Bitcoin Price Forecast: BTC edges closer to all-time high as US-China trade deal cheers markets

- Bitcoin price stabilizes around $104,000 on Monday after rallying 10.44% the previous week.

- Risk-on gains traction as the US and China agree to major tariff reductions for 90 days.

- Metaplanet announces that it added 1,241 BTC worth $125.30 million on Monday, bringing its total holding to 6,796 BTC.

Bitcoin (BTC) price is stabilizing at around $104,000 at the time of writing on Monday after rallying 10.44% the previous week. Risk-on gains traction as the US and China agree to major tariff reductions for 90 days, which could fuel a price rally for risky assets like Bitcoin. Additionally, Metaplanet announces that it added 1,241 BTC worth $125.30 million on Monday, bringing its total holding to 6,796 BTC.

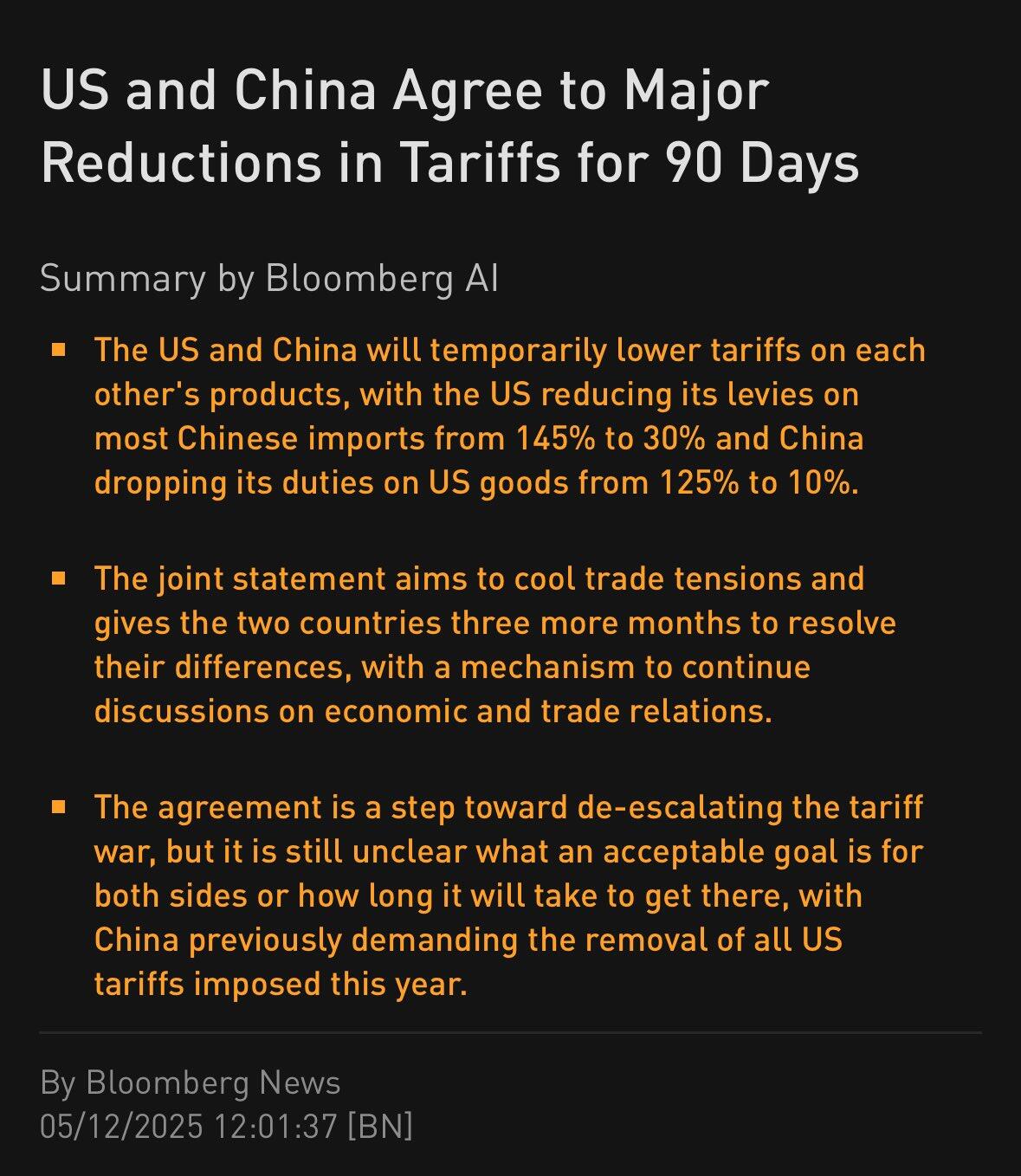

Risk-on sentiment soars as the US and China agree to major tariff reductions

On Monday, the US and China announced a 90-day tariff reduction agreement, dropping US tariffs on Chinese goods from 145% to 30% and China's tariffs on US goods from 125% to 10%, Bloomberg reports. The agreement follows weekend talks between the two countries in Geneva, Switzerland, led by US Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer from the US side and by Vice Premier He Lifeng from the Chinese side.

Additionally, a trade deal between the US and the UK was announced on Thursday. This trade places a 10% tariff on goods imported from the UK to the US, while Britain agreed to lower its tariffs to 1.8% from 5.1% and provide greater and faster access to US goods.

The easing of the tariff dispute between two major global economies (the US-China) and the UK sparks a risk-on sentiment in the crypto market, boosting investor confidence in riskier assets like Bitcoin, which is edging toward its all-time high of $109,588 set on January 20.

Corporate and institutional demand for Bitcoin continues to strengthen

Corporate demand started this week on a positive note. On Monday, Japanese investment firm Metaplanet announced that it had acquired 1,241 BTC worth $125.30 million, bringing its total holding to 6,796 BTC.

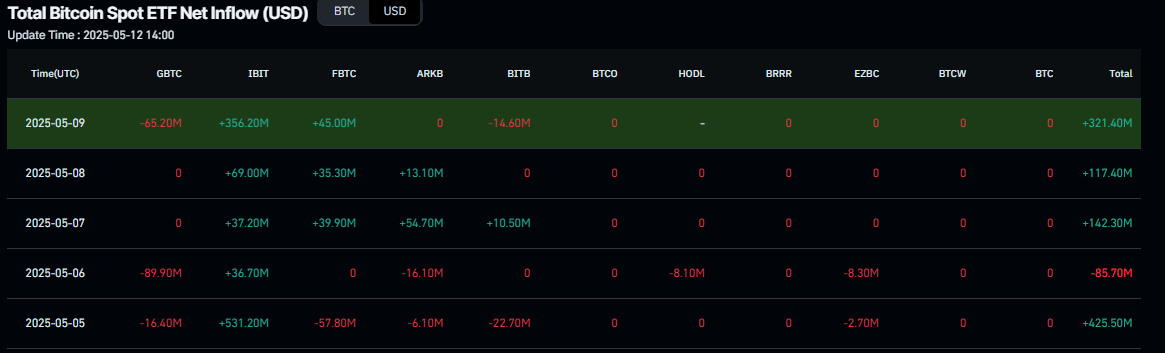

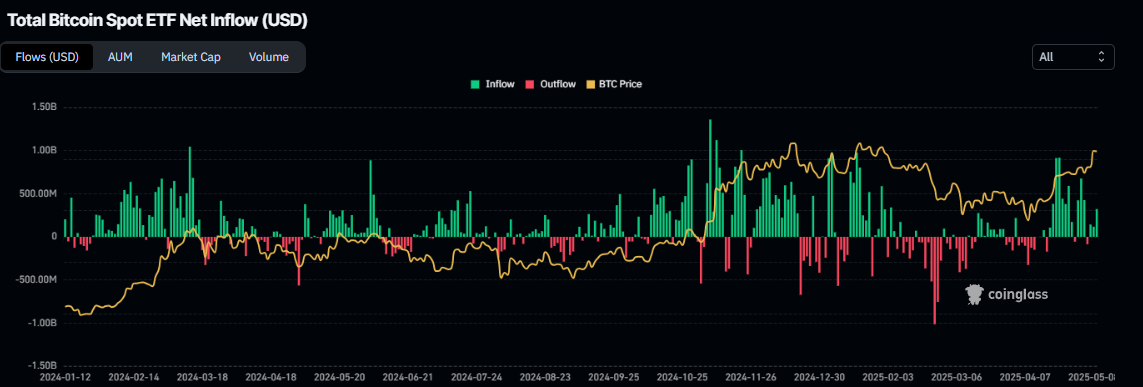

Moreover, institutional demand continues to strengthen. According to Coinglass data, the US spot Bitcoin Exchange Traded Funds (ETFs) recorded a total inflow of nearly $920.90 million last week, continuing its four-week inflow streak since mid-April. If these inflows continue and intensify, Bitcoin prices could rally further.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

The demand from corporate companies and institutions is positive for Bitcoin as it indicates a growing acceptance of BTC as a strategic asset, boosting its legitimacy and potentially driving long-term adoption.

Bitcoin Price Forecast: Key resistance test may decide next move

Bitcoin broke and closed above the daily resistance level of $97,700 on Thursday and rallied 8% until Saturday. However, after reaching a key resistance level near $105,000, BTC saw a slight pullback on Sunday. At the time of writing on Monday, BTC is trading slightly lower at around $104,000, continuing to face resistance at the $105,000 level.

This price action suggests two possible scenarios for Bitcoin in the near term.

As discussed above, the recent easing of the US-China tariff dispute has sparked broader risk-on sentiment, which could support further gains in Bitcoin. A decisive daily close above the $105,000 resistance level could open the door for a rally toward the all-time high of $109,588 set on January 20.

On the other hand, signs of bullish exhaustion are emerging on momentum indicators. The Relative Strength Index (RSI) on the daily chart stands at 74, above the overbought threshold of 70, and points downward, indicating a potential decline in buying momentum. If RSI continues to fall below overbought territory, it may confirm a weakening bullish trend.

If Bitcoin fails to break above $105,000 and continues to correct, it could slide further to retest the psychological support level at $100,000.

BTC/USDT daily chart

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.