ADP Employment Change is likely to increase concerns about the US labour market

- The ADP and NFP reports will serve as indicators of US employment this week, the canary in the cage for the Fed’s policy.

- The US private sector is expected to have added 68K new payrolls in August.

- The US Dollar struggles at the lower end of August’s trading range.

This week, the US employment is set to take centre stage. Automatic Data Processing Inc. (ADP), the largest payroll processor in the US, is set to release the ADP Employment Change report for August, measuring the change in the number of people privately employed in the US, at 12:15 GMT on Thursday.

Investors will be especially attentive to August’s ADP job report, after July’s Nonfarm Payrolls (NFP) shock that triggered the ousting of a key Labour Department official and sent the US Dollar (USD) into a tailspin.

August’s figures will also be crucial to determine the Federal Reserve’s (Fed) monetary policy, as it will be the last employment report ahead of the September 16 and 17 meeting.

These figures come in a context of escalating attacks from US President Donald Trump on the Federal Reserve, calling for less restrictive interest rates, as traders ramp up their bets for a resumption of the Fed’s easing cycle in September.

The ADP survey is typically published a few days before the official Nonfarm Payrolls data are released. It is frequently viewed as an early indicator of potential trends that may be reflected in the Bureau of Labor Statistics (BLS) employment report. However, the two reports do not always align.

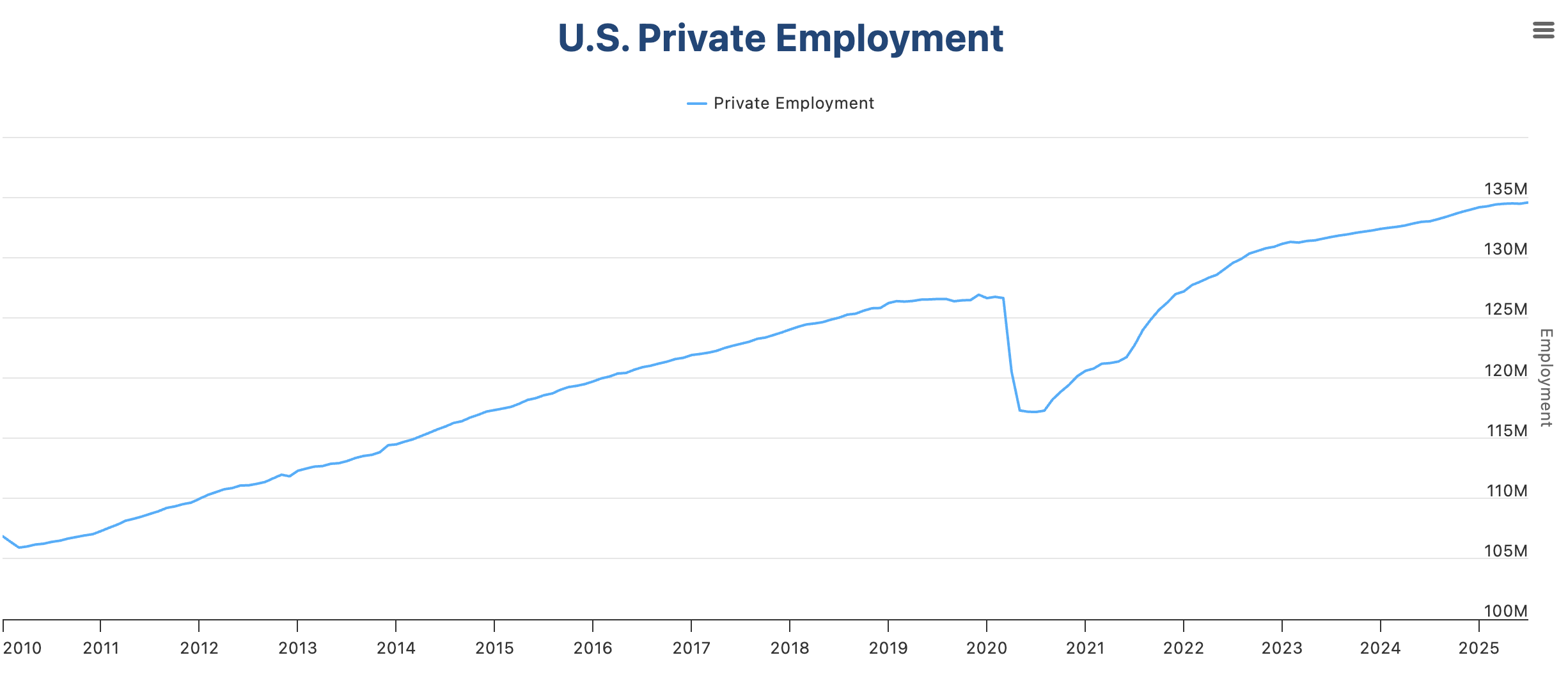

Chart from Automatic Data Processing

Labour data might confirm a Fed rate cut in September

Employment serves as a fundamental element of the Fed’s dual mandate, in conjunction with keeping price stability.

In that sense, the unexpectedly weak job data seen in July boosted speculation about downside risks to the economy and forced the central bank to shift its focus away from the inflationary risks of Trump’s tariffs.

The poor employment gain seen in July, coupled with sharp downward revisions of the previous two months’ release in the NFP, rattled markets, shattering the theory of US economic exceptionalism and forcing the Federal Reserve to reconsider its hawkish stance.

US inflation figures seen over the previous week have contributed to easing concerns about escalating price pressures, at least for now, and Fed President Jerome Powell accepted the idea of a one-off impact from trade tariffs. A significant change of tone that strengthened the case for immediate interest rate cuts.

Another Consumer Prices Index (CPI) report is due ahead of this month's Federal Open Market Committee (FOMC) meeting, but further signs of a weakening labour market might practically confirm a Fed cut at the next meeting.

The CME Group’s Fed Watch Tool is showing a nearly 90% chance of a 25 basis point cut this month, ahead of the release of US employment numbers, and at least another quarter point cut before the end of the year.

When will the ADP report be released, and how could it affect the US Dollar Index?

The ADP Employment Change report for August is set to be released on Thursday at 12:15 GMT. The market consensus points to 68K new jobs following a 104K increase in July. The US Dollar Index (DXY), which measures the value of the Greenback against the world’s most traded currencies, is moving up from four-week lows, but remains well below the levels seen before the release of July’s employment figures

Against this background, the risk is on a weaker-than-expected reading, which would force the Fed to accelerate its easing cycle and bring the possibility of a 50-basis-point cut to the table, triggering fresh selling pressure on the US Dollar.

An upbeat result, on the contrary, would ease concerns about a sharp economic slowdown, but is unlikely to alter expectations about Fed easing, at least until Thursday’s figures are confirmed by Friday’s NFP report. Such an outcome is likely to have a moderate positive impact on the USD.

Regarding the EUR/USD, Guillermo Alcala, FX analyst at FXstreet, sees the pair looking for direction within the last 150-pip horizontal range that has contained price action since early August.

Alcalá sees an important resistance area ahead of 1.1740: “The confluence between the descending trendline resistance, now around 1.1730, and 1.1740, which encompasses the peaks of August 13 and 22, as well as Monday's high, is likely to pose a serious challenge for bulls.”

To the downside, Alcalá highlights the support area above 1.1575: “Euro bears are likely to face significant support at the bottom of the monthly range, between 1.1575 and 1.1590, which capped bears on August 11, 22, and 27. Further down, the 50% Fibonacci retracement level of the early August bullish run, at 1.1560, might provide some support ahead of the August 5 low, near 1.1530.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Sep 04, 2025 12:15

Frequency: Monthly

Consensus: 68K

Previous: 104K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.