Dow Jones Industrial Average rallies as Supreme Court strikes down Trump tariffs

- The US Supreme Court ruled 6-3 that Trump's IEEPA tariffs are unconstitutional, sending equities higher on Friday.

- Q4 GDP came in at just 1.4%, well below the 3% consensus, weighed down by the Q4 government shutdown.

- Core PCE inflation unexpectedly rose to 3.0% year-over-year, complicating the Federal Reserve's rate cut outlook.

- S&P Global flash PMIs for February showed softening across both manufacturing and services sectors.

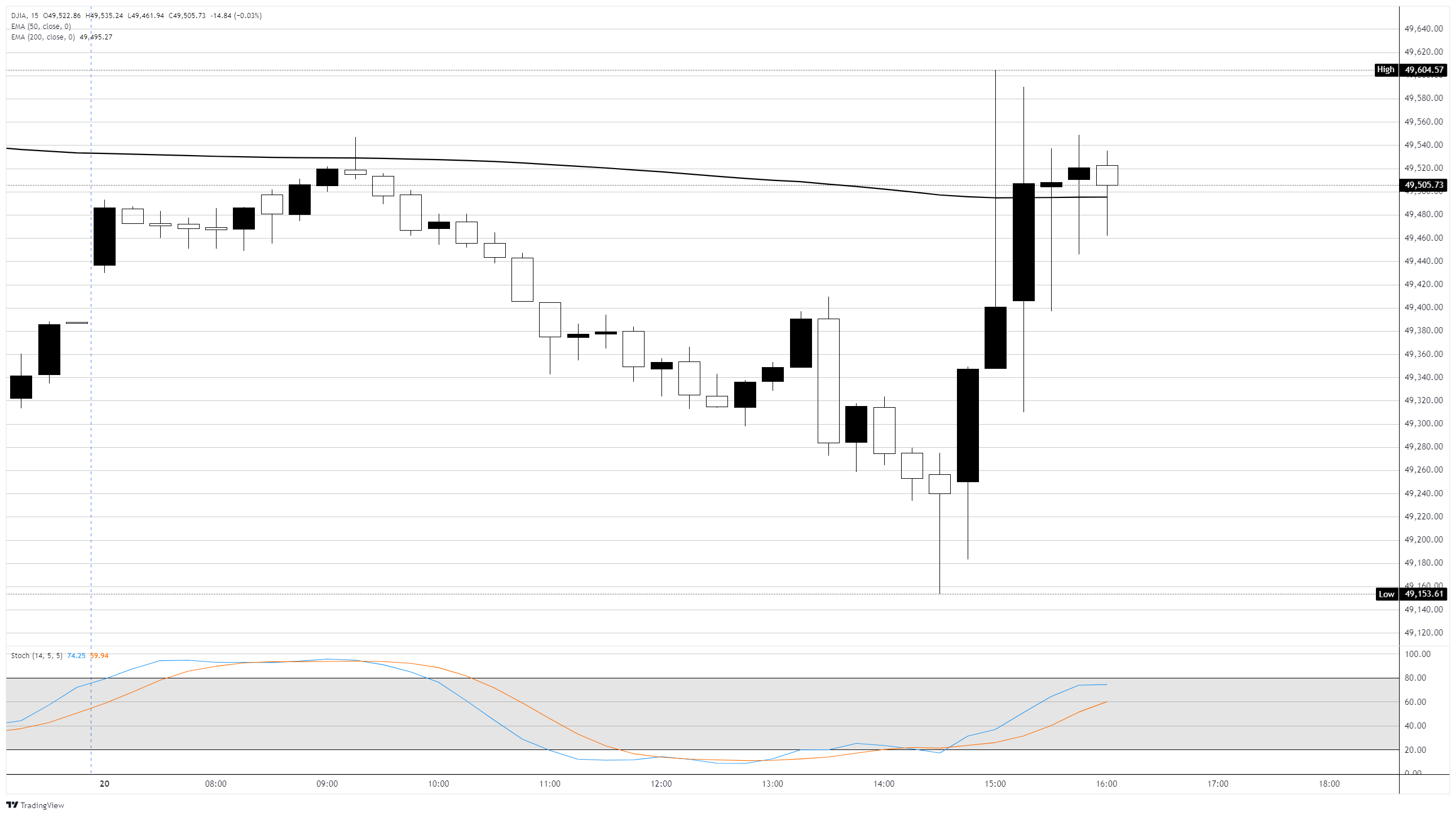

The Dow Jones Industrial Average (DJIA) reversed early-session losses on Friday after the US Supreme Court struck down President Trump's sweeping tariffs in a landmark 6-3 decision. The Dow rose 207 points, or 0.42%, to trade near 49,600 after falling over 200 points in early trading on disappointing economic data. The S&P 500 gained 0.52% to 6,895 and the Nasdaq Composite rose 0.68% to 22,837. Retail-heavy ETFs like the SPDR S&P Retail ETF (XRT) briefly surged 1.8% in the immediate aftermath of the ruling, with companies most affected by import duties leading the charge.

Supreme Court delivers blow to Trump's signature economic policy

The Supreme Court ruled that the International Emergency Economic Powers Act (IEEPA) does not give the president authority to levy tariffs, invalidating the "Liberation Day" reciprocal tariffs and the 25% duties imposed on Canada, China, and Mexico. Chief Justice John Roberts wrote the majority opinion, joined by Justices Gorsuch and Barrett alongside the three liberal justices. Justices Thomas, Alito, and Kavanaugh dissented. The ruling does not affect tariffs imposed under other trade authorities, such as the 50% levies on steel and aluminum under Section 232. Estimates from the Penn-Wharton Budget Model suggest more than $175 billion in collected IEEPA duties may need to be refunded, though the ruling was silent on the refund question. The Trump administration has previously signaled it would attempt to replicate the tariff structure through alternative legal mechanisms, but analysts note replacement measures would likely be more limited in scope and slower to implement.

Weak GDP and hot inflation data weigh on early sentiment

Before the Supreme Court ruling stole the show, markets opened lower after a double dose of discouraging economic data. Q4 2025 Gross Domestic Product (GDP) came in at an annualized 1.4%, sharply below the Dow Jones consensus estimate of 3.0% and a dramatic slowdown from Q3's 4.4% expansion. The government shutdown during the fourth quarter took a significant bite out of growth, with analysts estimating the disruption shaved anywhere from 0.25 to 1.5 percentage points off the headline. For full-year 2025, the US economy grew 2.2%, the weakest pace since 2020. On the inflation front, the Personal Consumption Expenditures Price Index (PCE), the Federal Reserve's (Fed) preferred inflation gauge, rose 2.9% year-over-year in December, slightly above estimates. Core PCE, stripping out food and energy, accelerated to 3.0% from 2.8%, topping expectations and marking its highest reading in nearly a year. Both headline and core readings rose 0.4% month-over-month, above the 0.3% consensus.

Fed's Bostic keeps hawkish tone in final days before retirement

Outgoing Atlanta Fed President Raphael Bostic, who is retiring at the end of February, has maintained his hawkish stance in the days leading up to Friday's session, rating a 7.2 out of 10 on the FinancialJuice hawkish-dovish scale. In recent appearances, Bostic has stressed that inflation remains too high and that the Fed should be patient. He has projected no rate cuts for 2026, noting that one or two cuts could bring policy to neutral, and warned that it is premature to declare victory on inflation. Bostic has also flagged that tariff-related inflation pressures are not yet fully worked through the economy, a view that takes on fresh significance in light of the Supreme Court ruling. With IEEPA tariffs now struck down, the inflationary impulse from trade policy could ease faster than the Fed had anticipated, though replacement measures from the White House could muddy the picture. The CME FedWatch Tool currently shows a roughly 90% probability the Fed will hold rates at 3.50%-3.75% at the March meeting, with markets pricing in around a 32.5% chance of 50 basis points in total cuts through the end of the year.

Friday's economic calendar rounds out a data-heavy session

Beyond GDP and PCE, Friday's data slate brought a mixed bag. Preliminary S&P Global PMIs for February showed softening activity, with manufacturing slipping to 51.2 from 52.4 and services easing to 52.3 from 52.7, both below consensus. The University of Michigan (UoM) consumer sentiment index for February came in at 56.6, slightly below the 57.3 consensus, while the expectations index held at 56.6. Notably, UoM 1-year consumer inflation expectations ticked down to 3.4% from 3.5%, and 5-year expectations eased to 3.3% from 3.4%. New home sales for November rebounded 15.5% month-over-month after a revised -8.8% decline in October, while December new home sales fell 1.7%.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.