Gold recovers as EU-US trade tensions take focus

- Gold reacts to renewed trade EU-US trade tensions as prospects of a deal fade.

- US Dollar dips, with investors seeking refuge in alternative assets, bullion gains.

- XAU/USD retests symmetrical triangle resistance, hinting at a potential breakout.

Gold (XAU/USD) is benefiting from renewed trade tensions on Monday, which have triggered demand for the safe-haven yellow metal.

As the August 1 tariff deadline looms, prospects of a deal between the European Union (EU) and the United States (US) are fading. As a result, XAU/USD has recovered to trade above $3,370 at the time of writing.

EU-US trade tensions rise, lifting demand for Gold

Ongoing talks between the EU and the US have failed to make any meaningful progress over recent weeks. US President Donald Trump has threatened to impose a 30% tariff on most goods imported from members of the EU bloc in an effort to reduce the current trade deficit.

In an interview with CBS News over the weekend, US Commerce Secretary Howard Lutnick signaled optimism about a potential deal. He stated that “These are the two biggest trading partners in the world, talking to each other. We’ll get a deal done. I am confident we’ll get a deal done.”

However, he also warned that an extension would not be granted. “That’s a hard deadline, so on August 1, the new tariff rates will come in,” he said.

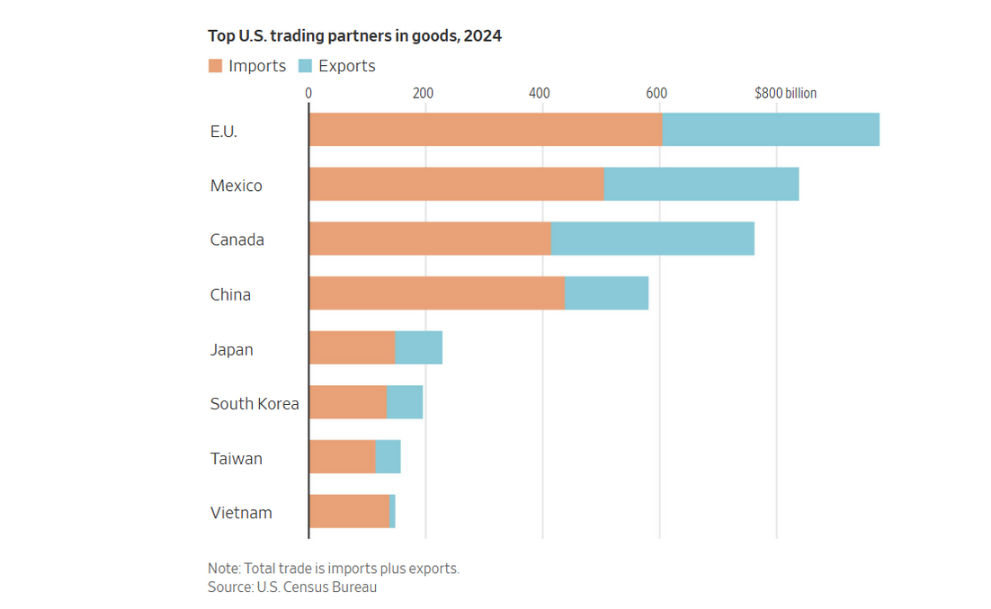

According to CNBC, the European Council reported that the total value of trade between the EU and US amounted to $1.96 trillion in 2024.

The chart below represents the value of trade between the US and its largest trading partners, as illustrated in an article in The Wall Street Journal.

Even with a deal, the US has signaled that the bloc would still be exposed to a baseline tariff of 15% to 20%. As the EU prepares for the worst-case scenario, it has threatened to retaliate against the US if a deal is not reached. A wide range of countries are finding themselves in a similar situation, which is causing a reduction in demandfor the US Dollar. A weaker USD also makes Gold less expensive for foreign investors seeking safety in alternative assets.

Daily digest market movers: Gold reacts to renewed trade tensions

- Sector-specific tariffs are also set to remain in place. This includes the 50% tariff on steel and aluminium, with the same rate applying to copper imports to the US beginning next month.

- Auto parts imported to the US are currently subject to a 25% levy. Trump has also indicated that tariffs on pharmaceuticals and semiconductors may be implemented soon.

- According to Bloomberg, estimates from the EU indicate that duties are already impacting roughly 70% of imports to the US. This amounts to approximately $442 billion worth of trade.

- Economic data from the US has recently revealed that the economy remains resilient despite the fundamental risks associated with increased import costs.

- Michigan Sentiment data released on Friday showed that US consumers remain optimistic. Meanwhile, the University of Michigan (UoM) also published its preliminary inflation expectation figures. The survey revealed that both the 1-year and 5-year inflation expectations have decreased.

- US Retail Sales data on Thursday also surpassed analyst predictions, indicating robust consumer spending.

- As the Federal Reserve (Fed) remains reluctant to cut interest rates, citing concerns that tariffs may still lead to price increases, markets are currently pricing in a 57.8% probability of a rate cut in September. Meanwhile, the CME FedWatch Tool indicates that the likelihood of rates remaining unchanged at the same meeting stands at 39.5%. Any shifts in these expectations will impact the demand for US yields. Rising yields do not bode well for non-yielding assets, such as Gold.

Gold technical analysis: XAU/USD retests symmetrical triangle resistance, hinting at a potential breakout

The daily chart of spot Gold shows a symmetrical triangle pattern, indicating consolidation and potential for a breakout. With XAU/USD still struggling to gain traction and break through triangle resistance, bulls would need to hold above the 23.6% Fibonacci retracement level of the April low-high move near $3,372 in an effort to reclaim the $3,400 psychological level. A surge in bullish momentum above this zone would bring the June 16 high of $3,452 back into play, opening the door for a potential retest of the $3,500 all-time high.

Gold daily chart

On the downside, immediate support is found at the $3,350 psychological level, resting above the 50-day Simple Moving Average (SMA) at $3,327. The 38.2% Fibonacci level at $3,392 and the 50% level at $3,328 may provide a floor for price action in the event of a pullback.

Meanwhile, the Relative Strength Index (RSI) at 56 signals a slight bullish bias, still far from overbought territory.

Overall, the market appears poised for a directional move, with traders likely watching for a decisive breakout from the triangle structure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.