Warren Buffett Has Repeated His Warning to Wall Street for 12 Quarters. Now, as 2026 Approaches, Is It Time to Listen?

Key Points

Warren Buffett believes in buying quality stocks and holding on for the long term.

This strategy has helped him deliver exceptional returns over nearly 60 years.

- 10 stocks we like better than S&P 500 Index ›

Warren Buffett is known for his love of investing in stocks. Yet, over the past few years, he's been doing more selling than buying. The billionaire chairman and chief executive officer of Berkshire Hathaway has been a net seller of stocks over the past 12 consecutive quarters, a move that could be seen as a warning to Wall Street as the S&P 500 marches higher. The major benchmark, driven by artificial intelligence (AI) stocks, climbed over the past two years for a 53% increase, and this year it's heading for yet another double-digit gain.

Buffett, in keeping with his usual investing behavior, didn't jump onto the bandwagon. Instead, the billionaire, through his actions, has suggested that investors should proceed with caution. In addition to selling stocks, Buffett built up a significant pile of cash, reaching record levels.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Still, investors have continued piling into stocks, driving the S&P 500 to multiple records. Now, though, as 2026 approaches, is it finally time to listen to Buffett's warning? Let's find out.

Image source: The Motley Fool.

Decades of market-beating returns

First, it's important to understand why investors generally sit up and take notice when Buffett makes an investing decision. Buffett never follows market trends and doesn't mind picking stocks that may be out of favor with other investors. This, along with a focus on choosing quality companies for reasonable prices, has helped Buffett guide Berkshire Hathaway to market-beating returns for nearly six decades. And the billionaire has invested throughout both bull and bear markets, showing that his techniques work during any market environment.

Considering all of this, investors pay attention to Buffett's moves -- and sometimes follow them -- with the hope of generating big returns.

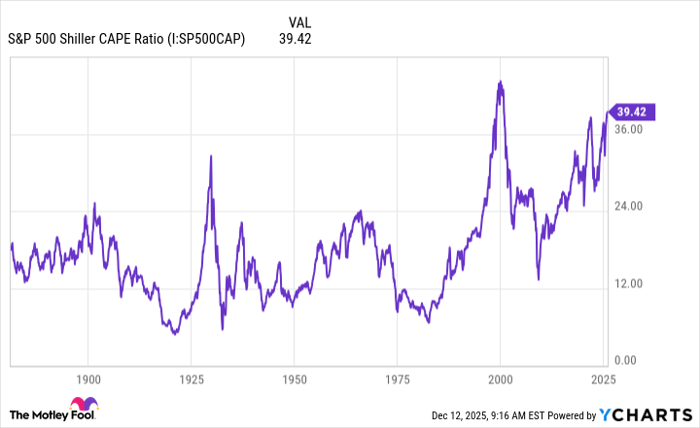

Before getting back to our question, it's worth talking about the reason for Buffett's caution in recent years. Buffett hasn't spelled out exactly why he's more often been a seller than a buyer of stocks or why he's built the Berkshire Hathaway cash level to more than $381 billion, a record level. But one particular element likely is involved, and this is valuation. The S&P 500 Shiller CAPE ratio has reached its second-highest level ever -- its highest level was during the dot-com boom -- and this suggests that, overall, stocks are expensive right now.

S&P 500 Shiller CAPE Ratio data by YCharts

The Shiller CAPE ratio is a reliable metric since it measures stock price and earnings per share over 10 years, allowing for shifts in the economy.

Buffett and value investing

It's clear that Buffett isn't ignoring such a movement in valuation since he's known for value investing. The billionaire won't overpay for a stock and instead seeks out companies that are trading for less than what they're really worth.

So, ahead of the new year, should investors finally listen to Buffett's warning? As I mentioned above, the investment community generally is eager to follow tips from this expert investor. But, in recent quarters, investors have piled into stocks -- particularly AI and growth players -- and in some cases, they may have paid hefty prices.

A few weeks ago, concerns mounted that an AI bubble might even be forming, and that temporarily weighed on the S&P 500's performance. Those fears eased amid positive news regarding AI spending and AI demand, but it's key to note that when valuations reach high levels, vulnerability exists. Any disappointment from the companies themselves or a negative bit of economic news may prompt investors to ask whether valuations might be sustained at such levels.

And history shows us that declines in the S&P 500 generally follow peaks in valuation.

All of this means that it's a good idea to follow Buffett's lead and invest with caution. The key word here is "invest," meaning you should continue to look for opportunities and seize them -- like Buffett does. But with stocks at one of their priciest levels ever, now, as the new year approaches, it's also wise to listen to the message Buffett has repeated over the past 12 quarters.

Should you buy stock in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 15, 2025.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.