Bitcoin Weekly Forecast: BTC bulls aim for $105,000 after nearly 10% weekly gains

- Bitcoin price stabilizes around $103,000 on Friday after rallying nearly 10% this week.

- Risk-on sentiment prevails as Trump announced a trade deal with the UK and ahead of the meeting with China this weekend.

- Institutional demand logs in a fourth week of gains, with US spot ETFs recording nearly $600 million in inflows until Thursday.

Bitcoin (BTC) price is stabilizing around $103,000 at the time of writing on Friday after rallying nearly 10% this week. The sharp price increase was supported by improved market sentiment as US President Donald Trump announced a trade deal with the United Kingdom (UK), partly easing the tariff-related uncertainty that has weighed on crypto since Trump's inauguration.

Trade uncertainty cools off, boosting risk-on sentiment

Risky assets were the winners this week, with Bitcoin soaring nearly 10%, fueled by the news on Thursday of a trade deal between the US and the UK that was announced by US President Donald Trump and British Prime Minister Keir Starmer.

This trade leaves in place a 10% tariff on goods imported from the UK to the US, while Britain agreed to lower its tariffs to 1.8% from 5.1% and provide greater access to US goods.

“Trump's administration has been under pressure from investors to strike deals and de-escalate its tariff war after the US president's often chaotic policymaking upended global trade with friends and foe alike, threatening to stoke inflation and tip the global and US economies into recession,” reports Reuters.

Moreover, US Commerce Secretary Howard Lutnick said that, after the US trade deal with the UK, he expects more deals with big economies soon.

“Over the next month or so, we’re going to roll out dozens of deals,” Lutnick said on CNBC on Thursday.

The world’s two biggest economies, the US and China, are set to start talks on Saturday and Sunday to try to de-escalate the trade war. High-level trade talks between the two countries will begin in Switzerland on Saturday, with Chinese Vice Premier He Lifeng and US officials Scott Bessent and Jamieson Greer leading the discussions.

Easing tariff uncertainty has boosted risk-on sentiment in the market, propelling Bitcoin to levels last seen in early February—now just 5% shy of its all-time high of $109,588.

US States' race toward BTC reserve continues

Arizona Governor Katie Hobbs signed House Bill 2749 on Wednesday, allowing the state to claim ownership of digital assets, including cryptocurrencies, that remain unclaimed for over three years.

The law also establishes a Bitcoin and Digital Asset Reserve Fund to generate value from staking and airdrops without taxpayer funding. This move follows New Hampshire’s similar pro-crypto legislation earlier this week and signals growing state-level interest in digital asset adoption.

The approval of the New Hampshire BTC reserve bill and Arizona’s recent development could set a precedent for other states, such as North Carolina and Texas, which are also listed in the State Reserve Race. This could be positive for Bitcoin in the long term and for its broader adoption and crypto-friendly laws.

Institutional demand strengthens as BTC spot ETF records fourth straight weekly inflows

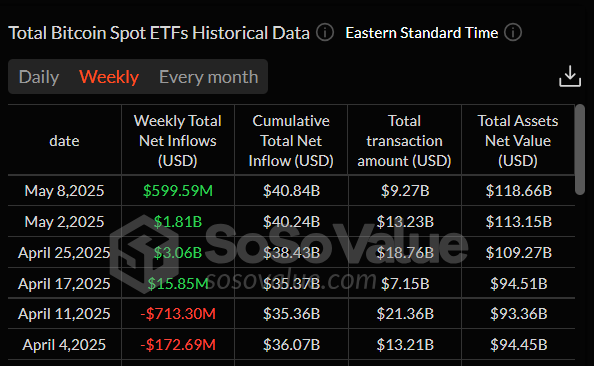

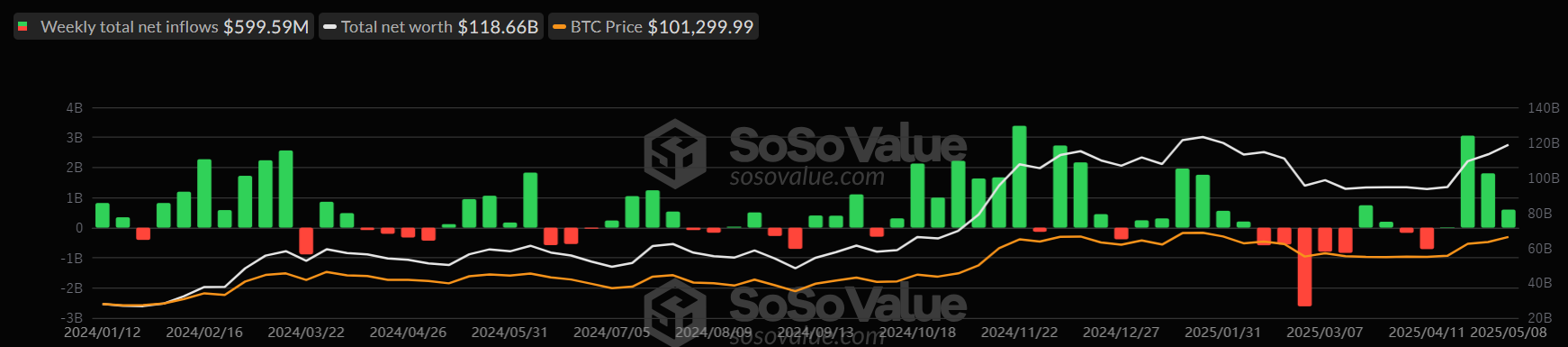

Institutional demand alsosupported Bitcoin's rally this week. According to SoSoValue data, the US spot Bitcoin ETF has recorded a total inflow of nearly $600 million as of Thursday, continuing its four-week inflow streak since mid-April. If these inflows continue and intensify, Bitcoin prices could rally further.

Total Bitcoin Spot ETFs weekly chart. Source: SoSoValue

This week, corporates announced they continued to add BTC to their portfolio.

Strategy announced on Monday that it has acquired 1,895 BTC for $180.30 million, bringing its total holding to 555,450 BTC. This news follows last week’s Q1 earnings presentation, where the company revealed a new $21 billion at-the-market offering to add more BTC to its reserve.

During the same period, Semler Scientific added 167 BTC, holding 3,634 $BTC, and is now the fourth largest Bitcoin Treasury Company in the US.

The demand from corporate companies is positive for Bitcoin as it indicates a growing acceptance of BTC as a strategic asset, boosting its legitimacy and potentially driving long-term adoption.

Bitcoin bulls aim for $105,000 before reaching an all-time high

Bitcoin price broke above the daily resistance level of $97,700 on Thursday and closed at around $103,200, a level not seen since early February. At the time of writing on Friday, it trades around $103,000.

If BTC continues its upward trend, it could extend the rally toward its key psychological importance level at $105,000 before revisiting its all-time high at $109,588.

The daily chart's Relative Strength Index (RSI) reads 76, above its overbought levels of 70, indicating strong bullish momentum. However, traders should be cautious as the chances of a pullback are high due to its overbought condition. Another possibility is that the RSI remains above its overbought level of 70 and continues its upward trend.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart showed a bullish crossover on Thursday, giving a buy signal.

BTC/USDT daily chart

However, if BTC faces a pullback, it could extend the decline to retest its next support level at $100,000.