Bitcoin and Ethereum traders could watch this signal for the next bull run

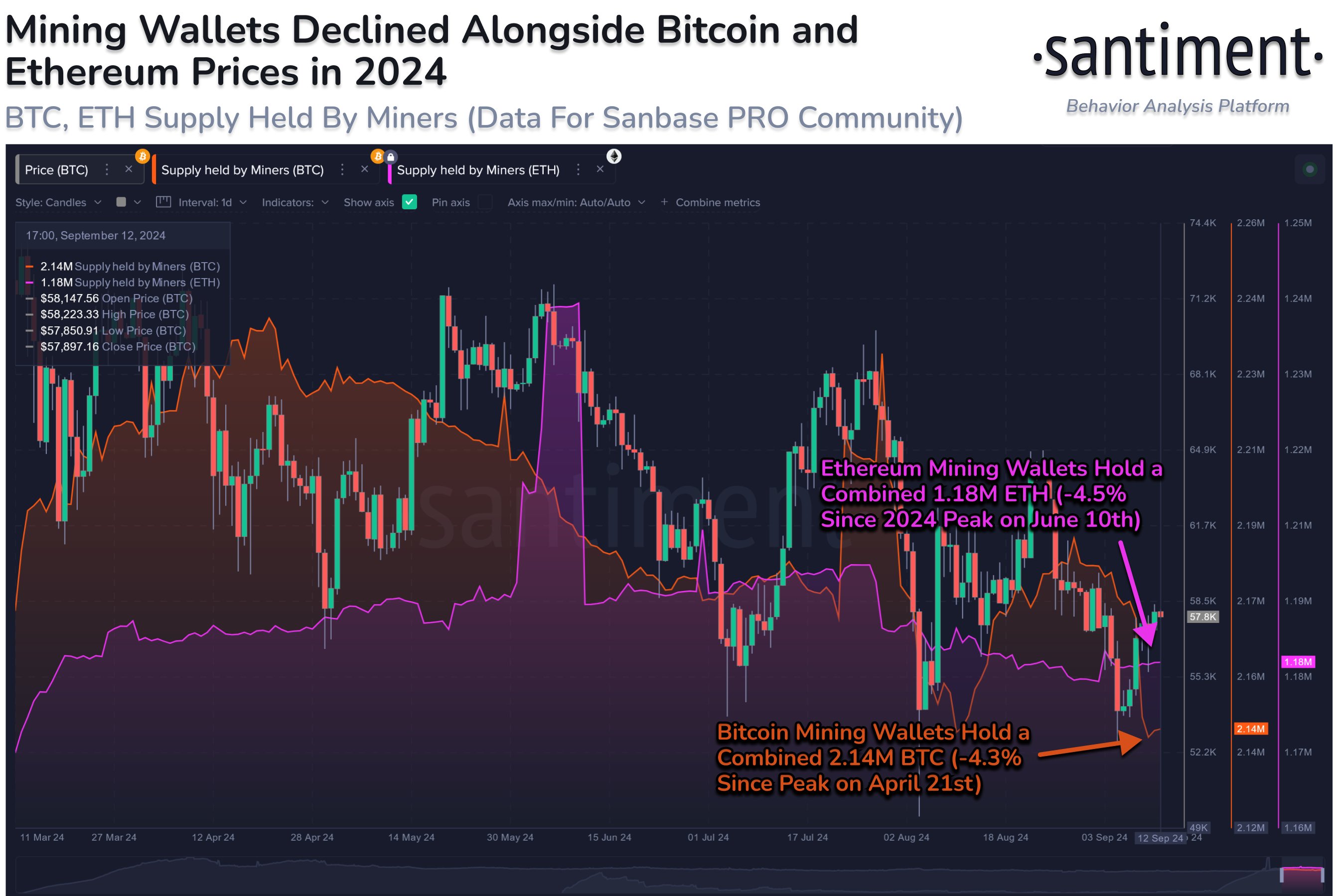

- Bitcoin and Ethereum mining wallets note a decline in supply held since the first half of 2024.

- The recent rebound in the combined supplies of Bitcoin and Ethereum mining wallets is a sign of a potential rally in the assets.

- BTC and ETH hover around key support levels on Friday.

Crypto mining is the process by which new Bitcoin and Ethereum enter circulation. Data from crypto intelligence tracker shows that wallets of Bitcoin and Ethereum miners noted a decline in their holdings of the assets in the first half of the year.

Analysts believe that a recovery in their holdings could signal a bull run in the two assets.

This could signal a Bitcoin and Ethereum bull run

Analysts at crypto intelligence tracker Santiment said in a recent tweet on X that a recovery in the BTC and ETH holdings of miners’ wallets could be considered a sign of a bull run. Bitcoin and Ethereum mining wallets noted a steep decline in supply held during H1 2024, as seen in the chart below.

Bitcoin mining wallets hold 2.14 million BTC, down 4% since April peak. Similarly, Ethereum mining wallets hold 1.18 million Ether tokens, down 4.5% from the 2024 peak. Analysts state that once the supply held by the mining wallet increases, it could be considered a sign of an incoming bull run in the two assets.

Bitcoin, Ethereum mining wallet supply

The phenomenon can be better explained when one considers that Bitcoin and Ethereum miners typically sell their holdings to meet costs of operations. The selling pressure from miners adds to the profit-taking of traders and typically, negatively influences asset prices.

If miners reduce the supply sold or transferred to centralized exchanges and hold on to their BTC, ETH asset holdings, it could ease selling pressure and signal an anticipation of gains in the two cryptocurrencies.

Therefore, analysts consider an increase in supply of mining wallets as a sign of an approaching bull run. At the time of writing, Bitcoin trades at $57,940 and Ether at $2,349.

Traders watch other signs like Bitcoin dominance, relative to altcoins and the performance of top 50 altcoins ranked by market capitalization against Bitcoin as the other signs for a bull run in BTC or alts.