Bitcoin Price Forecast: BTC trades above $118,000 as Fed rate cut optimism fuels risk-on sentiment

- Bitcoin price steadies above $118,000 on Thursday, having rallied over 5% so far this week.

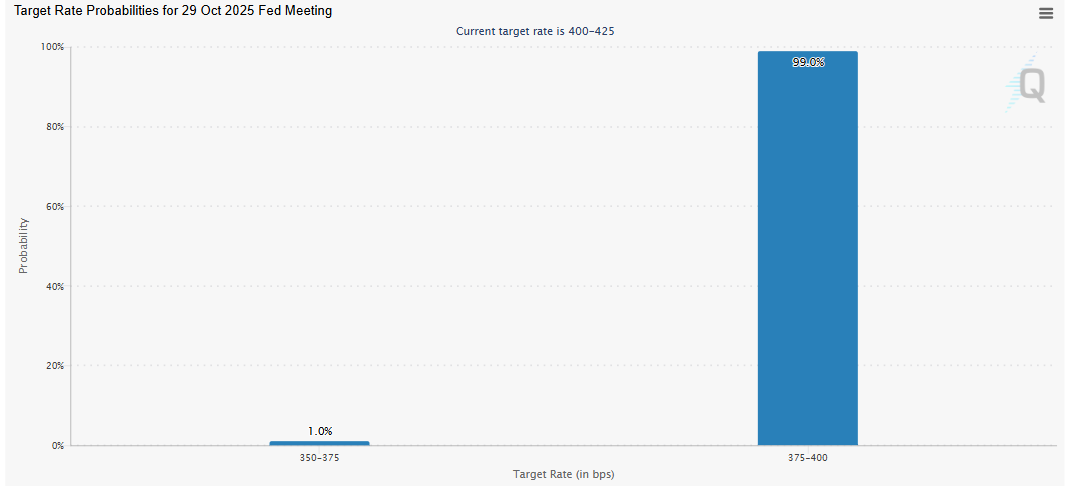

- CME FedWatch tool shows 99% chance of the Federal Reserve cutting interest rates in October, fueling risk-on appetite.

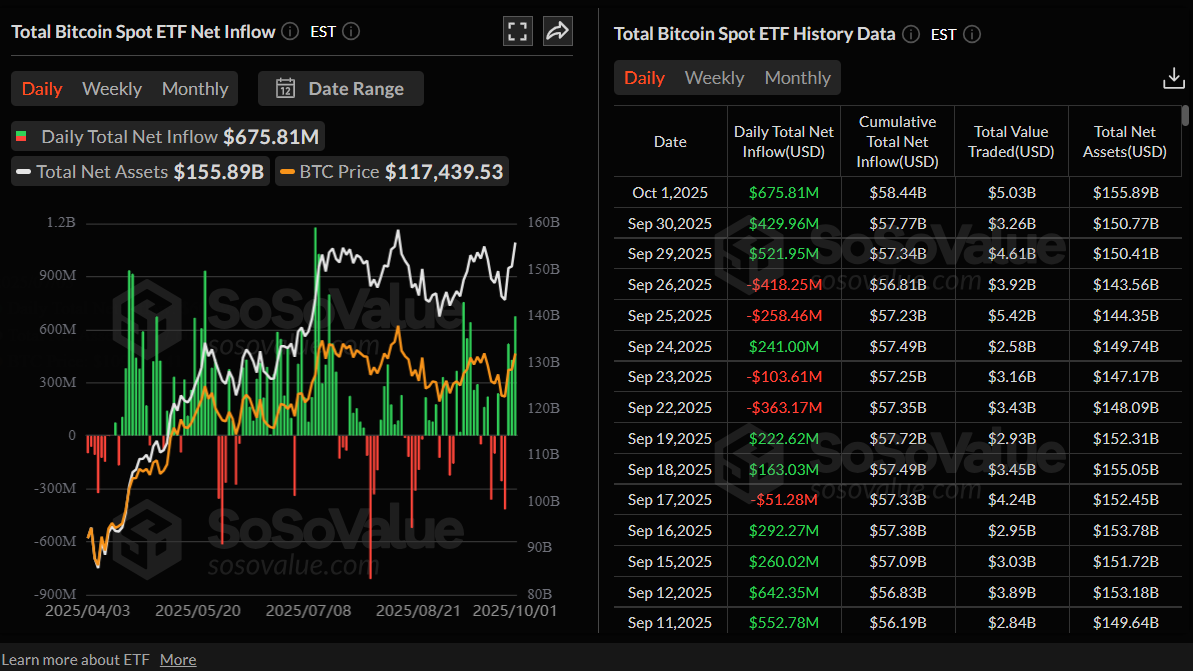

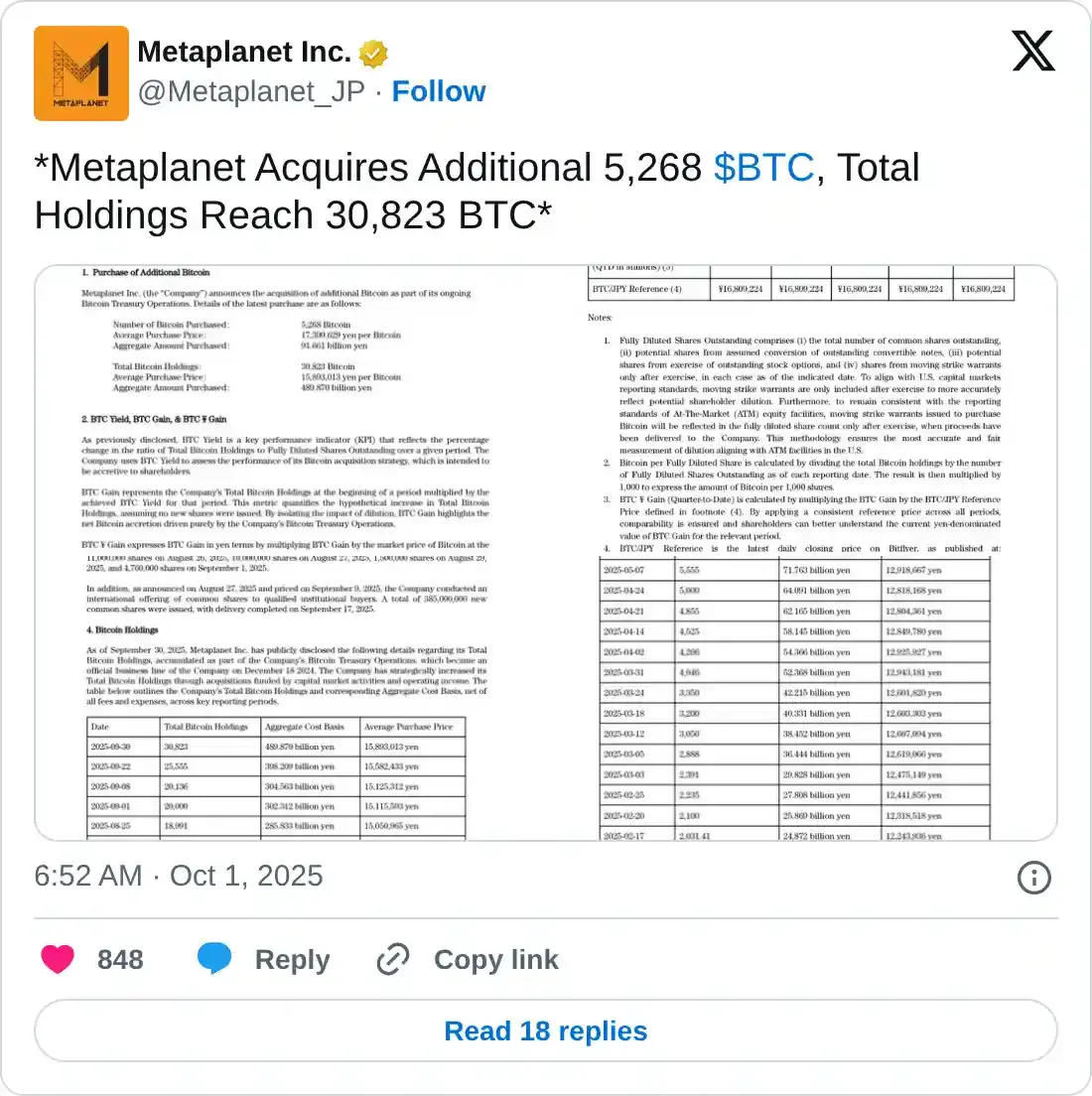

- US-listed BTC spot ETFs recorded a third consecutive day of inflows on Wednesday, while Metaplanet added 5,268 BTC to its holdings.

Bitcoin (BTC) stabilizes above $118,000 at the time of writing on Thursday after rallying over 5% so far this week. The upward trend strengthens as market participants price in an over 99% chance that the US Federal Reserve (Fed) would lower borrowing costs on October 29. Moreover, the institutional demand also remains strong, with BTC spot Exchange Traded Funds (ETFs) recording their third consecutive day of inflows this week on Wednesday, while Metaplanet added 5,268 BTC to its reserve.

Macroeconomic conditions fuel Bitcoin price rally

Bitcoin price rose nearly 4% on Wednesday, closing above the $118,500 mark. The rally came as the US government began a shutdown after Congress failed to pass a funding bill. The news pressured the US Dollar (USD), which slipped under modest selling pressure, and with BTC’s inverse correlation to the USD, the cryptocurrency surged sharply.

On the macroeconomic front, Automatic Data Processing (ADP) reported on Wednesday that private-sector employers shed 32,000 jobs in September, marking the biggest drop since March 2023. Moreover, the August payrolls number was revised to show a loss of 3,000, compared to an increase of 54,000 initially reported.

The data reinforced bets for two more rate cuts by the Federal Reserve by the year-end. According to the CME Group’s FedWatch tool, traders are pricing in an over 99% chance that the US Federal Reserve will lower borrowing costs by 25 basis points on October 29. This development had triggered a risk-on sentiment in the market, supporting Bitcoin’s price rally.

Institutional demand for BTC continues to strengthen

Bitcoin price rally has been supported by institutional and corporate investors so far this week. The SoSoValue data below shows that Bitcoin spot ETFs recorded a third consecutive day of inflow worth $675.81 million on Wednesday. If these inflows continue and intensify, the BTC price could rally further.

On the corporate front, Japanese investment firm Metaplanet purchased an additional 5,268 BTC, bringing the firm’s total holdings to 30,823 BTC on Wednesday.

Bitcoin exchange reserve drops to its lowest since 2018

CryptoQuant's Bitcoin Exchange Reserve - All Exchanges chart below shows the reserve has dropped to 2.4 million as of Thursday and has been consistently declining since early September.

The BTC reserve at the exchange has reached its lowest level since 2018, indicating lower selling pressure from investors and a reduced supply available for trading.

Apart from reducing the selling pressure, a drop in reserve also signals an increasing scarcity of coins, an occurrence typically associated with bullish market movements.

-1759388951177-1759388951178.png)

Bitcoin Exchange Reserve– All Exchanges chart. Source: CryptoQuant

Bitcoin Price Forecast: BTC bulls aiming for record highs

Bitcoin price started the week on a positive note, rallying nearly 2% on Monday and closing above the 50-day Exponential Moving Average (EMA) at $113,764. On Tuesday, BTC edged slightly down, found support around the 50-day EMA, and rallied nearly 5% the next day. At the time of writing on Thursday, it trades at around $118,500.

If BTC continues its upward momentum, it could extend the rally toward the psychological level of $120,000. A successful close above this level could extend gains toward its record highs at $124,474.

The Relative Strength Index (RSI) on the daily chart reads 62, which is above its neutral level of 50, indicating that bullish momentum is gaining traction. Additionally, the Moving Average Convergence Divergence (MACD) showed a bullish crossover on Wednesday, providing a buy signal and suggesting the start of an upward trend ahead.

BTC/USDT daily chart

However, if BTC faces a correction, it could extend the decline toward the daily support at $116,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.