Ripple Price Forecast: XRP downside risks escalate amid largest single-day ETF outflow

- XRP extends losses, down over 2.5% on Friday amid persistent bearish sentiment.

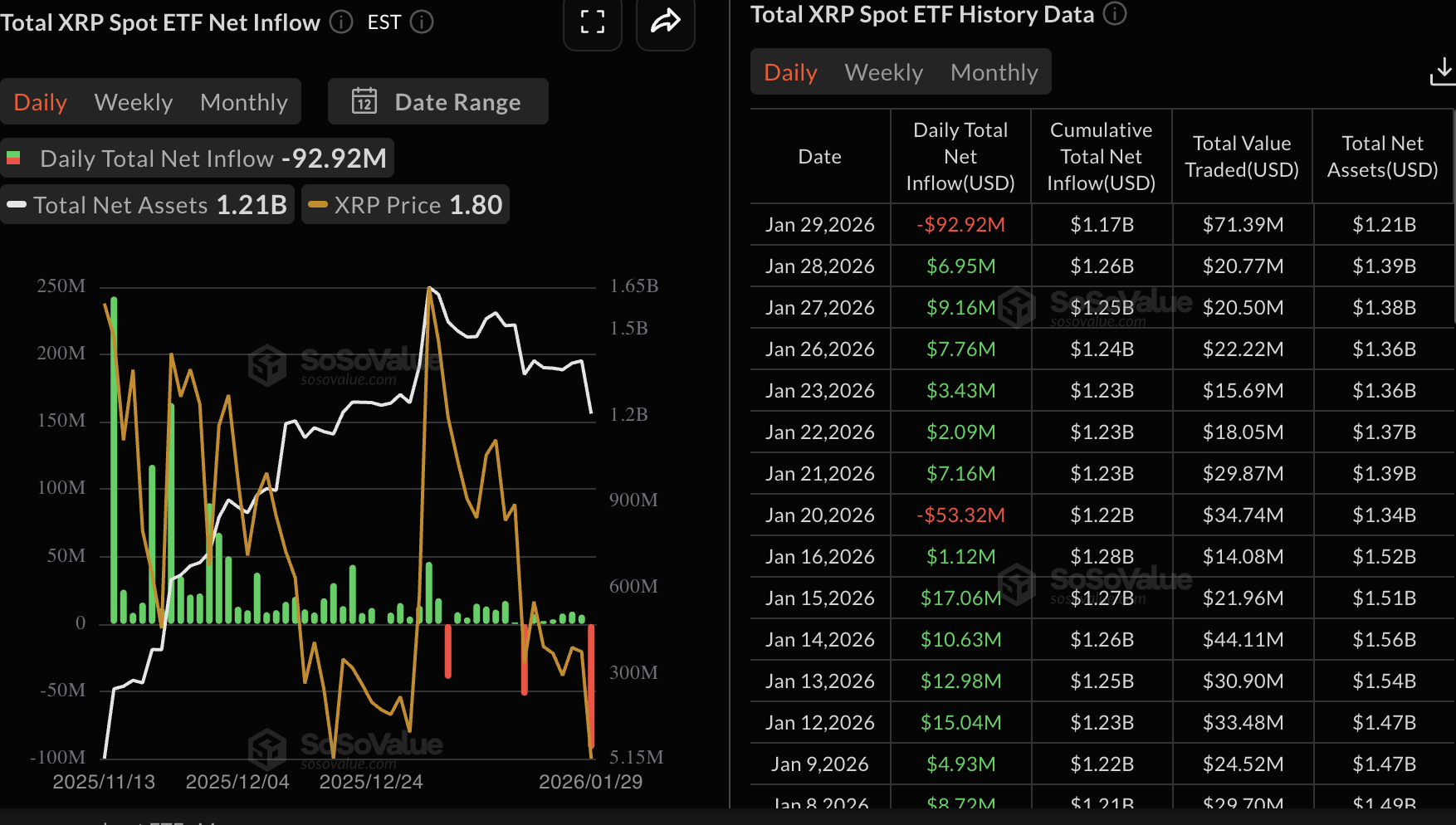

- XRP ETFs recorded the largest single-day outflow of nearly $93 million on Thursday.

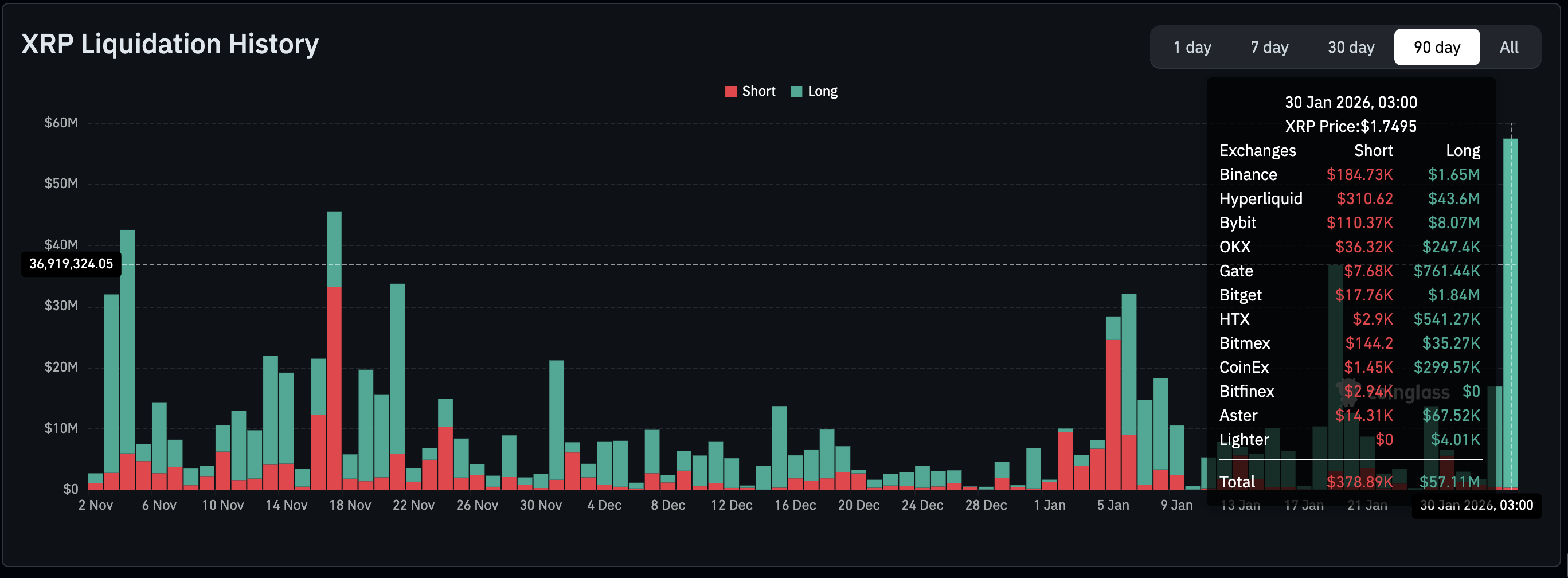

- Leverage XRP traders face the highest liquidation in three months, totalling $57 million, as retail interest wanes.

Ripple (XRP) is trading under intense selling pressure, down over 2.5% intraday to $1.75 at the time of writing on Friday. The cross-border remittance token faced significant capital flight on Thursday, with the highest outflow from Exchange-Traded Funds (ETFs) since launch. With risk-off sentiment still persistent, XRP is at risk of extending the bearish momentum into the weekend.

XRP plunges as capital flight intensifies

XRP spot ETFs recorded the largest single-day outflow of nearly $93 million on Thursday, reducing the cumulative inflow to $1.17 billion and net assets under management to $1.21 billion. ETF flows serve as a gauge for market sentiment, with large or steady outflows indicating that investors lack confidence in XRP amid heightened Volatility.

Meanwhile, liquidations hit a record $57 million on Friday, the highest in three months, according to CoinGlass data. If the current volatility continues and XRP price extends its downtrend, more traders will be forced out of their leveraged long positions, adding to the selling pressure.

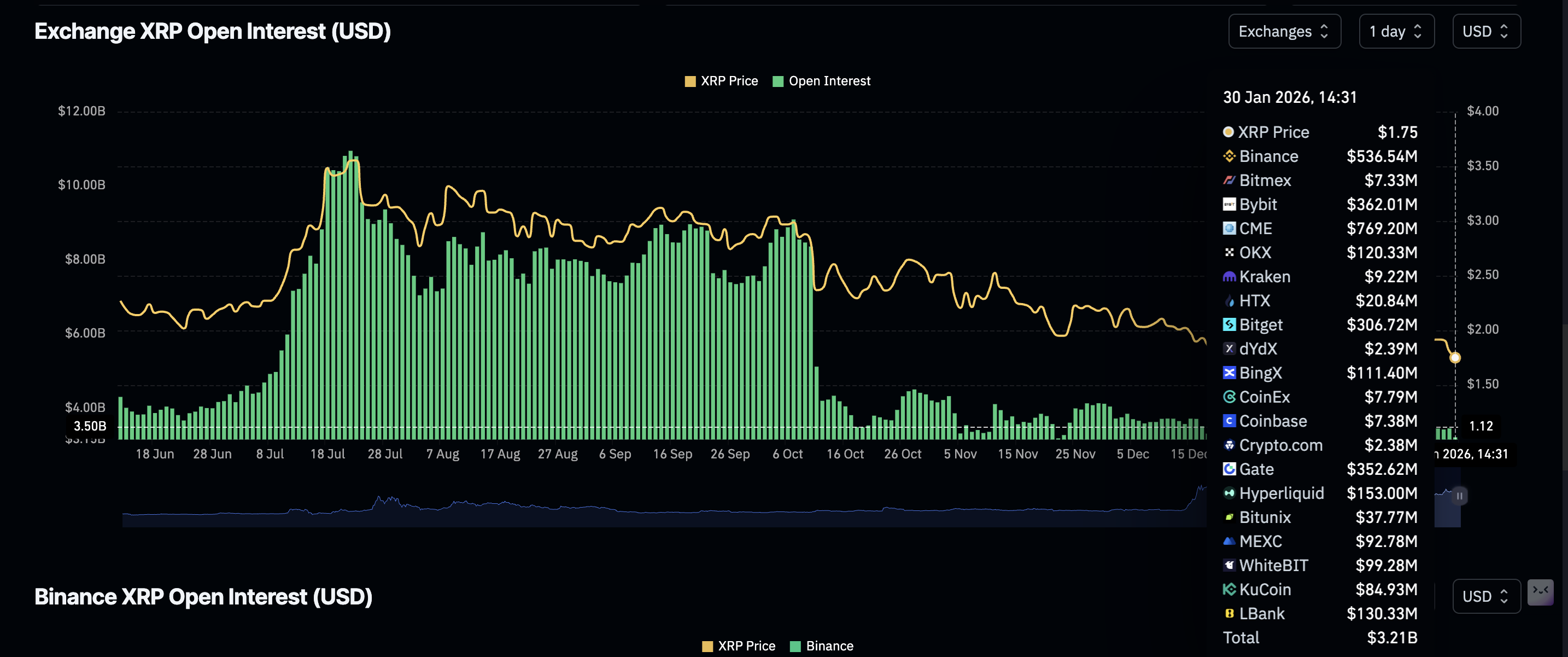

Retail interest in XRP is evidently declining as futures Open Interest (OI) fell to $3.21 billion on Friday, from $3.46 billion the previous day. OI tracks the notional value of outstanding futures contracts; hence, low retail activity indicates that investors lack confidence in the token’s ability to sustain an uptrend. It also means that investors are closing positions rather than opening new ones, depriving XRP of the tailwind to recover.

Technical outlook: Assessing XRP’s recovery potential

XRP hovers between support at $1.72 and support-turned resistance at $1.81, as bears push to extend their control. The down-trending 50-day Exponential Moving Average (EMA) at $2.00, the 100-day EMA at 2.13 and the 200-day EMA at $2.27 confirm the short-term bearish outlook.

An extended sell-off toward the April low of $1.61 could ensue if the Moving Average Convergence Divergence (MACD) indicator remains below its signal line on the daily chart. Red histogram bars expanding below the zero line could encourage investors to reduce exposure, adding to the selling pressure.

The Relative Strength Index (RSI) at 34 on the same chart is poised to slide into oversold territory, as bearish momentum accelerates.

Still, XRP could head for a knee-jerk reversal as market participants react to United States (US) President Donald Trump's nomination of Kevin Warsh as the next Federal Reserve (Fed) Chair – Warsh served as Fed governor and as an economic adviser to the president.

Crypto markets sold off as risk-off sentiment surged after Wednesday’s Fed decision to leave interest rates unchanged, offering no lifeline to riskier assets.

XRP sellers remain in control unless bulls push to reclaim December 31 support at $1.81 and the next key hurdle, the 50-day EMA at $2.00.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.