Ripple Price Prediction: XRP downside risks persist amid low network activity

- XRP starts the week on the back foot, challenging the $3.00 support level.

- Active addresses on the XRP Ledger extend decline, averaging above 22,500 as downside risks persist.

- A descending trendline and the 50-day EMA hold as key support levels.

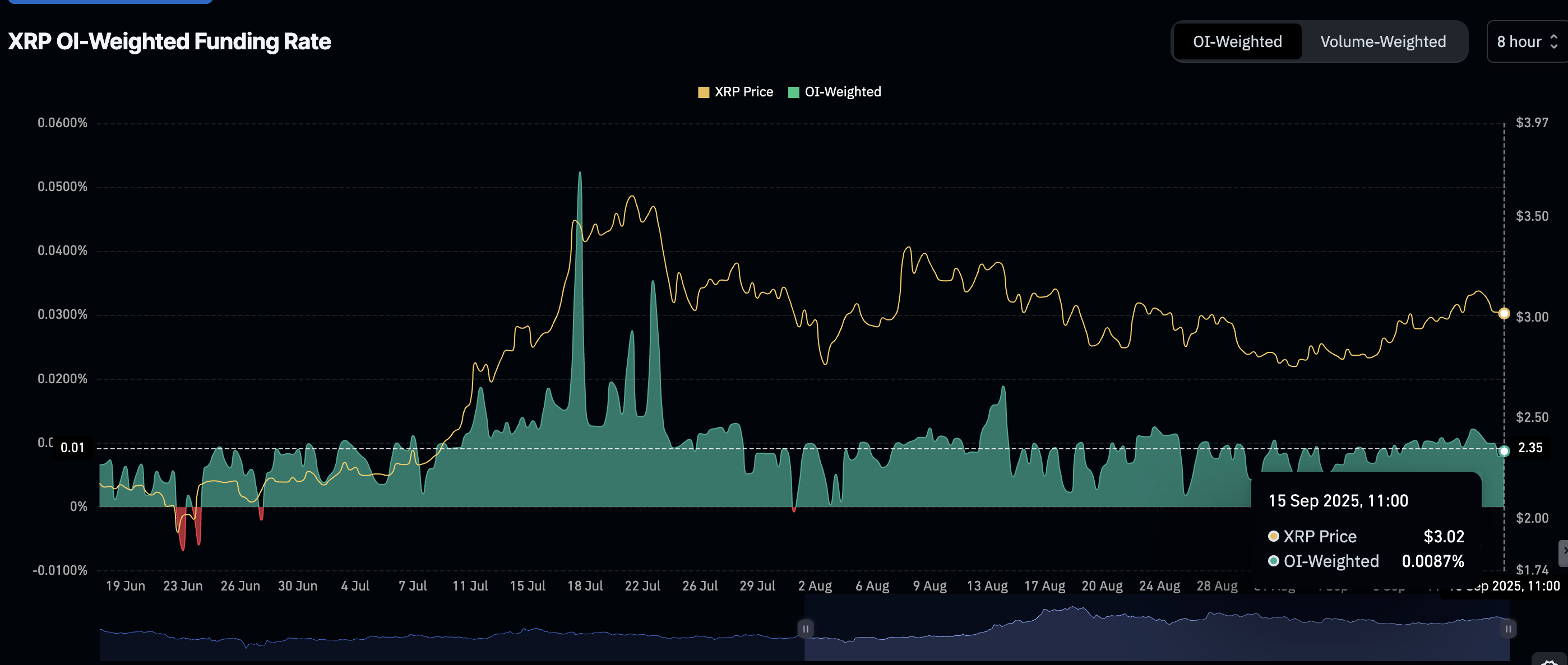

Ripple (XRP) is challenging the $3.00 support level on Monday amid a bearish shockwave criss-crossing the broader cryptocurrency market. Retail interest in the cross-border money remittance token remains elevated, as shown by the OI-weighted funding rate, which averages 0.0087% at the time of writing.

A positive and steady funding rate implies that more traders are piling into long positions.

XRP OI-Weighted Funding Rate | Source: CoinGlass

XRP struggles at $3.00 as network activity slows

The elevated retail demand for XRP, as indicated by the futures weighted funding rate and Open Interest (OI), has not been reflected in on-chain activity. According to CryptoQuant’s data, active addresses on the XRP Ledger (XRPL) are down 55% to approximately 22,500 from roughly 50,000 in mid-July.

Such a reduction in addresses interacting with the network, whether by sending or receiving XRP, indicates reduced network engagement, low transaction volume and diminishing demand for the token.

If the downtrend in the Active Addresses metric persists, XRP could experience price stagnation or downside pressure.

-1757947000955-1757947000955.png)

XRP Active Addresses | Source: CryptoQuant

Technical outlook: XRP could extend decline

XRP is trading around the $3.00 critical level on Monday, down from an intraday high of $3.06. The daily chart below shows a descending trend line support around the same level, increasing the potential for a rebound.

Still, the Relative Strength Index (RSI), which has dropped to 53 after peaking at 61 on Saturday, backs the short-term bearish outlook. If the RSI extends the decline below the midline, indicating that bullish momentum is fading, XRP could drop to retest the 50-day Exponential Moving Average (EMA) support at $2.94.

The 100-day EMA at $2.81 and the 200-day EMA at $2.56 are positioned to offer support in case investors significantly reduce their exposure.

XRP/USDT daily chart

Traders should monitor the Moving Average Convergence Divergence (MACD) indicator for insights into the next direction the XRP price is likely to take. If the blue MACD line remains above the red signal line, a bullish reversal toward resistance at $3.18, which was previously tested on Saturday, could gain momentum.

Still, a sell signal would be confirmed if the same blue MACD line crosses below the red signal line, affirming risk-off sentiment. Investors often consider de-risking with the MACD indicator trending downward, while maintaining a sell signal.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.