Bitcoin whitepaper 17th anniversary: From cypherpunk vision to global financial asset

- The Bitcoin whitepaper, published by the pseudonymous Satoshi Nakamoto, marks its 17th anniversary on Friday.

- Over the past 17 years, BTC has evolved from a peer-to-peer digital cash concept to an institutional-grade asset class, backed by spot ETFs, corporate treasuries, and sovereign adoption.

- Bitcoin’s rise to $126,000 in its 17th year and its market cap surpassing $2 trillion underscore its transformation into a mainstream financial asset.

The Bitcoin (BTC) whitepaper, published by the pseudonymous Satoshi Nakamoto, marks its 17th anniversary on Friday. A decentralized peer-to-peer electronic cash system that has evolved into an institutional-grade asset class has reached a value of over $2 trillion and has been embraced by institutions, corporations, and sovereign entities. The largest cryptocurrency by market capitalization rose to $126,000 in its 17th year, underscoring its transformation into a mainstream financial asset.

Cypherpunk’s vision: Creation of the Whitepaper

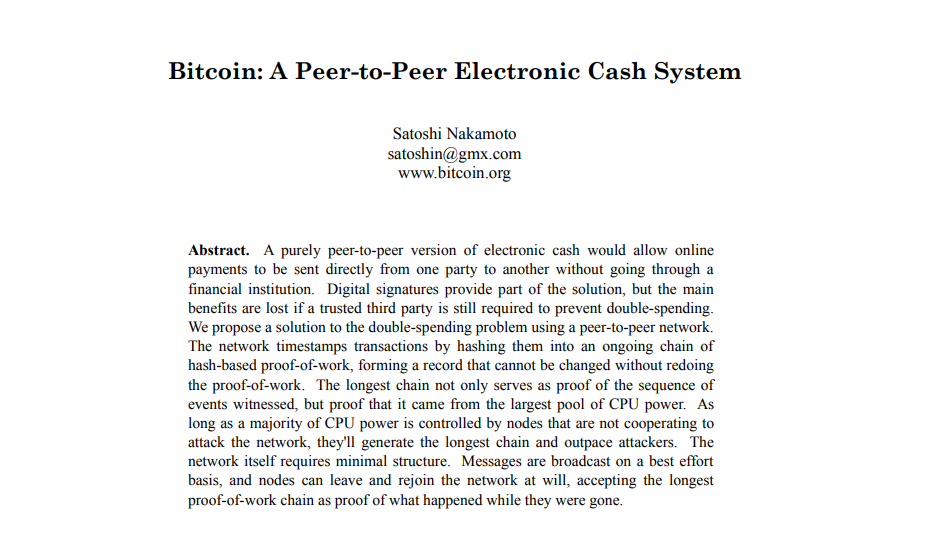

The Bitcoin whitepaper, released on October 31, 2008, with the nine-page PDF headlined “Bitcoin: A Peer-to-Peer Electronic Cash System,” laid the foundation for a new era of digital finance.

It presented a revolutionary idea of a decentralized electronic cash system that enables online payments to be sent directly between parties without the need for intermediaries like banks. The whitepaper explored key innovative ideas, such as cryptographic hashing, block architecture, and timestamp mechanisms, that, together, addressed the long-standing “double-spending” problem through a peer-to-peer network.

The Cypherpunk’s vision was rooted in decentralization, financial freedom, and disintermediation, removing the need for trusted third parties like banks or governments.

This could be seen as the first line of the whitepaper's abstract: “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

The Bitcoin whitepaper was released in the aftermath of the 2008 global financial crisis, a period marked by collapsing banks and eroding trust in traditional financial systems.

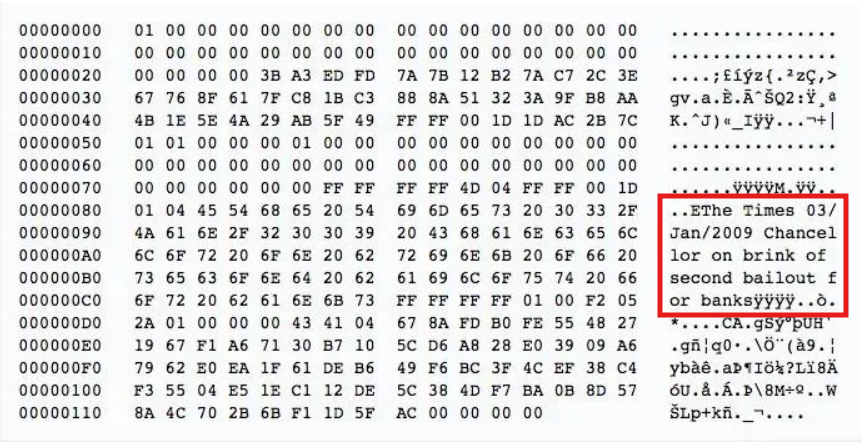

This was clearly seen in the Genesis Block (the very first block in the Bitcoin blockchain), where the creator left a message, also known as the Genesis Block Message, on January 3, 2009: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

This message on the Genesis block was the headline from The Times about the UK's response to the 2007–2008 financial crisis. Nakamoto spoke out against the idea of financial institutions that were too big to fail and wanted Bitcoin to be different.

Core principles from Satoshi Nakamoto’s writing

Peer-to-Peer Transactions | Bitcoin was designed to enable individuals to transfer value directly to one another without intermediaries such as banks or payment processors. |

Decentralized Control | The network would be secured and maintained by independent nodes and miners rather than centralized authorities, ensuring trust through consensus, i.e., Proof of Work (POW). |

Censorship Resistance | No government or corporation should have the power to block, reverse, or seize transactions on the Bitcoin network. |

Limited Supply (21 Million BTC) | By capping the total supply, Bitcoin was built to protect against inflation and the monetary manipulation common in fiat systems. |

Privacy and Autonomy | Although not entirely anonymous, Satoshi envisioned Bitcoin as a system that gives users financial privacy and freedom from centralized surveillance. |

How Bitcoin turns into a global financial asset

Over the last 17 years, the Bitcoin landscape has undergone significant changes. BTC, which began as a tool for digital freedom and financial independence, has now evolved into a mainstream financial asset, widely adopted by hedge funds, corporations, and institutional giants through spot Exchange Traded Funds (ETFs).

Bitcoin, once synonymous with cypherpunk ideals of privacy and decentralization, now stands shoulder-to-shoulder with traditional assets in the portfolios of the world’s largest investors, with its current market capitalization reaching over $2.18 trillion and standing at 8th position in top assets by market capitalization in the world, overtaking top companies such as Broadcom and Meta Platforms, as shown in the image below.

The first Bitcoin transfer occurred in 2009, when Satoshi Nakamoto sent 10 BTC to Hal Finney, a software developer and one of the earliest contributors to Bitcoin. This marked the birth of true peer-to-peer electronic cash transactions — a direct exchange without intermediaries. A year later, on May 22, 2010, Laszlo Hanyecz, an early Bitcoin developer, spent 10,000 BTC to buy two pizzas from Papa John’s. This event, now celebrated as Bitcoin Pizza Day, became the first known commercial transaction in Bitcoin’s history.

In today’s landscape, however, Bitcoin’s role has transformed significantly. Institutional adoption has surged, with major firms such as BlackRock, Fidelity, MicroStrategy, and Tesla now holding or trading Bitcoin.

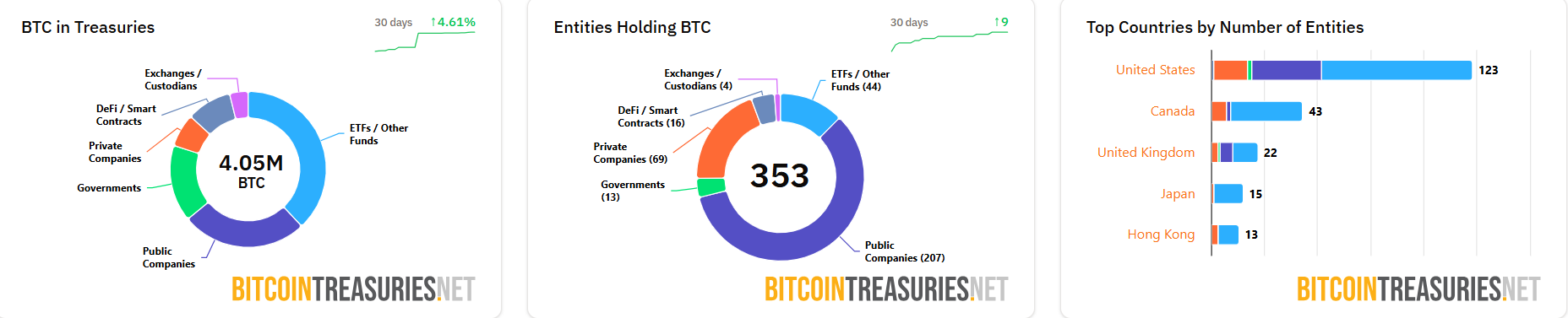

According to data from BitcoinTreasuries.net, more than 353 entities collectively hold around 4.05 million BTC, representing roughly 20.31% of Bitcoin’s current circulating supply of 19.94 million and 19.3% of its total supply of 21 million BTC.

Apart from corporations, governments from the United States, Canada, El Salvador, and Bhutan have also become holders of Bitcoin, highlighting its expanding role in national reserves and digital asset strategies. In particular, the United States has emerged as a global hub for cryptocurrencies under President Donald Trump’s administration, following the passage of pro-crypto regulations aimed at fostering innovation, legitimacy, and broader adoption across financial and institutional sectors.

The approval of Bitcoin ETFs, both spot and futures, has brought BTC firmly into traditional financial markets. Rather than being used as an everyday payment method, Bitcoin is now more often referred to as ‘digital gold’, a hedge against inflation and economic uncertainty, and is often viewed as an alternative investment to the safe-haven asset, Gold.

Moreover, Bitcoin currently trades mostly in regulated exchanges and through institutional custody services, operating under strict Know Your Customer (KYC) and Anti-Money Laundering (AML) frameworks. These are the very intermediaries and oversight mechanisms that Satoshi Nakamoto originally sought to eliminate in pursuit of financial privacy, user autonomy and freedom.

While the rising institutional demand has strengthened Bitcoin's adoption, liquidity and legitimacy, it also represents a clear departure from Satoshi’s original anti-establishment vision. The network that began as ‘money for the people’ has become a popular asset of global investment portfolios.

Technical outlook of Bitcoin

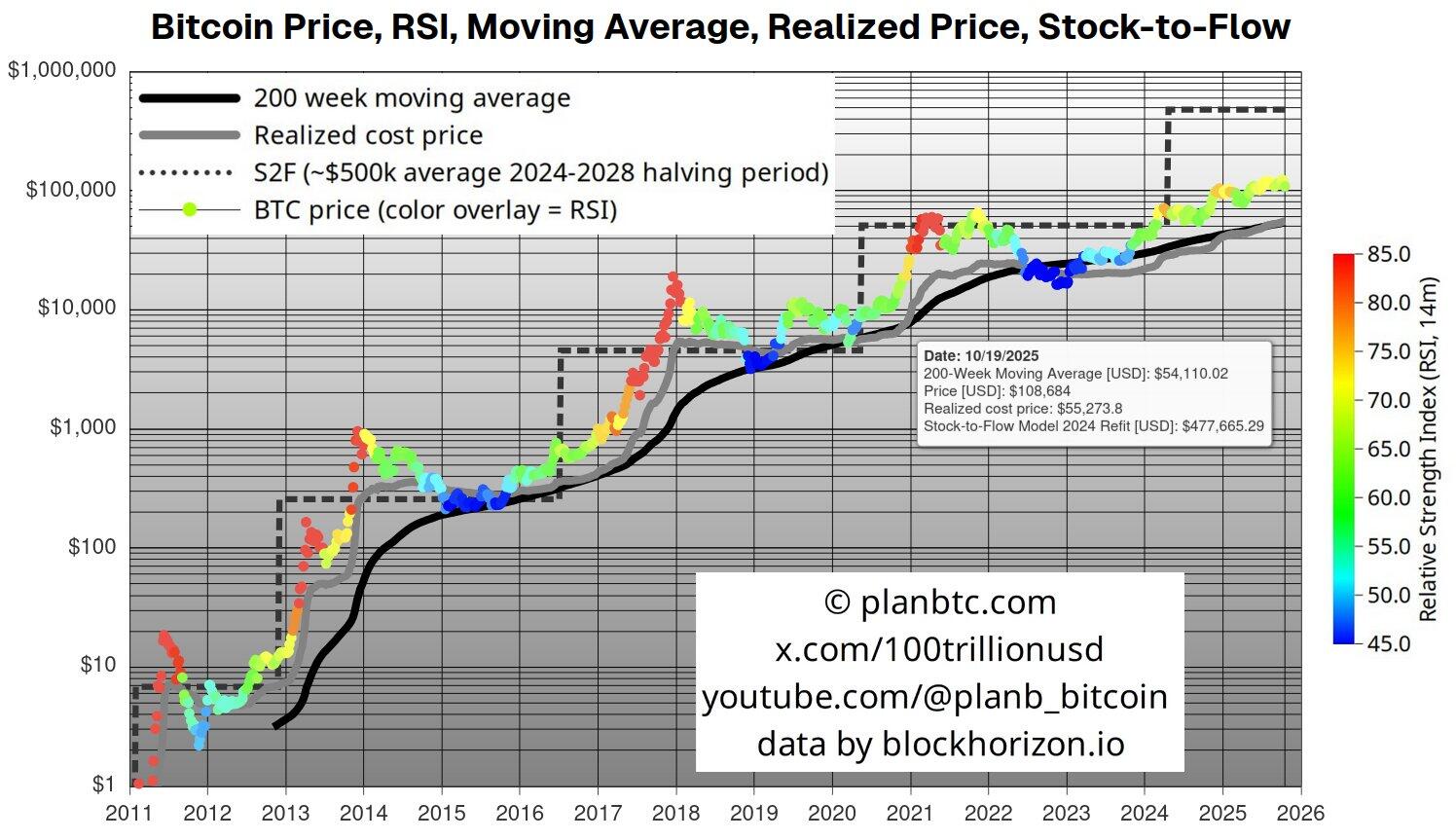

On the technical side, BTC reached a new all-time high of $126,199 on October 6 and is currently trading around $110,000 at the time of writing.

PlanB, a well-known crypto analyst, posted on X that bearish narratives linking Bitcoin’s market tops solely to its four-year halving cycle argue that three past cycles provide insufficient data for reliable conclusions, as there have been only three halving cycles so far, which is a too-small sample size.

His Stock-to-Flow (S2F) model instead projects an average Bitcoin price of $288,000 to $500,000 for the 2024 to 2028 period, without pinpointing an exact market top.

According to PlanB’s latest analysis, Bitcoin’s realized price continues to track near the 200-week moving average, with the Relative Strength Index (RSI) over a 14-month period still below 80 as of mid-October 2025 — a sign that Bitcoin has not yet entered an extreme overvaluation phase, which he views as necessary before any deep correction occurs.

With Bitcoin trading around $110,000, down from its $126,199 peak, PlanB suggests that strong institutional inflows and delayed macroeconomic catalysts such as interest rate cuts could extend the current bull cycle into 2026 or beyond.

Experts' price projections for Bitcoin

Some key figures in the crypto industry remain optimistic about Bitcoin’s long-term potential. Michael Saylor, founder of Strategy, told CNBC this week on Wednesday that Bitcoin could reach $150,000 by the end of this year. Saylor is also projecting a long-term target of $20 million per coin over the next two decades.

In an exclusive interview with Geoff Kendrick, Global Head of Digital Assets Research at Standard Chartered, he told FXStreet that BTC could reach the $300,000 mark by 2026.

Edul Patel, CEO of Mudrex, told FXStreet that "Bitcoin is likely to maintain its bullish momentum, heading towards new highs in the $130,000 to $140,000 range by the end of the year, amid positive developments."

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.