Gold sinks below $3,400 despite ongoing Middle East tensions

- Gold price drops after spiking to $3,452 on heightened geopolitical risk in the Middle East.

- Iran signals openness to nuclear talks, cooling safe-haven demand for Bullion.

- Traders await Fed, BoJ, BoE decisions amid busy week of US economic data.

Gold price tumbled below $3,400 during the North American session, down over 1% despite tensions in the Middle East remaining high as the Israel-Iran conflict escalates. At the time of writing, XAU/USD trades at $3,399 after reaching an eight-week peak of $3,452.

On Friday, Israel attacked Iran’s military and nuclear facilities and targeted major officials after arguing that Tehran could produce nuclear bombs within days – an argument in opposition to US intelligence. Talks between the United States (US) and Iran have halted due to Israel launching the war.

In breaking news, Gold rallied sharply. Nevertheless, Bullion has retreated as Iran signaled that it's ready to end hostilities and resume talks about its nuclear program – according to the Wall Street Journal (WSJ) – which has improved risk appetite. However, some Iranian officials have denied that report.

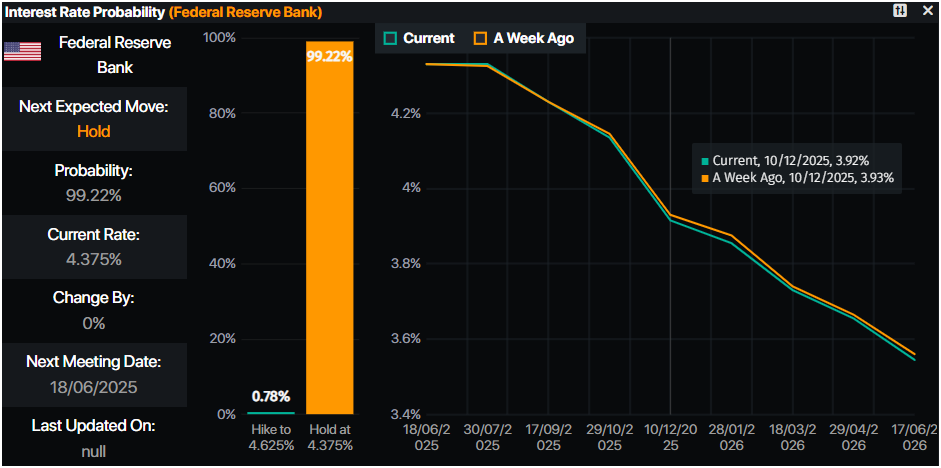

Major central banks are expected to deliver their latest monetary policy decisions. The Federal Reserve (Fed) is projected to hold rates steady. Traders are also eyeing the decisions of the Bank of Japan (BoJ) and the Bank of England (BoE).

Ahead in the week, following the Fed’s decision, the US docket will feature the release of Retail Sales, housing, and business activity data revealed by the Fed's regional banks.

Daily digest market movers: Gold retreats, but rising geopolitical risks loom

- Despite retreating, Gold is expected to edge higher as major central banks, such as the People’s Bank of China (PBoC), are likely to continue their buying spree.

- The latest inflation reports in the US warrant further easing by the Fed. Any dovish hints by the US central bank could boost Gold prospects as the non-yielding metal fares well in lower interest rate environments.

- Geopolitical risks would keep Bullion prices higher. The lack of progress in Russia-Ukraine talks and the Middle East conflict broadening to include Iran would keep the yellow metal underpinned by risk aversion.

- US Treasury yields are recovering, with the US 10-year Treasury yield rising over three and a half basis points (bps) to 4.446%. US real yields followed suit, edging up almost four bps to 2.166%, capping Bullion’s advance.

- The US Dollar Index (DXY), which tracks the value of the Dollar against a basket of peers, is down 0.16% at 97.98, close to hitting a multi-year low of 97.60.

- Money markets suggest that traders are pricing in 46 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price consolidates near $3,400 ahead of FOMC meeting

Gold price uptrend remains in place even though XAU/USD fell below $3,400. Price action indicates that the precious metal is maintaining its higher high and higher lows market structure, confirming the bullish bias. The Relative Strength Index (RSI) remains bullish, even though buyers are losing some steam, as the RSI continues to aim downward toward its neutral line.

If XAU/USD closes daily below $3,400, anticipate a pullback toward the $3,350 area. A breach of this level would expose the 50-day Simple Moving Average (SMA) at $3,281, followed by the April 3 high-turned-support at $3,167.

On the side, if Gold stays above $3,400, look for a test of $3,450, as it clears the path to challenge the record high of $3,500 in the near term.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.