Ripple Price Forecast: XRP steadies, keeping uptrend intact as $1 billion in futures open interest boom stimulates speculation

- XRP futures Open Interest surged by more than $1 billion in the past week, driving speculative activity towards the token.

- Increasing trader interest keeps the XRP rally steady, with bulls aiming for highs above $3.00.

- Risk appetite remains elevated as whales increase exposure to XRP, betting on extended gains in the short term.

Ripple’s (XRP) price trades broadly stable at around $2.60 on Wednesday, upholding the recent bullish trend as crypto markets cheer amid improved sentiment. The uptrend, now in its second consecutive week of gains, is bolstered by a surge in XRP futures Open Interest (OI), growing by more than $1 billion, signaling increasing trader confidence and adding to the chances of a potential breakout above $3.00.

XRP futures open interest soars by over $1 billion in a week

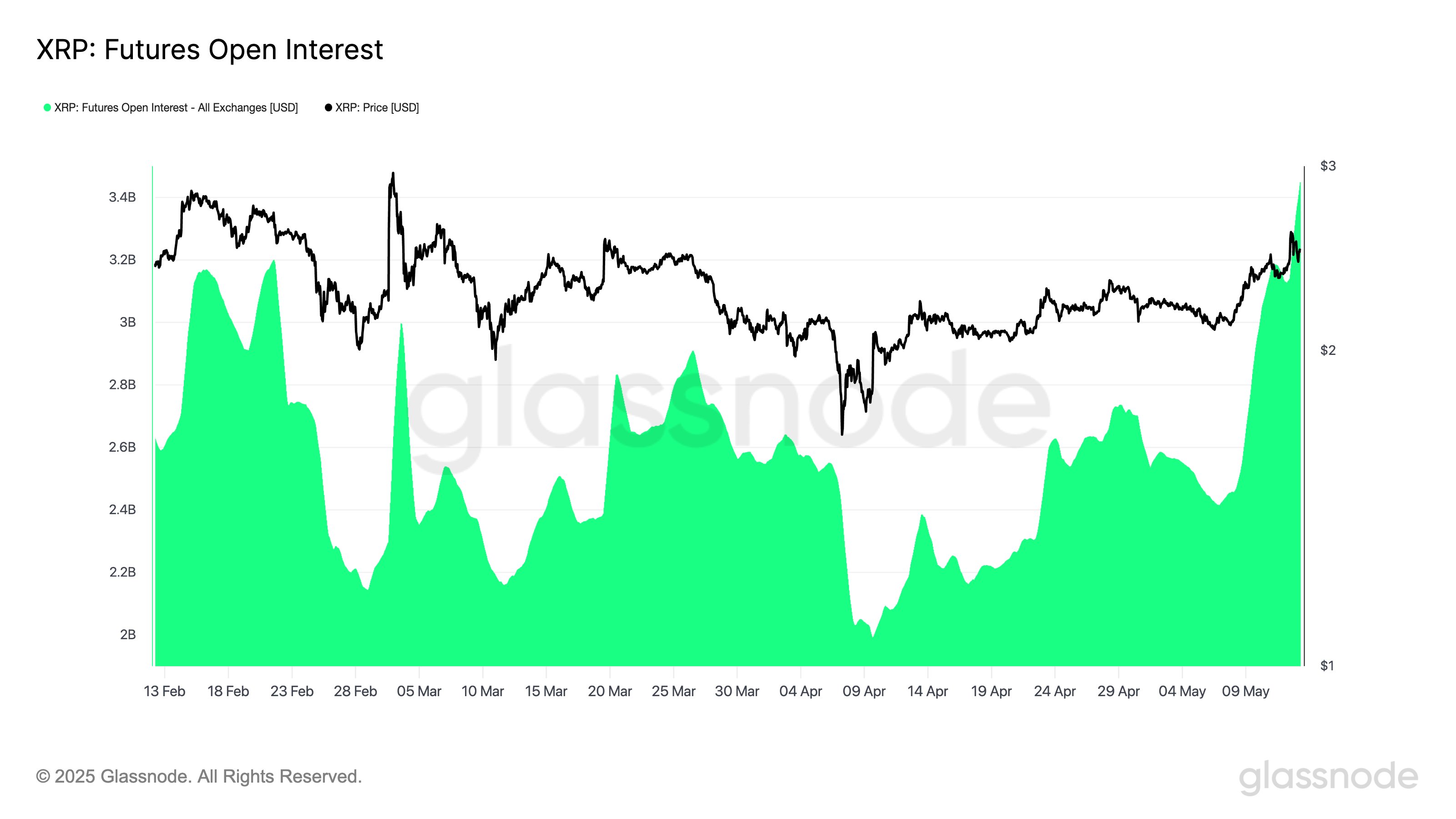

XRP's consistent price increase from the tariff-triggered crash to $1.61 in April continues to attract traders and investors. Glassnode’s data released Tuesday revealed a remarkable surge in the XRP futures OI by more than 41.6%, or by over $1 billion, in leverage positions in a week.

OI had been volatile since mid-February, peaking around $3.2 billion in late February before sliding to $2.2 billion around mid-March. Sideways fluctuations continued through April before surging to a three-month high of $3.42 billion.

XRP futures OI data | Source: Glassnode

Rising OI signals “elevated speculative activity and growing directional conviction,” Glassnode explained in an X post. OI represents the number of outstanding futures contracts that have yet to be settled.

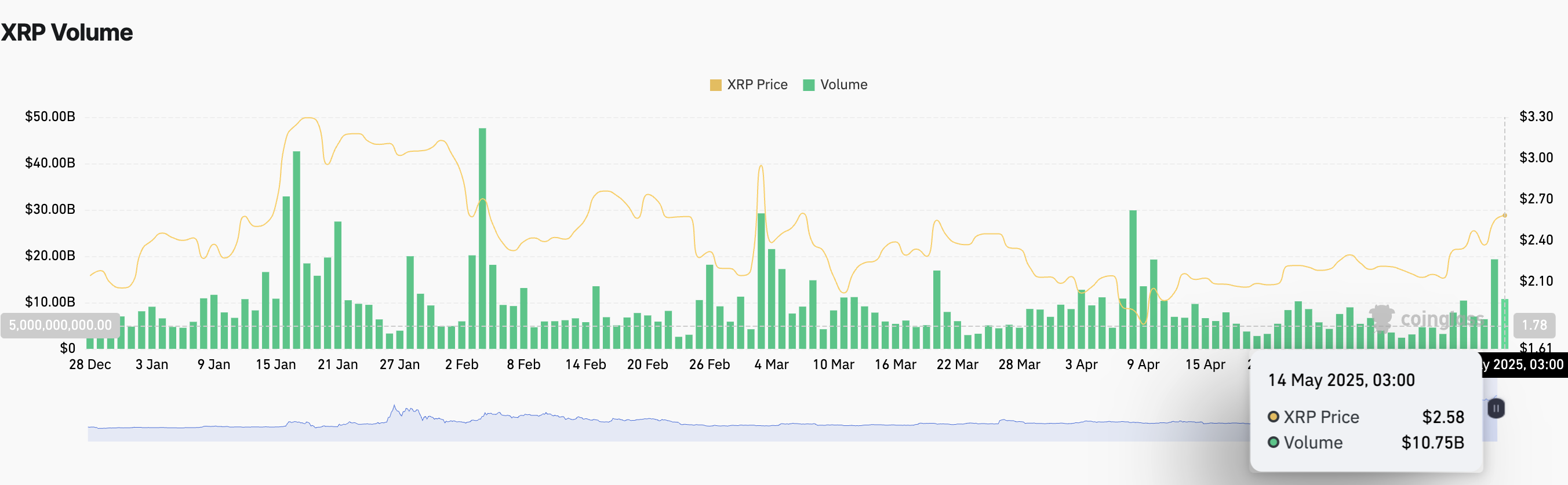

Meanwhile, following the rise in OI, the futures trading volume has lost steam from Tuesday, dropping from a peak of $19.31 billion to $10.75 billion at the time of writing, per CoinGlass data.

Trading volume highlights the total amount of XRP traded in US dollars (USD) over a specific period. A drop in volume as XRP futures OI surges implies mixed signals in the market as traders respond to various dynamics and sentiment.

XRP futures volume | Source: Coinglass

The rise in OI occurred alongside growing risk appetite among large volume investors, who have significantly increased their exposure to XRP from mid-March. Santiment’s Supply Distribution chart below shows that addresses with between 10 million and 100 million XRP currently hold 12.22% of the supply, up from 10.76% on March 17.

On the other hand, investors with over 1 billion coins have recently renewed interest in XRP after selling at April’s peak price of $2.36. This cohort now accounts for 39.13% of the supply, up from 37.53% recorded on May 3.

[08-1747212173797.50.42, 14 May, 2025].png)

Supply Distribution metric | Source: Santiment

Increased risk appetite as whales buy XRP signals confidence, boosting demand and potentially driving the price towards the mid-term target of $3.00. Traders may see heightened volatility, with opportunities for gains but also risks of a sharp correction if whales sell to realise profit.

Looking ahead: XRP bulls hold steady, eyeing $3.00

XRP’s price hovers around $2.60 at the time of writing, reflecting increasing trading volume and trader confidence in the uptrend targeting highs past $3.00. The cross-border money transfer token sits significantly above key moving averages, including the 50-day Exponential Moving Average (EMA) at $2.26, the 100-day EMA at $2.24 and the 200-day EMA at $2.02, adding credence to the bullish outlook.

The Moving Average Convergence Divergence (MACD) indicator in the daily time frame validates the bullish momentum as it lifts above the centre line. This, and the MACD line’s (blue) crossing above the signal line (red) and the expanding green histograms, suggest that XRP has the potential to close the gap toward $3.00.

XRP/USDT daily chart

XRP’s Relative Strength Index (RSI) at 69.71 nears overbought territory, reflecting robust bullish momentum. While this underscores a strong uptrend, it also flags a potential correction risk if traders opt to lock in profits at current levels.

The RSI’s potential reversal towards the midline of 50 could imply buyer exhaustion and a possible drawdown toward short-term support at $2.50, tested as resistance in March, the 50-day EMA at $2.26, the 100-day EMA at $2.24 and the 200-day EMA at $2.02.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.