If You'd Invested $5,000 in the Vanguard S&P 500 ETF 15 Years Ago, Here's What You'd Have Today

Key Points

The stock market has had an incredible run over the last 15 years.

Giving your money plenty of time to grow can result in life-changing wealth.

Investing small amounts consistently could help you earn even more.

- 10 stocks we like better than Vanguard S&P 500 ETF ›

Investing in the stock market is a proven way to build long-term wealth, and over time, even relatively small amounts can add up to life-changing earnings.

The Vanguard S&P 500 ETF (NYSEMKT: VOO) is a powerhouse investment, tracking the S&P 500 and holding stocks from 500 of the largest and strongest U.S. companies. It's experienced explosive growth over the last decade or so, and those who had stayed invested for the long haul have reaped the rewards.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Here's what your earnings might look like if you'd invested $5,000 in the Vanguard S&P 500 ETF 15 years ago -- plus one way to earn even more.

Image source: Getty Images.

The difference that 15 years makes

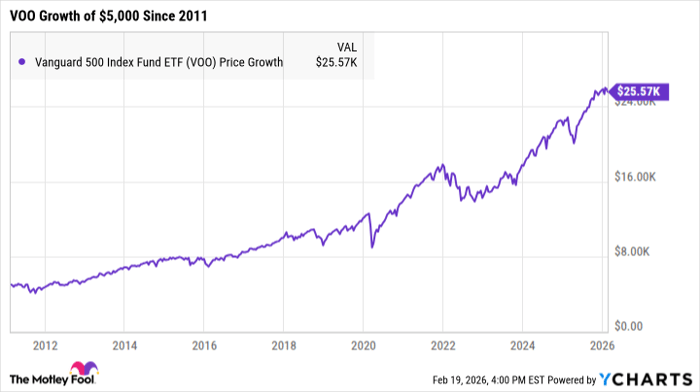

The last couple of decades have been lucrative for the market, and the Vanguard S&P 500 ETF is no exception. Since February 2011, this ETF has earned total returns of over 411%.

If you'd invested $5,000 back then and simply left it alone for 15 years, you'd have nearly $26,000 by today.

VOO data by YCharts

While this can be life-changing growth for many people, small, consistent contributions could help you earn even more over time.

For example, say that rather than investing $5,000 at once, you invest $100 per month. Since its inception in 2010, the Vanguard S&P 500 ETF has earned an average annual return of 14.84%. At that rate, $100 per month could add up to more than $56,000 after 15 years.

Time is an incredibly valuable resource when generating wealth in the stock market, and the longer you can give your money to grow, the more you can potentially earn.

Should you buy stock in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,151,865!*

Now, it’s worth noting Stock Advisor’s total average return is 892% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 21, 2026.

Katie Brockman has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.