Gold jumps as Fed cut offsets Powell’s hawkish tone

- Gold jumps 1.5% after Fed cuts 25 bps to 3.75–4%, despite Powell’s cautious remarks about the December meeting.

- Yields fall as markets digest dovish 10–2 vote split; Miran sought 50 bps, Schmid no cut.

- Powell says labor market remains resilient but near neutral, hinting at possible pause ahead.

Gold price rallies over than 1.50% on Thursday after the Federal Reserve (Fed) reduced rates as expected despite Chair Jerome Powell’s hawkish comments at the press conference. Falling US Treasury yields and geopolitics boosted the yellow metal, which trades at $3,995 at the time of writing.

Bullion rebounds above $3,990 amid softer yields and geopolitical jitters

On Wednesday, the Fed reduced borrowing costs by 25 basis points to 3.75%-4% on a 10-2 split vote. The two dissenters were Fed Governor Stephen Miran, voting for a 50-bps cut, and Kansas City Fed President Jeffrey Schmid, who opted to keep rates unchanged.

At the press conference, the Fed Chair Jerome Powell surprised the markets, saying “a further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it.” This headline sent waves on Gold prices, which tumbled under $3,920, before recovering, on Thursday throughout the Asian and European sessions.

Powell added that the Fed’s main concern is the labor market, but also expressed that, despite lacking official data, the FOMC collected state unemployment claims and said that the jobs market is not deteriorating sharply.

He noted that some members of the FOMC see rates at a neutral stance or closer to neutral.

Bullion’s advance could be capped by US-China trade news after both Presidents, Trump and Xi Jinping, met in South Korea for a couple of hours, agreeing to strike a one-year trade truce.

Daily market movers: Gold rallies despite US Dollar strength

- The US Dollar Index (DXY), which tracks the performance of the buck versus six currencies, climbs 0.37% to 99.50.

- Conversely, US Treasury yields fall, as depicted by the 10-year Treasury note yield flat at 4.091%. US real yields — which correlate inversely to Gold prices — climb one and a half basis points to 1.791%.

- US President Donald Trump said that the meeting was "amazing." He stated that China agreed to resume soybean purchasesand the US reduced fentanyl tariffs to 10%, while opening the door to Beijing to discuss chops. Trump added that the rare-earth issue was solved and that tariffs on China’s products were slashed from 57% to 47%.

- In the Federal Reserve’s monetary policy statement, it was announced that the Quantitative Easing (QE) would finish on December 1.

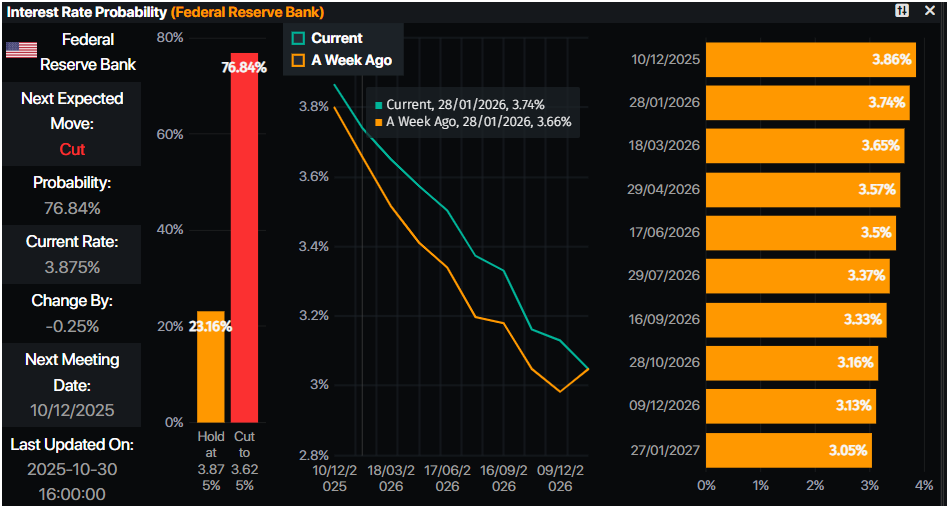

- For the December meeting, expectations that the Federal Reserve would cut rates are at 76%, down from 85% before the Fed's decision, according to Prime Market Terminal data.

Source: Prime Market Terminal

Technical outlook: Gold price climbs towards $4,000

Gold’s technical outlook remains constructive, though buyers need a daily close above $4,000 to sustain bullish momentum and set up a test of the 20-day Simple Moving Average (SMA) at $4,079.

The Relative Strength Index (RSI) shows buyers regaining strength, suggesting further short-term upside potential.

A break above the 20-day SMA would expose resistance at $4,100, followed by the October 22 peak at $4,161. On the downside, a daily close below $4,000 would open the door for deeper losses toward the October 28 low at $3,886 and the 50-day SMA near $3,779.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.