Mexican Peso hits fresh YTD high as Banxico rate cut, Fed signals, and US trade tensions loom

- The Mexican Peso advances as inflation trends and risk sentiment support continued currency strength.

- The upcoming Banxico decision on Thursday is expected to shape the near-term direction of the Peso..

- USD/MXN declines below key support, with further downside possible if bearish pressure persists.

The Mexican Peso (MXN) posts a second consecutive day of gains on Wednesday against the US Dollar (USD), slipping below 19.40 ahead of key commentary from Federal Reserve (Fed) officials that could influence the monetary policy outlook.

At the time of writing, USD/MXN is trading 0.32% lower during the European session as markets continue to digest Tuesday’s softer US CPI data, narrowing interest rate differentials, and resilient investor sentiment toward emerging markets.

The April US Consumer Price Index (CPI) report released Tuesday came in below expectations, signaling further easing in inflation and reinforcing market confidence in a potential rate cut by the Federal Reserve later this year. With the Fed keeping rates unchanged at its last meeting, markets continue to price in the first rate cut for September. However, upcoming commentary from central bank officials will be crucial in determining whether this timeline holds.

On Wednesday, Vice Chair Philip Jefferson, a voting member, and San Francisco Fed President Mary Daly, a non-voting member, are scheduled to speak.

Their remarks will offer early insight into how the Federal Open Market Committee (FOMC) is interpreting the recent softer inflation data.

This sets the stage for Thursday, when Fed Chair Jerome Powell takes the spotlight. His comments will be closely scrutinized for any shift in policy tone following the latest CPI report, with the US Dollar’s near-term direction particularly sensitive to any dovish or hawkish signals from these key appearances.

Banxico expected to cut rates again as differential narrows

The Bank of Mexico (Banxico) will announce its latest interest rate decision on Thursday at 19:00 GMT, and analysts widely expect a third consecutive 50 basis-point cut (0.5%), which would bring the benchmark rate to 8.5%.

The timing is especially significant given the contrast in policy direction between the US and Mexico.

With the Fed expected to hold rates steady until at least September and Banxico accelerating its easing cycle, the narrowing interest rate differential is reducing the Mexican peso’s yield advantage.

While Mexico’s inflation outlook supports further easing, the diminished appeal of the Peso relative to the Dollar may weigh on MXN in the near term, particularly if Fed officials push back against imminent rate cut expectations in the wake of the softer CPI data.

Mexican Peso daily digest: Banxico easing, Fed divergence, and US trade risks weigh on outlook

- Banxico has cut rates at six straight meetings since August, so a 0.50% cut on Thursday would mark a cumulative 2.5% reduction over seven decisions.

- In contrast, the Fed has cut rates three times since July, lowering its benchmark rate from 5.25%-5.50% to 4.25%-4.50% by January.

- Escalating trade tensions with the US threaten Mexico’s export-driven economy, as the US accounts for over 80% of Mexican exports; tariffs could disrupt manufacturing, weaken investor confidence, and slow economic growth.

- The US has imposed 25% tariffs on Mexican goods not covered by the USMCA, including steel and aluminium alluminimum, steel and auto March, citing concerns over border security and fentanyl trafficking.

- According to Reuters, Mexico’s Economy Minister, Marcelo Ebrard, has proposed starting the USMCA review this year, ahead of the formal 2026 timeline, stating that the goal is “to give investors and consumers greater certainty” amid rising US-Mexico trade tensions. The USMCA is the foundation of North American trade, governing over $1.5 trillion in annual commerce and ensuring stability for cross-border supply chains, jobs, and investment.

USD/MXN breaks lower as Peso strength drives downside breakout

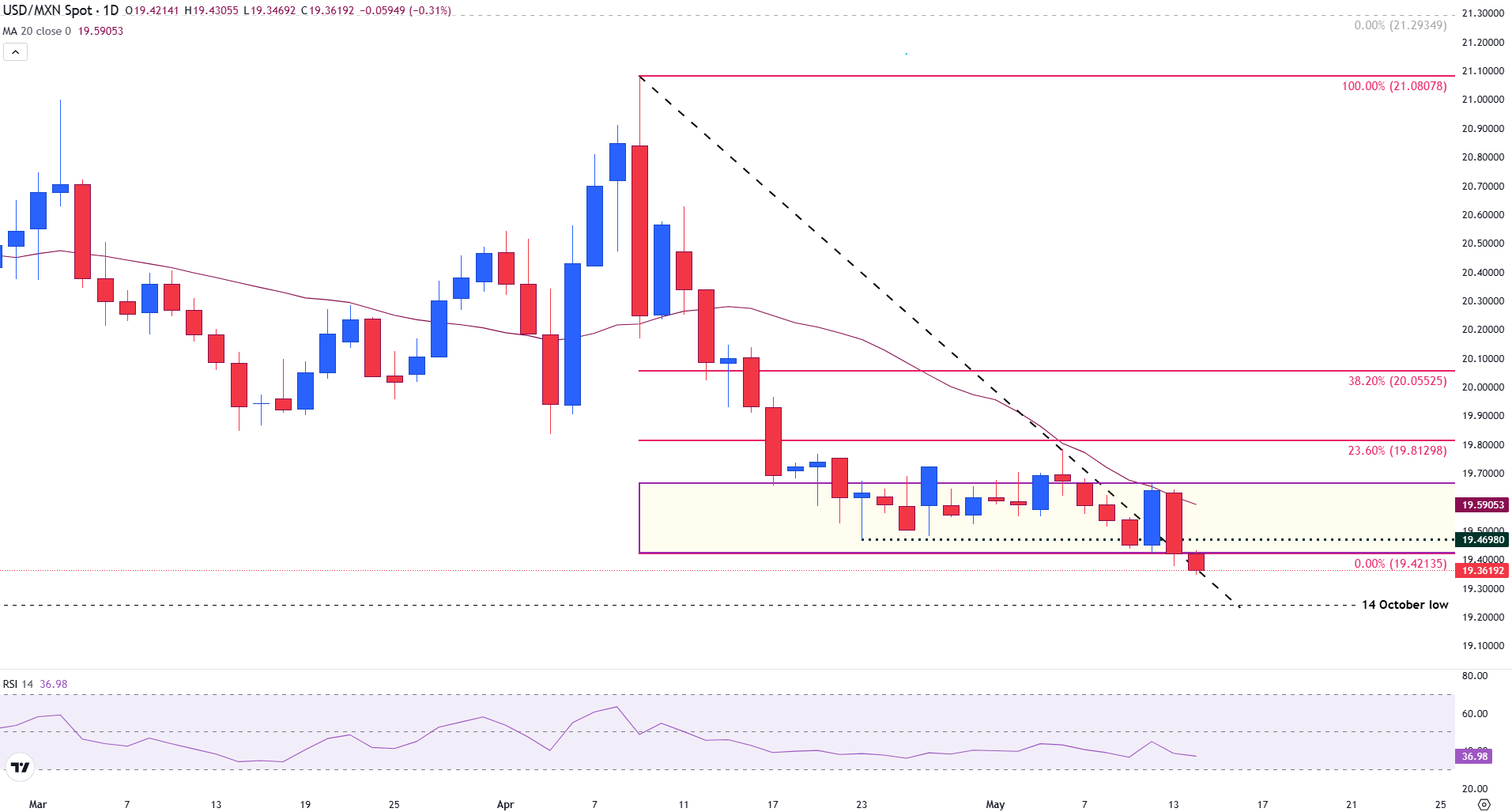

USD/MXN extends its decline on Wednesday following Tuesday’s drop, breaking below the key horizontal support at the April low of 19.42.

The pair has now exited the month-long consolidation range, marked by multiple failed attempts to recover above the 20-day moving average at 19.59 and the 23.6% Fibonacci retracement level of the April decline at 19.81. With this decisive move lower, the Peso has reached its strongest level since October, reinforcing a bearish breakout.

The Relative Strength Index (RSI) at 36.86 confirms building downside momentum, though it is not yet oversold, leaving room for further losses.

USD/MXN daily chart

If bears maintain control, the next support zone lies near 19.30, close to the October 14 swing low.

However, a daily close back above 19.42 would neutralize the bearish structure, exposing the pair to a potential rebound toward 19.81 and, if momentum builds, the psychological 20.00 handle, which aligns with the 38.2% Fibonacci level at 20.06.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.