EUR/USD steadies near 1.15 as traders scale back Fed rate-cut bets

- EUR/USD flat after strong US ADP and ISM data as December Fed rate cut odds decline to 62%.

- DXY steady at 100.18; Scotiabank warns a break below 100 could extend USD rebound.

- Eurozone Composite PMI grows at fastest pace since May 2023, led by Spain and Germany.

EUR/USD consolidates at around 1.1480 on Wednesday, snapping five days of losses after economic data in the US prompted investors to grow less confident about a rate cut by the Federal Reserve (Fed) at the December meeting. At the time of writing, the pair trades unchanged at 1.1484.

Euro halts five-day losing streak amid upbeat Eurozone PMIs, firm US data

Sentiment improved during the North American session, that’s why the Euro (EUR) trimmed earlier losses, despite optimistic economic data in the US. Market players had begun to trim the chances for a rate cut after the ADP National Employment Change showed that companies hired more people than expected. Other data revealed that business activity in the services sector improved, according to the Institute for Supply Management (ISM)

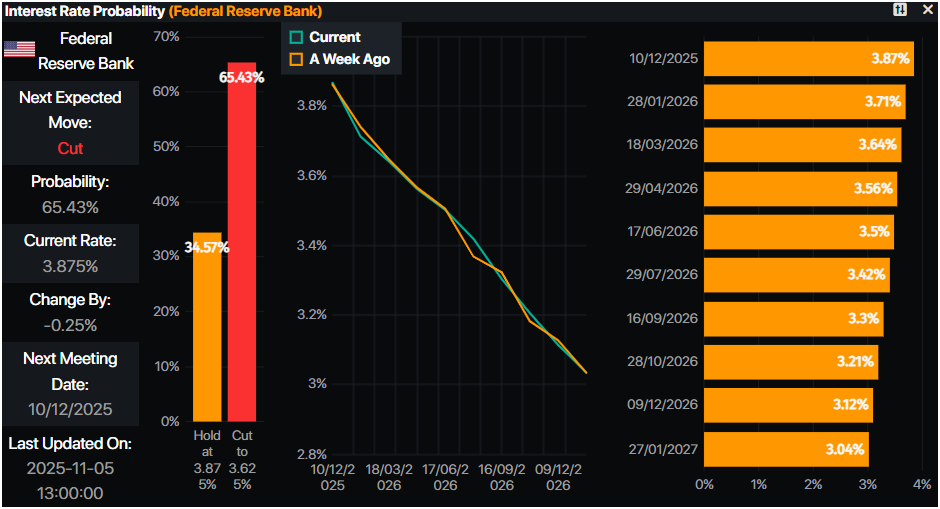

Data from Prime Market Terminal shows that odds for a 25-basis-point rate cut are at 62%, down from 68% before the ADP’s announcement.

Consequently, the US Dollar Index (DXY), which tracks the performance of the buck’s value versus a basket of six currencies, remained steady at 100.18 for the second straight day.

Analysts at Scotiabank noted, “A push through the low 100 level would suggest that the general USD rebound is likely to extend, potentially quite significantly over the next few weeks.”

In Europe, the economy expanded at its fastest pace since May 2023 in October, revealed the HCOB Eurozone Composite Purchasing Managers’ Index (PMI). Spain led the pack of countries in the Euro area, with the German economy showing surprising strength at its highest level in almost two and a half years.

Daily market movers: Euro recovers on upbeat PMI data

- The Institute for Supply Management (ISM) reported that US services sector activity accelerated in October, with the Services PMI rising to 52.4 from 50 in September, beating expectations. The Prices Paid index jumped to 70—the highest level since October 2022—signaling renewed inflationary pressures.

- Separately, the ADP National Employment Report showed private payrolls increased by 42,000 in October, surpassing forecasts of 25,000 and rebounding from September’s downwardly revised decline of 29,000 jobs.

- According to Bloomberg, “The US Supreme Court appeared skeptical of President Donald Trump’s sweeping global tariffs as key justices suggested he had overstepped his authority with his signature economic policy.”

- Three members of the Supreme Court questioned Trump’s use of an emergency-powers law to collect tens of billions of US Dollars in tariffs a month.

- “A decision against Trump could force more than $100 billion in refunds, remove a major burden on the US importers that are paying the tariffs, and blunt an all-purpose cudgel the president has wielded against trading partners,” revealed Bloomberg.

- Federal Reserve officials offered mixed views following the latest data. Governor Stephen Miran welcomed the stronger ADP employment figures but maintained that interest rates should be lower. Chicago Fed President Austan Goolsbee said inflationary pressures remain persistent, while Fed Governor Lisa Cook noted that the labor market is showing signs of vulnerability.

- The Eurozone HCOB Services Final PMI in October was 53 exceeding expectations and September’s reading of 52.6. The HCOB Composite Final PMI for the same period, rose by 52.5 a tick up from estimates and the prior’s month 52.2 print.

Technical outlook: EUR/USD stays bearish below the 1.1500 figure

EUR/USD remains under selling pressure after breaking below the 1.1500 handle, with momentum indicators signaling scope for further downside. The Relative Strength Index (RSI) has formed a lower trough, reinforcing the bearish tone.

Key support is seen at 1.1450, followed by the 1.1400 figure. A break below this zone would expose the August 1 low at 1.1391 ahead of the 200-day Simple Moving Average (SMA) at 1.1332. On the upside, a move back above 1.1500 could lead to a test of 1.1550, followed by the 1.1600 milestone.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.