Pi Network Price Forecast: PI holds steady, defying the broader crypto market downtrend

- Pi Network trades flat for the third consecutive day as risk-on sentiment declines in the cryptocurrency market.

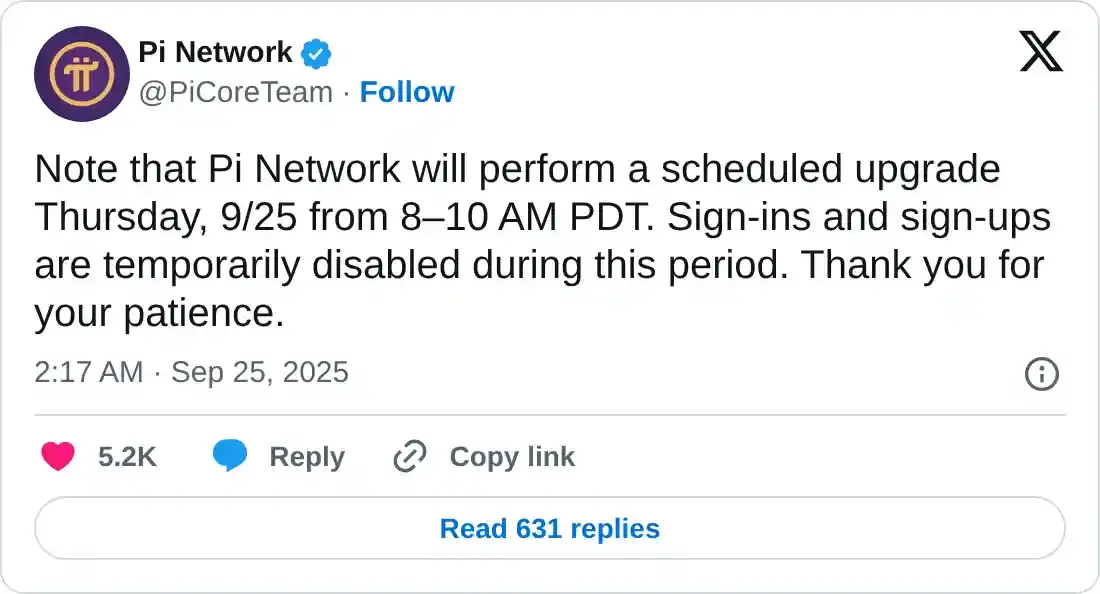

- A scheduled network outage will temporarily disable signup and login features on Thursday.

- CEXs' reserves continue to decline, indicating that traders are acquiring PI at discounted levels.

Pi Network (PI) price trades above $0.2700 at the time of writing on Thursday, taking a sideways shift after Monday’s 19% drop. The mobile mining cryptocurrency holds on thin ice amid the broader cryptocurrency market downtrend and a scheduled network outage on Thursday.

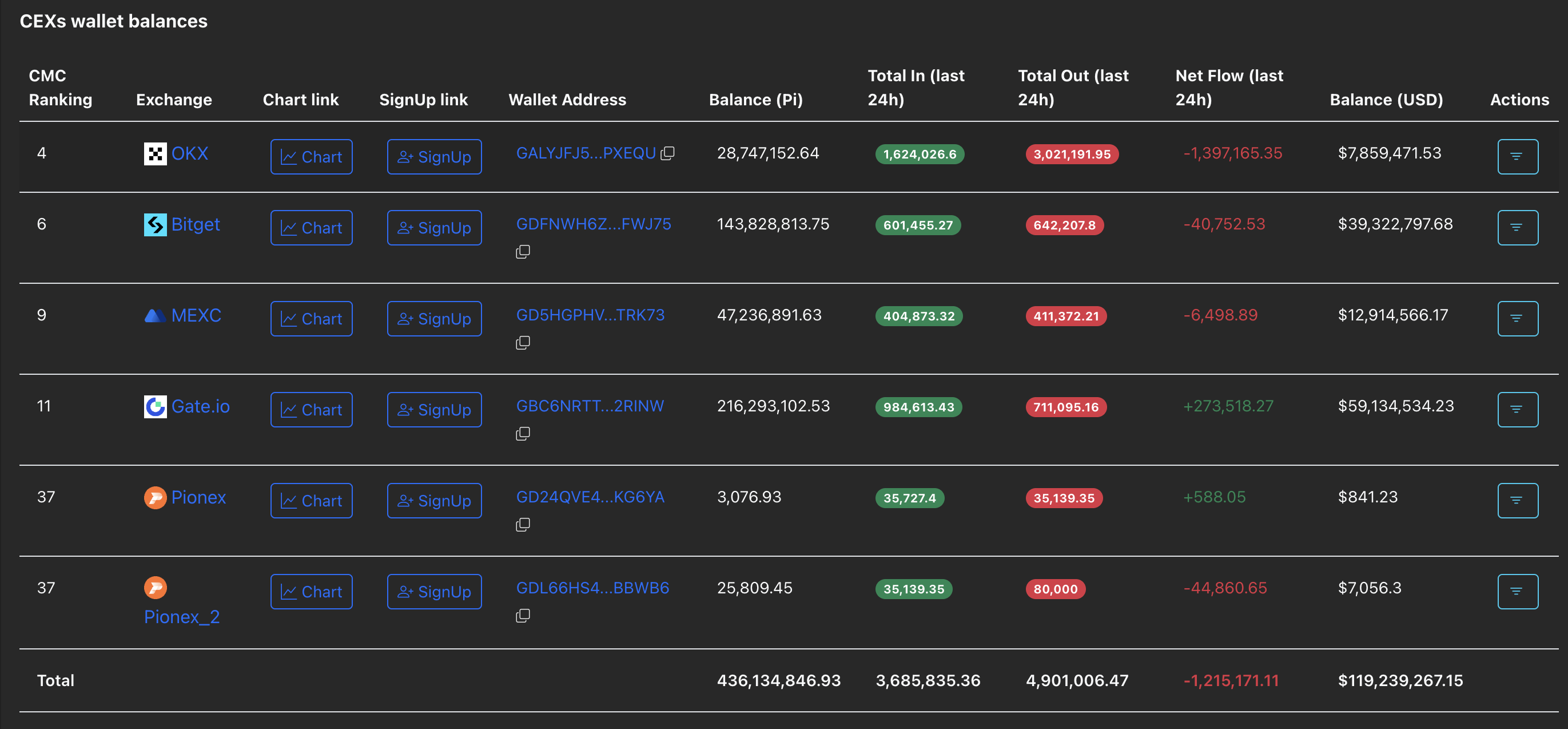

Furthermore, the net outflows from Centralized Exchanges (CEXs) reserve indicate the bullish struggle to absorb incoming supply pressure.

Scheduled upgrade and declining CEXs' balances flash mixed signals

Pi Network announced in an X post on Thursday that a scheduled upgrade between 15:00 and 17:00 GMT will temporarily disable features. This upgrade comes as part of the Stellar protocol version 23 shift, which would enable smart contract functionalities on the Pi Network. As of Thursday, the Pi Network Testnet 1 has undergone a complete shift, with Testnet 2 under upgrade. Following this, the Pi Mainnet will initiate its upgrade.

Flashing bullish potential, CEXs wallet balances maintain a net outflow, indicating that traders continue to buy the dip. The PiScan data suggest that over 1.21 million PI tokens have been withdrawn from CEXs, continuing the net outflow trend of 1.94 million PI and 7.96 million PI tokens, as previously reported.

CEXs wallet balances. Source: PiScan

Pi Network stays weak as bearish momentum remains elevated

Pi Network edges lower by 3% at press time on Thursday, erasing the 2.89% gains from the previous day. The intraday pullback holds above the $0.2700 level as the risk-on sentiment in the broader cryptocurrency market decreases.

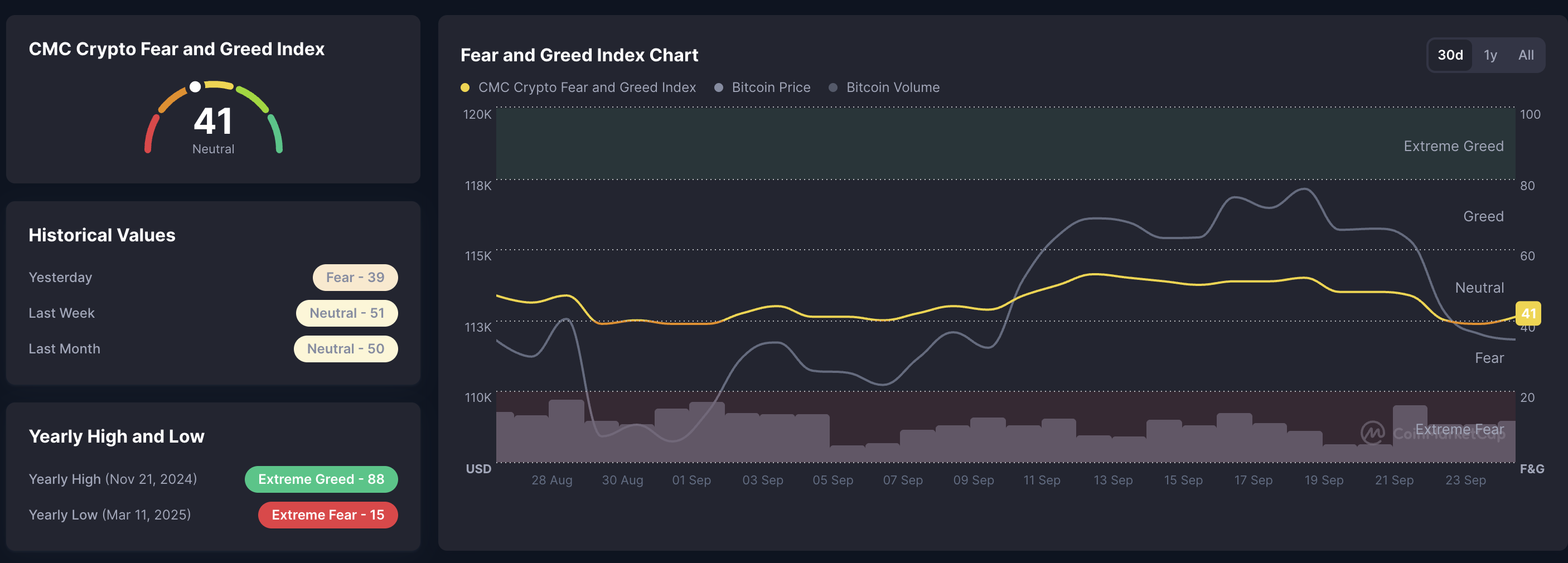

CoinMarketCap’s Fear and Greed Index remains steady in the neutral zone at 41, after a decline from 51 last week. If this index drops below 40, it will signal a risk-off sentiment in the broader market.

Fear and Greed Index. Source: CoinMarketCap

If PI extends the intraday pullback below $0.2700, it could result in a free fall to the S2 support level at $0.2387.

Flashing the bearish pressure, the Relative Strength Index (RSI) at 27 on the daily chart remains within oversold territory, suggesting that sellers are dominating the price trend. Additionally, the Moving Average Convergence Divergence (MACD) and its signal line take a nosedive in the negative territory, following the bearish crossover on Sunday. The steady rise in red histogram bars indicates that the bearish momentum is increasing.

PI/USDT daily price chart.

On the flip side, if PI rebounds upwards, it could challenge the 50-day Exponential Moving Average (EMA) at $0.3618.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.