Crypto Today: Bitcoin sails through $115,000, Ethereum $3,700, XRP $3 as Trump tariffs take effect

- Bitcoin reclaims the $115,000 level as spot ETFs reverse four consecutive days of outflows.

- Ethereum and other altcoins recover slightly as US tariffs come into effect.

- XRP flirts with $3.00 but faces resistance at the 50-period EMA in the 4-hour time frame.

Cryptocurrency prices are showing signs of a potential recovery on Thursday, with Bitcoin (BTC) stepping above the $115,000 level from an intraday low of $114,259. Altcoins, including Ethereum (ETH) and Ripple (XRP), are also edging higher, albeit to a lesser degree. ETH is trading slightly above $3,700 while XRP finds footing after reclaiming the $3.00 level.

Market overview: Bitcoin ETF inflows resume as Trump tariffs take effect

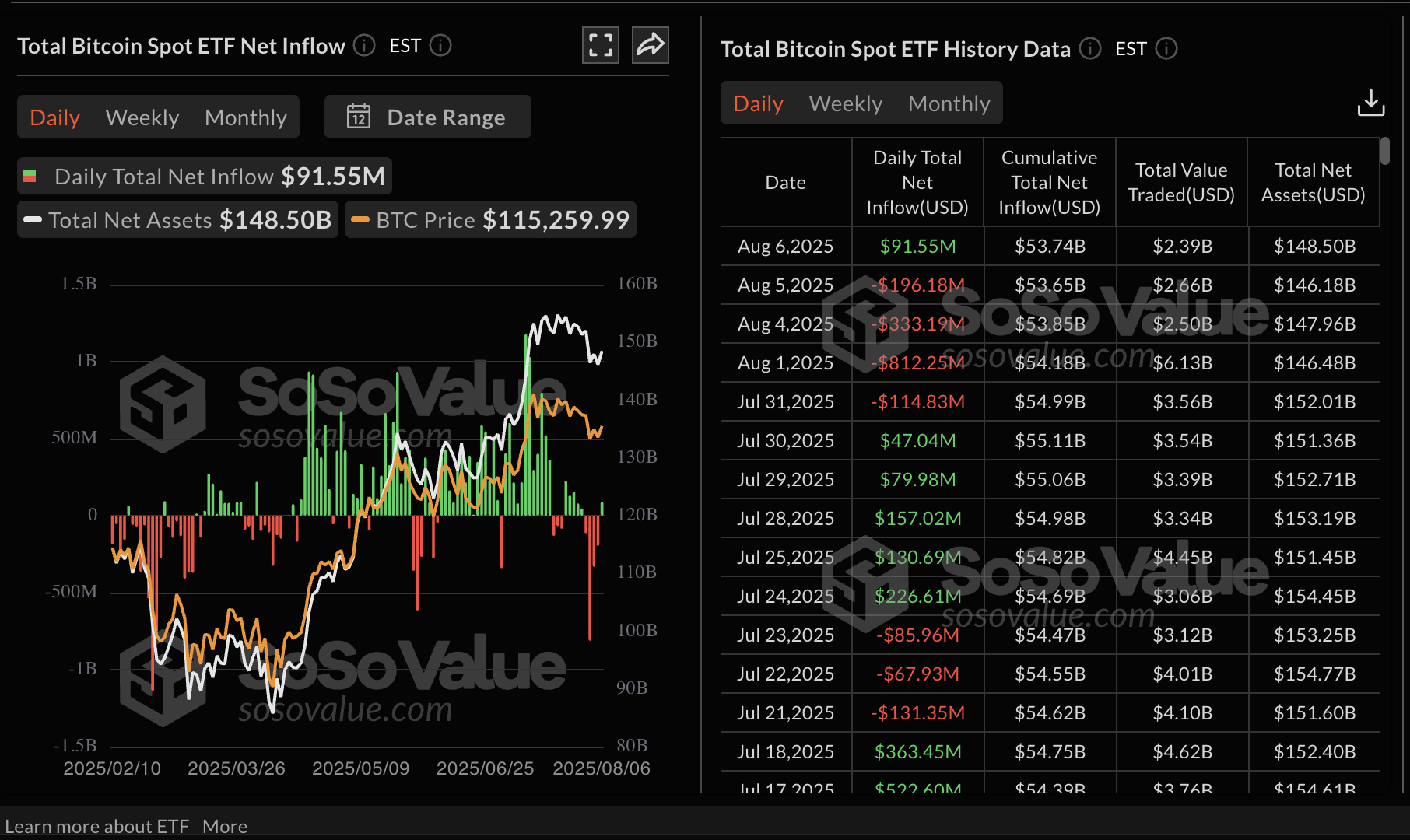

Bitcoin spot Exchange Traded Funds (ETFs) have reversed a four-day streak of outflows, with inflows averaging at $92 million on Wednesday.

Bitcoin spot ETF stats | Source: SoSoValue

The outflows persisted amid risk-off sentiment triggered by macroeconomic uncertainty as the United States (US) Federal Reserve (Fed) held interest rates steady in the range of 4.25% to 4.50% and the expected impact of President Donald Trump's higher tariffs.

The so-called "reciprocal tariffs" take effect on Thursday, with some countries like Brazil facing duties as high as 50%. President Trump says that these tariffs are meant to correct the trade deficit that has long existed between the US and most of its partners.

Fed Chair Jerome Powell said in his remarks after the Federal Open Market Committee (FOMC) meeting on July 31 that higher tariffs could accelerate inflation as prices of goods and services rise and that the central bank needs more time to study incoming data before considering rate cuts.

The hawkish statements left investors in the equities and crypto markets on the edge, leading to a sell-off last week. Still, the latest Nonfarm Payrolls data, which showed that the US labor market health is worse than previously thought, is prompting several Fed officials to talk more openly about rate cuts in September and beyond. According to the CME FedWatch Tool, there is more than 90% chance of a 25 basis point rate cut next month.

In this context, Bitcoin has recovered part of the losses to trade at around $115,000 at the time of writing, while altcoins such as ETH and XRP offer bullish signs.

Chart of the day: Bitcoin attempts breakout above $115,000

Bitcoin price is trading at around $115,000 while holding onto support provided by the 200-period Exponential Moving Average (EMA) at $114,737 on the 4-hour chart. The 50-period EMA at $115,087 caps price movement on the upside, with the 100-period EMA at $115,658 likely to slow down the recovery in upcoming sessions.

Backing the recovery is a buy signal from the Moving Average Convergence Divergence (MACD) indicator, maintained since Sunday, when the blue line crossed above the red signal line. Bullish momentum could build if investors increase exposure, anticipating a breakout toward the key round-figure resistance at $118,000.

BTC/USDT 4-hour chart

Altcoins update: Ethereum, XRP saw signs of sustained recovery momentum

Ethereum price is back to trading above $3,700 following a 10% upswing from the support tested at around $3,500 on Sunday.

The largest smart contracts token by market capitalisation sits above key moving averages, including the 200-period EMA at $3,391, the 100-period EMA at $3,591 and the 50-period EMA at $3,634, backing positive sentiment.

A buy signal from the MACD indicator and the upward moving Relative Strength Index (RSI) support bullish momentum, which is also accentuated by the SuperTrend indicator currently trailing the price of Ethereum.

The SuperTrend indicator often suggests incoming bullish momentum when it flips below the price, triggering a buy signal with its colour changing to green from red.

If the bullish structure on the 4-hour chart below remains intact in upcoming sessions, it could pave the way for the Ethereum price to move toward the $4,000 key level.

ETH/USDT 4-hour chart

As for XRP, bulls are eyeing a breakout above the descending channel on the four-hour chart after reclaiming the $3.00 support. Still, sideways price action remains of concern, with the RSI stabilising slightly above the mean line. The 50-period EMA at $3.01 caps upside movement, with the 100-period EMA holding slightly above it at $3.03.

XRP/USDT 4-hour chart

Traders will look for a daily close above the $3.00 support to affirm the bullish outlook. Other key levels of interest include the resistance at $3.10, which was tested on Tuesday, and $3.32, tested on July 28. The 200-period EMA could provide support at $2.92 if the downtrend resumes toward support established at $2.72 on Sunday.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.