Bitcoin Price Forecast: BTC reclaims $109,000 as traders eyes Bitcoin Conference-driven volatility

- Bitcoin price continues to recover for the fourth consecutive day on Tuesday after Friday’s sharp correction.

- QCP Capital reports a near-term rise in volatility, suggesting that traders are positioning themselves ahead of the Bitcoin Conference in Las Vegas.

- Traders should be cautious, as short-term holders are realizing profit, which could bring selling pressure.

Bitcoin (BTC) continues to recover and reclaims $109,000 on Tuesday, following its nearly 4% correction on Friday. The highly anticipated Bitcoin 2025 Conference starts on Tuesday in Las Vegas, drawing heightened attention from traders and investors. QCP Capital reports that the rise in near-term implied volatility suggests that market participants are positioning themselves around potential headline risks tied to the event, which could lead to volatility spikes and liquidations in the largest cryptocurrency by market capitalization.

Trader lock-in for the Bitcoin Conference in Las Vegas

The Bitcoin conference in Las Vegas, Nevada, from Tuesday to Thursday, is a key event to watch. This three-day conference marks the sixth annual Bitcoin conference since 2019, highlighting the growth, innovation, and adoption of Bitcoin.

The highly anticipated Bitcoin 2025 Conference brings together some of the most powerful voices in crypto, finance, and politics.

Some of the speakers’ names are shown below:

- JD Vance– Vice President of the United States

- Michael Saylor – Executive Chairman, MicroStrategy

- Donald Trump Jr. – Businessman

- Eric Trump – Co-founder & Chief Strategy Officer

- Senator Cynthia Lummis – U.S. Senate

- Hester Peirce – Commissioner, U.S. SEC

- Ross Ulbricht – Digital Freedom Advocate

- Nigel Farage – UK Member of Parliament

QCP’s Capital reports that sustained elevation in near-term volatility suggests that traders are positioning around headline risk ahead of this event.

The report further explains that July’s Nashville Bitcoin Conference 2024 saw a sharp spike in 1-day implied volatility above 90 as current US President Donald Trump delivered a speech during this event. This volatility spike was followed by a swift reversal, resulting in a nearly 30% decline in BTC within two days.

“The probability of a similar drawdown appears low; positioning suggests a defensive tilt (.....).”

"BTC is likely to remain range-bound in the near term; once the event passes and key speeches conclude, front-end vols are expected to compress as risk premia fade,” says QCP’s analyst.

Short-term BTC holders’ book profits

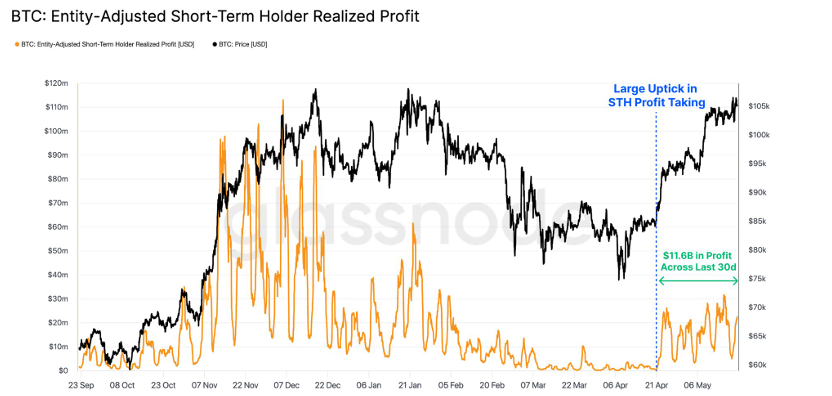

According to the graph below, over the past 30 days, BTC’s short-term holders have realized a cumulative $11.4 billion in profit, a staggering contrast to the $1.2 billion realized in the previous 30-day period. This rise in profit booking also indicates that some degree of consolidation is likely as the market digests this wave of distribution before attempting another leg higher.

Despite short-term selling pressure, the institutional demand continues to strengthen. On Monday, Strategy added 4,020 BTC for $427.1 million, bringing the total BTC holdings to 580,250 BTC.

Bitcoin Price Forecast: BTC recovers above $109,000

Bitcoin price reached a new all-time high (ATH) of $111,980 on Thursday and declined by 3.92% on Friday. However, it found support around the $106,406 daily level on Saturday and recovered in the last two days. At the time of writing on Tuesday, it continues to recover, trading at around $109,600.

If BTC continues to recover and closes above its all-time high, it could extend the rally toward the key psychological level of $120,000.

The Relative Strength Index (RSI) on the daily chart reads 67, pointing upward toward its overbought level of 70, indicating bulls are still in control of the momentum. Traders should be cautious as the Moving Average Convergence Divergence (MACD) indicator shows a bearish crossover, giving a sell signal and suggesting a downward trend ahead.

BTC/USDT daily chart

If BTC faces a pullback and closes below its daily support at $106,406, it could extend the correction to retest its next key support level at $100,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.