BoC expected to cut interest rate again amid weak growth and a soft labour market

- The Bank of Canada is expected to lower its interest rate to 2.25%.

- The Canadian Dollar remains on the back foot vs. the US Dollar in October.

- The BoC reduced its policy rate by a quarter-point in September.

- The impact of US tariffs on the domestic economy clouds the outlook.

The Bank of Canada (BoC) is widely expected to trim its benchmark interest rate by another quarter point on Wednesday, bringing it down to 2.25%. That would follow a similar move in September as the central bank continues its gradual easing cycle.

The case for more cuts has been building. Growth has stalled, the labour market has lost momentum, and inflation remains stubbornly above target. Canada’s economy shrank by 1.6% in the second quarter, worse than forecast, while the job market surprised with a 60K gain in September, keeping the Unemployment Rate steady at 7.1%.

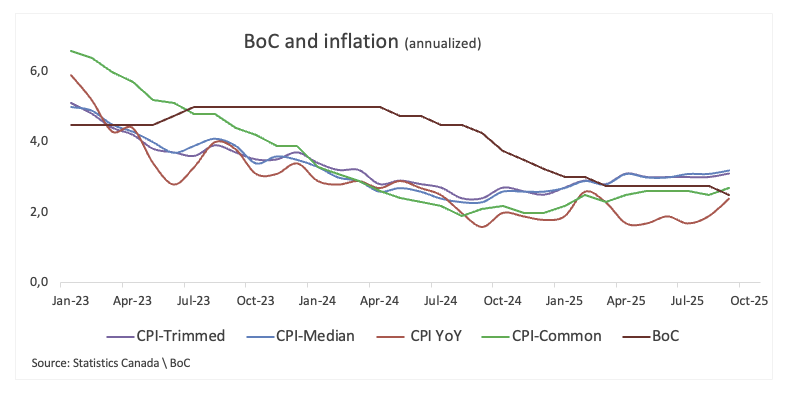

Inflation remains a sticking point. Headline CPI rose 2.4% YoY last month, surpassing expectations, and core CPI climbed to 2.8%. The Bank’s preferred measures—Common, Trimmed, and Median CPI—also nudged higher to 2.7%, 3.1%, and 3.2%, respectively.

Back in September, the BoC cut rates by 25 basis points to 2.50%, a move that markets had fully priced in. After that meeting, Governor Tiff Macklem struck a cautious tone, saying the inflation picture hadn’t changed much in the last few months. He pointed to mixed data and emphasised a meeting-by-meeting approach. While inflationary pressures appear somewhat more contained, he stressed that the Bank stands ready to act if risks start to tilt higher.

Previewing the BoC’s interest rate decision, analysts at TD Securities noted: “We look for the Bank of Canada to cut rates by 25bps to 2.25% in October, which we believe will mark the endpoint of its easing cycle. We do not believe stronger September data will be enough to keep the Bank on hold, but it should contribute to a more balanced tone in the statement as the Bank stresses a data-dependent approach going forward.”

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision on Wednesday at 13:45 GMT, followed by Governor Tiff Macklem’s press conference at 14:30 GMT.

Markets are already braced for a rate cut and pricing around 31 basis points of easing by the end of the year.

According to FXStreet’s Senior Analyst Pablo Piovano, the Canadian Dollar (CAD) has been consolidating near the upper end of its recent range, near the key 1.4000 mark. He notes that as long as USD/CAD holds above the 200-day simple moving average (SMA) around 1.3950, the pair could have more room to climb.

A renewed bullish tone, Piovano adds, could see USD/CAD retesting the October peak at 1.4080 (October 14), before potentially eyeing the April high at 1.4414 (April 1).

On the flip side, he points out that strong support sits around the 200-day SMA at 1.3952, seconded by the transitory 55-day and 100-day SMAs at 1.3887 and 1.3799, respectively. A break below that zone might open the door to the September floor at 1.3726 (September 17), with the July base at 1.3556 (July 3) coming into view if selling pressure deepens.

“Momentum indicators are still tilted to the upside,” Piovano adds. “The Relative Strength Index (RSI) is hovering near 57, while the Average Directional Index (ADX) stands near 37, suggesting the trend remains strong.”

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Last release: Wed Sep 17, 2025 13:45

Frequency: Irregular

Actual: 2.5%

Consensus: 2.5%

Previous: 2.75%

Source: Bank of Canada

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.