

Gold (XAU/USD) retreats more than 4% on Monday after the US President Donald Trump announced his pick to lead the Federal Reserve (Fed) in succession to the Fed Chair Jerome Powell. Economic data in the US paint an optimistic outlook as manufacturing activity improves. At the time of writing,XAU/USD trades at $4,681.

XAU/USD sinks below $4,700 as markets reprice a firmer Fed outlook and US manufacturing hits multi-year highs

Since last Friday, Gold price tumbled by over 14%. Although the nomination of Kevin Warsh was seen as one of the catalysts behind the precious metals rout. Economic activity in the manufacturing sector improved the most, reaching levels last seen in 2022, according to the Institute for Supply Management (ISM).

Although bullion prices had recovered, US Dollar strength and higher US Treasury yields keep XAU/USD prices below the $5,000 mark. Despite reaching a daily low of $4,402, the trend is up, as sellers failed to conquer the October 17 swing high turned support at $4,381.

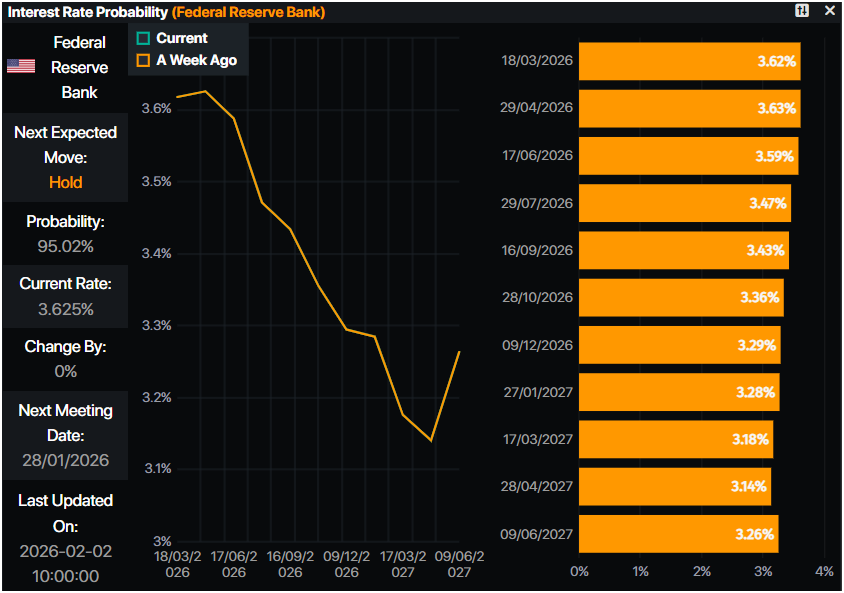

Last week, the Fed decided to hold rates unchanged, signaling that they would be data-dependent and decisions would be made meeting-by-meeting.

What’s next in the calendar this week?

The US economic docket will feature speeches by Federal Reserve officials, jobs data, S&P and ISM Services PMIs and the University of Michigan Consumer Sentiment. January’s Nonfarm Payrolls report will not be released due to the partial government shutdown, revealed Barron’s.

Daily digest market movers: Gold drops weighed by strong US Dollar

- The DXY, which measures the American currency performance versus six peers, surges 0.7 4% up to 97.54, a headwind for bullion prices.

- US Treasury yields are rising in a sign that speculators see fewer odds that Warsh could cut rates “indiscriminately” to please the White House. The US 10-year Treasury note yield is up two and a half basis points at 4.263%.

- Data-wise, the ISM Manufacturing PMI crushed forecasts of a 48.5 reading, expanded by 52.6 in January, up from December’s 47.9 contraction. The Prices Paid subcomponent rose for the sixteenth straight month, while the Employment index contracted, remaining below the 50 expansion contraction level.

- S&P Global Manufacturing PMI for January showed an expansion in the sector and the best reading since May 2022. The Index came at 52.4, up from a preelimnar 51.9.

- Last week, the US Bureau of Labor Statistics (BLS) revealed that inflation on the producer side rose by 3% in headline figures, above estimates. Core figures, increased by 3.3% YoY, which would warrant rates to remain unchanged unless the Producer Price Index (PPI) resumes lower.

- Money markets had priced in 48 basis points of easing by the Federal Reserve, towards the end of the year, as revealed by data from Prime Market Terminal.

Technical outlook: Gold collapses below $4,700 as sellers pile in

Gold retreated to a daily low of $4,402 before bouncing off that low, yet it remains far from reaching the daily open of $4,792. Momentum remains bearishly biased, but if bulls keep XAU/USD spot above $4,381, the uptrend is intact.

If Gold rises above $4,700, buyers could test the 20-day Simple Moving Average (SMA) at $4,773. A breach of the latter will expose the current day open and $4,800. Conversely, a drop below $4,600 will expose the $4,550 and $4,500 mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.