Crypto Today: DeFi tokens gain $3.5B despite BTC, ETH and XRP lead $640M crypto market capitulation

- Cryptocurrencies market capitalization decreased to $2.7 trillion on Monday, shedding another 3% in the last 24 hours.

- DeFi protocols market capitalization grew by $3.5 billion, with Hyper Liquid, Mantle and Ethena posting significant gains.

- Bitcoin, XRP and Ethereum continue to hold key support levels above $80,000, $2 and $2,000, respectively.

- Crypto traders booked another $640 million in liquidations, anticipating more hawkish signals on the next US CPI this week.

Bitcoin market updates:

- Bitcoin price rebounded 3% to reclaim the $82,200 level at noon European trading on Monday, having tested new lows near $80,000 earlier in the day.

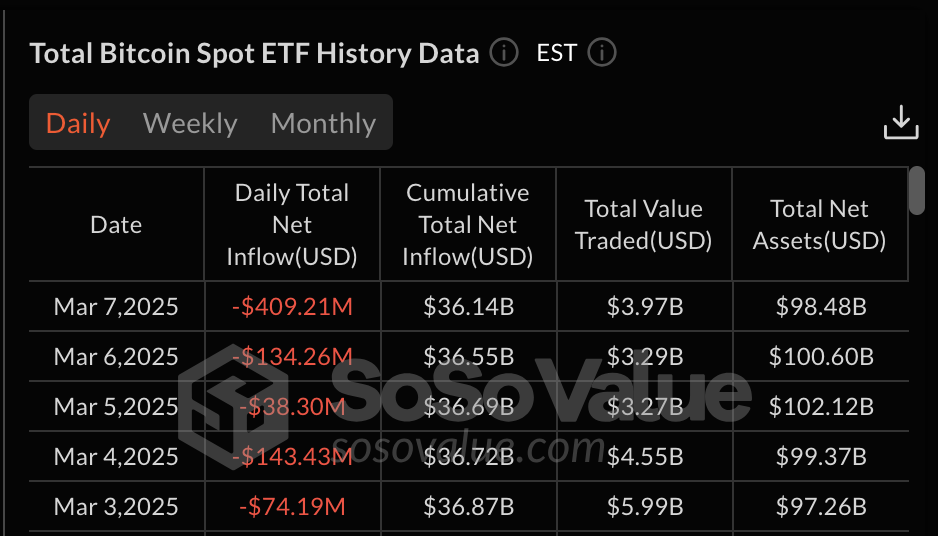

- After the US NFP data release on Friday, Bitcoin ETFs recorded $409.2 million outflows, surpassing the total cumulative outflows of $389 million recorded in the first four trading days of the week.

Bitcoin ETF Flows, March 20255 | Source: SosoValue

- The rapid surge in Bitcoin ETF outflows on Friday suggests that the majority of institutional traders are looking to exit BTC and risk asset positions for fixed-income instruments on expectations of increased interest rates.

Altcoin market updates: Ethereum and Ripple (XRP) reclaim key levels as $647M liquidations sparked rapid sell-offs

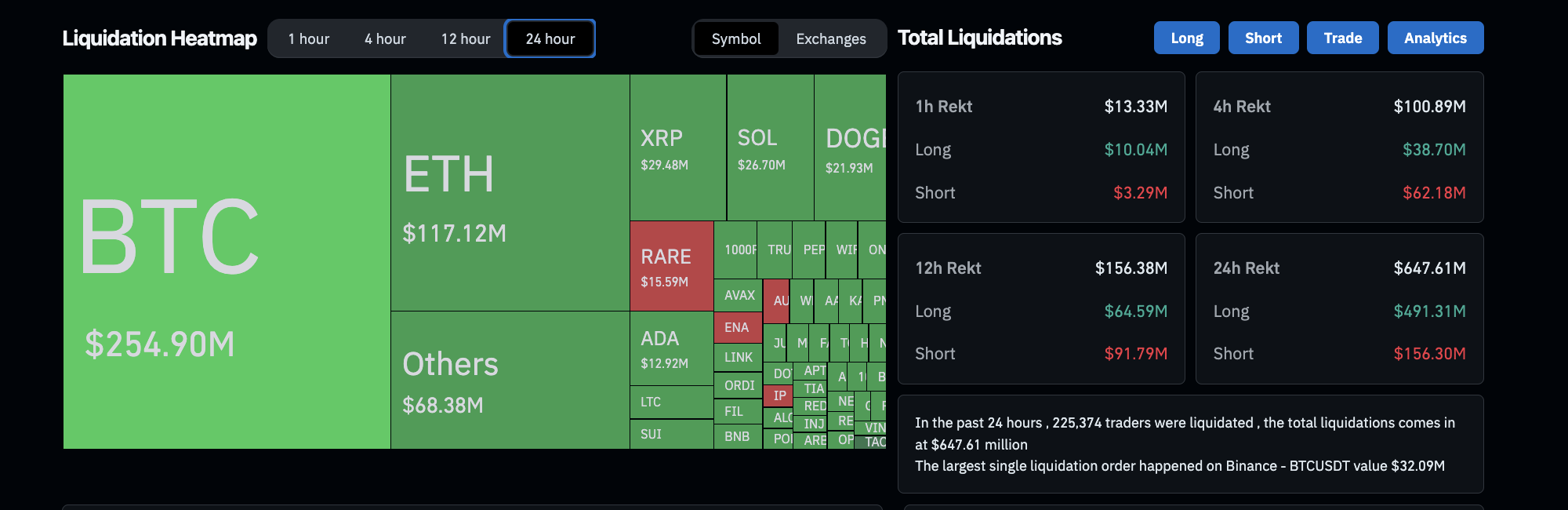

The cryptocurrency derivatives market faced a sharp correction on Monday, with total liquidations reaching $647.61 million in the past 24 hours.

Traders holding long positions on Bitcoin, Ethereum, XRP and Dogecoin bore the brunt of the losses. Bitcoin liquidations alone totaled $254.90 million, followed by Ethereum at $117.12 million and XRP at $29.48 million.

Crypto Market Liquidations, March 10, 2025 | Source: Coinglass

- Long traders suffered the heaviest impact, with $491.31 million liquidated compared to $156.30 million in short liquidations.

- The largest single liquidation order occurred on Binance's BTC/USDT pair, valued at $32.09 million.

This suggests that the majority of bull traders who have placed bullish bets ahead of the White House Crypto Summit have now been wiped out. It remains to be seen if the likes of ETH and XRP will find sufficient demand to hold key levels in the days ahead.

- Ethereum (ETH) price rebounded 3% to reclaim the $2,200 mark at press time.

- Ripple (XRP) traders continue to show resilience, holding the $2.20 support despite over $29 million XRP long liquidations on Monday.

Chart of the day: DeFi Markets see $3.5B inflows as investors seek yield to navigate bear market

United States (US) President Donald Trump’s trade policy updates have fueled market speculation in recent weeks.

However, the US Nonarm Payrolls (NFP) data published on Friday provided concrete evidence of how recent tariffs have negatively impacted consumer demand and increased unemployment figures.

In response to the prospect of a more hawkish Federal Reserve (Fed), investors are reallocating capital from risk assets in search of real yield.

However, rather than exiting the crypto markets, some strategic traders are shifting funds into yield-bearing DeFi protocols.

Total DeFi Sector Performance, March 10 | Source: TradingView

Supporting this trend, the latest data from TradingView shows that the aggregate market capitalization of DeFi-related tokens increased by 8%, adding $3.5 billion to reach a total market cap of $79 billion as of Monday.

A closer look at live trading data on Monday reveals that projects like Ethena, Hyperliquid and Mantle are among the biggest beneficiaries of this shift in investor behavior. AAVE has gained 2.5%, Hyperliquid is up 2% and Ethena has surged 5.8%.

Ethena Price Action

These movements indicate that rather than withdrawing from crypto markets entirely, some investors are strategically reallocating capital into yield-bearing DeFi protocols to navigate the ongoing bear market.

Crypto news updates:

- Whale trader nets $7.5M profits shorting Bitcoin’s latest price dip

A skilled whale trader earned profits in excess of $7.5 million by shorting Bitcoin’s recent decline.

According to on-chain data from Lookonchain, the trader opened a short position at around $96,500 on February 22.

As Bitcoin’s price plummeted below $80,000 within a week, they executed a near-perfect exit, closing their short at approximately $78,900.

- Thailand SEC grants approval for Tether USD₮ as a recognized cryptocurrency

Thailand’s Securities and Exchange Commission has officially approved Tether’s USD₮ as a recognized cryptocurrency, allowing its use on regulated exchanges and for payments.

The approval, effective March 16, 2025, follows amendments to Thailand’s digital asset regulations aimed at expanding investor options and market flexibility.

With a market capitalization of $142 billion, USD₮ is the largest stablecoin globally, widely used for transactions and liquidity management.

The decision strengthens Thailand’s digital asset framework, facilitating broader adoption of stablecoins within the country’s financial system.

- Strategy to issue $21B in preferred stock to expand Bitcoin holdings

Strategy has announced plans to sell up to $21 billion in 8.00% Series A Perpetual Strike Preferred Stock through an at-market offering, according to a Monday filing with the SEC.

The company intends to use the proceeds for general corporate purposes, including acquiring more Bitcoin and strengthening its working capital.

The Nasdaq-listed firm has entered into a Sales Agreement with multiple financial institutions, including TD Securities, Barclays Capital and Cantor Fitzgerald, to facilitate the sale.

The preferred shares, set to trade under the ticker “STRK” on the Nasdaq Global Select Market, will be sold over time through 12 financial institutions acting as sales agents, who will receive up to 2% of the gross proceeds.