Mantle Price Forecast: MNT eyes 30% recovery after Ethereum staking software upgrade

- Mantle tests initial hurdle at $1.28 as bulls aim to extend recovery by 28%.

- Mantle upgrades Buffer Pool’s liquid staking mechanism, designed for on-demand institutional liquidity.

- A MACD buy signal and support from the 50- and 200-day EMAs back MNT’s recovery potential.

Mantle (MNT) is trading above a short-term support at $1.28 at the time of writing on Monday, as the broader cryptocurrency market stabilizes in the wake of last week’s monetary policy-triggered volatility. If bulls tighten their grip further, MNT could extend its recovery by 30% to $1.63 in the short to medium-term.

Mantle staking upgrade achieves on-demand liquidity

Mantle has upgraded its Ethereum liquid staking software, the Buffer Pool, enabling 24-hour redemptions via a dual-liquidity pathway. According to the announcement, the mETH Protocol “supplies a portion of staked ETH into Aave to preserve yield and support fast, on-demand liquidity with no additional fees.”

The mechanism operates by routing smaller requests via the instant buffer pool, while larger ones are processed via the 'Aave ETH Market' reserve. Both mechanisms support 24-hour redemption requests with no downtime.

Mantle stated that mETH Protocol has grown into a liquid staking token (LST) purpose-built for institutional scaling, meeting high liquidity demands without compromising utility.

“As one of the largest ETH liquid staking tokens, mETH helps secure networks such as EigenDA and Symbiotic while powering yield strategies through integrations with over 40 leading dApps including Ethena and Compound,” Mantle said in a blog post.

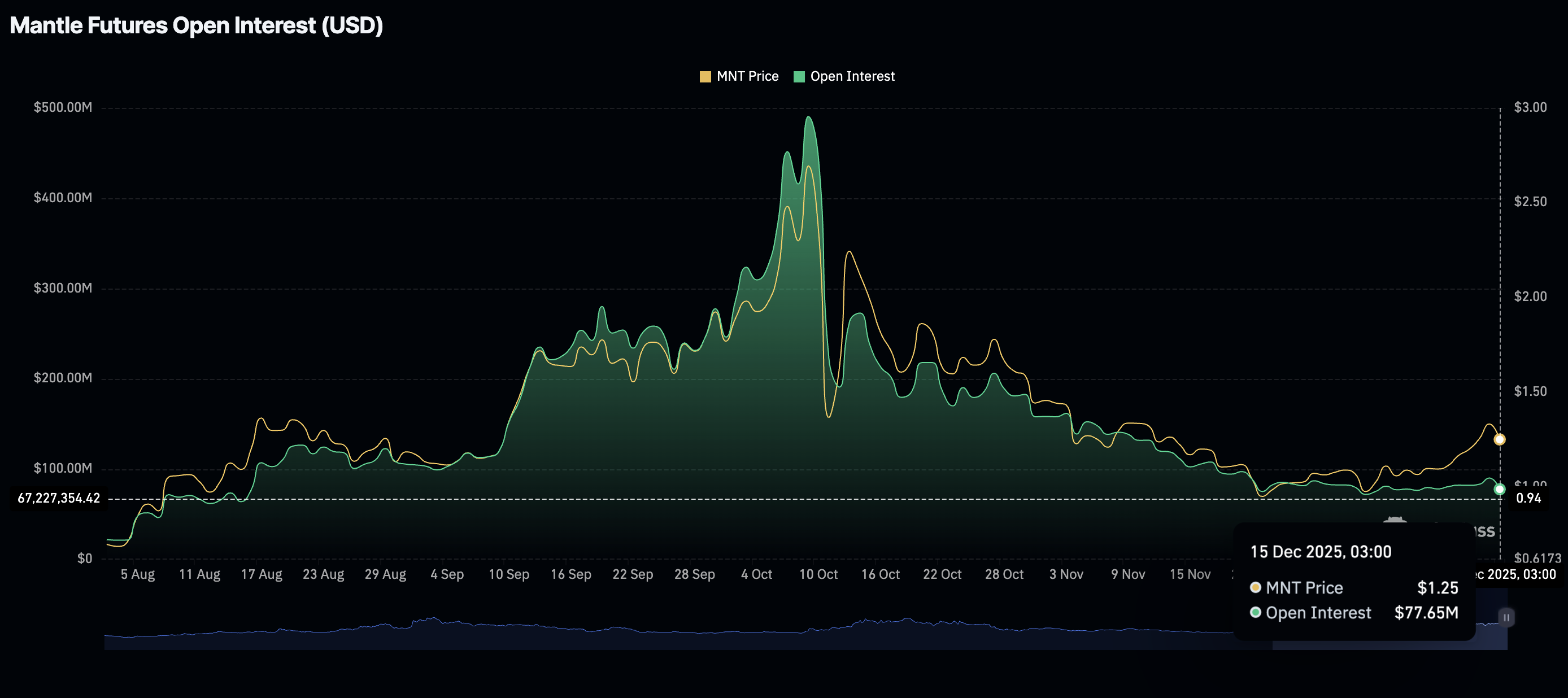

On the other hand, retail demand remains significantly suppressed despite the software upgrade. CoinGlass data highlights a weak derivatives market, with futures Open Interest averaging $78 million, down from a record high of $490 million, recorded on October 9.

A weakening derivatives market suggests that investors are losing confidence in the token’s ability to recover or sustain an uptrend, with many staying on the sidelines.

Technical outlook: Mantle poised for breakout

Mantle is trading between key support at $1.23 and resistance at $1.28 at the time of writing on Monday, as bulls fight to maintain control of the trend. The 50-day Exponential Moving Average (EMA) reinforces the immediate support at $1.23 while the 100-day EMA highlights the hurdle at $1.28.

The Moving Average Convergence Divergence (MACD) indicator maintains a buy signal on November 26, and the green histogram bars expanding above the mean line support a short-term bullish outlook.

A daily close above the 100-day EMA hurdle may pave the way for a 30% increase to $1.63, matching the 0.618 Fibonacci retracement level.

Still, traders should be cautious because a correction below the support band at $1.21-$1.23 could trigger an extended decline toward November’s low of $0.86.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.