Solana price outlook brightens as SOL staking volume surpasses Ethereum’s

- Solana remains bullish but struggles to break the 100-day EMA resistance and extend the uptrend above $150.

- Solana staking volume surpasses that of Ethereum, but the ETH protocol has an edge in optimizing decentralization and infrastructure.

- SOL could extend gains beyond $160 following a falling wedge pattern breakout.

Solana (SOL) is trading at $148 during the European session on Friday, down slightly on the day, even as the crypto market extends a sigh of relief on the promise of potentially easing trade tensions between the United States (US) and China.

According to China’s Commerce Ministry, "the US has proactively reached out to China through multiple channels, hoping to hold discussions on the tariff issue," Reuters reports. Although the exact timing of a tariff truce between China and the US remains unknown, sentiment across the crypto market has remained largely bullish.

Solana staking surpasses Ethereum and security implications

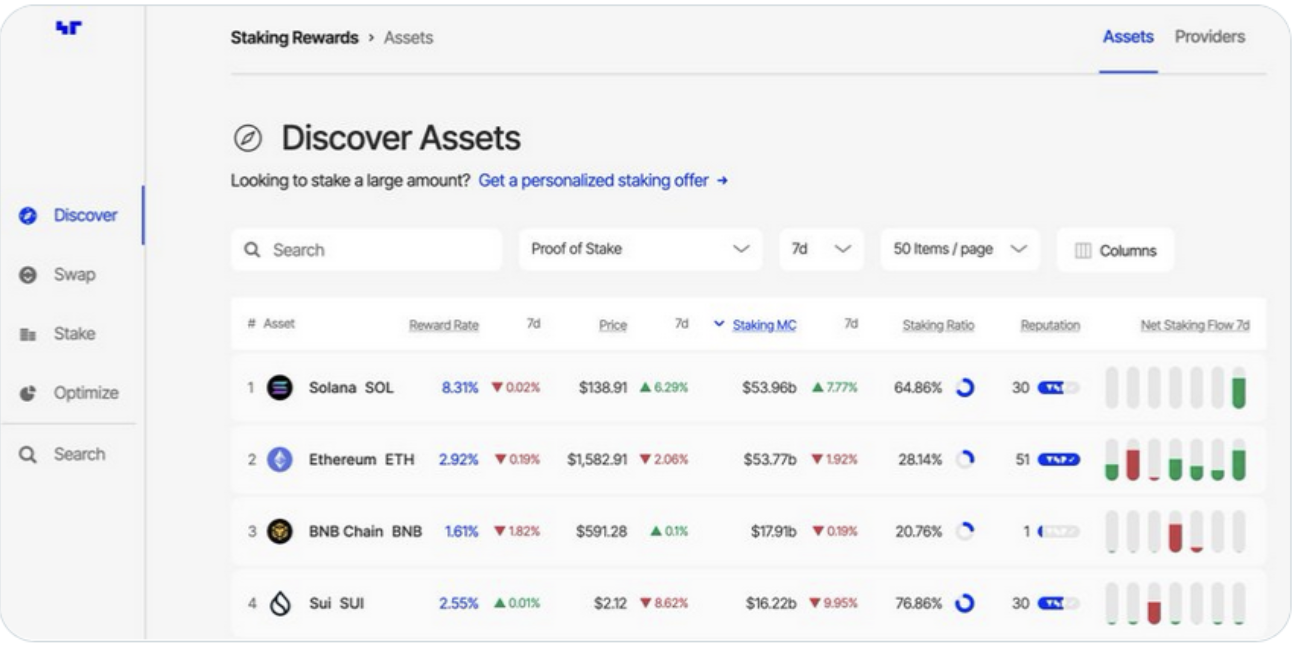

The Solana protocol on April 21 surpassed the Ethereum network in total staked value of their respective native tokens, SOL and ETH, reaching approximately $53.96 billion compared to the latter's $53.77 billion. This has sparked discussions about the impact of staking on both networks.

Staking stats by crypto network | Source: Staking Rewards

In an article published on Wu Blockchain's Substack, @Ox_Todd said that, considering the basics of Proof of Stake (Pos) mechanisms, "attacking ETH is significantly harder than attacking Solana." This observation assumes that if the success rate of attacking Solana is 0.001%, the difficulty of attacking Ethereum could be 0.0001%.

"The reason is that ETH, as an ancient blockchain, has truly experienced PoS attacks from the early days. It has made extensive preparations to prevent this potential risk, such as encouraging retail investors to participate in staking," the article states.

Nevertheless, the increase in Solana's staking value to nearly par with that of Ethereum underscores the growing investor interest in SOL. This continues to propel the SOL-ETH ratio, which holds at 0.081, up from its lowest point of 0.0071 in June 2023.

SOL-ETH ratio chart

The increase in Solana staking value risks destabilizing the network's decentralized finance (DeFi) ecosystem. With staked SOL accounting for 65% of the supply, fewer tokens are dedicated to DeFi activities, such as liquidity provision in automated market makers (AMM) and lending protocols. Holders prefer staking SOL for rewards, which stands at 8.8% compared to the 3% staking rewards on Ethereum.

Solana's uptrend hinges on reclaiming the 100-day EMA

Solana's bullish outlook holds between two critical levels: the 50-day Exponential Moving Average (EMA) support at $140 and the 100-day EMA resistance at $150. A break above this resistance would clear the path for more gains that could complete a 40% falling wedge pattern's breakout target to $161, coinciding with the 200-day EMA.

A buy signal presented by the SuperTrend indicator reveals that bulls could have the upper hand, especially if they break above the 100-day EMA. This signal, encouraging traders to buy SOL, occurs when the indicator flips below the price, changing color from red to green, as illustrated on the chart.

SOL/USDT daily chart

However, with green histograms in the Moving Average Convergence Divergence (MACD) indicator diminishing, Solana's price could face potential sell-side pressure. Failure to break above $150 in the coming sessions could exhaust bulls, increasing the chances of a pullback. A sell signal would confirm a reversal, with the MACD line (blue) crossing below the signal line (red). Key levels on the downside include the 50-day EMA at $140 and the demand zone at $125.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.