Bitcoin Price Forecast: BTC extends consolidation as whale buying, regulatory clarity boost sentiment

- Bitcoin price has been consolidating within the $116,000-$120,000 range for 16 days.

- Whale wallets continue their buying spree and OTC balance reaches record lows.

- JPMorgan and Coinbase sign a deal to link customers’ bank accounts to their crypto wallets directly.

- The White House released its crypto report on Wednesday, pushing for regulatory clarity.

Bitcoin (BTC) price is trading above $118,500 at the time of writing on Thursday, continuing a consolidation phase that has been underway for the past 16 days. Despite the lack of a clear price direction, on-chain data shows some signs of optimism for the largest cryptocurrency as large-wallet holders' accumulation increases and Over-The-Counter (OTC) balance has reached record lows.

Market participants are also digesting two major positive developments for the digital asset space — the crypto policy report from the White House and a partnership between JPMorgan and Coinbase.

White House releases its first virtual asset policy

The White House released its first virtual asset policy on Wednesday, as required by US President Donald Trump’s Executive Order (EO) 14178. The report, spanning over 160 pages, contains dozens of recommendations related to crypto policy and pushes for regulatory clarity in the US.

“By implementing these recommendations, policymakers can ensure that the United States leads the blockchain revolution and ushers in the Golden Age of Crypto,” the White House said in a fact sheet on the report from the Working Group on Digital Asset Markets.

David Sacks, Special Advisor for AI and Crypto, led the Working Group on Digital Asset Markets, alongside other delegates, including Treasury Secretary Scott Bessent and Chairman of the Securities and Exchange Commission (SEC) Paul Atkins.

The report had a muted impact on Bitcoin's price, as BTC stabilized at around $111,700 on that day. Market participants likely ignored the text as the subject of the Bitcoin Strategic Reserve, which is key, was not clearly addressed.

However, key areas of interest include recommendations for the US SEC to establish clear guidelines for the development of tokenized stocks and treasuries. It also presses regulators to clarify “permissible bank activities” regarding stablecoins and the use of blockchains, promote transparency on how institutions can obtain bank charters, and ensure that bank capital rules better reflect the risks particular to digital assets.

JPMorgan and Coinbase join hands to link bank accounts to crypto wallets

Bloomberg reported on Thursday that US bank JPMorgan Chase & Co. and American cryptocurrency exchange, Coinbase Global Inc., had signed an agreement to link customers’ bank accounts to their cryptocurrency wallets directly.

“The connections between Chase bank accounts and Coinbase crypto wallets are expected to go live next year,” reported Bloomberg.

The deal marks a shift away from reliance on data aggregators such as Plaid Inc., MX Technologies Inc., or Akoya, which have traditionally served as behind-the-scenes connectors between the companies and banks.

The partnership indicates a bullish long-term impact on the cryptocurrency market, including Bitcoin, as it enhances wider adoption, growing cooperation between traditional banks and crypto platforms.

Fed keeps interest rates unchanged

The US Federal Reserve (Fed) kept the interest rate unchanged at 4.25% to 4.50% range for the fifth consecutive time, despite intense pressure from US President Donald Trump and his allies to lower borrowing costs.

Bitcoin price was muted on this news and stabilized around $117,000 on Wednesday, as the market had broadly expected the Fed to keep interest rates unchanged.

The decision, however, met opposition from Fed Governors Michelle Bowman and Christopher Waller. This was the first time since 1993 that two governors had dissented on a rate decision.

Haresh Menghani, an analyst at FXStreet, reported that in the accompanying monetary policy statement, the committee had a more optimistic view and noted that the economy continued to expand at a solid pace.

Adding to this, Fed Chair Jerome Powell said during the post-meeting press conference that the central bank had made no decisions about whether to cut rates in September, highlighting Powell’s hawkish stance, which does not bode well with riskier assets like Bitcoin prices.

Traders now look to the Fed's preferred inflation gauge – the core PCE Price Index – for a fresh impetus for Bitcoin.

Signs of optimism

Despite the ongoing 16 days of consolidation and US interest rates remaining unchanged, on-chain data shows some signs of optimism for BTC.

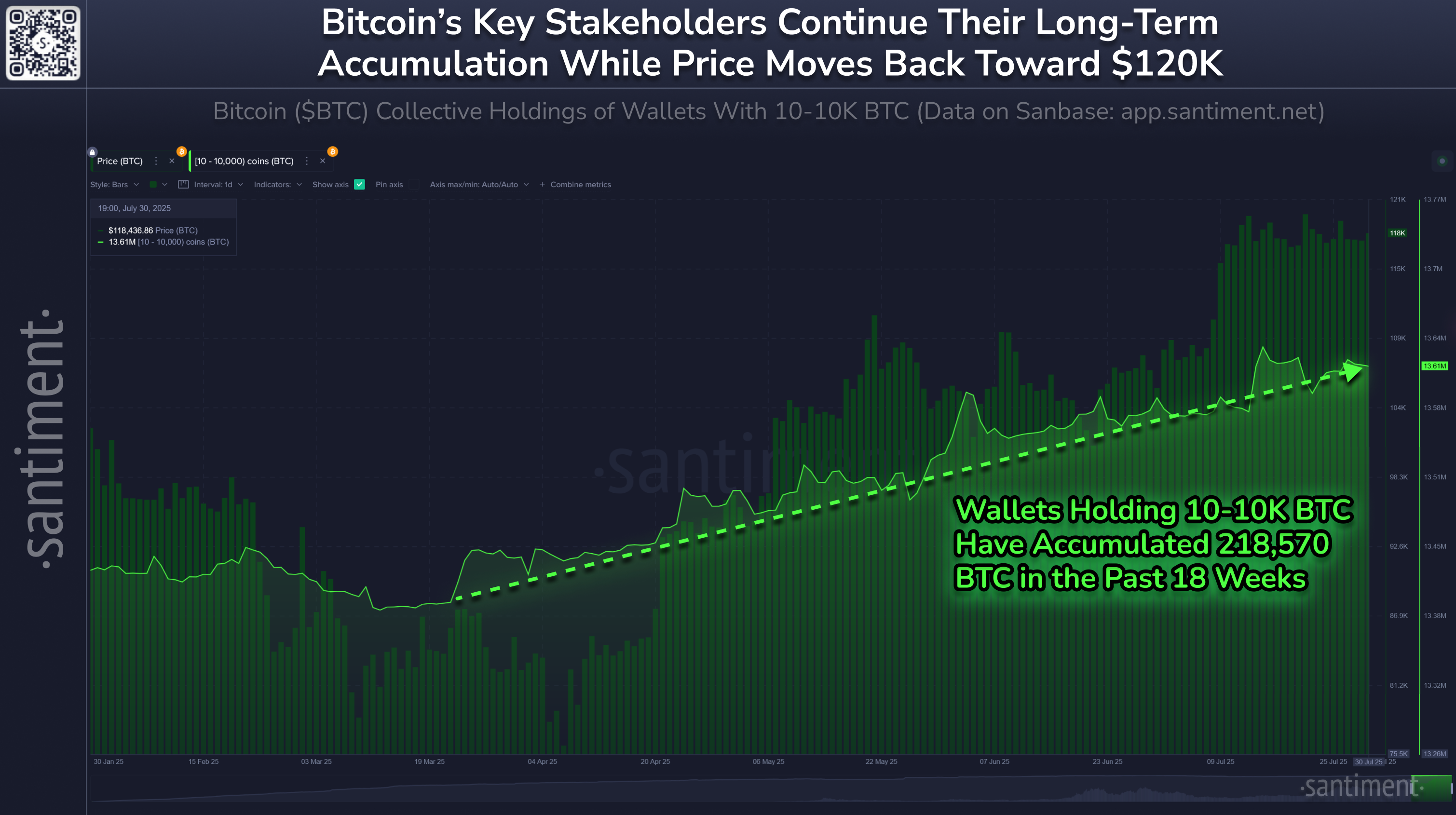

Santiment chart below shows that wallets with 10 to 10,000 BTC holdings have constantly accumulated 218,570 BTC more since late March. These key stakeholders collectively hold 68.44% of all of Bitcoin's supply, adding 0.9% of all coins to their wallets during this time frame.

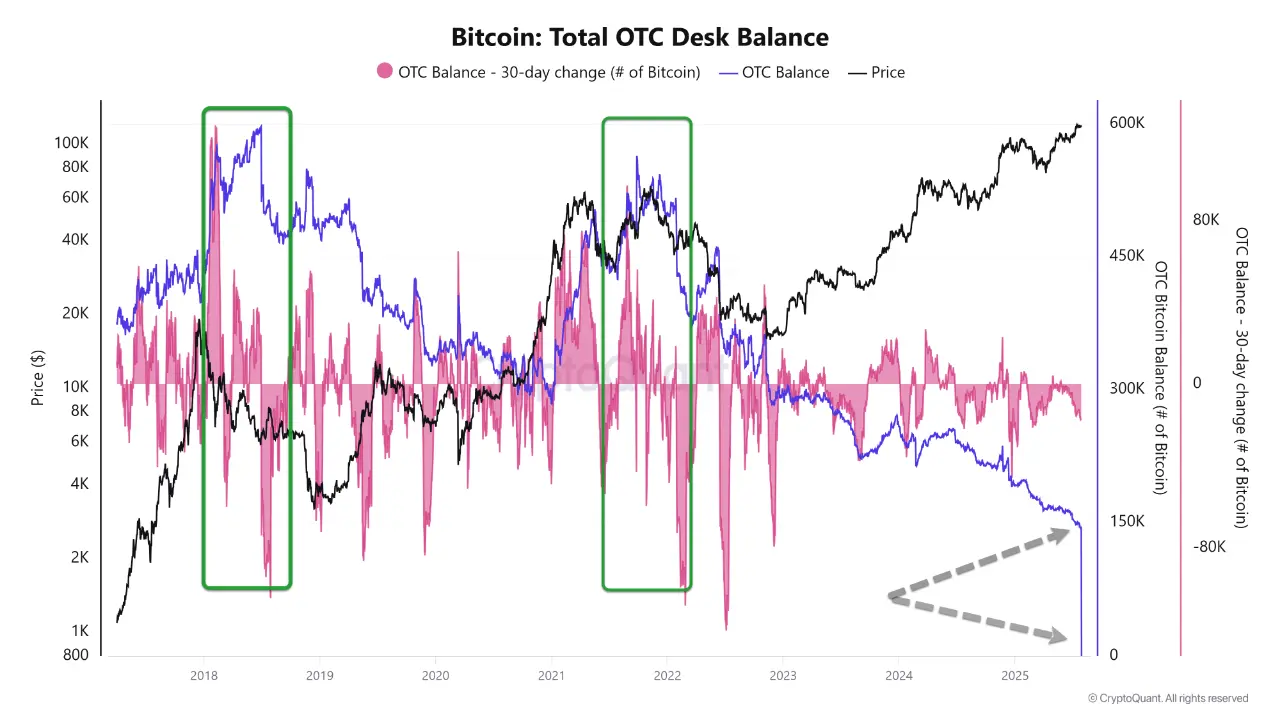

Looking down on the Over-The-Counter (OTC) wallet balance provides a clearer picture for large accumulation. CryptoQuant data indicates that the OTC balance for BTC has been steadily decreasing, reaching its lowest level ever, which suggests that large investors (market whales) or institutions are not selling BTC at OTC.

Bitcoin Total OTC Desk Balance chart. Source: CryptoQuant

Bitcoin Price Forecast: BTC trades sideways

Bitcoin price has been trading broadly sideways, between $116,000 and $120,000, for the past 16 days after reaching a new all-time high (ATH) of $123,218 on July 14.

The daily chart below shows that a similar range-bound scenario had unfolded when BTC reached its ATH of $111,980 back on May 22, when it consolidated for 47 days, before the breakout.

If BTC closes above the upper boundary of the consolidation range at $120,000 on a daily basis, it could extend the recovery toward the fresh all-time high at $123,218.

The Relative Strength Index (RSI) on the daily chart reads 59 and points upward, indicating that bullish momentum is gaining traction.

BTC/USDT daily chart

However, if BTC breaks below the lower consolidation boundary at $116,000 on a daily basis, it could extend the decline to retest the 50-day Exponential Moving Average (EMA) at $112,952.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.