Dogecoin Price Forecast: DOGE pullback tests weak hands as Fed rate cut lingers

- Dogecoin shows signs of weakness ahead of the Federal Reserve's interest rate decision.

- Declining futures Open Interest implies growing risk-off sentiment.

- The 50-period EMA support on the 4-hour chart is crucial for Dogecoin's potential bullish reversal above $0.3000.

Dogecoin (DOGE) shows signs of weakness, trading above $0.2650 on Wednesday. The meme coin has retraced by more than 13% from the previous week's high, testing the resilience of holders and traders alike.

Dogecoin holds support ahead of the Fed interest rate decision

The United States Federal Reserve (Fed) is expected to announce its decision on interest rates later on Wednesday. Participants in the broader cryptocurrency market are optimistic that the central bank could deliver a 25-basis-point cut, increasing the prospects for riskier assets, including meme coins like Dogecoin.

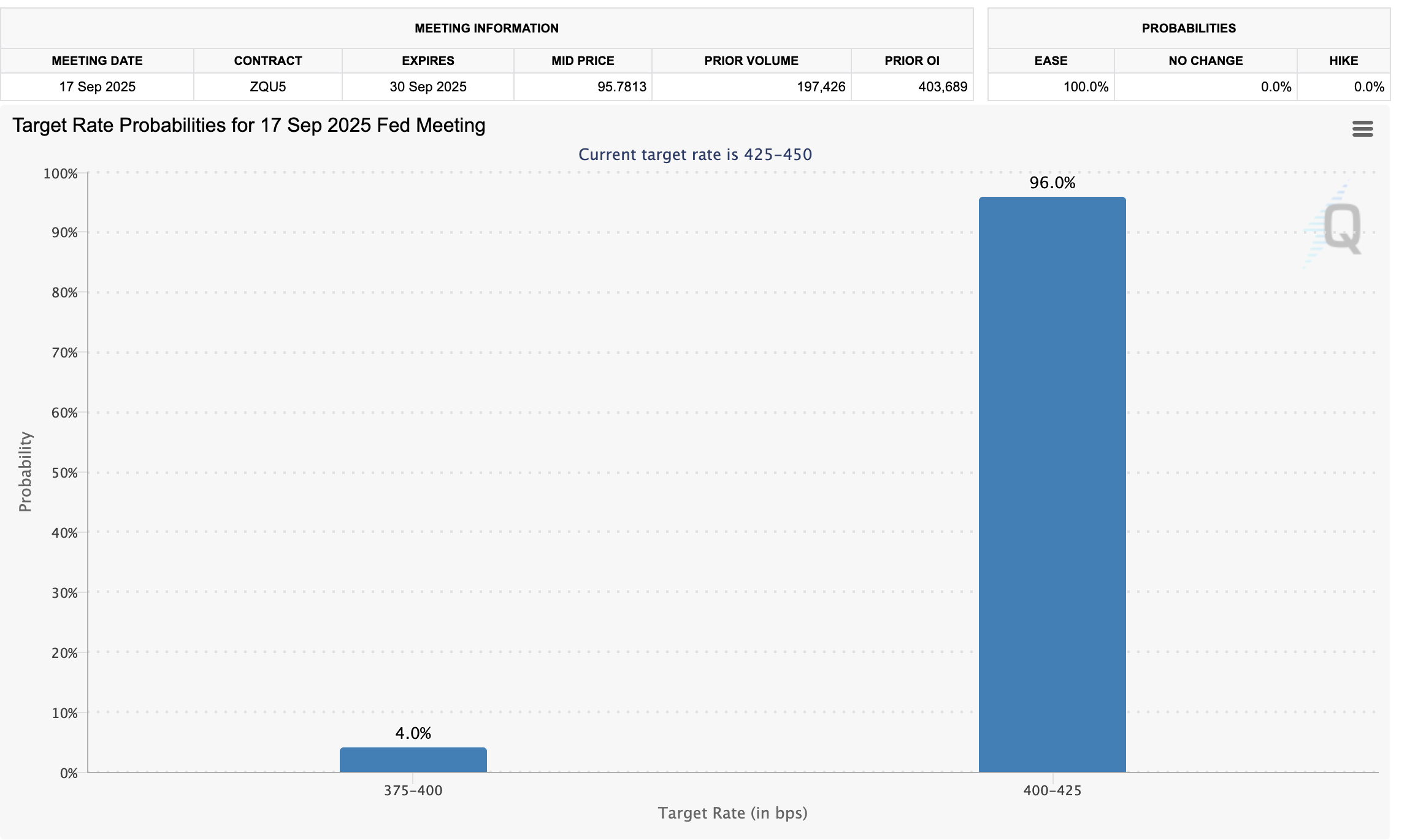

According to the CME Group's FedWatch tool, the odds stand at 96% in favor of a 25 bps cut. Lower interest rates often encourage investment in riskier asset classes, such as cryptocurrencies and equities. This thesis could boost investor interest in digital assets in the fourth quarter.

FedWatch tool | Source: CME Group

Meanwhile, retail interest in Dogecoin remains relatively high with the futures Open Interest (OI) averaging $5.4 billion on Wednesday despite a minor correction from $6 billion on Sunday.

OI refers to the notional value of outstanding futures contracts. If the correction persists, it would imply a shift in sentiment from bullish to bearish. However, a reversal in this derivatives indicator would signal a revamped risk-on sentiment, as more traders increasingly bet on the Dogecoin price returning above $0.3000 in the short term.

Dogecoin Futures Open Interest | Source

Technical outlook: Can Dogecoin hold 50-period EMA support?

Dogecoin experiences a spike in short-term volatility, with the price holding slightly above the 50-period Exponential Moving Average (EMA) at $0.2621 on the 4-hour chart. The Relative Strength Index (RSI), currently at 47, is in the bearish region, supporting the bearish outlook.

Lower RSI readings approaching oversold territory will indicate fading bullish momentum, increasing the chances of Dogecoin extending the pullback below the 50-period EMA.

The SuperTrend indicator reinforces the bearish outlook with a sell signal that has been maintained since Monday. This trend-following tool serves as a dynamic resistance when positioned above the DOGE price.

Investors could consider reducing their exposure as long as the SuperTrend maintains the sell signal and the RSI continues to decline. Below the 50-period support at $0.2621, the 100-period EMA at $0.2500 and the 200-period EMA at $0.2382 are in line to absorb the potential selling pressure and prevent losses from stretching toward the critical $0.2000 level.

DOGE/USDT 4-hour chart

Still, a bullish reversal could stem from the immediate 50-period EMA support. A favorable Fed interest rate decision could boost Dogecoin's bullish potential, perhaps support gains above the resistance at $0.3000, which was tested on Saturday.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.