Ethereum Price Forecast: ETH retests $4,100 as treasury firms SharpLink and BitMine buy the dip

Ethereum price today: $4,000

- Ethereum treasury SharpLink grew its stash to 859,853 ETH last week after purchasing $75 million worth of the top altcoin.

- The company trails BitMine, which holds over 3.23 million ETH following its purchase of 203,826 ETH last week.

- ETH is on the verge of suffering a rejection at the $4,100 resistance for a second consecutive day.

Ethereum (ETH) is testing the $4,100 resistance again on Tuesday, following strong accumulation from digital asset treasuries (DATs) SharpLink and BitMine.

SharpLink joins BitMine to continue ETH buying spree

Ethereum treasury company SharpLink Gaming (SBET) bought 19,271 ETH for $75 million last week, increasing its stash to 859,853 ETH, according to a statement on Tuesday.

The Minnesota-based firm said it completed the purchase at an average price of $3,892 per ETH after raising $76.5 million in a private offering.

"The capital raise completed last week was executed at a premium to NAV," said SharpLink co-CEO Joseph Chalom. "Shortly thereafter, we took advantage of attractive market conditions to acquire ETH at prices lower than when we raised the capital."

The company also reported staking earnings of 458.9 ETH and cash/equivalents holdings of $36.4 million.

SharpLink's ETH accumulation comes behind that of BitMine (BMNR), which has also accelerated its buying pressure following the crypto market pullback in the past two weeks.

BitMine announced on Monday that it added 203,826 ETH to its holdings last week, its largest weekly accumulation so far in October. The company said its reserve has grown above 3.23 million ETH, about 2.7% of Ethereum's circulating supply, making it the largest public holder of the top altcoin.

"We are more than halfway towards our initial pursuit of the 'alchemy of 5%' of ETH," Fundstrat CIO and BitMine chairman Thomas Lee said in a Monday statement.

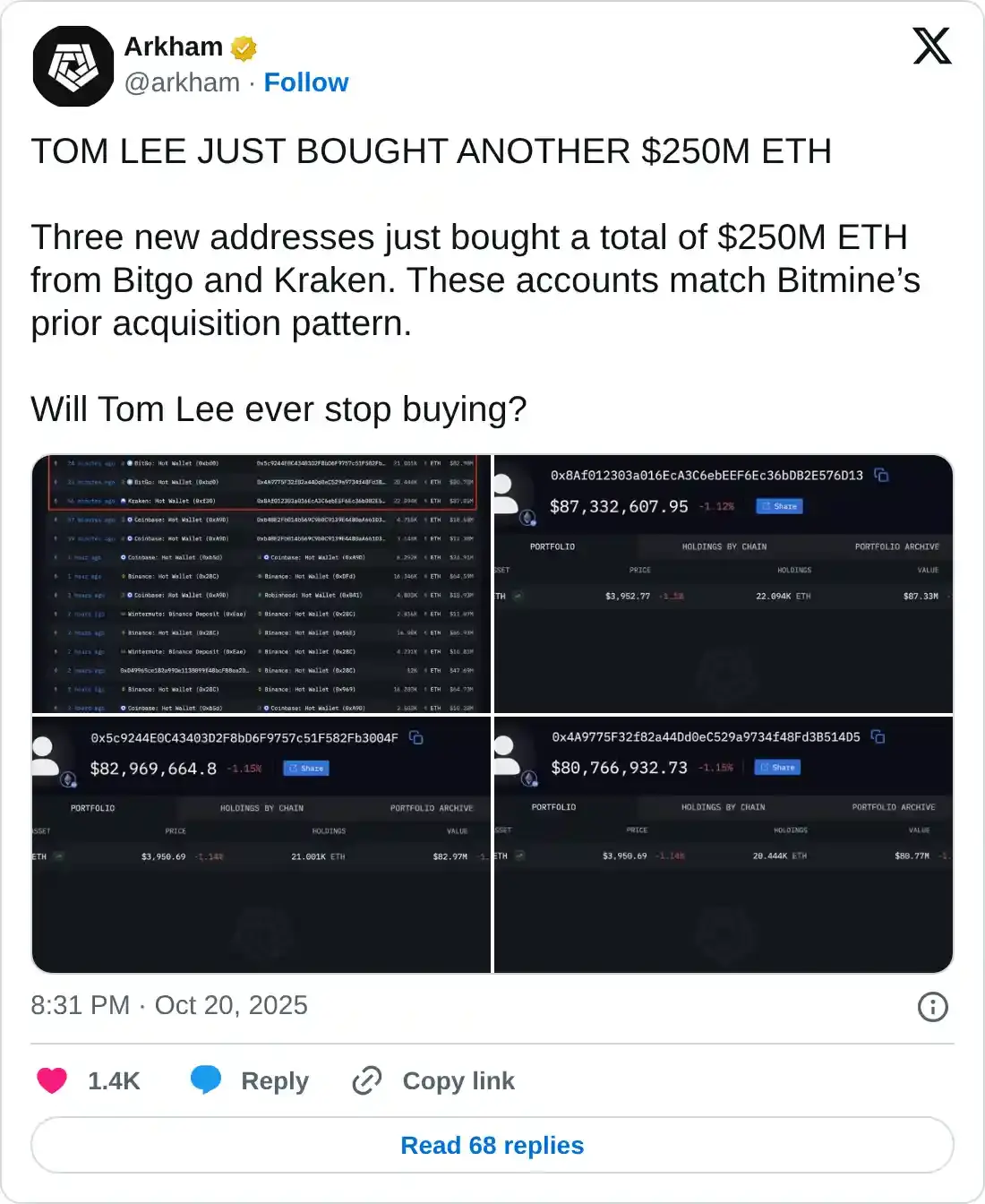

Shortly after its statement, data from crypto analytics platform Arkham Intelligence shows BitMine acquired another 63,539 ETH on Monday, although the company has yet to confirm the purchase.

While crypto treasuries accumulate, US spot ETH exchange-traded funds (ETFs) investors are selling. The products logged net outflows of $145.6 million on Monday, after shedding $311.8 million last week, according to SoSoValue data.

Ethereum Price Forecast: ETH retests $4,100 key resistance

Ethereum saw $153 million in futures liquidations over the past 24 hours, led by $80.1 million in short liquidations, per Coinglass data.

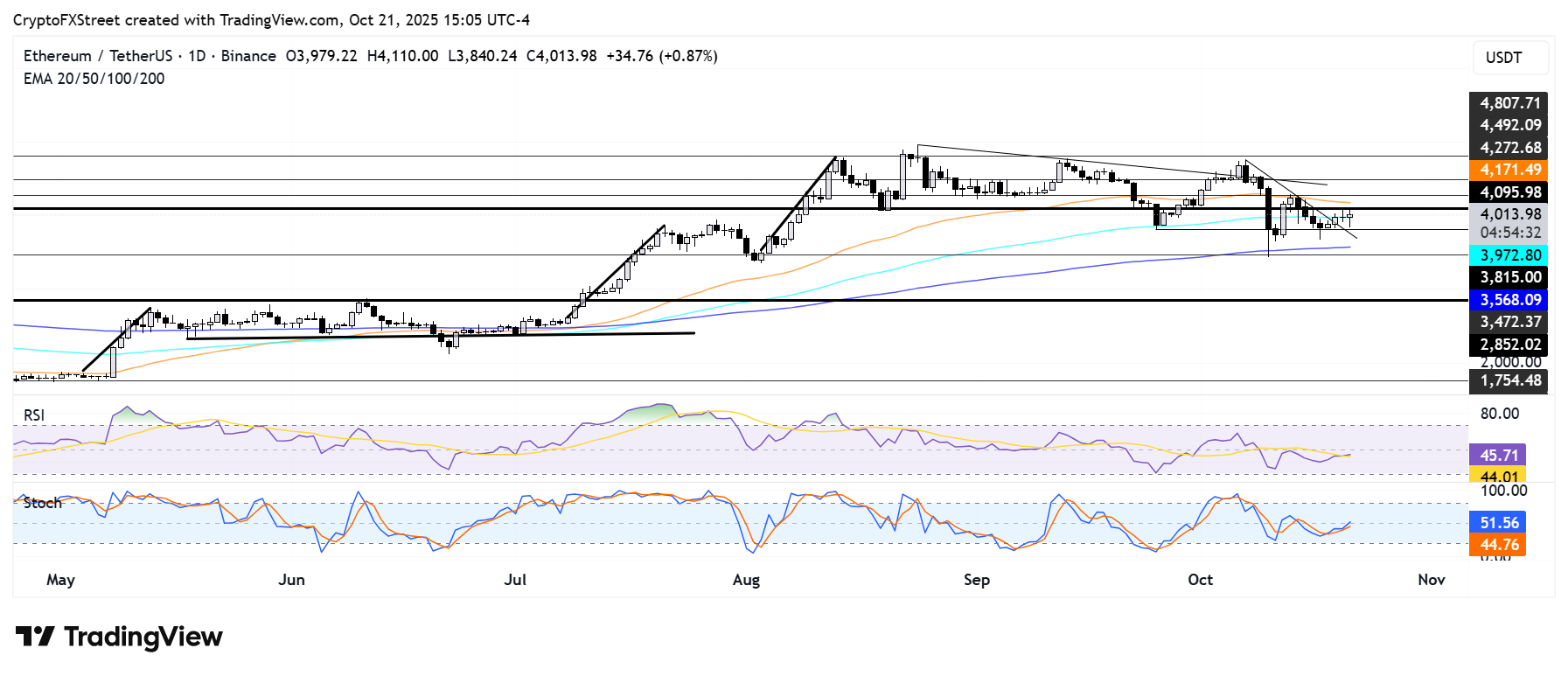

The top altcoin looks set to suffer another rejection at $4,100 for a second consecutive day as it struggles to clear the 50-day and 100-day Exponential Moving Averages (EMAs). ETH consistently saw a rejection near $4,100 in 2024 before eventually overcoming the level on August 9.

ETH/USDT daily chart

To sustain an uptrend, ETH has to firmly clear resistance levels at $4,100, $4,270 and the 50-day and 100-day EMAs. However, ETH could decline to $3,470 if it loses the support near $3,800.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are testing their neutral levels, indicating a weakening bearish momentum.