Crypto Today: Bitcoin, Ethereum, XRP attempt breakout amid reigniting risk-on sentiment

- Bitcoin tests $110,000 resistance as retail traders pile into long positions.

- Ethereum edges higher toward the 100-day EMA hurdle despite fading institutional interest.

- XRP rises for the first time in two days, reflecting growing retail demand.

Bitcoin (BTC) is trading below $109,000 at the time of writing on Thursday, after staging a recovery from the previous day's low of $106,666. Although minor, the uptick in price points to improving risk-on sentiment in the broader cryptocurrency market.

Altcoins, including Ethereum (ETH) and Ripple (XRP), also flipped green earlier in the day, following Bitcoin's footsteps. ETH hovers below $3,900 while XRP holds above $2.40, an immediate support level.

Data spotlight: Bitcoin builds momentum as retail investors return

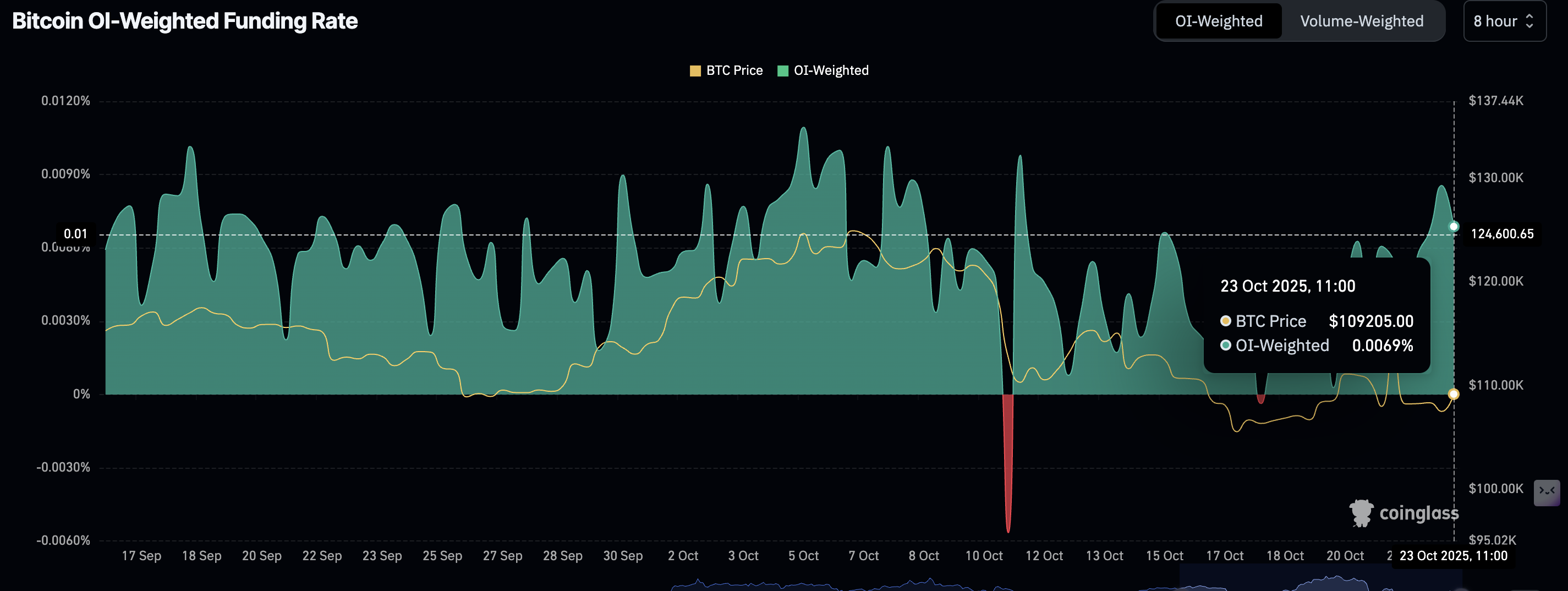

Retail interest is gradually making a comeback in the Bitcoin derivatives market following the October 10 deleveraging event, which saw $19 billion in crypto assets liquidated. The Open Interest (OI) weighted funding rate plummeted to -0.0056% at the time.

Bitcoin has faced extreme volatility over the last two weeks, fluctuating between the October low of $102,000 and the resistance of $114,000, which was tested on Tuesday.

According to CoinGlass data, the OI-Weighted Funding Rate metric averaged 0.0069% at the time of writing, after a brief correction from 0.0086% earlier in the day.

The OI-weighted funding shows the level of interest among traders. A steady rise indicates that traders are increasingly seeking exposure to long positions as confidence improves.

Bitcoin OI-Weighted Funding Rate | Source: CoinGlass

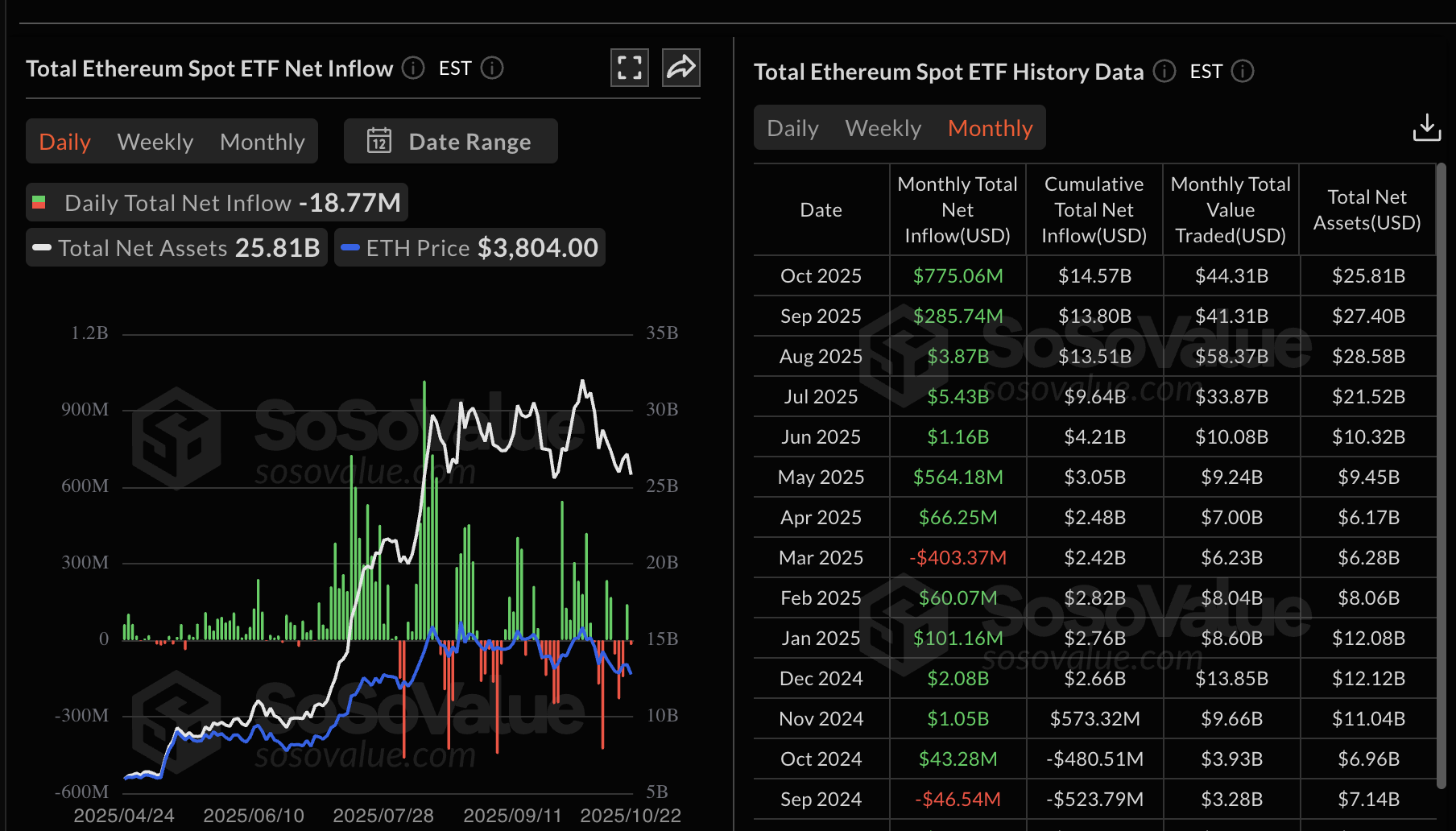

Meanwhile, institutional demand for Ethernet-related financial products, such as the spot Exchange Traded Funds (ETFs), significantly faded over the last two months. In September, ETF inflows totaled $286 million compared to $3.87 billion in August and $5.43 billion in July. So far in October, inflows stand at $775 million.

Ethereum ETF monthly stats | Source: SoSoValue

Following a bullish turnaround, Ethereum ETFs recorded $142 million in inflows on Tuesday, breaking three consecutive days of outflows. However, they quickly turned negative on Wednesday, with SoSoValue data highlighting approximately $19 million in outflows. This risk-off sentiment, coupled with macroeconomic uncertainty and a lack of price catalysts, could continue to deprive ETH of the momentum required to sustain recovery above the $4,000 mark.

Ethereum ETF daily stats | Source: SoSoValue

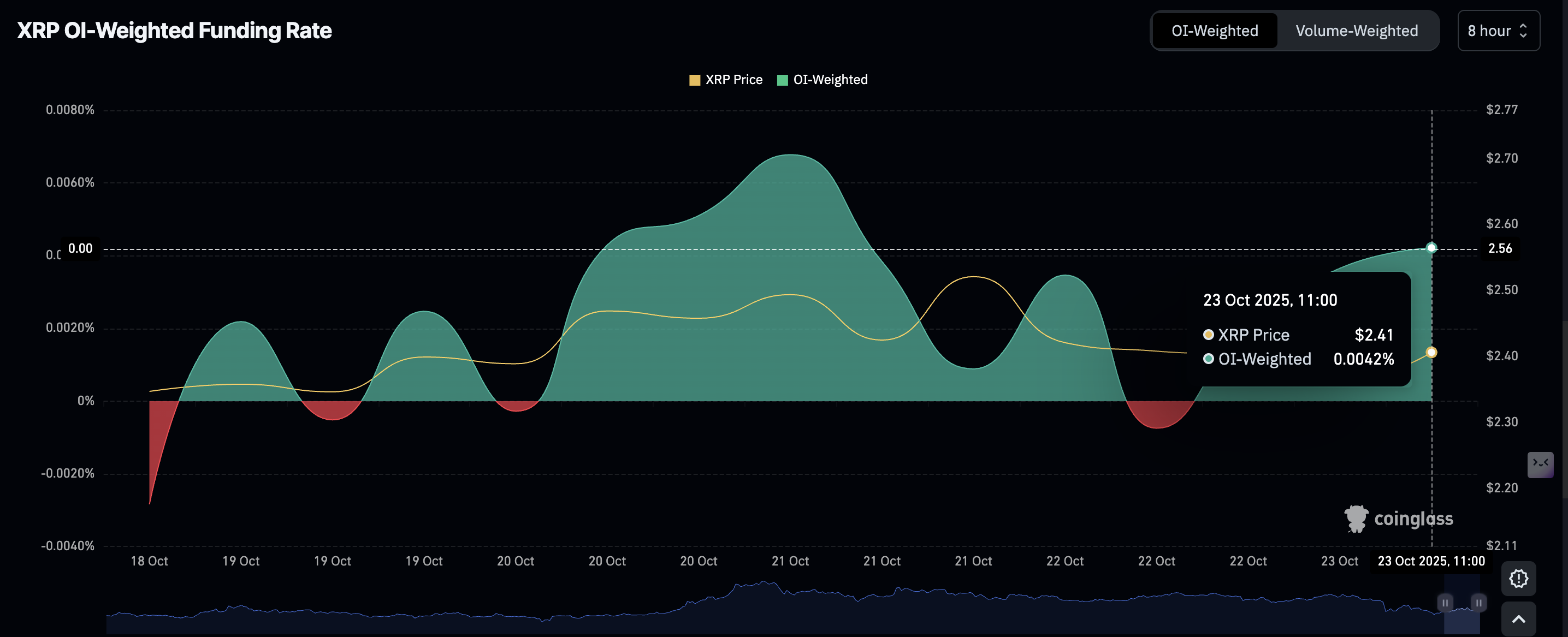

XRP, on the other hand, has experienced a sharp rebound in the OI weighted funding rate to 0.0042% on Thursday from -0.0007% on Wednesday. The OI weighted funding rate tracks the level of trader interest in XRP. Hence, a steady increase signals that traders are confident about rejoining the market, piling into long positions, which strengthens the token's short-term bullish picture.

XRP OI-Weighted Funding Rate | Source: CoinGlass

Chart of the day: Bitcoin reclaims key support, targets breakout

Bitcoin is trading above $109,000 at the time of writing on Thursday, following an intraday push to $110,298. The largest cryptocurrency by market capitalization also sits above the 200-day Exponential Moving Average (EMA) at $108,077, supporting a short-term bullish outlook on the daily chart.

An uptrending Relative Strength Index (RSI) at 43 indicates that bullish momentum is building. Traders will look out for a break above the midline to ascertain Bitcoin's strength ahead of the weekend.

A buy signal could also emerge from the Moving Average Convergence Divergence (MACD) indicator in the same daily range if the blue line crosses and settles above the red signal line. A buy signal encourages traders to increase risk exposure, contributing to buying pressure.

Key milestones to look out for are a sustained break above the $110,000 round-number level, the 50-day EMA at $113,421 and the supply at $114,000.

BTC/USDT daily chart

Altcoins update: Ethereum, XRP bulls regain control

Ethereum is edging higher, aiming to break above the immediate hurdle at $3,900 and later the pivotal $4,000 level. The path of least resistance on the daily chart is upward, supported by the RSI bullish crossover and ascent to 43. Higher RSI readings above the midline imply that bullish momentum is increasing, raising the odds of a technical breakout in the short term.

Meanwhile, Ethereum's reaction around the 100-day EMA at $3,965 could determine the direction the smart contracts token may take. A steady breakout would support the uptrend, but signs of weakness may lead to a reversal as investors book early profits. Traders should not lose sight of the demand area at $3,860, which was tested on Friday and the 200-day EMA at $3,572.

ETH/USDT daily chart

As for XRP, bulls are working to regain control and push for a sustained recovery above the 200-day EMA at $2.61. A recent attempt to breach this hurdle failed as volatility increased in the broader crypto market amid the lack of key price catalysts. The RSI, facing upward at 40, supports the bullish outlook on the daily chart.

XRP/USDT daily chart

Still, a Death Cross pattern formed when the 50-day EMA crossed below the 100-day EMA on Sunday, points at prevalent bearish sentiment. Therefore, a pullback below the immediate $2.40 support and the next demand area at $2.18 cannot be ruled out, particularly if investors realize short-term gains.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.