Ripple Price Forecast: XRP edges higher as Ripple eyes ETF approval in Q4

- XRP renews its uptrend above the 200-day EMA, supported by increasing risk appetite.

- XRP spot ETFs could launch in Q4, following revised SEC listing standards.

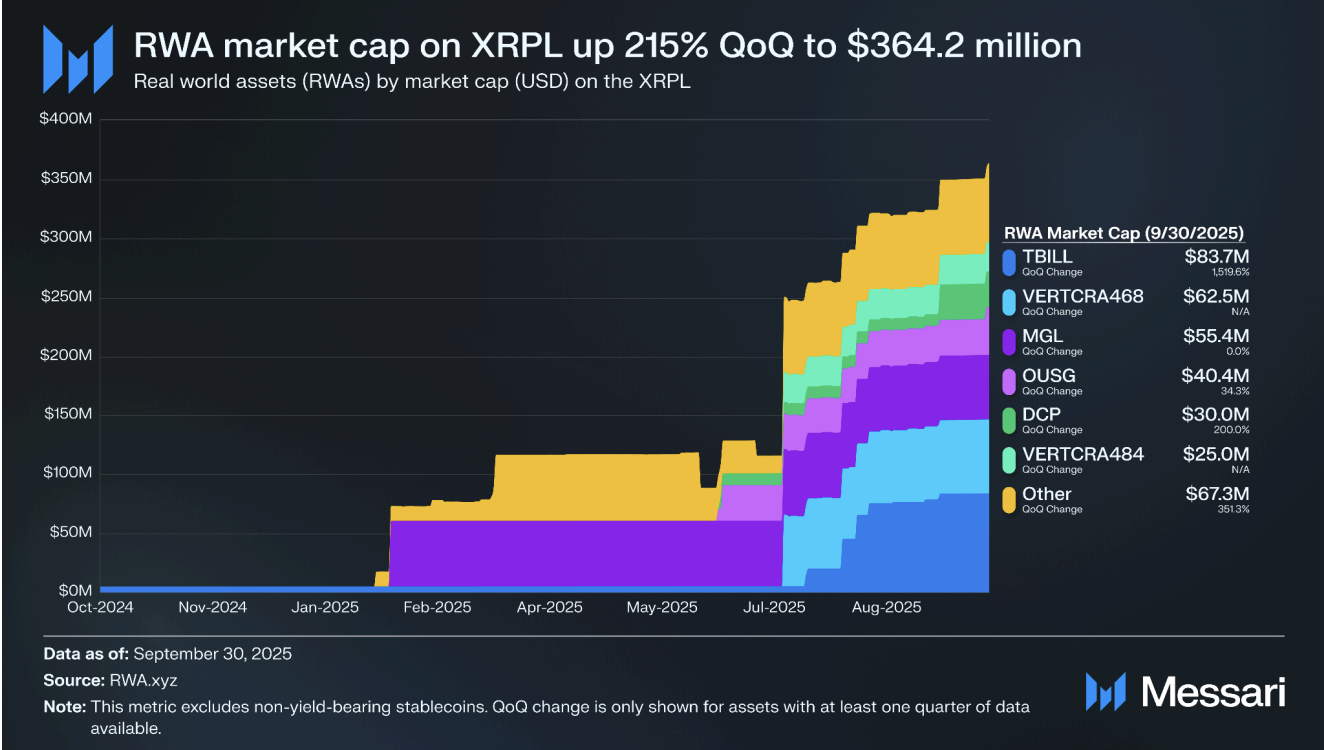

- The XRP Ledger’s RWA market capitalization grew by 215% in Q3 to $364 million, bolstered by institutional adoption.

Ripple (XRP) moves higher on Wednesday, in step with crypto majors such as Bitcoin (BTC) and Ethereum (ETH). The cross-border money transfer token holds steadily above $2.65, as bulls tighten their grip, building on optimism that the Federal Reserve (Fed) will continue to ease its monetary policy by lowering interest rates by 25 basis points later in the day.

Ripple anticipates XRP ETFs approval

Blockchain data analytics platform Messari released the 'State of XRP Ledger Q3 2025' report on Tuesday, highlighting key insights into the blockchain and ecosystem. Messari stated that seven US XRP spot Exchange Traded Funds (ETFs) applications are pending with the US Securities and Exchange Commission (SEC).

Following the implementation of new generic listing standards for spot crypto ETFs in September, the agency is expected to make its decision by November 18. The consensus, based on Polymarket bets, is a 99% chance of several XRP ETFs approvals in the fourth quarter.

Meanwhile, institutions are increasingly seeking exposure through Digital Asset Treasuries (DATs), pioneered by Strategy’s Executive Chairman, Michael Saylor. Some of these companies include Trident Digital Tech Holdings, with $500 million invested in XRP; Webus International, with $300 million; Wellgistics, with $50 million; Nature's Miracle Holdings, with $20 million; and Reliance Group Global, with $17 million, among others.

The joint decisions by Ripple and the SEC to drop their appeals in the Second Circuit brought the longstanding litigation to an end on August 7, upholding the ruling of US District Judge Analisa Torres.

Judge Torres ruled that Ripple did not violate federal securities laws by selling XRP on third-party platforms such as Coinbase and Binance, but found the company answerable for direct sales to institutional clients.

Ripple was penalized $125 million but settled with the SEC, paying only $50 million. The conclusion of the lawsuit bolstered risk appetite, as institutions pushed ahead with XRP-related DATs.

XRP Ledger’s transactions, RWA surge in Q3

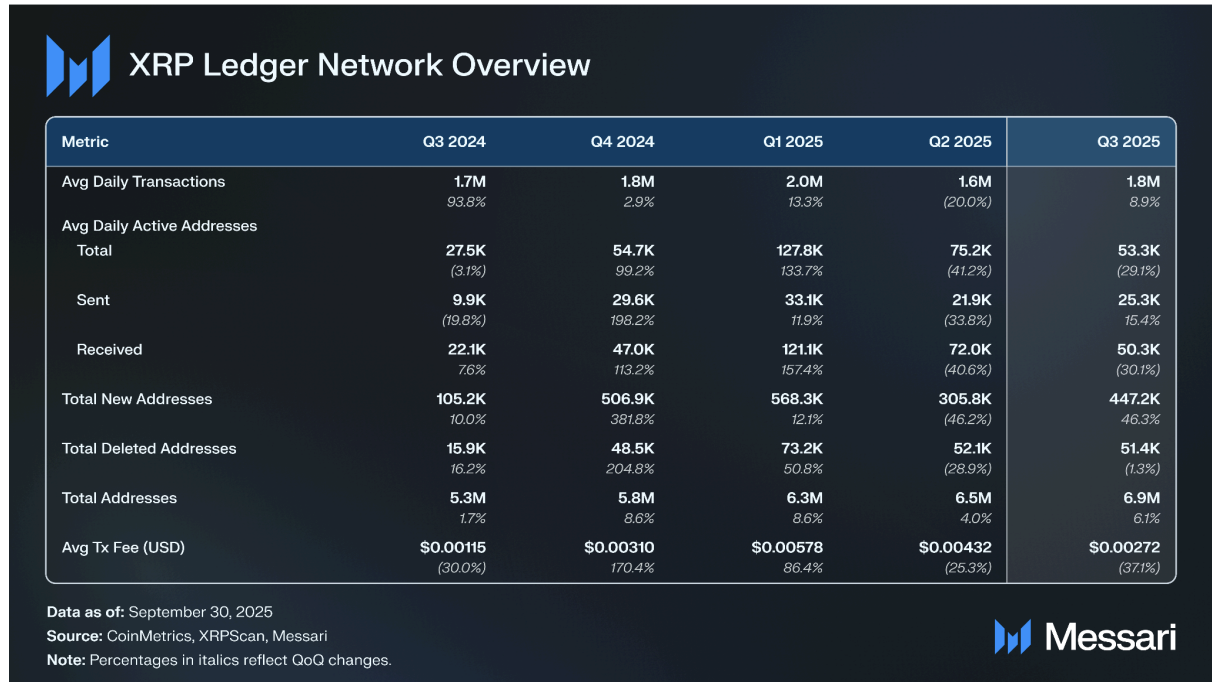

Messari also highlighted an 8.9% QoQ increase in Q3 in the average daily transactions on the XRP Ledger (XRPL) from 1.6 million to 1.8 million. Daily active addresses rose by 15.4% QoQ from 21,900 to 25,300, while the total number of new addresses rose 46.3% to 447,200.

XRP Ledger network Q3 analysis | Source: Messari

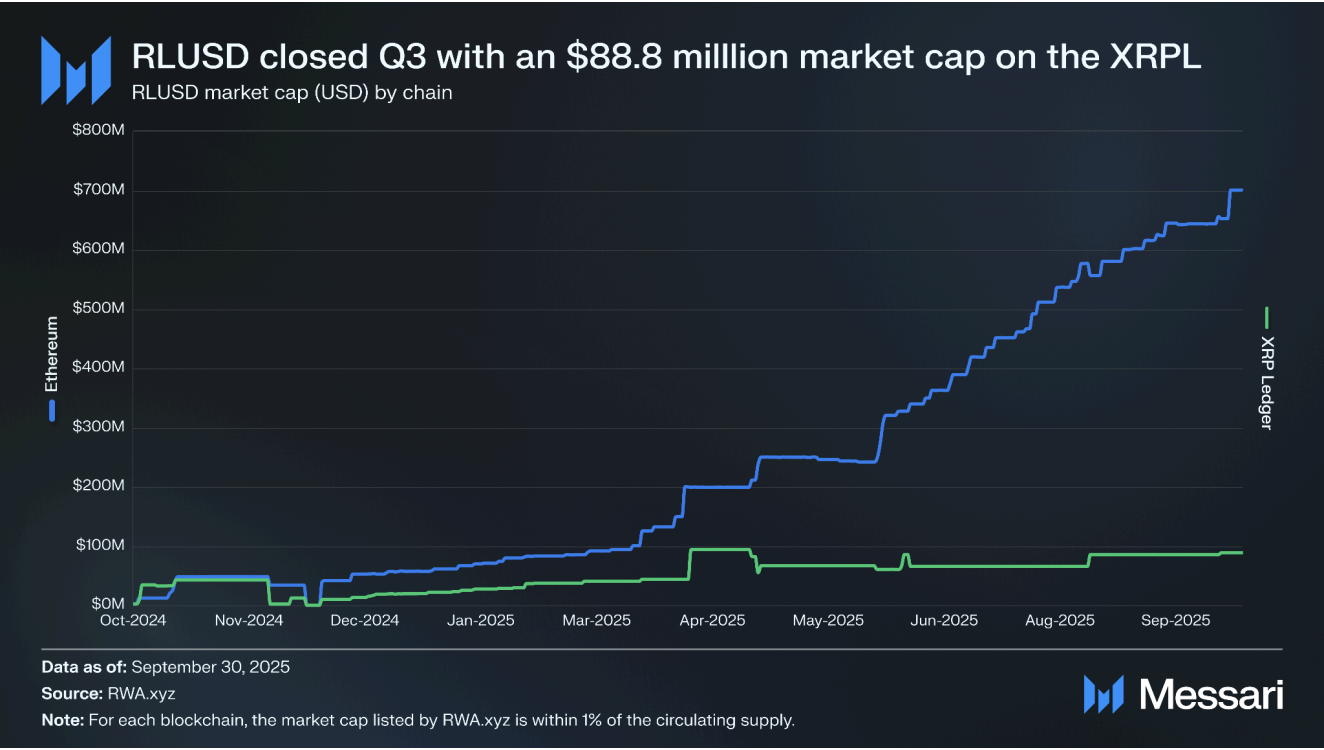

Ripple’s USD-pegged stablecoin RLUSD ended the third quarter with a combined market capitalization of $789 million on the XRP Ledger and Ethereum network.

“RLUSD closed Q3 with a market cap of $88.8 million on the XRPL (+34.7% QoQ), making it the network’s largest stablecoin,” Messari stated.

RLUSD stablecoin market cap | Source: Messari

Similarly, the XRPL ended Q3 with a massive 215% QoQ increase in real-world asset (RWA) market capitalization, from $115.5 million. Major RWAs include OpenEden US Treasury Bill Vault (TBILL), Brazil’s VERT’s 94th CRA, Ondo Short-Term US Government Bond Fund (OUSG) and the Digital Commercial Paper (DCP.

XRP Ledger’s RWA stats | Source: Messari

Technical outlook: XRP holds key support

XRP is trading above the 200-day Exponential Moving Average (EMA) at $2.61 on the daily chart as traders shift focus to the Fed’s monetary policy decision on Wednesday.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator sustained since Friday encourages investors to seek new opportunities, anticipating a breakout toward the $3.00 key level.

The Money Flow Index (MFI), which is marginally above the midline, indicates that money is increasingly flowing into XRP. Higher readings approaching overbought territory would indicate a steady risk-on sentiment.

XRP/USDT daily chart

Traders will watch for a break above the 50-day EMA at $2.68 and the 100-day EMA slightly above it to ascertain the uptrend’s strength this week. A subsequent breach of the descending trendline resistance, which has been in place since XRP reached a new all-time high of $3.66 in mid-July, could reinforce the bullish grip.

Still, traders should be cautiously optimistic, as losing the immediate 200-day EMA support at $2.61 could lead to further losses toward $2.18, last tested on October 17, and $1.90, previously tested in late June.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.